🧐 The new trend of decentralized DeFi, empowered by BSC + DAO: A deep analysis of the growth logic and dividends behind the launch of Unizen DAO @unizen_io —

In the past month, BNB Chain has undoubtedly become the market's focus:

CZ and He Yi have frequently promoted the ecosystem, with meme coin trading volume surpassing $15 billion in a single week, exceeding the combined total of Ethereum and Solana.

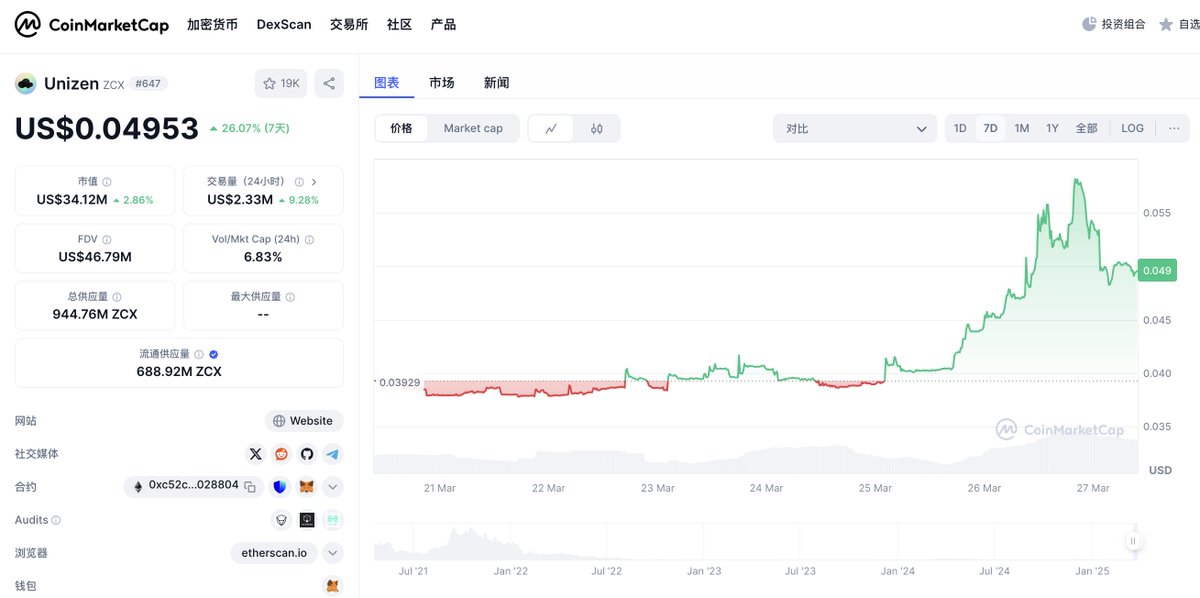

Amid this wave, Unizen, as a dark horse in the cross-chain aggregation track, has also welcomed significant good news, and saw a surge yesterday —

The reason for the increase is that Unizen timely announced the official launch of Unizen DAO on BNB Chain, in collaboration with DeXe DAO Studio, utilizing its mature governance framework,

Clearly, this will provide $ZCX holders with decentralized community governance and decision-making capabilities.

The first batch of proposals is now open for voting, including:

✅ ZCX token burn plan;

✅ Integration of AI/ML into liquidity mechanisms;

✅ Retail AI trading agents;

Additionally, to participate in governance, tokens need to be converted to bZCX on BNB Chain. Unizen has provided simplified cross-chain exchange steps:

pZCX → ZCX (ERC-20): Completed via a designated link.

ZCX (ERC-20) → bZCX: Completed via another link.

Remember to verify the correct contract address (bZCX contract address: 0x0Fdc787480BCaBD51Cc61c698a4220934920b831)

For more details, you can check the full announcement or join the community discussion.

Here, I mainly discuss the significance of the Unizen DAO launch —

1️⃣ Unizen DAO Launch: Dual Empowerment of BSC + DAO

In the current market where cross-chain liquidity competition is increasingly fierce, Unizen's DAO framework integrates with DeXe's advanced on-chain governance mechanism, enabling the community to achieve sustainable development in a decentralized and orderly manner.

It has now officially landed on the BSC chain, with several key highlights —

Governance democratization: Community members can vote on proposals to decide on fund allocation and ecological development direction, achieving more efficient and transparent decision-making;

Earn 2.0 expands to BSC chain: Users can earn returns by providing liquidity, further attracting cross-chain capital accumulation;

Technical synergy: BSC's high throughput (4600 TPS) and low-cost gas provide underlying support for Unizen's aggregated trading experience.

Clearly, the heat and liquidity of the BSC chain + DAO-style governance can bring dual empowerment to Unizen.

This move not only aligns with the dividend period of BSC chain's technological upgrades (such as sub-second transaction speeds and MEV protection mechanisms) but also leverages BSC's large user base to inject a strong boost into Unizen's liquidity growth, solidifying the foundation for Unizen's long-term growth.

2️⃣ How does Unizen secure its position as the "King of Liquidity Aggregation"?

As a decentralized liquidity router that combines AMM, PMM, and custom LP, Unizen now covers 17 blockchains and integrates over 200 DEXs, multiple private market makers, and exclusive LPs.

Its core competitive advantage lies in the technical barrier of "optimal price + lowest slippage." Recent ecological actions have been particularly noteworthy —

Collaborations with industry giants: From March to April, intensive deployments connected with CowSwap (daily trading volume of $200 million), BeBop (daily trading volume of $60 million), Across, and other top protocols, with total trading volume expected to exceed $400 million in the second quarter;

Becoming the default routing for top aggregators: Already capturing $100 million in daily traffic from a top platform, with technical strength validated by the market;

Accelerated cross-chain expansion: Further connecting multi-chain liquidity islands through cross-chain bridges like Wormhole and Conveyor.

Against the backdrop of BSC chain's DeFi TVL surpassing $5.35 billion and stablecoin market cap reaching new highs, whether for single-chain trading or cross-chain aggregation, whether serving wallets, market makers, or intended applications, Unizen's aggregation capability can undoubtedly become one of the core entry points for capital flowing into the DeFi ecosystem.

3️⃣ The value flywheel under the deflationary model —

A project's fundamentals do not necessarily require a buyback mechanism, but token buybacks can boost the market to some extent and are an important strategic layout for projects to endow token economics with long-term value.

Having revenue and buybacks is essential for a prolonged battle; at least the value bet in real money is something the market can see.

Recently, DeFi projects like dYdX, Jup, and Aave have experienced a wave of buybacks, with token prices showing significant increases in the secondary market, and the potential benefits brought by the buyback mechanism are evident.

Unizen's $ZCX token economics directly addresses market pain points — "Almost all revenue generated from each transaction, up to 100%, is used for buyback and destruction."

According to estimates, under the current cooperation scale, the platform's daily buyback amount reaches as high as $80,000, with an annualized deflation rate far exceeding similar projects. The scarcity of $ZCX will increase exponentially with trading volume, and the token price will have relatively healthy upward potential.

Conclusion —

While the market is still debating the bubble of meme coins, Unizen has quietly built a moat with its technical aggregation capabilities, DAO governance first-mover advantage, and token deflationary model.

As the BSC chain explodes back onto the main stage of market trading, Unizen may become a highly certain value target in this round of ecological dividends. My suggestion is to seize the Unizen ecological dividends in three steps —

Keep a close eye on official updates to get the DAO governance proposals and staking opening notifications as soon as possible.

The Earn 2.0 staking plan on the BSC chain is about to launch, allowing users to capture returns and governance rights through LP staking;

Join the DAO co-construction, influence project decisions with voting rights, and share the value returns brought by community growth.

Riding the wave of BSC, I believe now is the best time to pay attention to Unizen DAO. I will continue to monitor the movements of $ZCX, as being a wind catcher is always more advantageous than being a wind chaser!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。