Traditional financial giants hold trillions of dollars in capital but are constrained by compliance shackles; DeFi pioneers possess innovative technologies but struggle for mainstream recognition. This disjointed situation has existed for a long time, like an invisible chasm, becoming the biggest theme of the current cycle and the coming years, hindering the inflow of trillions in institutional funds.

Just last week, Ethena Labs and Securitize joined forces to launch Converge, a settlement network for traditional finance and digital dollar transactions. The vision is to provide the first settlement layer blockchain designed specifically for the integration of TradFi and DeFi.

The era of merging traditional finance and DeFi may be upon us.

Breaking the Three Major Dilemmas of RWA Development

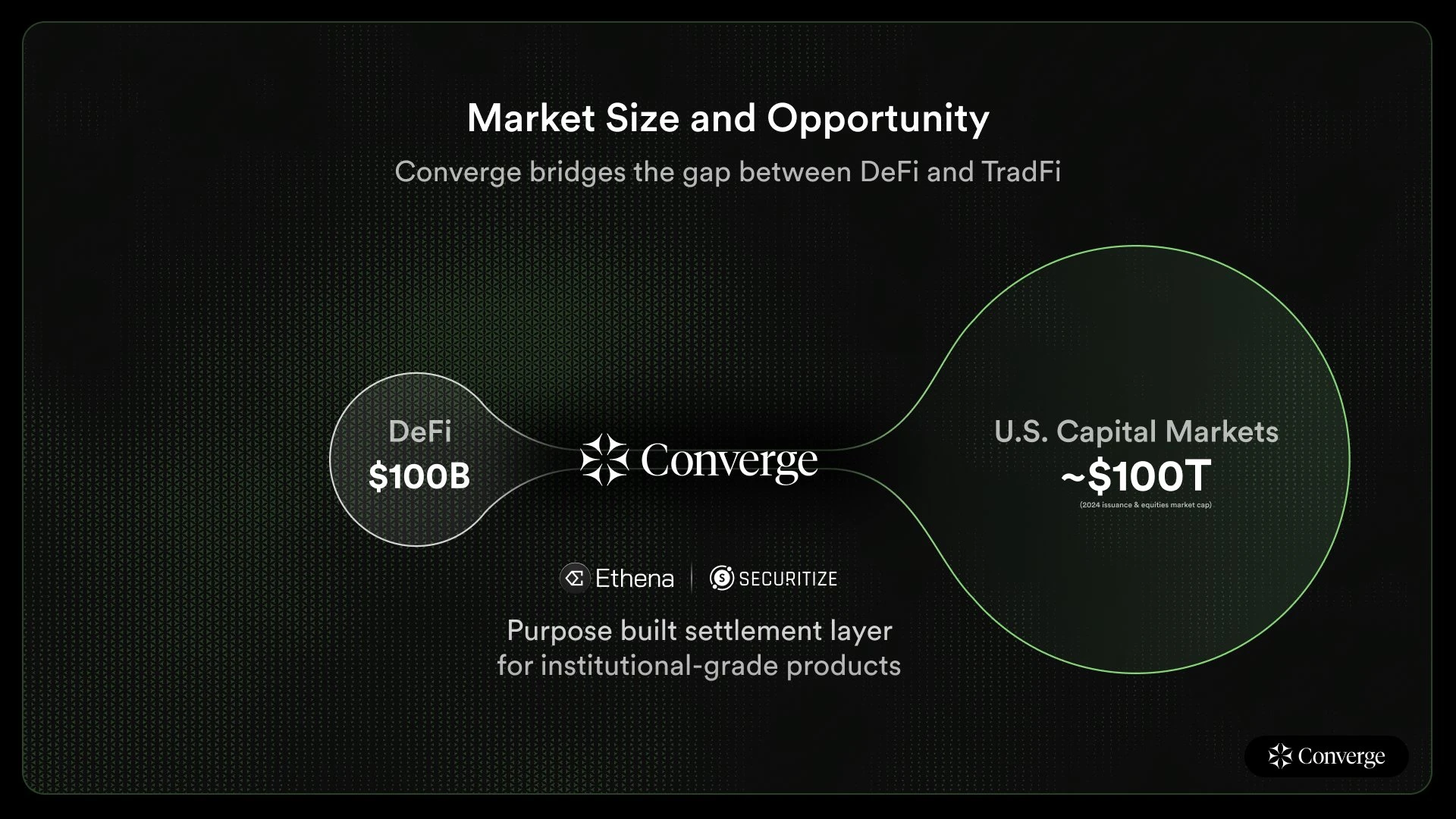

Faced with a trillion-dollar pool of funds in the traditional financial market, DeFi's current $100 billion TVL seems insignificant. Moreover, traditional financial institutions are not unwilling to enter the market; rather, they lack compliant and efficient access channels. The absence of KYC verification and transaction monitoring in existing public chains has deterred institutional investors holding substantial capital.

The launch of the Converge public chain by Ethena and Securitize is precisely aimed at this structural opportunity.

Converge's positioning is very clear: a Layer 1 blockchain designed specifically for RWA, compatible with EVM.

The problem it aims to solve directly addresses the core issues facing RWA development today—creating a settlement platform that meets the compliance needs of financial institutions while fully leveraging the decentralized advantages of DeFi.

In the official materials released, Converge provides a solution with a systematic approach:

First is the upgrade of technical infrastructure. By creating a high-quality public chain compatible with EVM, it reduces the friction costs of cross-chain asset transfers.

Second, the establishment of a compliance framework. This brings us to Ethena's long-time partner, Securitize, a U.S. investment and financing platform led by BlackRock. Securitize's BUIDL fund is currently the largest RWA fund, with a TVL of $1.2 billion. Last year, Ethena collaborated with Securitize to launch the USDtb stablecoin, backed by tokenized assets from the BUIDL fund. This time, the regulatory technology module from Securitize will be introduced in Converge to achieve full-process compliance coverage from KYC verification to transaction monitoring.

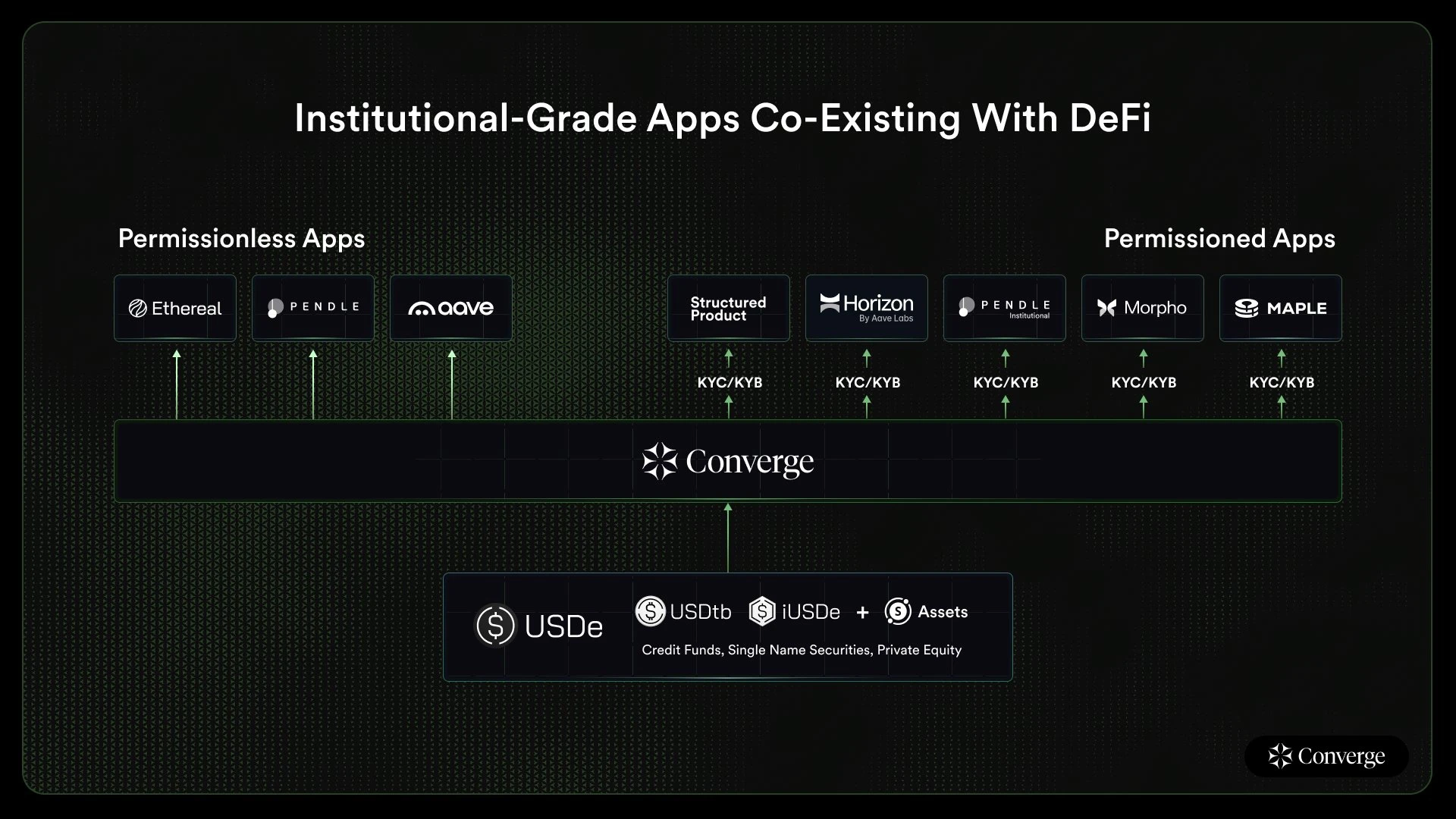

Finally, there is the construction of ecological synergy. Currently, the involvement of institutional custodians such as Copper, Fireblocks, Komainu, and Zodia provides security for institutional funds entering the market. In terms of DeFi protocols, leading protocols such as Aave, Ethereal, Maple Finance, Morpho, and Pendle have already committed to building and distributing institutional-grade DeFi products on Converge.

Thus, a "technology + compliance + ecology" three-dimensional layout is formed, creating a unique competitive advantage.

The Breakthrough of the Dual-Track Design

A close look at Converge's design reveals that the ecosystem will have three parallel operating pillars:

On the open ecosystem side, users can access a DeFi ecosystem and applications that have found product-market fit without permission, built on USDe, including projects incubated and accelerated by Ethena, such as EtherealDEX;

On the compliant finance side, a key highlight of Converge is its transaction settlement and asset custody services. To participate in investment products on the platform from Ethena and Securitize, users must complete the identity verification (KYC) process. This is to ensure transparency in the transaction process and compliance with legal regulations.

This architecture retains the open characteristics of DeFi while opening a safe channel for traditional funds to enter.

Notably, Converge also supports hybrid innovative products such as stock tokenization and leveraged trading of credit assets. This is akin to creating a "digital asset innovation testing zone" next to the traditional financial edifice, allowing financial institutions to maintain compliance while exploring cutting-edge application scenarios.

This design enables institutional clients to use familiar development tools while meeting regulatory requirements. It replicates a Wall Street-level clearinghouse in the crypto world, preserving the speed advantages of blockchain while embedding the risk control genes of traditional finance.

The Ambition of Crypto Newcomers to Break Boundaries: The Strategic Intent Behind the $6 Billion Ecosystem Migration

Founded less than two years ago, Ethena Labs has achieved remarkable success in just a few months, transforming from a startup team to an industry leader.

- The fastest decentralized stablecoin to reach a $5 billion market cap in history

- Became the third-largest stablecoin in the industry within 10 months of operation

- The protocol achieved $100 million in revenue in the second-fastest time in history

- Attracted more funds in Q4 2024 than Ethereum ETFs

- Maintained an 18% annualized yield for USDe throughout 2024

- Formed a strategic partnership with World Liberty Financial, linked to the Trump family

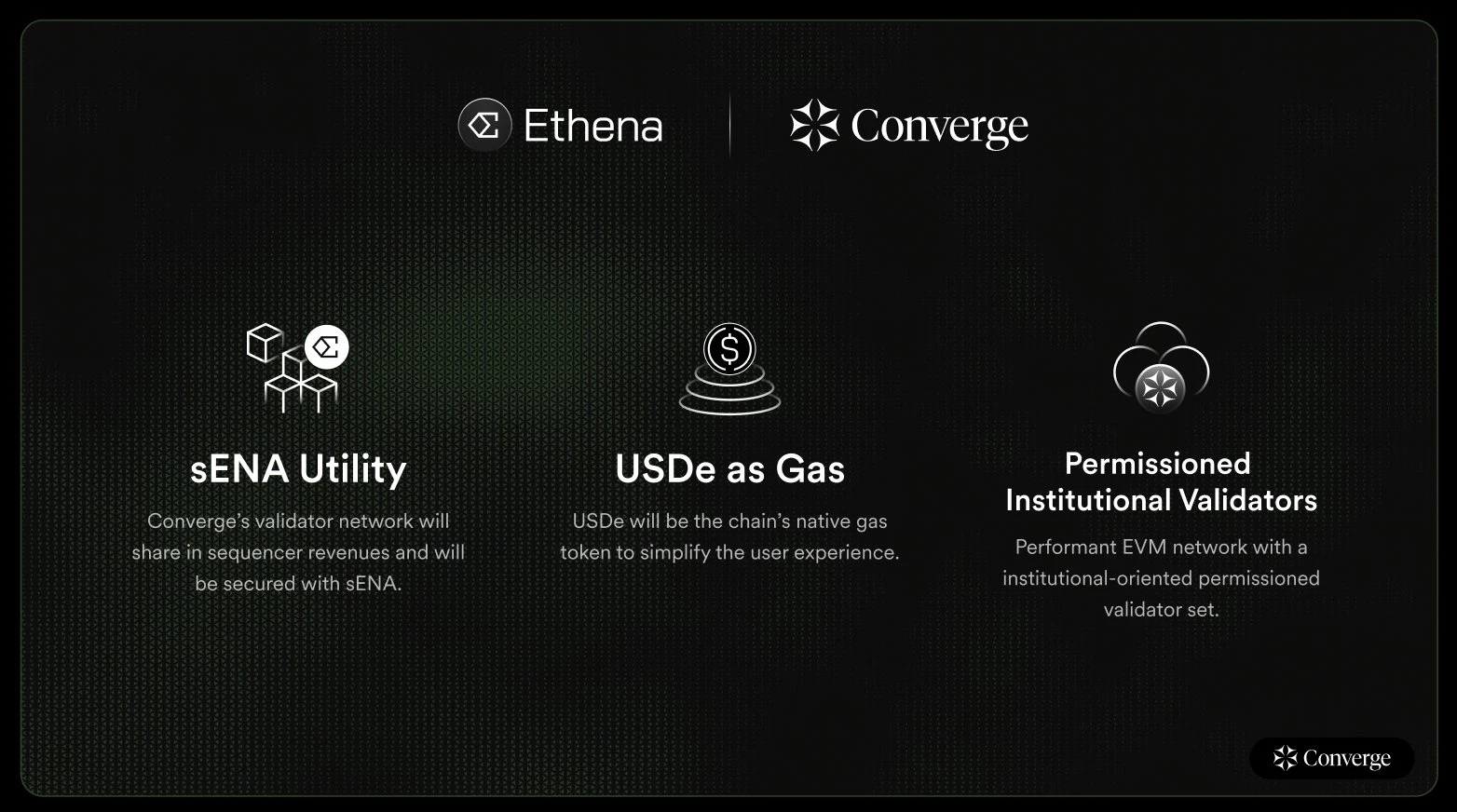

Their ambitions extend beyond just building a technology platform. Ethena plans to migrate over $6 billion in assets from its existing ecosystem to Converge and launch a series of stablecoin products such as USDe and iUSDe. These actions imply a deeper strategic goal—restructuring the on-chain dollar system. The dollar remains the structural foundation for the flow of funds on-chain, and all protocols involving dollars in DeFi can be rebuilt around Ethena, improving economic structures.

By packaging and outputting crypto-native assets in a way recognized by the traditional financial system, Ethena can establish a two-way funding channel. In this design, institutional clients can participate in DeFi through compliant entry points while incorporating on-chain assets into traditional balance sheets. This "two-way penetration" model may become the key to unlocking institutional funding.

RWA Enters the Deep Water Competition

The debut of Converge reveals three major trend shifts in the industry:

- From concept validation to substantial implementation: RWA projects are beginning to focus on specific application scenarios, such as the breakthrough in stock tokenization trading.

- Compliance becomes a necessity: Over 80% of surveyed institutions indicate that regulatory compliance is the primary consideration for participating in RWA.

- Ecological synergy replaces single-point breakthroughs: Project parties are placing greater emphasis on the ability to integrate technology, capital, and compliance resources.

These shifts indicate that the RWA track is moving from the early stage of conceptual hype into a deep water zone where substantial implementation capabilities are tested. Projects that can build compliant bridges and address real pain points may gain an advantage in this competition.

Quiet Waters Run Deep in Financial Transformation

Converge is expected to launch its mainnet in the second quarter of this year. The validator system will use ENA tokens for staking and transaction validation. Meanwhile, USDe and USDtb will serve as transaction fee tokens on the network.

Although the actual effects of Converge remain to be tested by the market, its demonstrated systematic thinking is worth emulating in the industry. In the process of merging traditional finance and DeFi, true breakthroughs often do not lie in a flashy technology but in finding the dynamic balance point between compliance and innovation. When institutional funds begin to flow steadily through these compliant channels, we may witness a profound transformation in the financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。