1. Introduction

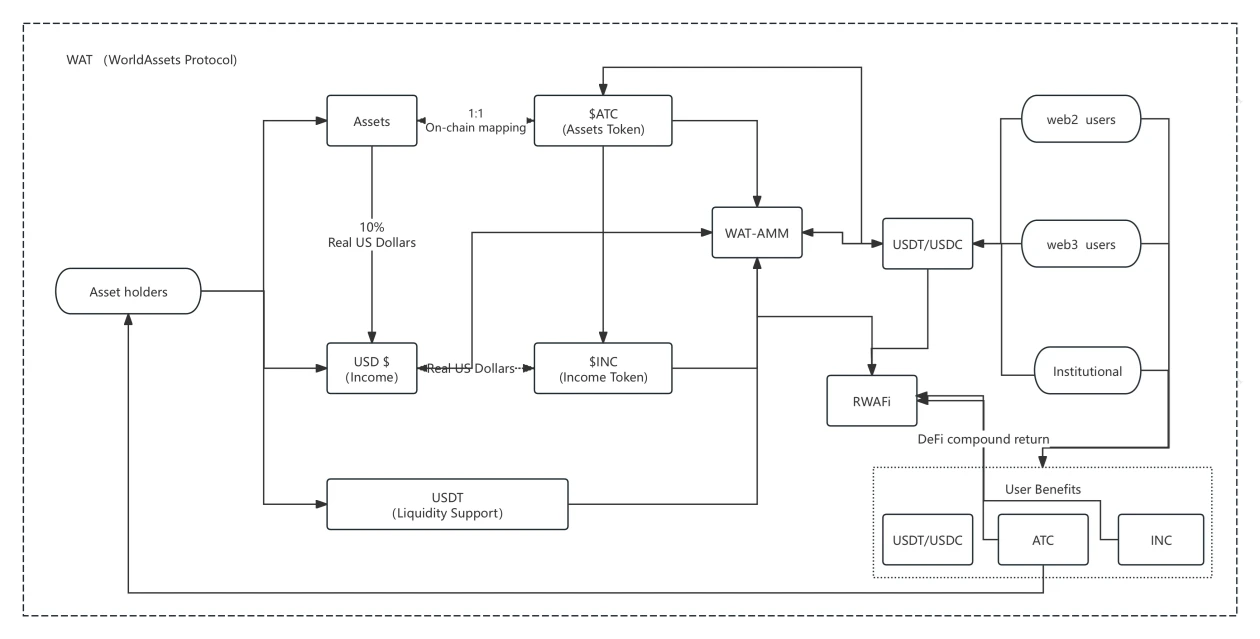

The popularity of the RWA track continues to rise, and the integration of traditional assets with crypto assets has once again become the market focus. However, the technical implementation of asset on-chain, liquidity assurance, and investment security mechanisms remain core challenges that restrict the development of this track. The WAT protocol (World Asset Protocol), as a heterogeneous composite architecture solution, introduces high-quality traditional assets into the on-chain ecosystem through an innovative asset mapping mechanism. While addressing the liquidity dilemma of traditional assets, it builds an investment infrastructure for crypto investors that combines asset security, stable returns, and instant liquidity, effectively bridging the value gap between traditional finance and the crypto ecosystem.

2. Core Mechanism of the WAT Protocol

The innovation of the WAT protocol lies in its five core functions

- On-chain traditional quality assets:

Compliance pre-processing layer: Traditional enterprises submit legally certified asset certificates (property rights certificates, appraisal reports, historical income statements, etc.), which are audited for document authenticity and value assessment by licensed institutions such as JPMorgan Chase, forming asset endorsements that comply with SEC/FCA regulatory frameworks;

Digital certification layer: The audited asset metadata (including cash flow models, collateral lists, risk parameters) is minted into ERC721 certification NFTs, achieving on-chain ownership verification of sensitive data under privacy protection through zero-knowledge proof technology.

Dynamic mapping layer: Deploy WAT-MintSmartContract smart contract groups, minting on-chain token symbols ATC (1ATC=1USDT) based on asset certification NFTs, with built-in cross-chain oracles to real-time synchronize off-chain asset audit reports and financial data, ensuring the token value mirrors the compliance of the underlying assets.

- ICDAO (Investment Committee DAO):

As the first on-chain RWA investment governance protocol, it adopts a five-dimensional dynamic weight model (reputation qualifications, professional capabilities, liquidity management, governance contributions, game calibration) to construct an institutional-level decision-making system. Through an improved Shapley value algorithm, it quantifies members' marginal contributions, achieving on-chain review of RWA assets, dynamic risk assessment, and compliance supervision. Members receive minting tax shares (0.3%), private placement subscription privileges, and governance optimization rights based on their weight proportions, and rely on an on-chain federated learning framework and regulatory sandbox-compatible modules to ensure that the decision-making mechanism possesses the rigor of traditional investment committees while retaining the agile advantages of DAO organizations.

- On-chain real dollar returns:

Traditional asset parties are required to provide the real dollar returns of the asset. Through the foundation's WAT-AMM market-making mechanism, real dollars are injected, making the on-chain assets not just superficial mapping symbols ATC, but also capable of injecting real dollar returns and supporting the issuance of income tokens INC (Income Token). This allows investors to not only tokenize and conveniently invest in quality physical assets but also obtain real dollar returns in reality, along with additional future returns brought by INC tokens.

- Additional liquidity guarantee:

To protect investors' rights, the WAT protocol requires asset parties to provide additional liquidity pools to avoid liquidity shortages (asset parties must set aside at least 10% of the asset value in USDT to ensure the liquidity trading of ATC) and provide additional INC token reward pools through the WAT-AMM market-making mechanism, comprehensively ensuring the safety and health of liquidity, thereby guaranteeing and enhancing the investment experience.

- RWAFi:

The WAT protocol innovatively constructs an RWA+DeFi composite yield engine, achieving deep coupling of traditional asset returns with on-chain composability through smart contracts: ① Building a layered yield structure, where the cash flow of the underlying assets and on-chain strategies such as staking mining and liquidity certificate derivatives form a yield stacking effect; ② Creating institutional-level liquidity pools to attract funding from family offices and asset management institutions, constructing a dynamic balance model of capital efficiency and yield stability through market maker incentive algorithms and cross-market arbitrage mechanisms. This mechanism allows investors to obtain fixed returns from underlying assets while autonomously configuring DeFi strategies such as leveraged farming and yield rights staking, optimizing risk-adjusted returns.

The WAT protocol breaks the core paradox of the RWA ecosystem through heterogeneous architecture design: its five-dimensional core mechanism constructs a composite protocol stack, using cryptographic verification frameworks to achieve dual guarantees of traditional asset liquidity transformation and crypto investor asset security. By building a three-layer structure of "physical assets - on-chain certificates - liquidity derivatives," it not only completes the standardized deconstruction of non-standard assets but also retains the composability advantages of DeFi, fundamentally bridging the structural contradictions between traditional financial asset liquidity and crypto market investment logic.

3. Comparison of the WAT Protocol with Other Types of Projects

As shown in the table above, the WAT protocol provides real returns and liquidity support while on-chaining assets, filling the gap between RWA projects and DeFi protocols, making it more competitive in the market.

4. Application Scenarios of the WAT Protocol

Quality asset parties:

High-quality assets with stable cash flow returns, such as equity, gold, energy, and real estate funds, can achieve asset on-chain through the WAT protocol, increasing transparency while providing quality investment targets for the crypto market.

Traditional financial institutions:

Banks and fund companies can utilize the WAT protocol to achieve the coordinated issuance of fund bonds, enhancing financial liquidity.

Crypto investors:

Institutional and individual investors can obtain safer and more stable investment opportunities through the WAT protocol without worrying about liquidity risks. In addition to conveniently investing in quality assets, they can also receive guaranteed dollar returns and additional future returns from ecosystem tokens.

WEB2 investors:

By leveraging traditional quality assets to address WEB2 users' understanding and trust, traditional investors and funds will enter in large numbers through the convenient operation of RWA tokenization to complete investment and financial management activities.

DeFi ecosystem:

The WAT protocol can be compatible with existing DeFi protocols, providing a richer variety of asset types for decentralized finance. It breaks the circle of DeFi, introducing financial rules, value support, and capital, solving the "hot potato" problem in DeFi, and providing composite yield product services for WAT ecosystem investors.

5. Core Mathematical Modeling of the WAT Protocol Mechanism

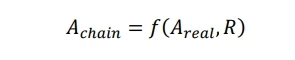

1. On-chain Model of Traditional Assets

After traditional assets are on-chain, their mapped value on the chain can be expressed as:

Where:

If R = 1, it means the asset is fully on-chain; if R < 1, it indicates that some assets may be restricted from being fully on-chain due to compliance or liquidity factors.

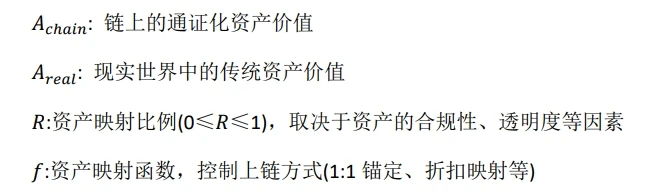

2. On-chain Model of Real Returns

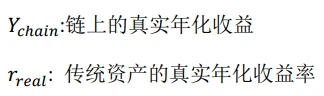

The WAT protocol requires traditional asset parties to also map real dollar returns onto the chain to ensure investment stability. The return calculation is as follows:

Where:

S: Return on-chain guarantee coefficient (0≤S≤1), reflecting the transparency and realization capability of returns.

When S = 1, it indicates that all returns are fully mapped onto the chain; if S < 1, it means some returns are not on-chain.

3. Additional Liquidity Support Model

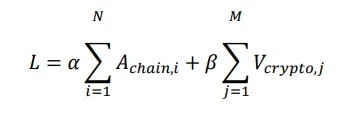

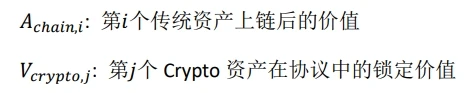

The WAT protocol provides additional liquidity pools to ensure that investors can trade at any time without experiencing liquidity shortages. The size of the liquidity pool can be defined as:

Where:

L: Total size of the liquidity pool (including asset value and additional USDT provided by the asset)

α, β: Liquidity weight coefficients (controlling the liquidity contribution ratio of traditional assets and crypto assets)

When L is sufficiently large, investors can trade without barriers; when L is too small, the WAT protocol may require additional liquidity support mechanisms.

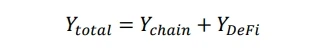

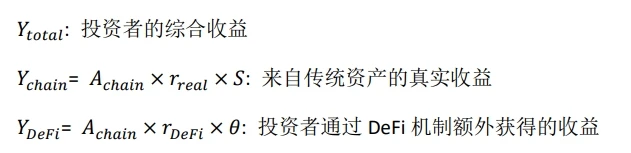

4. Comprehensive Yield Calculation

The comprehensive yield for investors in the WAT protocol includes real returns from traditional assets and DeFi yields (such as staking, lending, etc.). The new yield calculation is as follows:

Where:

Where:

θ: DeFi yield applicability rate (0≤θ≤1), indicating what proportion of the asset can be used for DeFi investment.

The comprehensive yield calculation for investors includes real dollar returns from assets + future token returns + DeFi yields, providing investors with richer and more flexible ways to appreciate their funds.

6. Asset Management Scale of the WAT Protocol

Currently, the WAT protocol has signed asset agreements totaling $270 million, including: Aupera visual chip R&D company, JoHome real estate fund company, Middle Eastern sovereign funds, Hong Kong Hercules gold regulatory warehouse, Cambodian quartz sand mine, Turkmenistan natural gas, etc. It is continuously exploring and signing more high-quality physical assets.

Tokenized trading and TGE trading are expected to commence in Q2 2025!

7. Conclusion

The WAT protocol constructs an RWA value exchange protocol layer through a heterogeneous multi-chain architecture, with its technological breakthroughs manifested in: ① Integrating dynamic pricing mechanisms and zero-knowledge verification frameworks to achieve high-efficiency liquidity transformation of traditional assets and verifiability of on-chain returns; ② Adopting a layered smart contract group (compliance verification module + risk isolation pool + liquidity derivative engine) to build an optimized risk-return configuration scheme for crypto investors under a compliance framework audited by third parties. Industry observation data shows that its protocol layer design has already demonstrated the synergistic effect of connecting traditional financial infrastructure with the DeFi ecosystem, providing key technical support for the standardization process of the RWA market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。