Don't worry about not having friends on the road ahead; there are like-minded individuals on the investment path. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the articles and videos from the King. Every day, I bring you different news from the crypto world and precise market analysis.

Bitcoin Market Analysis Report (March 26, 2025)

1. Current Market Environment and Price Dynamics

Short-term rebound and mid-term pressure. After experiencing a unilateral decline in the previous two weeks, Bitcoin has recently entered the 87K area for sideways consolidation, forming a box oscillation pattern.

Key resistance levels:

- First resistance: $89,300

- Second resistance: $88,300

Key support levels:

- First support: $86,800

- Second support: $85,600

If the price can hold above the $86.8K support (combined with the 200-day moving average and trendline support), it is expected to test the $90K mark; if it breaks below, attention should be paid to the effectiveness of the support at the ascending trendline 2.

Technical indicator signals:

Daily level: The MA30 moving average ($85,700) has broken through. The MACD shows a slight bullish crossover. The RSI is in the neutral zone (52), showing no overbought or oversold signals.

4-hour level: The middle band of the Bollinger Bands ($84,500) and the MA120 moving average ($85,500) form short-term support. Open interest has decreased by 2.01%, indicating weak leverage demand.

2. Key Influencing Factors Analysis

Geopolitics: Short-term positive news from Russia-Ukraine ceasefire negotiations.

U.S. President Trump stated that Russia and Ukraine will reach an agreement on maritime ceasefire and consider reducing sanctions against Russia. Although substantial progress will take time, market sentiment has been boosted. The consensus on maritime safety in the Black Sea may alleviate volatility in the energy and commodity markets, indirectly benefiting the risk appetite in the crypto market.

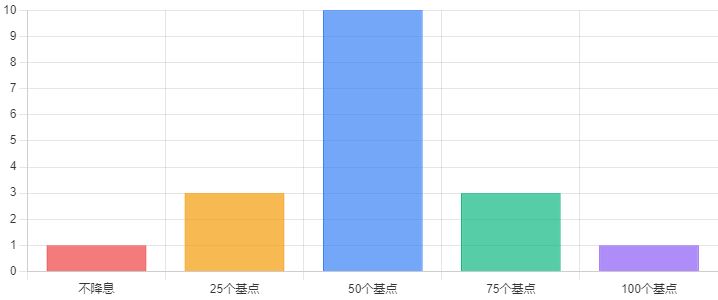

Federal Reserve Policy: Divergence in interest rate cut expectations for 2025.

The Federal Reserve's dot plot shows that the expectation for interest rate cuts in 2025 is concentrated around 50 basis points (supported by 10 officials), but there is significant divergence: 4 officials support only a 25 basis point cut, while 4 believe no cut is necessary. Powell emphasized that they are "close to pausing interest rate cuts," suggesting limited space for liquidity easing.

Interest rate cut expectation distribution:

If there is only one rate cut throughout the year, it may suppress Bitcoin's momentum to break through historical highs.

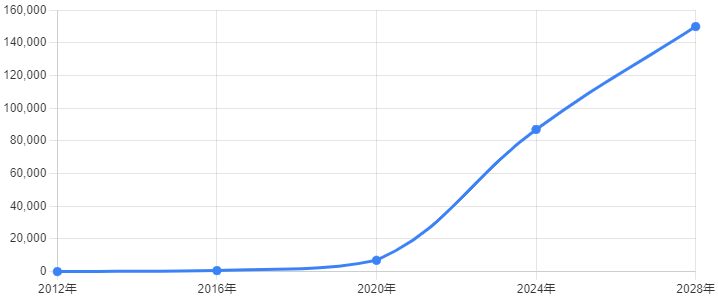

Bitcoin halving cycle effect:

After the halving event in April 2024, the market enters the "post-halving cycle." Historical patterns show that prices typically reach new highs within 480 days after halving. However, the current market is constrained by macroeconomic tightening and a slowdown in institutional capital inflows (such as stagnant spot ETF flows), and the halving effect may be delayed until the second half of 2025.

Halving historical patterns:

Miner selling pressure has eased due to the increase in transaction fees (over 30%), but fluctuations in overall network hash rate remain a concern.

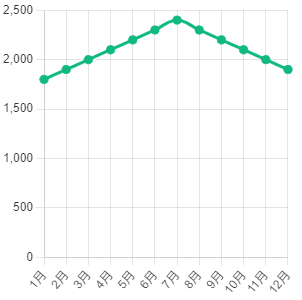

3. Ethereum Correlation Analysis and Target Validation

Key resistance breakthrough situation: Ethereum's short-term ceiling is $2,102. Once stabilized, the target points to $2,380-$2,420. The current price is consolidating around $2,200, and it needs to break through the $2,320 resistance (100-hour moving average) to confirm the upward trend.

Ethereum price trend:

Market sentiment and on-chain indicators:

The Ethereum social sentiment index has risen to a yearly high, with an increase in the number of active addresses on-chain, but the decline in Gas fees indicates a cooling of short-term speculative demand. Long-term holders (HODLers) account for a historical peak, indicating market confidence in the ETH 3.0 upgrade and the expansion of the L2 ecosystem.

4. Mainstream Institutional Predictions and Capital Flows

Divergence in institutional views:

Optimists: Spot on Chain predicts, based on AI models, that there is a 63% probability Bitcoin will break $100,000 in the second half of 2025, with a target of $150,000 in early 2026.

Cautious: The Coin Victory Group believes that a "crazy bull" market is unlikely in the second half of the year. After a daily golden cross, there may be another death cross. It is recommended to focus on ultra-short-term low buys while maintaining a bearish outlook for the mid-term.

Capital distribution and liquidity:

The $86,500-$87,000 range is a recent area of concentrated trading. After multiple failed tests by bears in this area, some funds have shifted to altcoins (such as SOL, ADA). The BTC inventory on exchanges has dropped to a yearly low, indicating an increase in long-term holders, but the decline in leverage in the derivatives market limits volatility.

5. Operational Strategies and Risk Warnings

Short-term strategy:

Long position opportunities: Enter lightly near $86,800, with a stop loss at $85,600 and a target of $88,300-$89,300.

Short position opportunities: Lightly short in the $88,300-$89,300 range, targeting $86,800-$85,600.

Mid-term risks:

Geopolitical conflicts: If the Russia-Ukraine negotiations break down or sanctions escalate, it may trigger a sell-off in safe-haven assets.

Federal Reserve policy shift: If inflation rebounds and the expectation for rate cuts fails, Bitcoin may test the psychological support at $80,000.

6. Conclusion

Currently, Bitcoin is in a transitional phase between bear and bull markets. A technical rebound needs to resonate with macroeconomic and capital market conditions to establish a trend. Investors should be wary of the "high and then low" volatility characteristic and prioritize range trading strategies while closely monitoring the Federal Reserve's policy path and geopolitical developments. If Ethereum can break through $2,320, it may become a key variable driving market sentiment.

This article is independently written by the Coin Victory Group. Friends in need of current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been primarily characterized by oscillations, accompanied by intermittent spikes. Therefore, when making trades, please remember to control your take profit and stop loss. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Friends who wish to watch can find the Coin Victory Group online and contact me for the link. The focus is on spot, contracts, BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT. Expertise style: mobile lock-up trading strategy around high and low support and resistance, short-term wave highs and lows, mid to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。