Overconfidence and superficial understanding are major taboos in trading. The human tendency to seek quick success and overnight wealth is a significant enemy of long-term successful investing. Often, slow is fast; the opposite extreme of rushing for success is ostrich thinking, which involves avoiding or procrastinating on problems with a negative attitude.

Hello everyone, I am trader Gege. Following up on the previous article, the short-term strategy discussed is quite accurate. For friends who like to operate based on market articles, you need to plan reasonably according to your habits and the changes in the market to achieve good results. Today, I will add some insights at the weekly level; friends who like big trends can pay more attention to this.

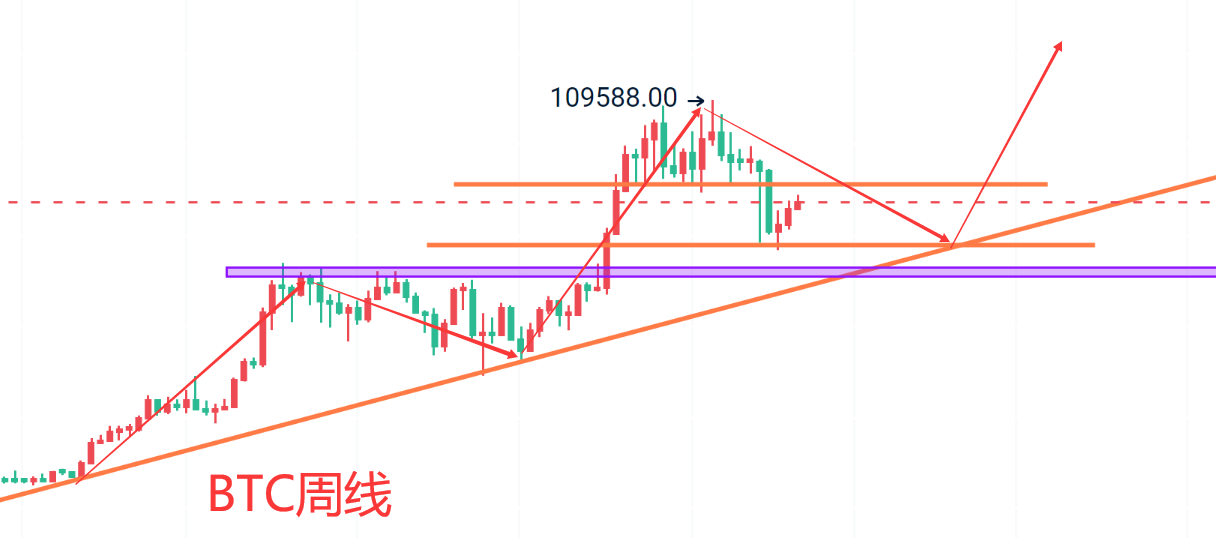

The weekly level of Bitcoin has touched the previously mentioned MA7, which is a key point to focus on. The probability of breaking through and approaching the middle track is very high. Conversely? This was already mentioned in yesterday's article; you can review it, so I won't elaborate here. What I want to add today is that regardless of whether it touches the middle track or breaks through later, be aware that there is a probability of another downward test. Therefore, for bulls, while being optimistic, caution is also necessary. Personally, I hope to test the previous low point again, which would solidify the gap and provide more strength for the subsequent rise, allowing it to go further.

The additional points have little impact on short-term trading; friends focused on long-term trends can refer to this and think more about the combination of left and right side trading methods. The MACD double line on the weekly chart needs repeated oscillation to correct. If it approaches the zero axis without breaking, and at that time, the candlestick pattern shows a bottoming signal, you should know what to do. Fans who enjoy Gege's articles can like and share more, as Gege's articles not only contain strategies but also trading logic, methods, and mindset management. Friends who like it can read it several times; I believe you will learn something.

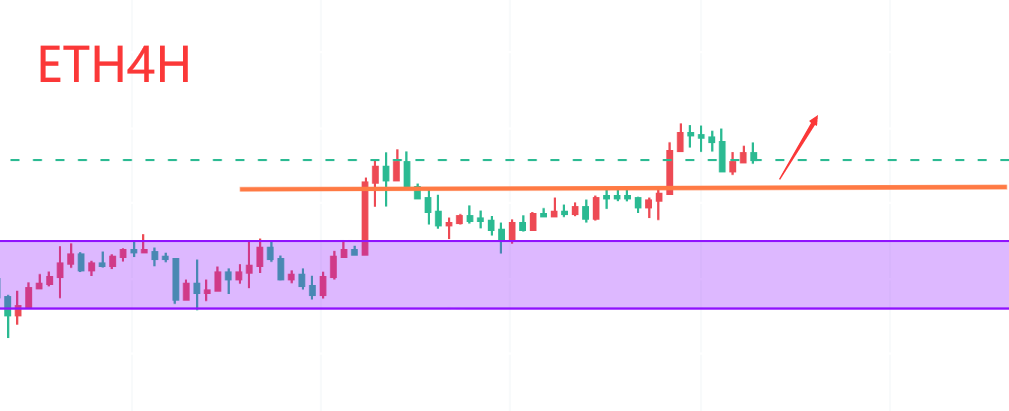

Today's short-term technical analysis of Bitcoin doesn't have much to say, as it is still within the structure. The support below continues to reference the trend line near the lower edge of the upward channel. Friends looking to short should wait near the upper trend line. The technical analysis for Ethereum is also to continue referencing yesterday's thoughts. If the short-term support at 2020 is not effectively broken, then continue to look for a rebound above it, corresponding to the MA7 near the daily level. If it breaks, those who entered should stop loss, and those who haven't entered should wait for the previous box's lower support to intervene based on the situation.

Bitcoin short-term: Buy near 85800-85500, aggressive buy near 86800-86500. Short near 90000 with a 500-dollar range.

Ethereum short-term: Buy near 2055-2025. Short near 2150 with a 20-dollar range.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage your profit and stop-loss space accordingly. Specific strategies should be based on real-time conditions; feel free to consult.

Alright, friends, we will see you next time. I wish everyone continued success in trading and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in making a comeback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。