The incredible thing about Bitcoin is that over time, it has slowly but steadily eliminated every existential risk.

Author: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Deep Tide TechFlow

I first heard about Bitcoin in February 2011.

At the time, I was working at ETF.com, managing a young team of financial analysts responsible for operating the world's first ETF data and analysis service. We held weekly meetings to discuss market dynamics. In February 2011, Bitcoin first broke the $1 mark, and one of my analysts announced this historic "dollar threshold." He then led a fascinating discussion about what Bitcoin was, how it worked, and what it might become in the future.

If I had invested $1,000 in Bitcoin after that meeting, it would be worth $88 million today. Instead, I left the office to grab a coffee.

I share this story because everyone—everyone—has that feeling. We all wish we had bought Bitcoin earlier.

But what we forget in these stories is that Bitcoin faced enormous risks at the time.

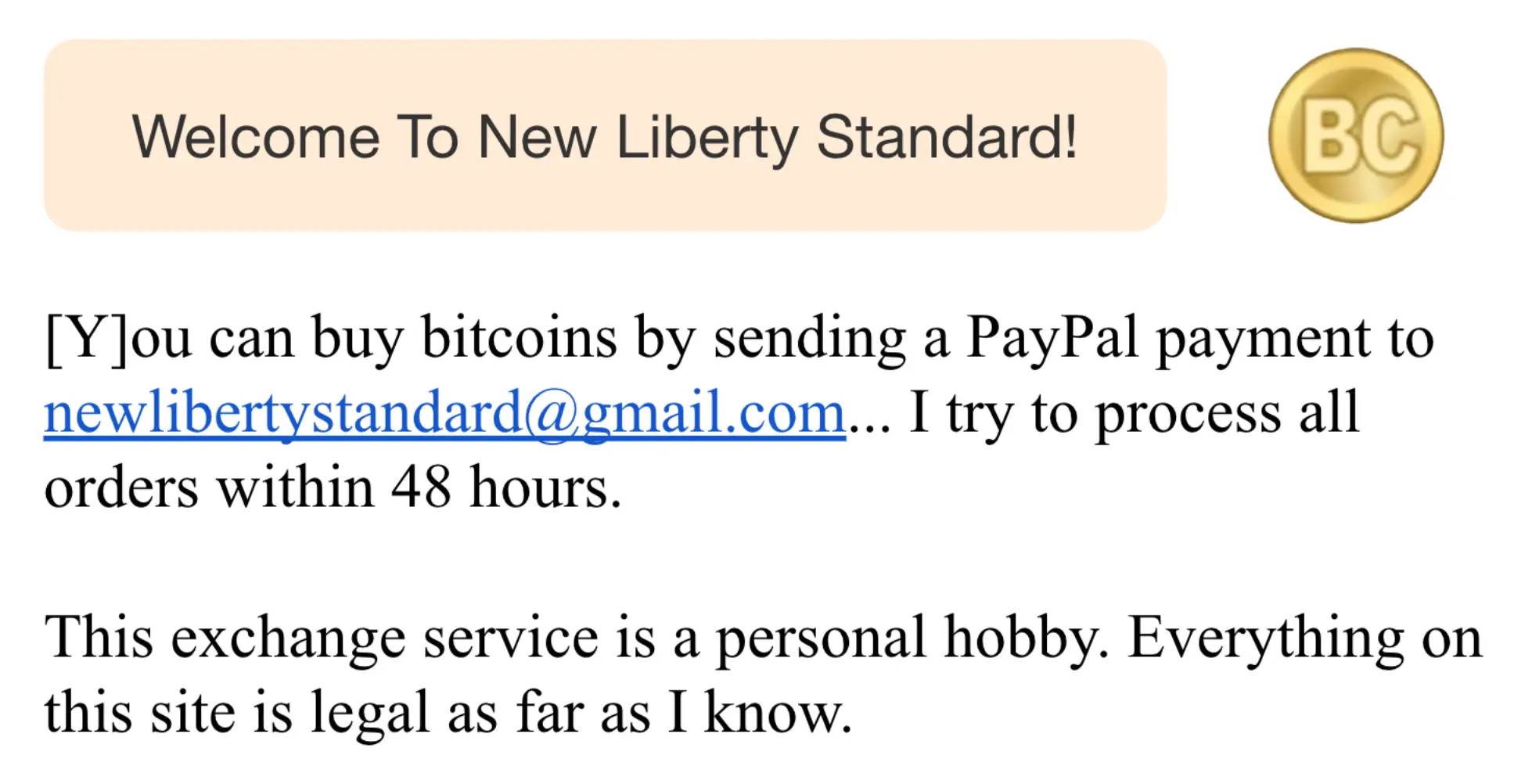

For example, on the day I held the $1 meeting, the largest cryptocurrency exchange in the world was New Liberty Financial. Here are their terms of service.

In hindsight, it's easy for me to say I should have bought $1,000 worth of Bitcoin. But at that time, it meant sending $1,000 to a random PayPal address. Add to that the risks of custody, regulation, technology, and government… investing $1,000 in Bitcoin in 2011 was a huge gamble.

I share this story now for two reasons:

1) To help you get over the initial regret of missing out on Bitcoin;

2) To help you believe that things are different now.

In fact, I believe today—right now—is the best time in history to buy Bitcoin at a risk-adjusted price.

We have just eliminated the last existential risk

Every investment involves weighing risks against rewards. A lottery ticket can turn $1 into $1 billion, but your expected return is zero.

In the early days, Bitcoin was a bit like a lottery ticket: huge upside potential, but equally huge risks.

For example, when Bitcoin first launched, no one could guarantee it would succeed. Yes, the white paper was brilliant. Yes, the logic suggested it would succeed. But before Bitcoin launched, there had been multiple attempts to create electronic cash that had all failed. (For example, take a look at this paper, "How to Mint: The Cryptography of Anonymous Electronic Cash," written by the NSA in 1997.)

But early Bitcoin faced other significant risks beyond the technology itself. For years, trading was risky—early exchanges were either unreliable or had low volume and poor operations. Then, Coinbase was founded at the end of 2011, and the game changed.

For a time, custody was also a risk—until well-known blue-chip companies like Fidelity began offering self-custody and institutional custody.

In Bitcoin's early days, there were also reasonable concerns about money laundering, criminal activity, regulatory standards, mining centralization, and more.

The incredible thing about Bitcoin is that over time, it has slowly but steadily eliminated every existential risk.

The spot Bitcoin ETF launching in January 2024 provides regulatory clarity for U.S. institutional investors hoping to enter the space, helping us overcome another major hurdle.

But even after the ETF launch, one existential risk always lingered in my mind: What if the government bans it?

U.S. Strategic Bitcoin Reserve

When someone asks me at a conference, "What keeps you up at night?" I always mention this.

I've been thinking about how the U.S. confiscated private gold reserves in 1933 to bolster the treasury. Why would it allow Bitcoin to develop to a point where it threatens the dollar?

To be honest, I don't know the answer.

When pressed on stage, I always remind people that the U.S. government bought gold from its citizens in 1933: If Bitcoin becomes large enough to challenge the dollar, I would say your investment could yield quite a nice return.

That's the best I can do.

But earlier this month, President Trump signed an executive order establishing the U.S. Strategic Bitcoin Reserve. Just like that, the last existential risk Bitcoin faced disappeared before my eyes.

Many people want to know why the U.S. would do this. Cliff Asness, founder of hedge fund AQR Capital, immediately wrote after Trump signed the executive order: "If cryptocurrency is a long-term competitor to the dollar, why would we promote this direct competitor to our status as the world's reserve currency?"

The answer, of course, is that Bitcoin is better than the alternatives.

For the U.S., the best-case scenario is that the dollar remains the world's reserve currency. But if we reach a point where that status is at risk, we better turn to Bitcoin rather than the currencies of other competing nations.

This is something I initially didn't consider: The U.S. will certainly embrace Bitcoin. It is the best backup plan on the market.

What this means for investors

Rumor has it that at Bitwise, we are starting to see the effects of this de-risking. Two years ago, Bitwise clients typically allocated about 1% of their portfolios to Bitcoin and other crypto assets, which was a loss they could easily afford.

Given that the possibility of Bitcoin being banned or facing other failures was not zero, this made sense. In today's environment, things are different. We are seeing allocations of 3% more frequently. As more people realize the massive de-risking we see in Bitcoin, I think you will see that number rise to 5% or even higher.

Risks and Important Information

No investment advice is provided; risk of loss: Each investor must conduct their own independent review and investigation of the merits and risks of any investment before making any investment decision and must make investment decisions based on such review and investigation (including determining whether the investment is suitable for the investor).

Cryptographic assets are digital representations of value that can serve as a medium of exchange, unit of account, or store of value, but they do not have legal tender status. Cryptographic assets may sometimes be exchanged for U.S. dollars or other currencies worldwide, but they are currently not backed by any government or central bank. Their value is entirely determined by market supply and demand forces and is more volatile than traditional currencies, stocks, or bonds.

Trading in cryptographic assets involves significant risks, including severe price volatility or flash crashes, market manipulation, cybersecurity risks, and the risk of losing principal or all of your investment. Additionally, the regulatory controls or customer protections for the cryptographic asset markets and exchanges differ from those for stocks, options, futures, or forex investments.

Trading in cryptographic assets requires an understanding of the cryptographic asset market. When attempting to profit from trading cryptographic assets, you must compete with traders around the world. You should have appropriate knowledge and experience before engaging in significant trading of cryptographic assets. Trading in cryptographic assets can lead to substantial and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to quickly liquidate positions at reasonable prices.

The views expressed represent an assessment of the market environment at a specific point in time and are not a prediction of future events or a guarantee of future outcomes, and are subject to further discussion, refinement, and revision. The information in this article is not intended to provide accounting, legal, or tax advice or investment advice and should not be relied upon as such. You should consult your accounting, legal, tax, or other advisors regarding the matters discussed in this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。