Market Overview

Concerns over tariffs and artificial intelligence have reignited, leading to the first decline in the three major U.S. stock indices in four days. The Nasdaq fell by 2%. The chip index dropped over 3%, with Nvidia down nearly 6%, Arm down 7.5%, and AI concept stock Micron down nearly 9%. Tesla fell over 5%.

The China concept index ended a six-day losing streak. European stocks fell, with the automotive sector down over 2%.

The yield on the 10-year U.S. Treasury bond rebounded, nearing a four-week high. After the White House confirmed it would announce auto tariffs, the U.S. dollar index accelerated its rise, reaching a three-week high during the session; the yen hit a three-week low; the offshore yuan fell over a hundred points, breaching 7.28; Bitcoin briefly dropped over $2,000, falling below $86,000.

Crude oil reached a new high for the month, with Brent crude rising for five consecutive days. Gold retreated, marking its third decline in four days. London copper fell nearly 2%, losing the $10,000 mark; New York copper hit a historical high for two consecutive days.

Market Review:

This week, market volatility significantly narrowed, with a 4,000-point fluctuation on Monday, and maintaining a 2,000-point range on Tuesday and Wednesday, with prices oscillating within Monday's fluctuation range.

The previous day closed with a doji candlestick, showing a slightly longer lower shadow than the upper shadow. Yesterday, the market oscillated weakly, and after breaking below 86,000 in the early morning, it began a slight rebound, closing with a small bearish candlestick that had a longer lower shadow than the upper shadow. Prices continue to oscillate within the total fluctuation range from Monday.

Market Outlook:

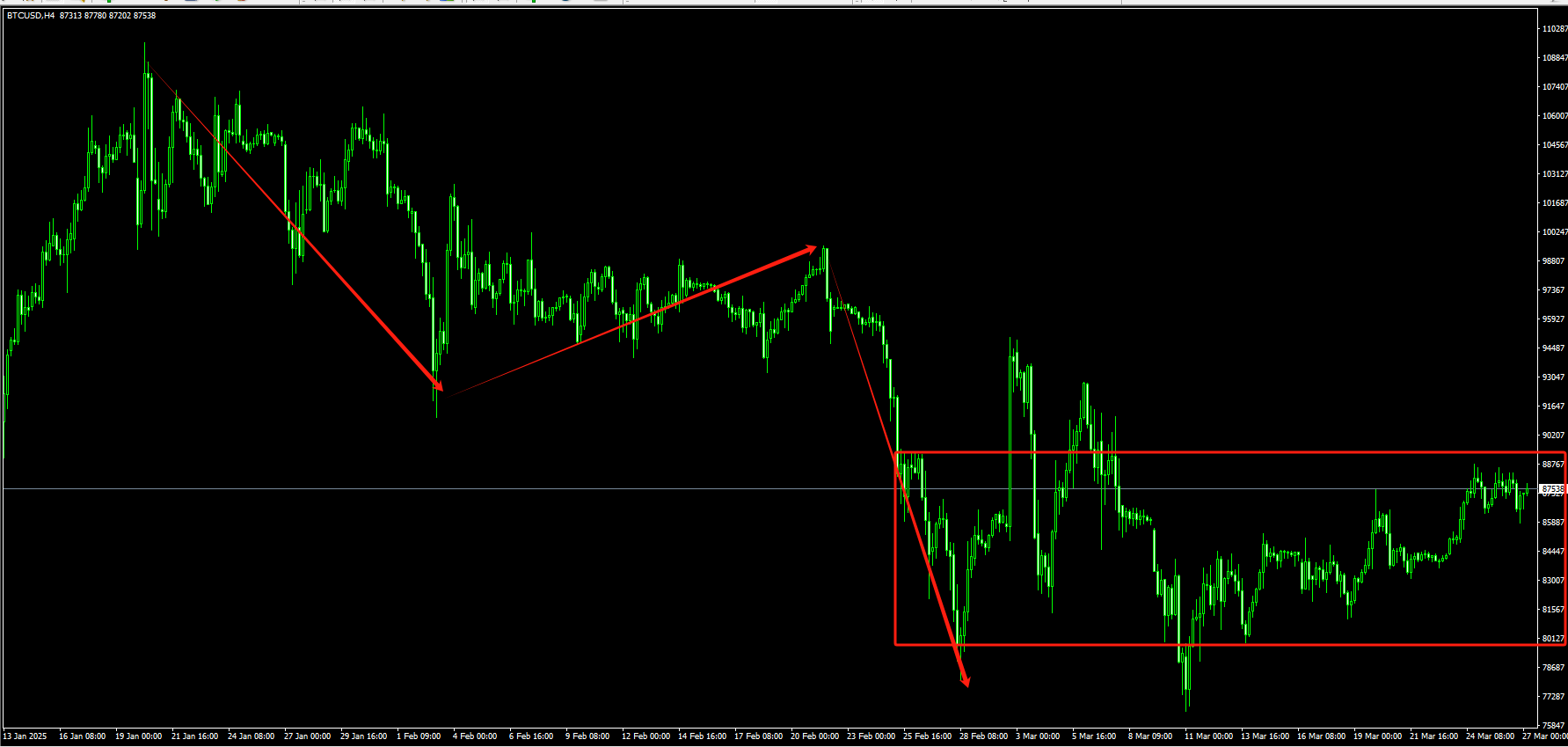

As shown in the BTC four-hour chart, after a significant three-wave accelerated decline, the price is currently entering a four-wave oscillation within the box! It can be observed that during the session, as long as a large bullish or bearish candlestick appears, the price will move in the opposite direction. This is the main rhythm of oscillation, making it difficult for both long and short positions to sustain in the ultra-short term.

Currently, the price maintains a slight upward trend in the short term, but this small trend is ultimately minor, merely an interlude within a larger downward trend. There is no market that is perpetually declining or perpetually rising. Interludes are inevitable!

In previous articles, we have repeatedly reminded everyone not to operate any short positions below 83,000 and 83,700, and to be optimistic about stabilizing these resistance levels in the short term. Although the price has moved far from the 83,000 and 84,000 levels, it is slowly rising at a steady oscillation pace. The ultra-short-term market feels slightly strong, and short positions are not significantly harmed; as long as there is a large bullish candlestick, there will be an immediate pullback. Therefore, the risk is relatively low. This is a characteristic of the current oscillation phase!

Both short-term and swing traders should be cautious; it is advisable not to operate any long positions above 86,000. Prices above 88,000 are considered high-risk; chasing long positions above 88,000 carries the danger of being caught in a trap! Respect the market, do not chase highs or panic sell!

The view is clear: Bitcoin is currently in a small oscillation interlude during a downward trend. Is a bottom in sight? Not at all, there is no easily visible bottom! Every bottom occurs when no one dares to buy, amidst widespread pessimism, as seen in early 2023 when BTC was at 16,000, and no one dared to buy. For the process of finding a bottom, refer to the sharp drop on May 19!

In the short term, the recent days have seen limited volatility, and the outlook remains bearish. Strictly control position size and arrange positions reasonably. As mentioned in the previous swing trading thoughts, do not operate any long positions above 86,000, and chasing prices above 88,000 risks being caught in a trap!

Know which price ranges are safe and which are high-risk; keep the market dynamics in mind!

If you found this helpful, please like and follow!

For more real-time price alerts and strategies, please follow the real-time updates!

Stay calm and composed, with a clear understanding of the market!

The above analysis and predictions are merely the personal probabilistic forecasts and judgments of the navigator regarding the market. Speculation carries risks; proceed with caution when entering the market!

2025.3.27 Navigator in the Crypto Circle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。