In March 2025, PumpFun finally launched its own AMM decentralized exchange: PumpSwap, which means that PumpFun's relationship with Raydium has shifted from cooperation to direct competition.

What we need to focus on is why Pump decided to launch Swap? What is its purpose? What are its differences and similarities compared to Raydium? This article will provide you with a comprehensive answer.

What is Pumpswap?

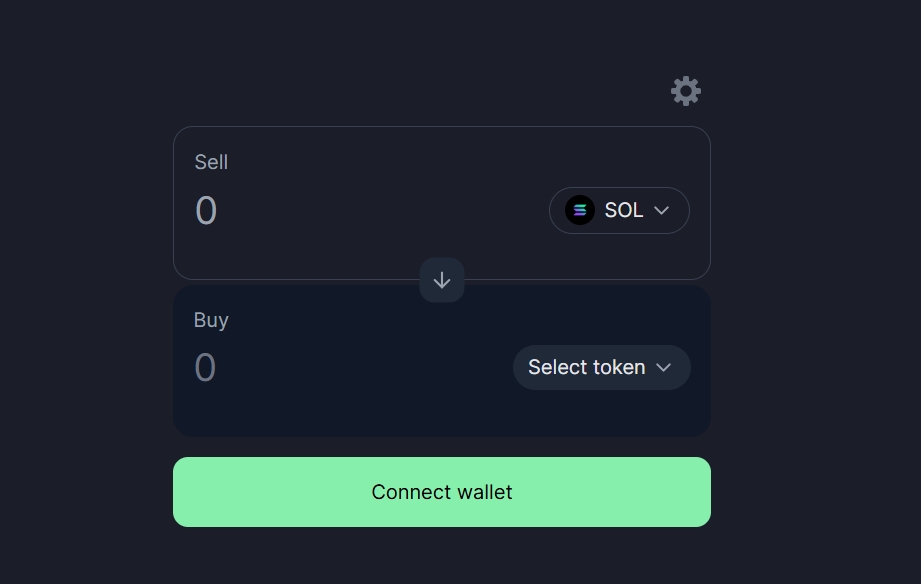

Pumpswap is a decentralized exchange (DEX) based on the Solana blockchain, launched by the meme token creation platform PumpFun in March 2025. It is primarily used to handle tokens launched on PumpFun, allowing them to migrate and start trading instantly. In simple terms, when the total tokens on Pump reach 85 SOL, they will be directly launched on PumpSwap instead of the previous Raydium.

Like Raydium V4, Uniswap V2, and PancakeSwap V2, Pumpswap adopts the AMM automated market maker mechanism, and its contracts have been audited by nine independent security companies, ensuring long-term open-source transparency and security.

Why launch Pumpswap?

As is well known, tokens launched on Pump are directly used to create a liquidity pool for trading on Raydium V4, with pool creation fees reaching up to 6 SOL. Although these 6 SOL come from the accumulated 85 SOL on Pump, it is still a significant cost for token developers. Moreover, PumpFun believes, why should Raydium earn this fee? Raydium has not contributed anything to this ecosystem and is unreasonably pocketing 6 SOL.

Given this, why not create a DEX for users to trade directly? Based on these reasons, a native PumpSwap was launched.

What are the features of PumpSwap?

Contract Type: The built-in contract of PumpSwap is an AMM automated market maker, using the constant product formula (x * y = k) to facilitate trading, similar to Uniswap V2 and Raydium V4.

Supported Tokens: In addition to supporting tokens successfully launched by PumpFun, PumpSwap also supports tokens from other blockchains, such as Aptos (APT), Tron (TRON), Coinbase's cbBTC, and Ethena's USDe. This is very valuable for many non-meme traders.

Incentive Mechanism: PumpSwap plans to introduce a creator revenue-sharing mechanism in the future, distributing a portion of the protocol's revenue (such as 0.05% of trading fees) to token creators. This initiative aims to incentivize the launch of high-quality tokens and enhance the alignment of interests between creators and the community.

Fee Structure: Like most DEXs, PumpSwap charges a fee of 0.25% for each transaction, with 0.20% allocated to liquidity providers and 0.05% retained by the official team.

How to trade on the market?

After understanding PumpSwap, traders or token creators may be more concerned about how to operate tokens on PumpSwap. Are there trading bots that support PumpSwap?

The answer is yes. Although PumpSwap has only recently launched, PandaTool has already introduced a trading bot that supports PumpSwap, helping users quickly complete buy and sell orders.

Users only need to import their wallet private key to control multiple addresses for trading. Through Jito's bundling feature, multiple addresses can be bundled for trading, making it faster and more convenient.

It is clear that the launch of Pumpswap marks PumpFun's innovation in the decentralized finance (DeFi) space. It not only reduces reliance on external platforms (like Raydium) but may also promote the prosperity of the PumpFun ecosystem by increasing liquidity. The PumpSwap trading bot launched by PandaTool will also better assist token creators in managing their token market capitalization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。