After returning home today, I started to intensively catch up on the information I missed before. A lot has happened this week, and the key points began with #Binance. First, there was the $GPS market maker incident, which locked up $3 million, and the GPS official has decided to compensate users. Then there was the $MOVE incident involving $38 million, and the project team has also agreed to compensate. Although the compensation plan is still being finalized, I heard through the grapevine that if there is no compensation, this batch of funds will be frozen.

In fact, my attitude towards Binance has changed somewhat recently, especially in the BNBChain space. I feel that Binance has a tendency to overexert itself, which could lead to a short-term explosion on-chain but may ultimately overdraw trust in the brand in the longer term.

Although I shouldn't be the one to say this, many friends in the #Solana community have expressed a desire to break free from the pervasive Meme situation. For a period, Solana was even referred to as the "gambling chain," which has sparked significant controversy internally. While the on-chain activity appears prosperous and protocol revenues have increased, it has essentially become a tool for a very small number of people to reap profits. So how different can BNBChain, which has retraced Solana's path, really be?

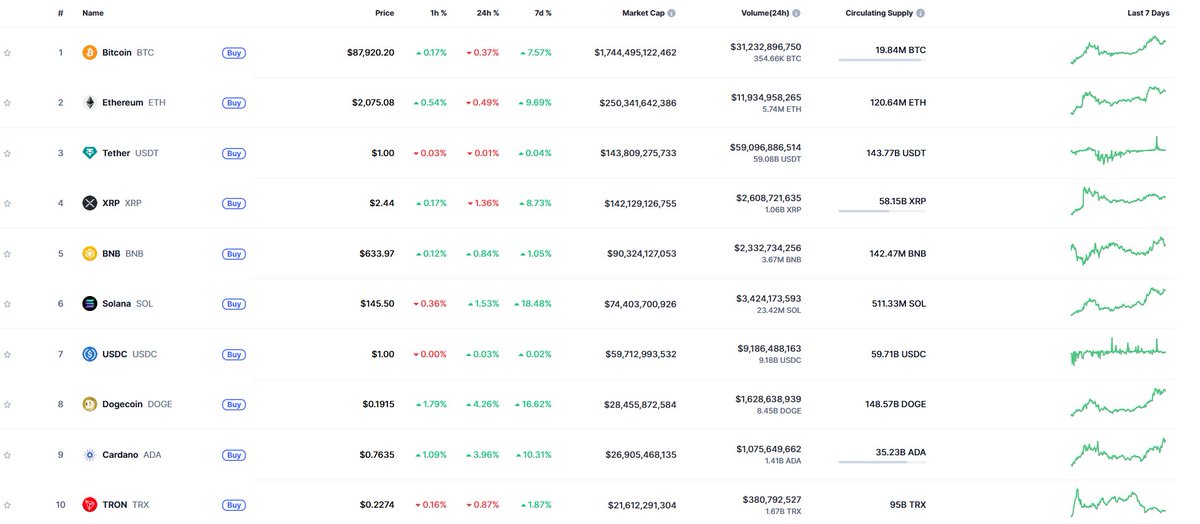

In the CMC rankings, $BNB has returned to the top five, but this is based on Solana's price being nearly halved from its peak. Why has this happened? Isn't it simply because the Meme wave in Solana has intermittently ended, with a large number of "big players" cashing out? They don't care about the price of $SOL; they are not here to build. Ultimately, they all want to convert their profits into USDT, and SOL is just a tool for their gains.

During this time, I've been worried that BNB might be in the same situation. Many friends know that I have been dollar-cost averaging into SOL and BNB for over a year, especially BNB, which is a significant position for me. In the BNBChain Meme space, aside from being pressured to buy $Siren, I haven't participated in any other Memes. Yet, my position is still very small because I am hesitant to make heavy bets in areas where I am not proficient. I want to make money, but I want to earn money that I can understand.

If my guess is correct, after this round of Meme voting, it is very likely that the Meme season for BNBChain will also enter a resting state. Even if it doesn't, how long can it last? Compared to the various angles explored in Solana's early days, it seems that there are only a couple of angles on BNBChain. Therefore, I feel that it has overexerted itself, and the lessons from the past are right here. I don't want to liquidate my BNB position so early.

So when I saw the information about locking up market maker compensation for investors, my conviction to sell BNB decreased somewhat. It is indeed clear that Binance understands that user interests are fundamental to the exchange, and that Binance's brand is the foundation of BNBChain. The value of BNB is the essential condition that determines whether people hold it.

The market is already in such a bad state; VC coins either become "something that even dogs won't play with," or they are shorted as soon as they are listed. Although we are currently in a liquidity trough, there are indeed some liquidity issues causing unfavorable prices, but launching at a peak will definitely draw criticism. Today, a friend even asked me what kind of exchange can be considered a successful exchange, and my answer is very simple.

It must create wealth effects and have brand assurance. The former relies on rules, while the latter relies on accumulation.

I hope that BNB's return to fifth place is not due to the decline of competitors, but because BNB can provide motivation for friends to hold their positions without selling. I've held it for several years, and I want to continue holding it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。