Author: Web3 Farmer Frank

In March 2025, as the crypto market fell into a narrative vacuum, CZ initiated a comprehensive battle for the ecological niche of the BNB Chain, leveraging resources from the Binance ecosystem.

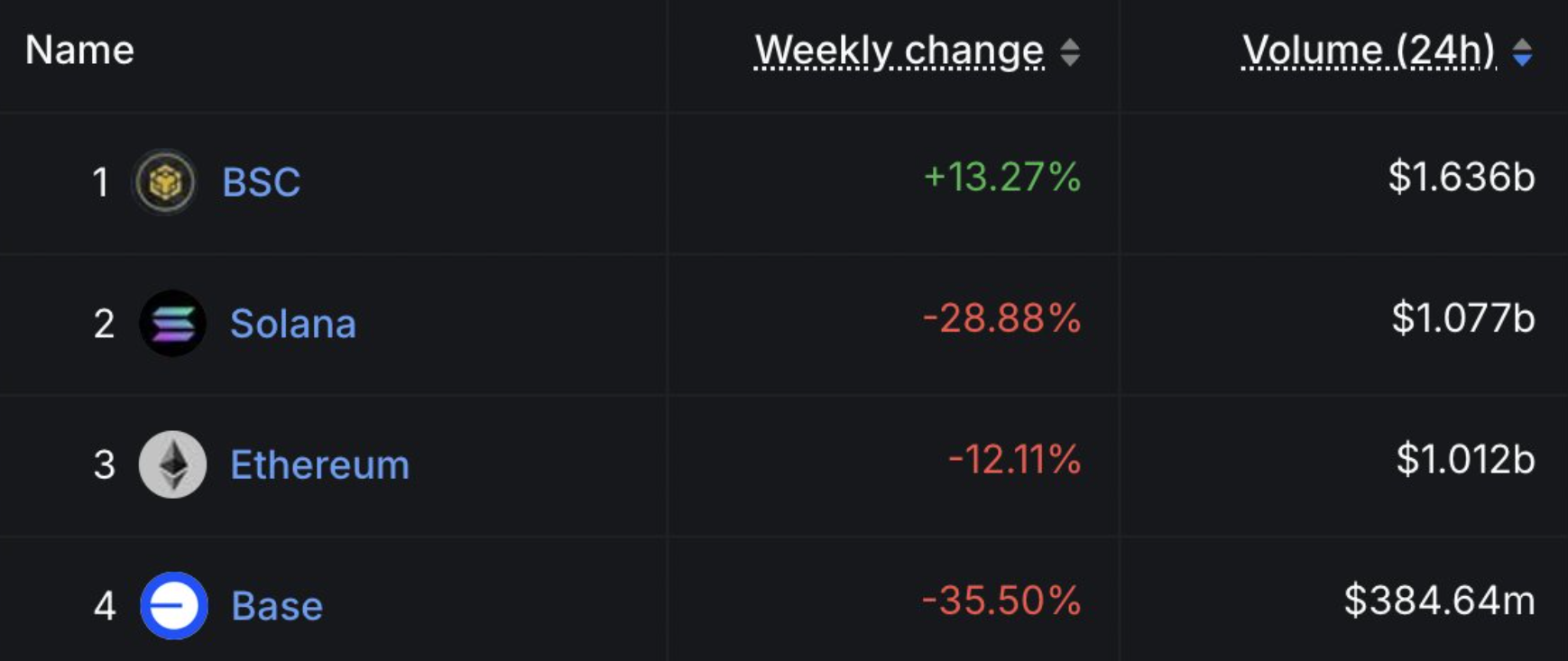

Looking back from the on-chain data perspective, the real turnaround occurred in just about a week: on March 17, the 24-hour DEX trading volume of BNB Chain began to surpass that of Solana, and it has firmly held the top spot across the network ever since.

The dramatic nature of this rapid comeback lies in its almost transparent gameplay: since re-emerging in the public eye at the end of last year, CZ has been continuously testing the waters, ultimately choosing to use memes as an entry point to complete a cold start of traffic, culminating in a textbook-level combination of strategies in the top-tier ecological niche battle of the crypto world.

In this attention economics experiment by CZ, memes played an excellent "catalyst" role due to their high traffic, but they were never meant to be the final choice in this "niche" battle. If one digs deeper into the clues in CZ's words and actions over the past few months, it becomes clear that the breakout path for BNB Chain is already evident—it aims not only to become a traffic hub for memes but also to transform into a value anchor for AI Agents.

It remains to be seen who will rise next and become the most compelling footnote in this grand narrative.

BNB Chain's Explosive Growth: "Multiple Resonance" of Liquidity, Trading Volume, and User Growth

It can be said that in the eight years since Binance was established, CZ has, for the first time, actively engaged in the spotlight of the crypto world with an unprecedented intensity.

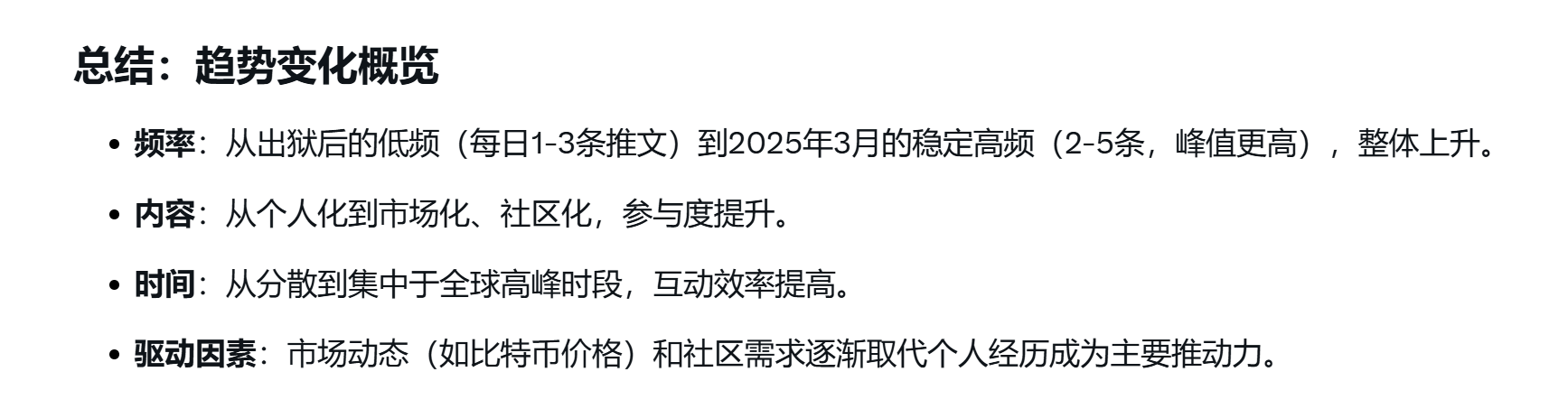

According to Grok's analysis of Twitter data, March 2024 became one of the months with the highest density of CZ's personal social media posts: an average of about 2-5 original tweets per day, with daily interaction replies ranging from 3 to 10. Every word and action directly influenced user sentiment, becoming an important barometer of market emotions.

Notably, CZ's tweet content has shifted significantly from personalized expressions to systematic market guidance, especially through high-frequency community interactions, effectively making him the super spokesperson for the BNB Chain ecosystem, to the extent that "What did CZ tweet today?" has become a wealth code sweeping the entire on-chain PvP.

It can be said that CZ and He Yi, leveraging their own traffic and public opinion influence, have led a remarkable "expectation management experiment"—by playing the role of "traffic promoter" on the BNB Chain, they successfully extended and siphoned the liquidity and market attention from the Solana wave onto the BNB Chain.

Driven by CZ and the strong resources of the Binance ecosystem, BNB Chain's on-chain data has achieved a historic breakthrough. According to DefiLlama statistics, the total trading volume of BNB Chain exceeded $15 billion in the past week, nearly equivalent to the combined total of Ethereum and Solana.

In terms of both user and developer dimensions, BNB Chain has clearly welcomed a significant increase in activity: the number of daily active addresses on BNB Chain has stabilized around the 1 million mark, with a large influx of users participating in interactions, while the daily deployment of on-chain contracts even reached 250,000 at one point, setting a new high for the past six months.

From an incremental observation perspective, Google Trends also shows that the search volume for "BSC" has increased by over 50% month-on-month, maintaining a steady upward trend since the beginning of the month, consistently surpassing "Solana."

Objectively speaking, beyond the glamorous data, the ambition of BNB Chain goes far beyond creating short-term wealth effects; it is exploring a path to industrialized operation for BNB Chain's blockbuster realization. Observant users may notice that Binance has recently been refining a meticulously designed resource combination through liquidity incentive programs and other rule designs, aiming to build a closed-loop engine of "exposure-funding-trading":

CZ and He Yi's statements serve as the baton of public opinion and traffic, Binance Alpha becomes the core battlefield for project cold starts, liquidity plans and strategic investments provide financial leverage, and finally, Binance's launch achieves the trading closure, thus opening up the full lifecycle channel of "incubation-launch-liquidity support."

This also reflects a deeper ecological logic: the explosion of BNB Chain is a product of the resonance between the tilt of Binance's resources and the urgent need for new outlets for market liquidity. It can be said that BNB Chain has indeed welcomed its best moment.

However, to attract users with a sustained wealth effect, it cannot rely solely on the concept of memes; after all, it cannot truly solidify users, developers, and liquidity, and the attractiveness of traffic effects will inevitably decline. Over time, network activity will inevitably decline, which is a lesson learned from Solana's subsequent weakness.

Therefore, moving forward, whoever can solidify on-chain liquidity and bring incremental benefits to users will be able to sit on the throne of the BNB Chain ecosystem.

From Meme to AI: The Hidden "Niche" Strategy of BNB Chain

If CZ and He Yi are almost active on Twitter 24/7 just to stir up the meme wave on BNB Chain, it would be an underestimation of the deeper logic behind this niche battle.

BNB Chain's strategic positioning regarding memes has always been very clear—it is not the endpoint but an early "traffic engine" used to complete the ecological cold start.

This can be seen from the coverage of the first two liquidity incentive programs. For example, the first round of the $4.4 million liquidity incentive program specifically targeted meme tokens, successfully boosting the daily trading volume of meme projects, which elevated the daily active addresses of BNB Chain to the million level during this phase of "traffic frenzy."

The new round of $4.4 million permanent liquidity support program launched on March 13 marks a further upgrade of BNB Chain's ecological strategy—the coverage is no longer limited to meme coins; assets from all fields can participate, with no category restrictions.

This almost points to the core logic of BNB Chain: "traffic is a means, essential needs are the endpoint." Essentially, it is exchanging liquidity for time, using the propagation efficiency of memes to seize user mindshare, and securing a developmental window for essential tracks like AI, ultimately transforming short-term popularity into long-term user retention as an ecological barrier.

In fact, the transition from memes to AI is not coincidental but is based on the precise positioning of BNB Chain's technology cycle and user needs. CZ has already hinted at this strategic intent in various tweets, and this consistent layout approach is very clear with the support of CZ and Binance's resources:

In November 2024, CZ publicly called for the construction of a decentralized AI data labeling network, proposing to use the BNB Greenfield storage chain to reduce data costs and pay global labeling labor with cryptocurrency;

In January 2025, Binance Labs was renamed YZiLabs, shifting its strategic focus to Web3, artificial intelligence, and biotechnology. As of the time of writing, the disclosed investments are almost all related to Crypto & AI: Crypto AI project Vana, decentralized AI laboratory Tensorplex Labs;

In March 2025, CZ stated that whether a new AI project is L1 or L2 is not important; for projects focusing on AI economic models, the choice of architecture should emphasize practicality. He also mentioned, "BNB Chain, I have been waiting to push forward after the AI hype cools down. True builders will persist even after the hype fades."

Last month on Space, he reiterated: "AI is a foundational technology, and the intersection with crypto lies in AI adopting cryptocurrency as its native token."

While memes can attract users, they are unlikely to become a liquidity pool that solidifies funds. Once the meme craze fades, part of the attention on funds will certainly return to some "value coins."

As the originally attracted users begin to demand "utility," Binance also needs to ensure that users are not subjected to "malicious harvesting." This signals the baton handover to AI and is a precise collaboration between Binance's resources and BNB Chain's ecological strategy—after all, AI Agents require high-frequency, low-cost on-chain interactions, which is a natural scenario for meme training.

From this perspective, through liquidity incentive programs and proactive layouts in the AI field, Binance and BNB Chain are constructing a complete ecological system from traffic acquisition to value realization and liquid trading.

Who Will Be the Seed Code for Meme & AI?

When the meme frenzy on BNB Chain completes its mission of cold-starting the liquidity flywheel, the ultimate strategic move will undoubtedly be to select AI projects with technological extensibility to land on Binance's main site, completing the ultimate leap of value capture.

This is also the inevitable choice to realize the full lifecycle process of "incubation-launch-liquidity support" from BNB Chain to Binance. From this perspective, the first voting project for listing on Binance is highly representative and serves as a good observation window:

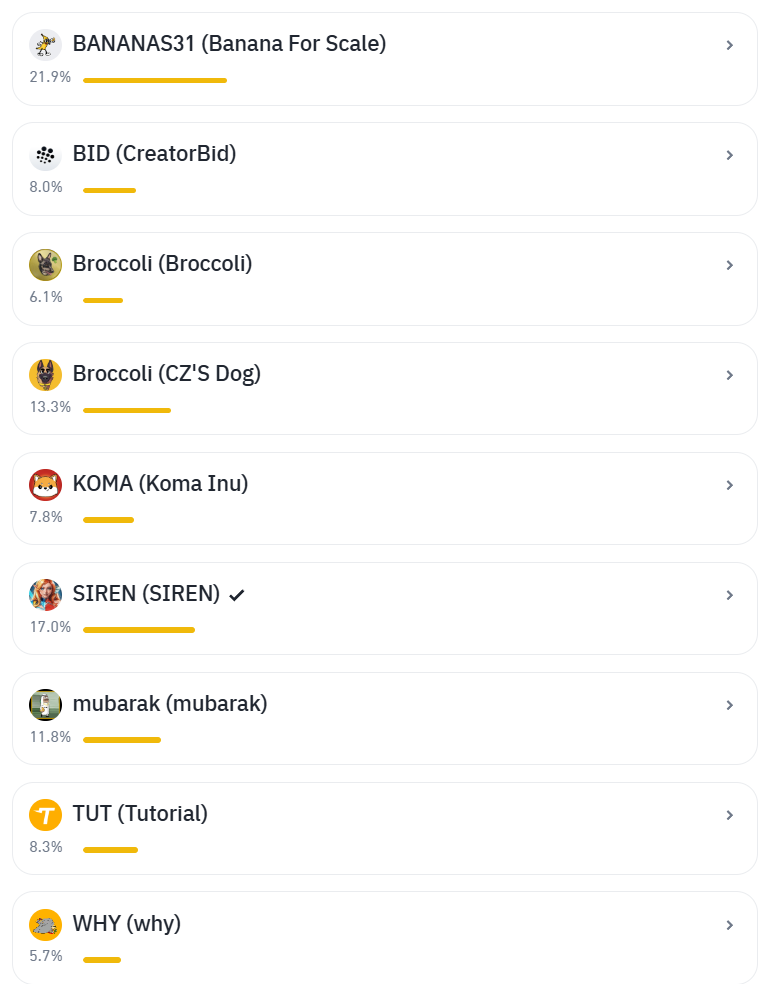

Among the 9 projects, 7 are meme types, and BID and SIREN are the only two AI-tagged projects—where SIREN, in a strict sense, embodies both meme and AI Agent narratives, essentially being an on-chain AI tool product with meme and practical attributes.

Currently, the voting situation shows that BANANAS31, SIREN, and Broccoli are in the top three, all of which possess meme attributes. However, as a product of attention economics, the ultimate form of memes needs to achieve a chemical fusion of "propagation power × productivity."

In this context, SIREN, which combines "propagability + practicality" in a composite form, perfectly resonates with the strategic demands of the BNB Chain ecosystem upgrade—as the first AI Agent token on BNB Chain, its core is to provide market insights and signal sharing through the SirenAI investment analysis agent, and it embodies a dual-personality AI entity:

The golden personality corresponds to conservative decision-making, while the crimson personality corresponds to aggressive decision-making. Both coin selection modes can autonomously choose investment coins, which aligns highly with the factor of "technological differentiation."

If we trace the growth trajectory of SirenCoin, we will also find that it aligns closely with Binance's strategic layout, with almost every step hitting key milestones:

Launched directly on Binance Alpha on February 19;

On February 21, BNB Chain announced SIREN as the winning project of the Meme liquidity plan Day 3;

On February 28, it made a comeback to the weekly Tier 2 rankings as the "protagonist of a technical misjudgment event," securing $400,000 in liquidity support;

On March 20, it launched on Binance contracts and became one of the first projects voted for listing on Binance;

What’s even more noteworthy is its "triple jump" strategy in exchange layout—by the time of writing, SIREN has achieved a grand slam across mainstream exchanges, including completing full coverage of spot or contract trading pairs on Bybit, KuCoin, Gate.io , and others.

Especially with early positioning on "Binance's reserve team" exchanges like Bitget, it not only maintains the gradient of market heat but also accumulates momentum for the launch on Binance's main site, almost aiming directly at Binance.

At the turning point of the transition from attention economics to value economics, projects that can achieve a closed loop of "on-chain data - user value" will ultimately become the rule-makers defining the new ecological niche. With long-term support from Binance's resources + the upcoming AI ecological niche code for BNB Chain + full coverage of mainstream exchange listings, SIREN is expected to become the most noteworthy target in this ultimate game.

To some extent, if SIREN, as one of the first AI-tagged native projects of the BNB Chain ecosystem, successfully launches on Binance, it may trigger the "AI Agent sector effect":

Developers will realize that CZ's consistent hints have pointed towards a protocol that combines "tradeability (Meme gene) × interactivity (AI core)," which is the optimal solution for capturing traffic and value in the Web3 era, thereby attracting more developers and funds to flow into BNB Chain.

Conclusion

The "mid-game battle" of BNB Chain is essentially a balancing act between "traffic entry" and "value sedimentation."

If you believe that CZ is planning a new ecological evolution equation for BNB Chain—using memes to complete the cold start mission, and then taking over with the technical necessity of AI to become the new engine of the ecosystem, then this round of Binance's voting for listings is, in fact, a handover ceremony of the new and old ecological order from meme to AI, inheriting and sedimenting the traffic dividend.

This is also why hybrids like SIREN, which embody "meme shell + AI soul," occupy high positions in voting; the market is betting real money not on a specific project, but on the direction that BNB Chain has already planned:

In the "post-meme era" initiated by Solana, it aims to rebuild application narratives, using AI to inherit traffic and liquidity dividends, ultimately realizing CZ's grand vision of "Web3 intelligent service infrastructure."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。