Arcium is committed to providing flexible, high-performance, and trustless privacy-enhancing technologies (PETs) for cross-industry applications.

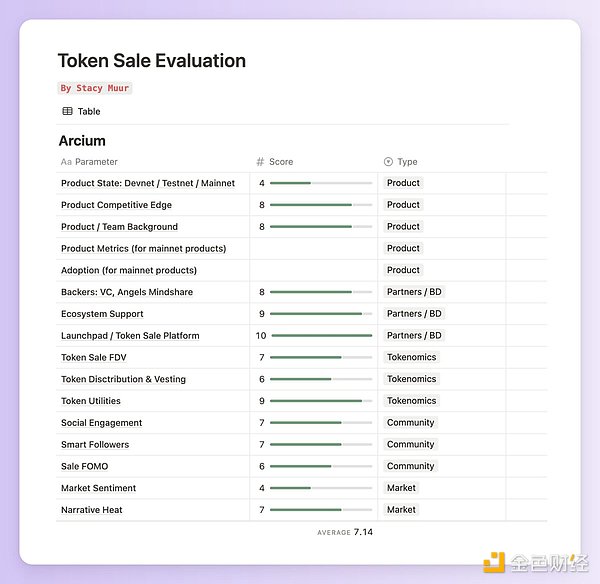

Written by: Stacy Muur, Web3 Researcher

Translated by: Jinse Finance xiaozou

CoinList recently launched the public sale of Arcium tokens.

As a competitor to Nillion, Arcium has a fully diluted valuation of $200 million and has secured $10 million in VC investment.

The following image provides a detailed analysis of the public sale:

A few weeks ago, I wrote an article about Arcium, introducing its product architecture. In this article, we will mainly look at the details of Arcium.

1. Product Introduction

- Field: Privacy Computing

- Competitor: Nillion

- Stage: Private Testnet (over 40K applications)

- Product Background: Elusiv, ZEUS

It is worth noting the last point: Arcium is derived from Elusiv and ZEUS.

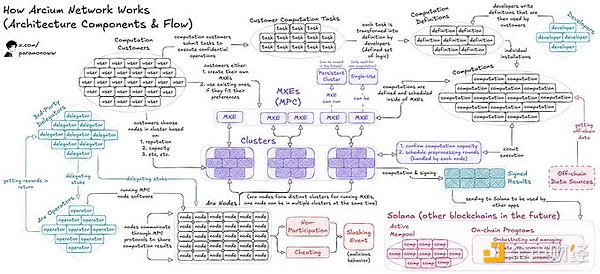

Elusiv is a Solana-based privacy application utilizing zero-knowledge proofs, supporting anonymous on-chain asset transfers and exchanges. ZEUS (Zero-Knowledge Encrypted User Protection System) is a decentralized compliance solution using encrypted computing to identify illegal activities. Based on this, Arcium is dedicated to providing flexible, high-performance, and trustless privacy-enhancing technologies (PETs) for cross-industry applications. The following image is a workflow diagram of the Arcium network provided by Pavel Paramonov—technology enthusiasts will definitely be impressed.

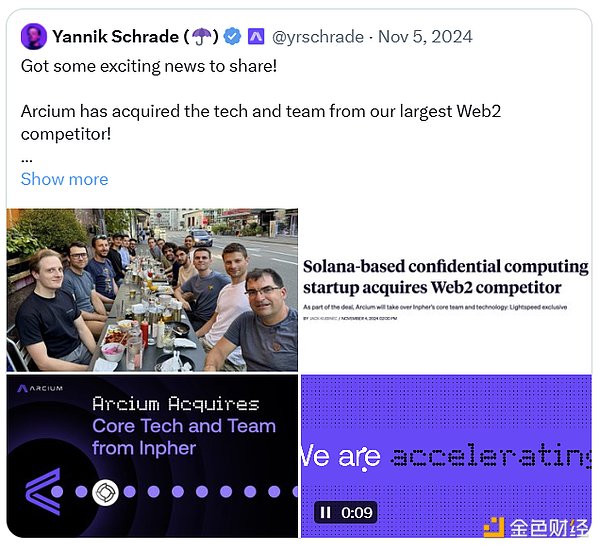

Regarding the team, it is noteworthy that Arcium acquired the leading Web2 confidential AI company Inpher and its team last November (which had received over $25 million in investments from institutions like JPMorgan). A significant amount of talent has flowed to Arcium.

2. Partnerships and Business

Secured $10 million in investments from institutions such as Coinbase Ventures, LongHash Ventures, Greenfield Capital, and Jump Capital.

I believe Anatoly's (toly) platform could be Arcium's hidden ace, especially as Solana will become the main hub for this protocol.

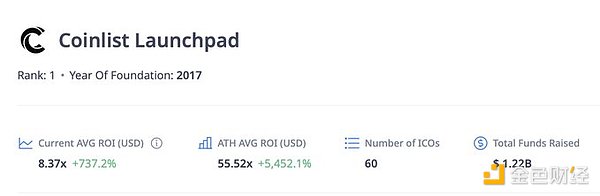

Choosing CoinList as the sale platform is perfect—this platform has an average historical investment return rate of 8.3 times, with cumulative financing exceeding $1 billion.

Its biggest competitor, Nillion, previously raised $20 million through CoinList (with a supply of 5% and an FDV of $400 million).

In comparison, Arcium's $200 million FDV valuation and 2% sale ratio are more suited to the current market.

3. Token Economics

In addition to a reasonable FDV, attention should also be paid to token utility and other aspects, such as:

- Dynamic supply mechanism

- Node operator rewards and staked tokens

- Deflationary burn mechanism

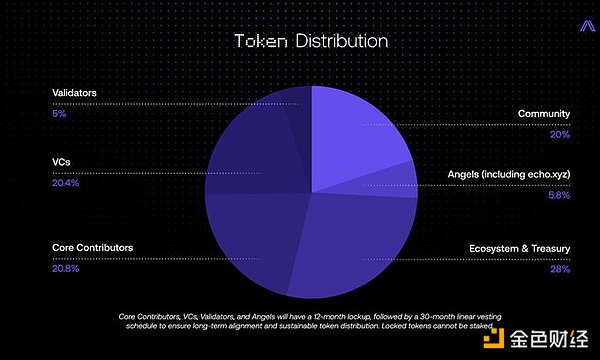

The token distribution ratio is shown in the following image. Although no unlocking details have been found, it is believed that all internal personnel (VCs, angel investors, team) will have at least a one-year lock-up period. However, the allocation ratio for internal personnel still appears to be relatively high.

4. Community Ecosystem

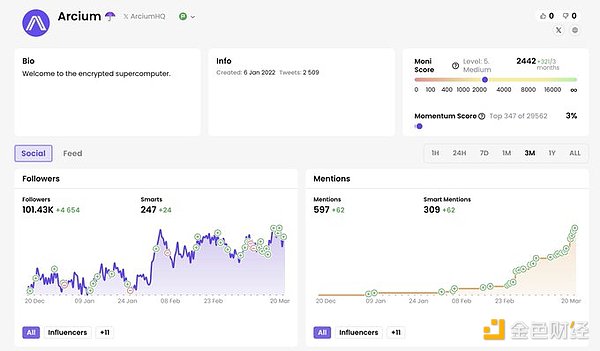

Arcium's social traction and intelligent fan growth are remarkable. Recently, it has gained significant attention from high-net-worth accounts, and user growth is highly organic.

5. Conclusion

This article aims to distill the key points of the Arcium sale to assist readers in their decision-making.

Remember: conduct your own research, do not blindly follow trends, and ensure that your investment decisions do not exceed your financial capacity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。