Those who do not sell their tokens often store them in centralized exchanges, missing out on the opportunity to earn passive income.

Author: Igor Jerkovic

Translation: Deep Tide TechFlow

I am a software engineer with over 15 years of experience, active in the crypto industry since 2017. Currently, I am experiencing my third crypto cycle (I am currently developing the DeFi Koala project). During my participation in these cycles, I have noticed a common phenomenon: many of my friends always buy cryptocurrencies at the peak of each four-year cycle—usually at the price top—only to experience significant unrealized losses (if they sell, it becomes realized losses).

However, those who do not sell often store their tokens in centralized exchanges, missing out on the opportunity to earnpassive income. Even those who profit from selling often let their stablecoins sit idle, waiting for prices to drop before buying again. I share this because trading is indeed difficult, but there are better ways to accumulate more crypto assets without frequent trading.

A Common Mistake: Ignoring Passive Income

Through conversations with many cryptocurrency holders, I found that most people are unaware that they can earn returns on their held assets. In this article, I will share a simple strategy to help you achieve passive income through cryptocurrency.

Simple Strategy: Lend Your Stablecoins

One of the easiest ways to earn passive income is to lend your stablecoins (like USDC) to borrowers in need, thereby earning interest. Decentralized finance (DeFi) lending platforms typically require over-collateralization, meaning borrowers must deposit collateral worth more than the loan amount. If the value of their collateral approaches the loan amount plus interest, they will face liquidation, and the lender will be automatically repaid.

A potential downside? Interest rate fluctuations.

For example, over the past year, the averageannual percentage rate (APR) for USDC on the Aave platform was 6.28%. This means that if you deposit $10,000, you can earn $628 in interest—in contrast, if you leave the funds in an exchange, the return is 0%.

Average supply rate on Aave for one year

But the problem lies in interest rate fluctuations.

A Better Strategy: Lock in Fixed Returns

At this point, Pendle becomes a solution. Pendle allows you to lock in fixed returns for a set period, eliminating the uncertainty brought by interest rate fluctuations.

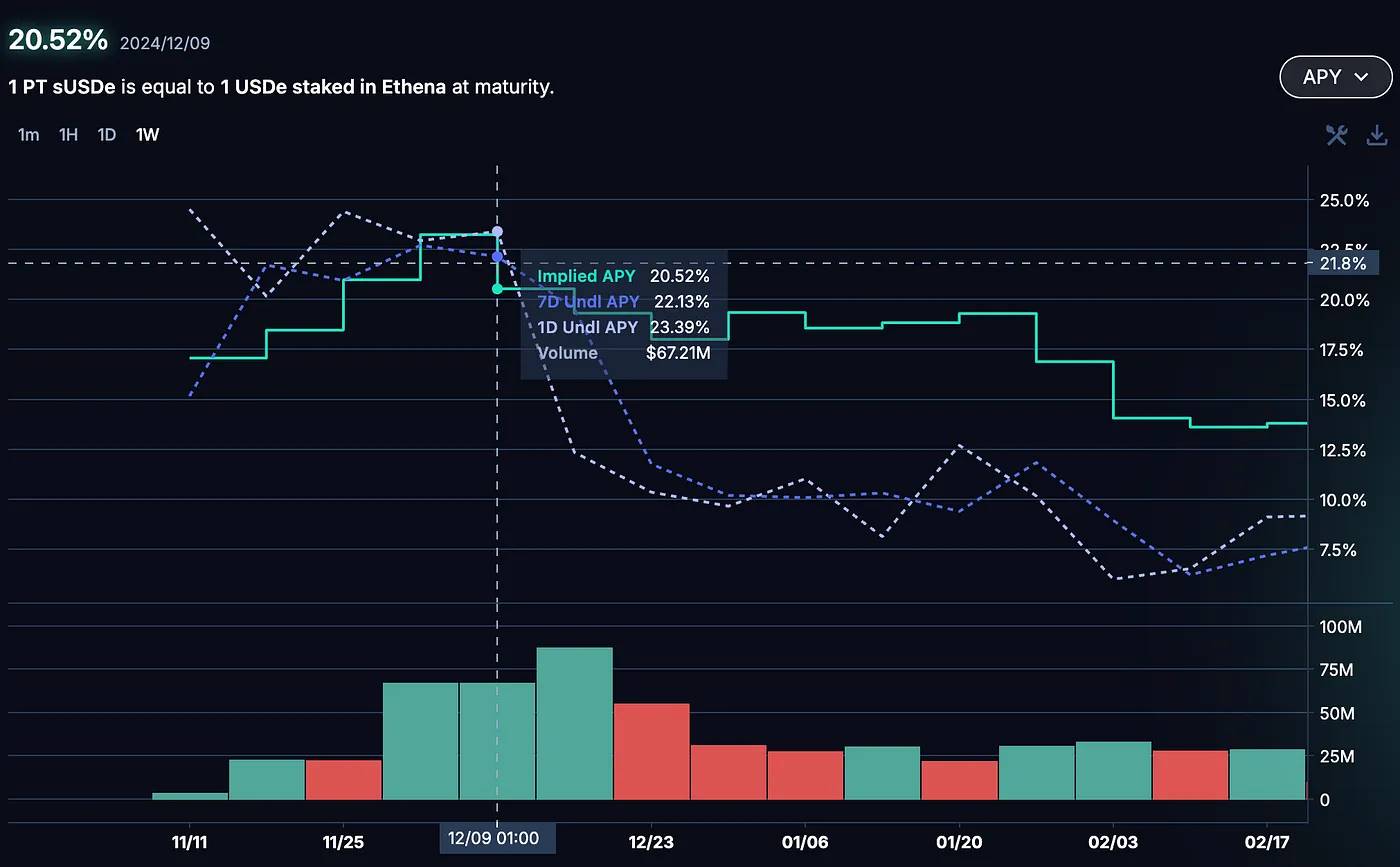

For example, in December 2024, Ethena's floating annual percentage rate (APR) reached as high as 27%. While this sounds enticing, this rate is not stable—as of the writing of this article, the rate has dropped to 9%. To address this issue, I used Pendle to lock in a fixed annual yield of 20.5% for six months.

How Pendle Works

Pendle splits yield-bearing tokens into two types:

Principal Tokens (PT): Their value steadily increases over time.

Yield Tokens (YT): They provide floating interest but gradually decay as the maturity date approaches.

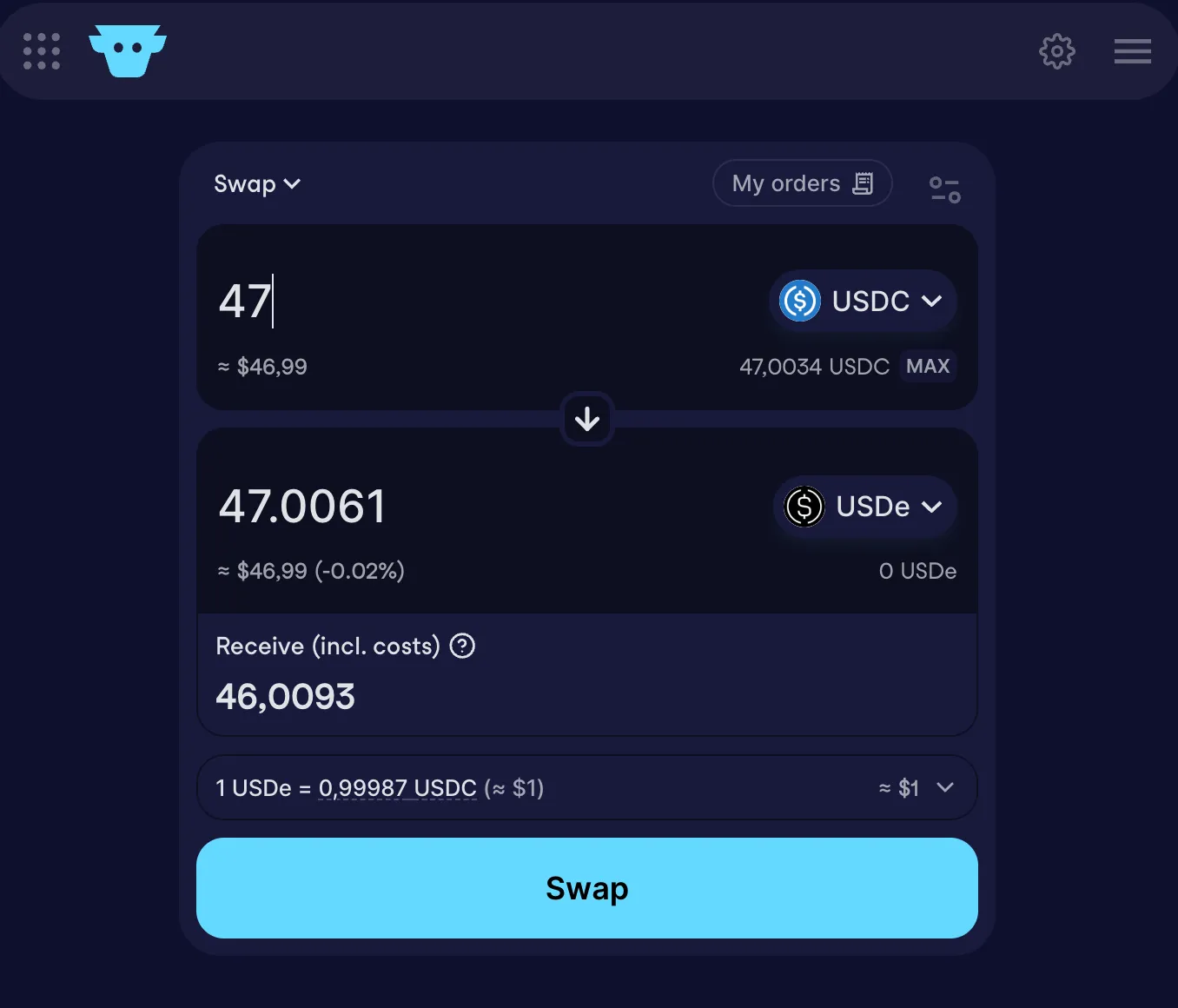

By December 2024, I exchanged USDC for sUSDe through CowSwap (a decentralized exchange aggregator that usually offers better rates than Uniswap) and then purchased sUSDe PT tokens maturing on May 29, 2025.

By May 29, 2025, I will achieve a 20.5% annual yield. This means that if I invest $10,000, I will receive $10,951 at maturity. Additionally, if I need to withdraw funds early, I can realize partial returns.

Note: Since I only locked in for six months, my actual annual yield is about 9.5%. If I had locked in for a full year, I would receive the full 20.5% return.

Pendle's locked yield on December 12, 2024

After maturity, I may continue to reinvest with Pendle, but I will also consider other DeFi opportunities based on market conditions.

Pendle effectively tokenizes fixed income DeFi strategies, similar to zero-couponbonds, providing investors with a tool to lock in fixed returns.

Step-by-Step Guide: How to Use Pendle to Lock in Fixed Returns

Before starting, assume you have:

✅ Knowledge of what a crypto wallet is.

✅ Knowledge of how to transfer tokens from a centralized exchange to an external self-custody wallet.

Tip: To interact with DeFi, you need a self-custody wallet (like MetaMask) or a hardware wallet (like Ledger connected through MetaMask).

Step 1: Connect to Pendle

- Open the Pendle official website and click "Connect Wallet."

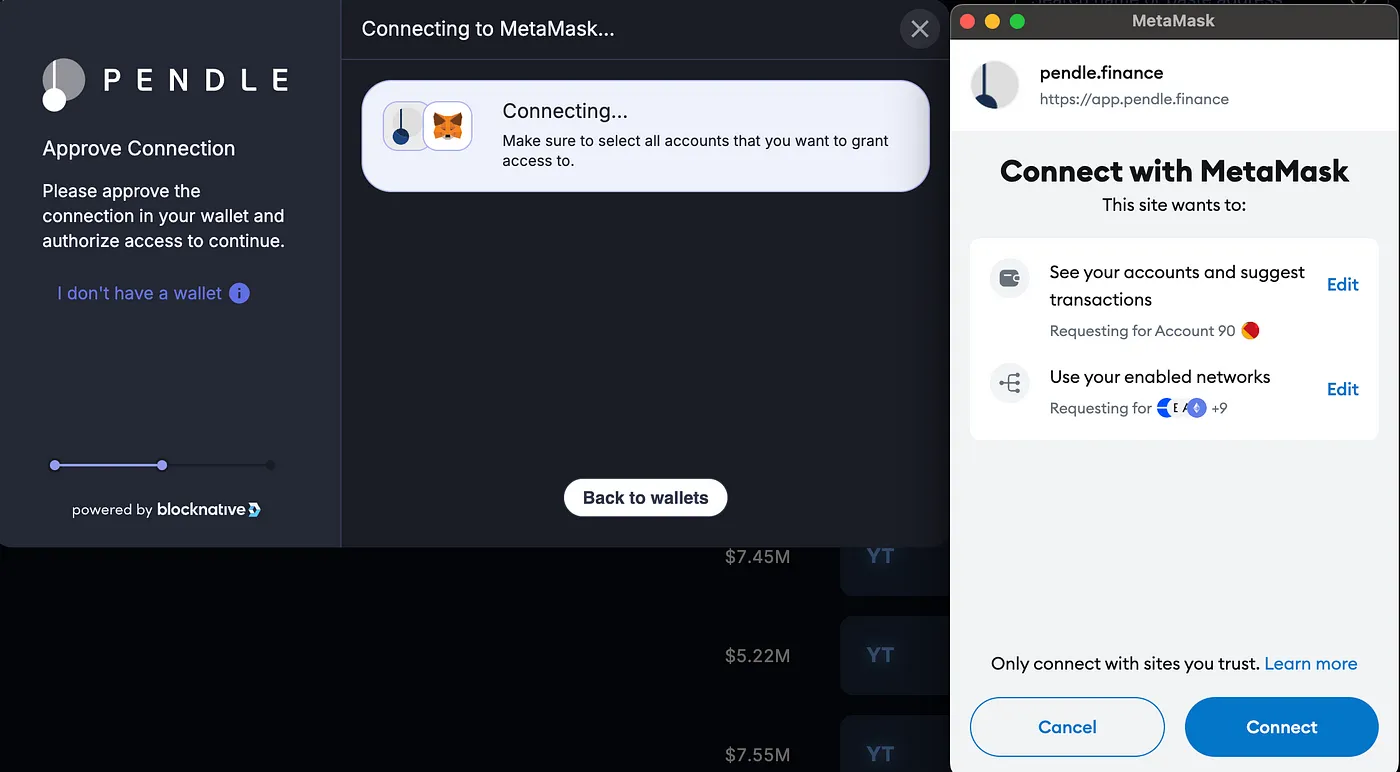

- Select MetaMask (if this is the wallet storing your private keys).

- A window will pop up asking you to connect to the site (this step allows Pendle to view your public key address and suggest signing necessary transactions)—click "Connect."

Step 2: Choose Fixed Returns

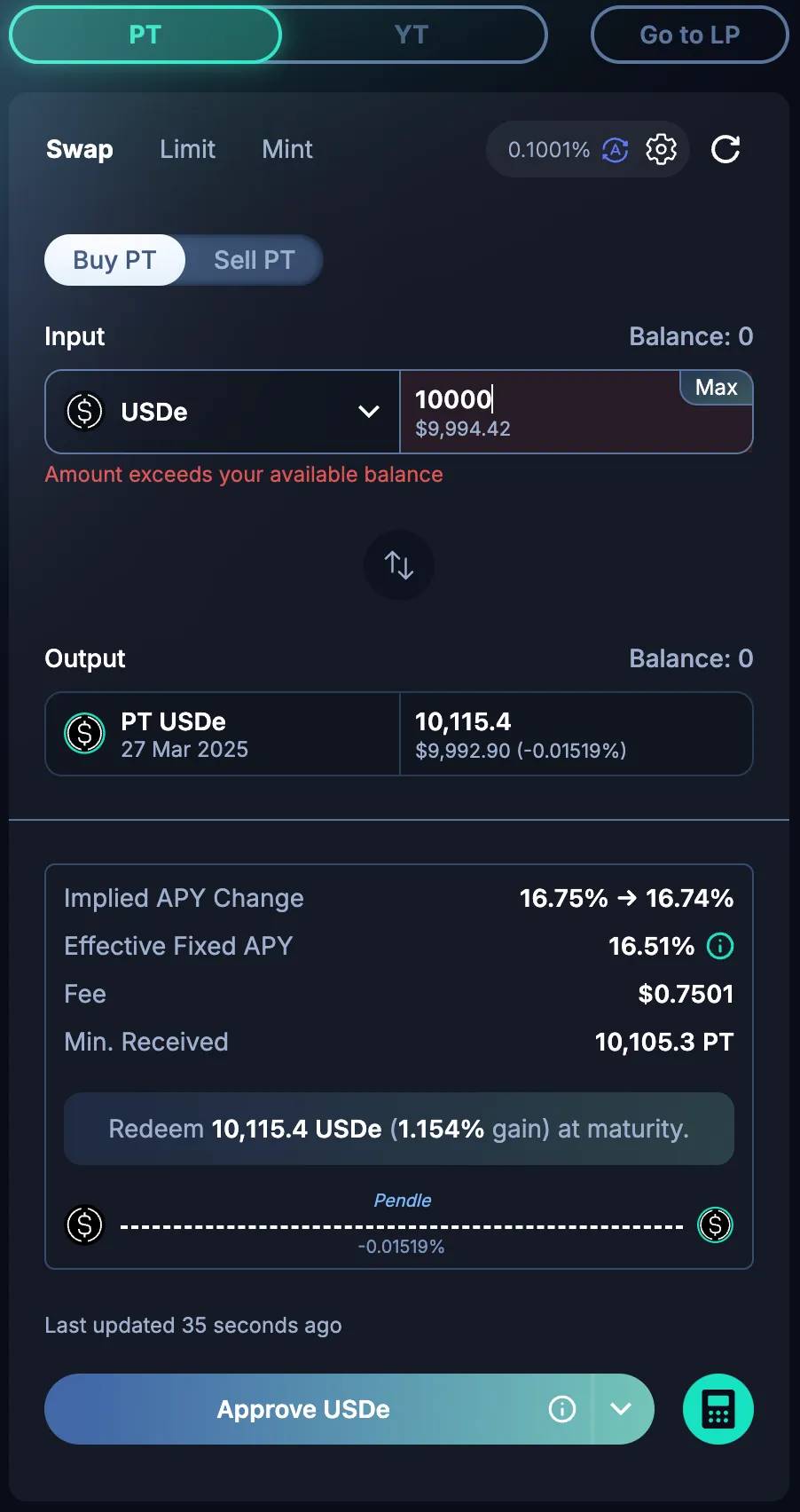

As of the writing of this article, Ethena's stablecoin (USDe) has a floating rate of 9% when staked as sUSDe. However, through Pendle, you can lock in a 16.75% annual yield, maturing on March 27, 2025.

Click the "PT 16.75%" button.

You will see historical interest rate fluctuations—the rates depend on market conditions.

Select the "PT" option (instead of "YT"), then click "Buy PT."

Enter the amount—for example, I set it to 10,000 USDe.

The user interface will display the expected returns:

By March 27, 2025, I can recover 10,115.4 USDe.

This equates to a 16.51% annual yield (annualized return) or a 1.154% return over 27 days.

In the same interface, you can view the interest rate fluctuations over time. Typically, when the market is extremely bullish and many people want to borrow stablecoins, lending rates rise, and lenders also earn higher returns. But once you lock in the rate with Pendle, this rate will remain unchanged, unaffected by market fluctuations.

Authorize the Use of USDe

Since USDe is an ERC-20 token, you need to authorize Pendle to use it in your wallet before proceeding.

Click "Approve USDe."

A MetaMask window will pop up—sign the transaction.

This step allows Pendle's smart contract to convert your USDe into PT-USDe-27Mar2025 tokens.

Why is authorization needed? The ERC-20 standard separates ownership from usage rights of tokens, ensuring that only authorized smart contracts can access your funds. This mechanism prevents unauthorized contracts from using your tokens without permission.

After authorizing and completing the operation, you will be able to redeem 10,115.4 USDe on March 27, 2025, which equates to a 16.51% annual yield (APY) or a 1.154% actual return over 27 days. If the market offers a full 365-day lock-in period, you will receive the full 16.51% return.

Notes:

The authorization step is necessary because USDe is an ERC-20 token based on the Ethereum network. The ERC-20 authorization signature mechanism requires users to explicitly allow smart contracts (like Pendle) to use the tokens on their behalf to prevent unauthorized token usage.

It is best to ensure that you already have USDe tokens in your wallet before proceeding, as the fees for directly exchanging for USDe PT tokens are usually lower than the costs of converting from other tokens to USDe PT tokens. If you do not have USDe yet, it is recommended to use CowSwap for the exchange, as it currently offers the best exchange rates among all decentralized exchanges (DEX).

Step 4: Execute the Swap

Click "Swap," which will prompt a MetaMask pop-up window for you to sign the transaction.

You are now exchanging USDe for PT tokens.

Congratulations! 🎉 You have successfully locked in a fixed income position.

In this transaction, you interact with the Pendle smart contract to exchange USDe tokens for PT-USDe-27Mar2025 tokens. Upon maturity, you can redeem the tokens and receive additional returns in the form of USDe.

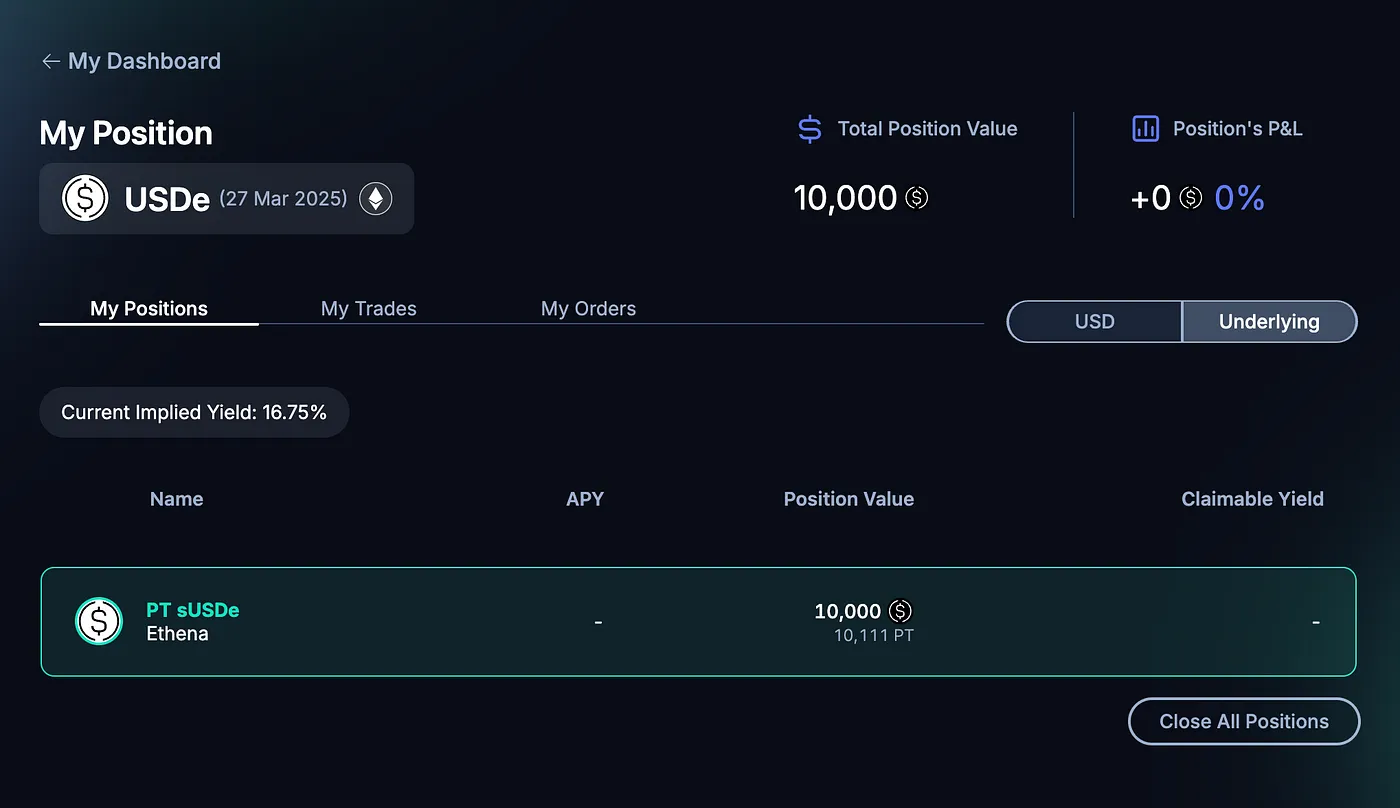

Step 5: Monitor Your Position

Click "My Dashboard" to view your holdings.

Over time, the profit and loss (P&L) of your position will gradually increase.

At maturity, you will receive the full returns.

On the holdings page, you can view your current open positions. As time goes by, the profit and loss (P&L) of your position will gradually increase, and at maturity, your returns are expected to reach a total of 111 USDe.

Congratulations! You have achieved a substantial return. Now, simply exchange USDe back to USDC or any other cryptocurrency you prefer. I will publish a detailed guide on how to exchange through CowSwap in a future post, as it offers the best rates.

Simplifying the Process: Making Fixed Income Investment Easier

Although this strategy is very effective, when I shared it with friends, they expressed reluctance to operate it themselves. This is because the entire process involves multiple steps:

Understanding the difference between floating and fixed interest rates.

Researching how Pendle works.

Switching between multiple DeFi platforms (like CowSwap, Pendle, Ethena) for operations.

To simplify the entire process, I developed a product that integrates these cumbersome steps into a "one-click lock in fixed income" experience.

If you are interested, you can check out DeFi Koala and subscribe to the closed alpha.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。