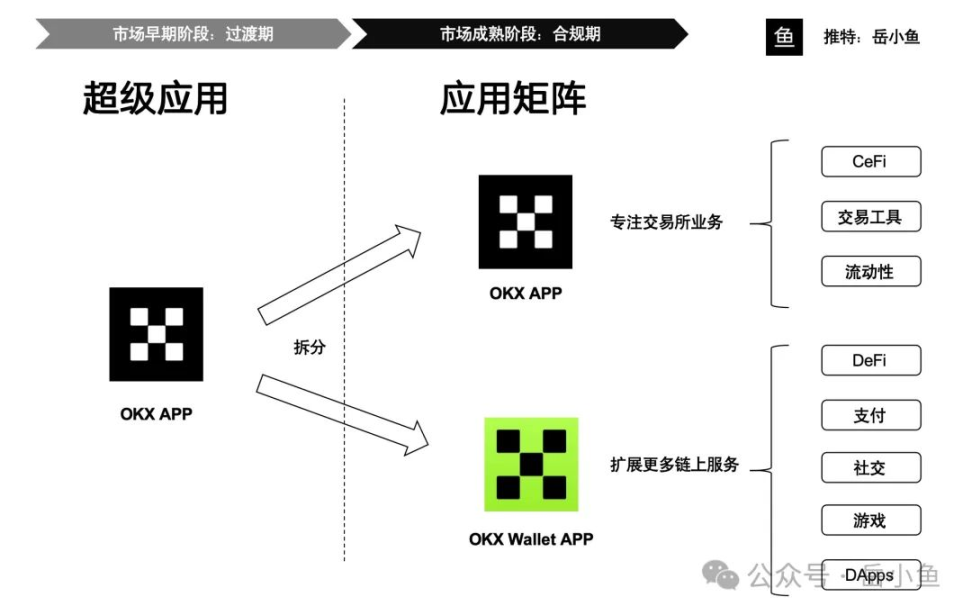

OKX officially transitions from a "super app model" to an "application matrix model."

Written by: Yue Xiaoyu

OKX will not leave its competitors with a long window of opportunity. After a week of hard work, the brand new OKX Wallet app has been launched.

At this point, it marks OKX's official transition from a "super app model" to an "application matrix model."

1. Why transition from a super app to an application matrix?

Every product model has its boundaries and lifecycle.

We need to view the changes in OKX's product model in conjunction with the broader perspective of industry development.

Firstly, we can see that in the early stages, the "super app model" was an inevitable choice.

This is because the entire industry is transitioning from off-chain to on-chain, which is a slow process that has been ongoing for several years.

During this transition period, the OKX exchange app effectively met users' diverse needs through one-stop services.

The user base in the Web3 industry is still immature, and the cost of market education is extremely high. A "universal" application can quickly attract traffic, lower the usage threshold for users, and achieve user retention and growth through the synergistic effects of its internal ecosystem.

At this transitional stage in the market, no other project has resources as powerful as OKX, and no other exchange has the same level of determination as OKX.

Thus, OKX's willingness to invest resources naturally allowed it to quickly become a leader and infrastructure provider in the Web3 world.

However, as the crypto industry matures, the diversification and specialization of user needs have become increasingly evident, and the limitations of super apps have begun to surface.

Firstly, while stacked functionalities bring convenience, they also lead to a cumbersome product experience, making it difficult for users to quickly focus on core needs within a single interface.

Secondly, the tightening regulatory environment has raised high compliance requirements for super apps, especially in cases where decentralized finance and centralized services coexist, leading to uncontrollable risks.

The brief suspension of OKX DEX services was a concentrated outbreak of this contradiction.

Now, OKX has split the OKX Wallet, which is a direct response to market changes and has proactively addressed compliance issues.

Overall, the "super app model" has completed its historical mission, and the "application matrix model" is an inevitable future.

Currently, the OKX Wallet has not only completed its cold start, fully acquiring users from the OKX exchange, but it has also cultivated user mindset for a considerable period, and the overall market has gradually matured.

At this point, transitioning to the "application matrix model" is a natural progression.

2. Is the application matrix really better?

We can gain some insights from the development of product models in the Web2 industry.

At this time, we can see an interesting point: Chinese applications are mostly super apps, such as WeChat and Alipay; while foreign applications often form an application matrix, with each app focusing on a specific function.

There are many historical and market environmental reasons for this:

First, the evolution of the internet is different;

China achieved a "leapfrog" in the mobile internet era, skipping the long popularization phase of PC internet and directly entering the smartphone market.

Convenience is paramount on mobile, and users tend to prefer solving all their needs within a single app rather than frequently switching between apps.

For example, WeChat has expanded from an instant messaging tool to include payment, ride-hailing, shopping, and even government services, allowing users to complete most of their daily operations without leaving the app.

In contrast, the internet development in foreign countries (especially in Europe and the U.S.) has undergone a gradual process from PC to mobile.

During the PC era, users were accustomed to using software with single functionalities (like Outlook for email, PayPal for payments), and this habit has carried over to mobile, leading to a design preference for "specialized and refined" applications.

Second, the technological ecosystem is different;

China's highly centralized infrastructure (such as QR code payments and logistics networks) provides technical support for super apps, enabling seamless connections across various scenarios.

However, the mobile ecosystem abroad heavily relies on the integration capabilities provided by operating systems (like iOS and Android), where users complete multitasking through system-level notifications, searches, and cross-app collaboration, rather than relying on a single app.

For instance, Apple's Siri and Google Assistant can seamlessly connect multiple independent applications, eliminating the need for a "super entry point."

This is completely different from the role of super apps as "ecosystem centers" in China.

Third, regulatory requirements differ;

China's relatively lenient early regulatory environment provided a foundational soil for the expansion of super apps.

For example, WeChat and Alipay broke traditional financial restrictions in the payment sector, quickly integrating online and offline services.

However, Europe and the U.S. have very strict regulations on data privacy and financial services, which limits the cross-border integration of super apps.

For instance, payment services require separate licenses, and social platforms venturing into finance may face compliance risks.

Thus, companies in Europe and the U.S. tend to prefer splitting functionalities into independent applications to reduce legal risks and enhance flexibility.

In summary, we can observe various differences in cultural, behavioral, market, and regulatory aspects between China and abroad.

OKX's transition from a super app to an application matrix, to some extent, also represents its adjustment from a "Chinese-style approach" to an "international approach."

In the Chinese market, OKX's super app model quickly attracted users by integrating trading, wallet, and other functions, aligning with local user habits.

However, in the global market, especially in Europe and the U.S., regulatory requirements and user preferences will drive products aiming for internationalization to split into application matrices to meet compliance, specialization, and ecosystem openness needs.

The future of OKX is clearly global.

3. What are the strategic differences between super apps and application matrices?

The strategic approach of the application matrix is quite different from that of super apps, and OKX needs to adjust its new product growth strategy.

The implementation of the application matrix means that OKX needs to completely bid farewell to its past growth model.

During the super app phase, OKX's growth logic relied more on the concentration and distribution of traffic, achieving internal cross-conversion through the large user base of the main app.

At this stage, the application matrix requires OKX to shift from a "traffic mindset" to an "ecosystem mindset," building a more open and diverse ecosystem through the synergistic effects of multiple products.

From the perspective of a product manager, the growth strategy for OKX Wallet can focus on the following directions:

First, shift from traffic concentration to ecosystem collaboration;

Previously, OKX relied on the massive traffic of the exchange app, guiding users to the wallet function through internal redirects, with a growth logic centered on "traffic distribution."

Now that OKX Wallet is independent, the traffic closed loop has been broken, necessitating a shift to an ecosystem collaboration approach.

For example, collaborating with leading DApps and public chains to attract native Web3 users.

Second, shift from functional integration to extreme specialization;

Previously, OKX pursued comprehensiveness in functionality, with the exchange app needing to handle trading, wallets, and DeFi, leading to resource dispersion.

Now, each product can focus on a specific area.

The OKX exchange should enhance trading efficiency (such as low latency and high liquidity), while OKX Wallet should deepen the decentralized experience (such as multi-chain support and optimized on-chain trading experience).

Third, shift from unified operations to precise positioning;

Previously, OKX's operations focused on a unified brand and user experience, catering to the general needs of all users.

Now, different products can conduct precise operations targeting different user groups.

The wallet targets native Web3 users, emphasizing decentralization and security; the exchange targets trading users, highlighting efficiency and reliability.

In summary, OKX Wallet has a more independent brand and clearer positioning, allowing for more possibilities.

The future of the wallet is not limited to asset management and trading; it can also seek incremental opportunities in payment, social, gaming, and other scenarios, thereby breaking through the traditional crypto user circle and achieving true mass adoption.

Of course, for existing users accustomed to super apps, OKX still needs various incentive mechanisms (such as airdrops and point systems) to lower their migration costs while cultivating usage habits.

Meanwhile, the relationship between the OKX exchange and the wallet also needs to be redefined; they are no longer in a hierarchical relationship but collaborators exploring different directions.

Through API interfaces, brand collaborations, and even joint marketing, OKX can achieve resource complementarity and sharing while maintaining their respective independence.

In summary

OKX's transition from a super app to an application matrix is a significant milestone in its development journey, necessitating a recalibration of its future strategic direction.

The super app has completed its historical mission and laid a solid market foundation for OKX;

The launch of the application matrix marks OKX's entry into a more complex yet more promising new phase.

A new round of the wallet war has already begun in full swing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。