The launch of USD1 coincides with a critical period as the U.S. Congress reviews the "Stablecoin Innovation and Establishment Act" (GENIUS Act).

Written by: Ashley

The BSC ecosystem, continuously buzzing, welcomed a new wave of excitement early this morning. The DeFi project World Liberty Financial (WLFI), supported by the Trump family, launched the dollar-pegged stablecoin USD1 on BSC. After CZ retweeted the news, the community quickly created a token of the same name, instantly activating its "money-making mode."

Due to the abundance of similarly named scams, both CZ and the official WLFI account issued warnings to users to be cautious of falling victim. Subsequently, the price of USD1 rapidly declined, dropping over 50% from its peak as of the time of writing.

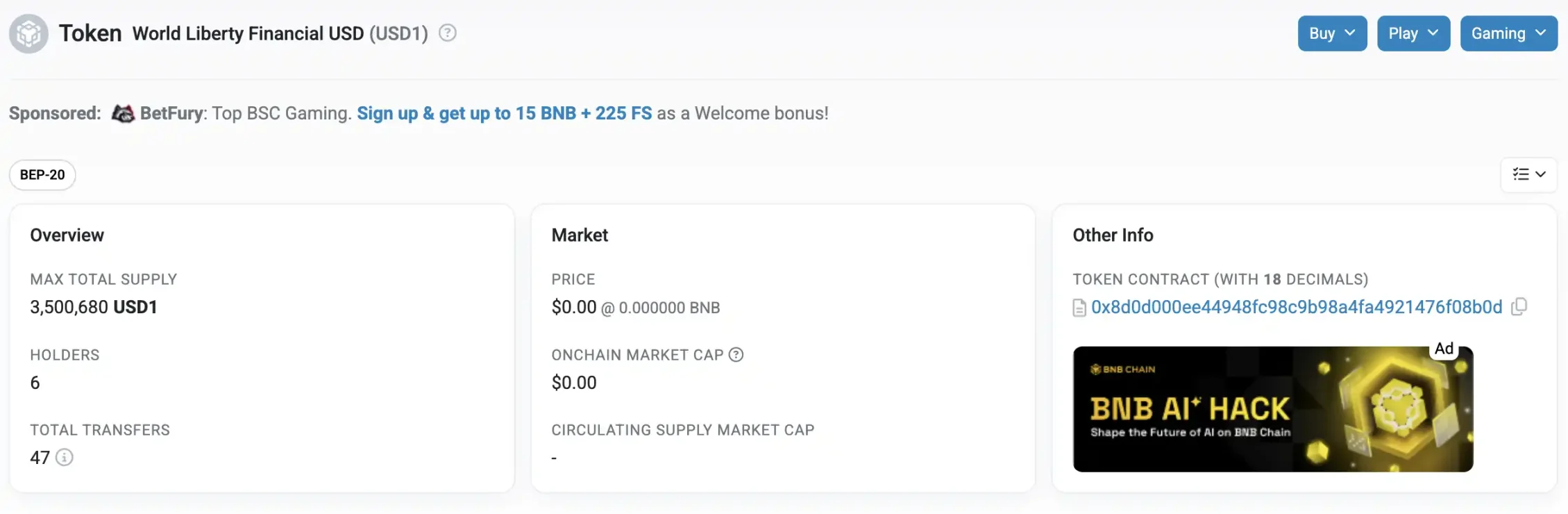

The total supply of USD1 exceeds 3.5 million dollars. According to on-chain data from Etherscan and BscScan, the project issued the World Liberty Financial USD (USD1) token in early March. CZ confirmed that the stablecoin contract has been deployed on the BNB Chain and Ethereum, currently open for testing to a limited number of addresses.

Why is WLFI targeting stablecoins?

The reason WLFI is focusing on stablecoins may lie in its development path. Since launching its initial token sale in October last year, WLFI has aimed to be a "new benchmark for decentralized finance," promoting itself to investors in the U.S. and globally. Trump himself serves as the "Chief Crypto Advocate," with his three sons holding titles as "Ambassadors" and "DeFi Visionaries," making the family brand its biggest selling point. However, difficulties in the first round of financing and the market's perception of it as a "meme project" have raised doubts.

In a bear market, stablecoin projects that can instead usher in a bull market not only provide WLFI with trading, lending, and liquidity but also bring considerable long-term returns. After the launch of USD1, it may become a funding entry point attracting a large number of institutions and retail investors, allowing WLFI to shed its "meme project" label and transform into a genuine DeFi player. According to data from WLFIArtemis and Dune, the number of active stablecoin wallets is expected to grow by over 50% from February 2024 to February 2025. In March of this year, the total market capitalization of stablecoins surpassed $230 billion, with USDT and USDC still dominating. WLFI's entry at this time may leverage favorable policies to compete for market share.

Since Trump's election, he has repeatedly publicly supported the development of cryptocurrencies, promising to make the U.S. a "global crypto hub" and emphasizing the dollar's dominant role in the digital economy. As an important vehicle for the digitization of the dollar, stablecoins naturally become a policy focus.

Related Reading: "Why has the crypto market evaporated $900 billion while stablecoin market capitalization hits a historic high?"

The launch of USD1 coincides with a critical period as the U.S. Congress reviews the "Stablecoin Innovation and Establishment Act" (GENIUS Act). The bill passed the Senate Banking Committee vote on March 13 with 18 votes in favor and 6 against, and is about to enter the full Senate voting process. This marks an important step toward the bill becoming law, indicating that stablecoin regulation has received approval at the Senate committee level for the first time.

Bo Hines, Executive Director of the President's Advisory Council on Digital Assets, expects the bill to be submitted for Trump's signature before June. Kristin Smith, CEO of the Blockchain Association, stated that the U.S. Congress may pass stablecoin-related legislation by August 2025, with the GENIUS Act seen as a key driving force. If WLFI can quickly refine USD1, it not only hopes to comply rapidly after the bill takes effect but may also leverage Trump's influence to seek a regulatory "green channel."

Is it a timely move or an opportunistic harvest?

Since Trump returned to the White House as the "Crypto President," every move he and his family project WLFI make has gradually become a barometer of trends in the crypto space. The BSC ecosystem has surged in popularity since CZ's return, with trading volumes warming up and various "couple-led meme coins" making the market lively. Meanwhile, stablecoins continue to capture attention as a "safe haven in a bear market." The USD1 launched by WLFI can be seen as combining the three major "BUFFs" of Trump's influence, the BSC ecosystem, and the stablecoin concept, naturally generating significant interest.

While the timing is fortuitous, in reality, WLFI's strategy regarding stablecoins is not a last-minute decision but rather a well-planned move. As early as October 14 last year, former Paxos CEO Rich Teo joined WLFI as the head of stablecoin and payment operations, which sparked market speculation about its entry into the stablecoin project.

Then, on October 29, Decrypt reported, citing sources, that WLFI planned to develop its own stablecoin. At that time, the project had raised $14 million through its initial token sale, but the product still needed time to refine its security.

On March 13 of this year, Bloomberg disclosed that WLFI had been in secret talks with Binance, with four insiders revealing that both parties had discussed the possibility of jointly developing a dollar-pegged stablecoin. Although the details of the negotiations were not made public, this clue aligns perfectly with USD1's choice to launch on BSC.

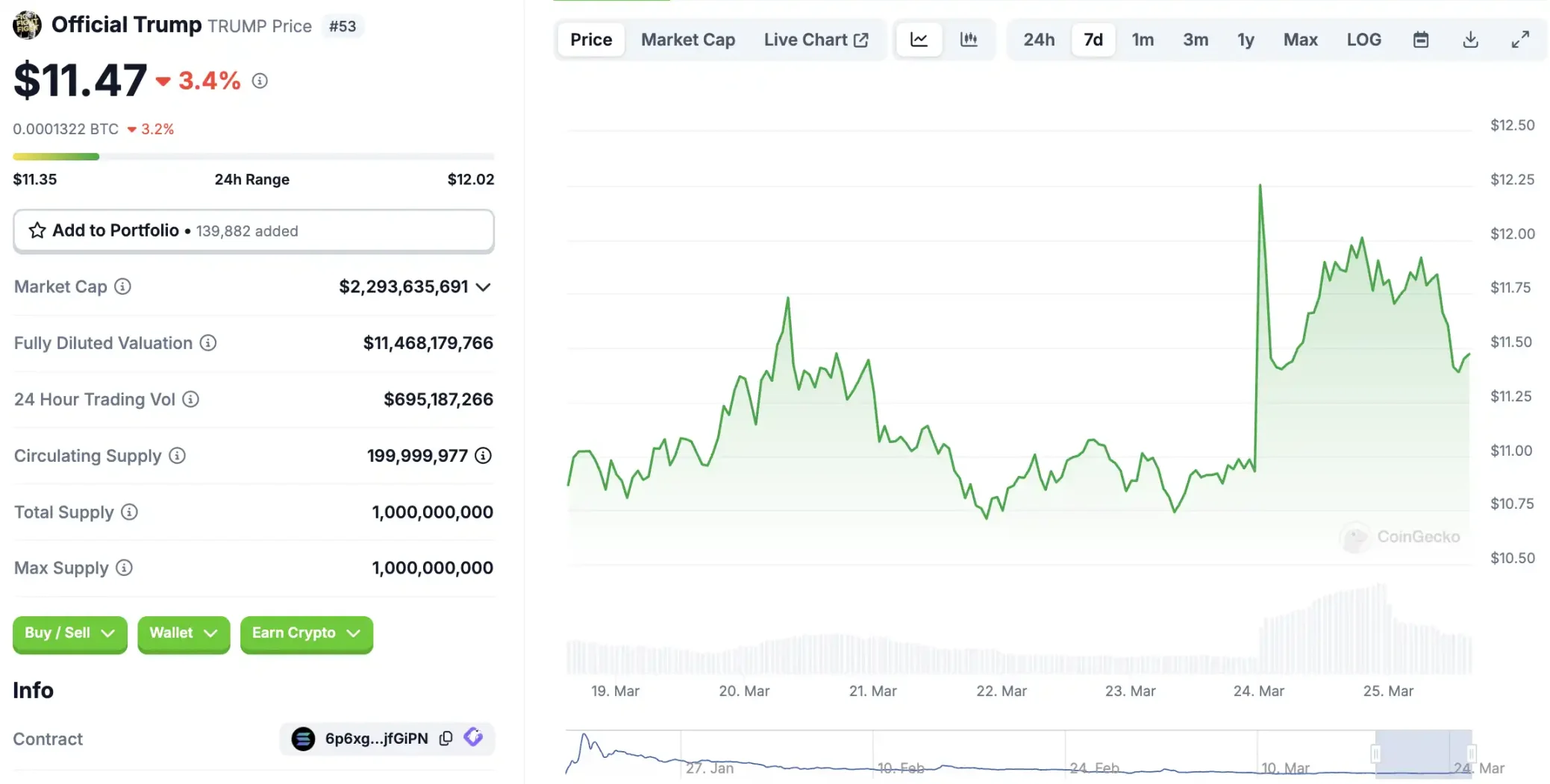

Although USD1 is not yet tradable, there is no shortage of speculation about whether this is yet another new "harvesting" strategy from Trump. After all, this year's crypto market has already been spun around by the president's tariff stick, meme bloodsucking, and post-liquidation calls. Just the day before, he was passionately shouting for his $TRUMP, "I LOVE $TRUMP—SO COOL!!! The Greatest of them all!!!!!!!!!!!!!!!!," but clearly, the market is no longer buying it, as this call only led to a brief rise of about 12% in $TRUMP before quickly falling back.

Related Reading: "Is Trump still a positive factor for the crypto space?"

As for USD1 itself, is its collateral mechanism transparent? When will the audit report be released? These key pieces of information have yet to be disclosed. Moreover, there has been ongoing controversy regarding WLFI and related interests. Since the WLFI platform launched in September 2024, many operational details have remained undisclosed. Its official website shows that Trump and some of his family members hold 60% of the company's shares. As of March 14, the project has completed two rounds of public token sales, raising a total of $550 million. According to the issuance documents for World Liberty's initial token sale, Trump and his associated company DT Marks DEFI LLC will receive 75% of the net income as fees—amounting to a profit of $390 million.

Perhaps the bigger question lies in Trump's true motives. Is his pro-crypto stance genuinely aimed at promoting industry development, or is it a means to "drain the swamp" for family interests? Can WLFI shed the doubts of "harvesting" and the stereotype of a "meme project" to truly become a builder in the DeFi space? The answer may only be judged by time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。