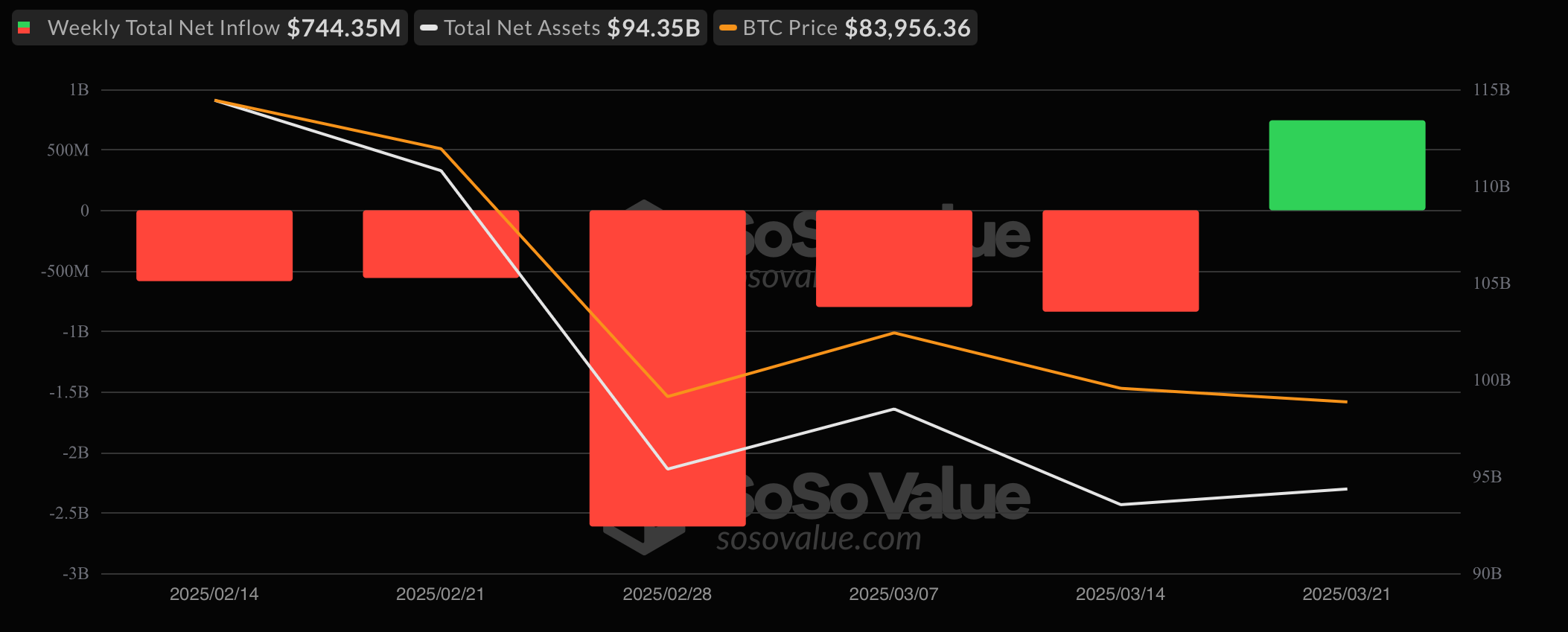

Bitcoin ETFs broke a five-week streak of outflows by attracting $744.35 million from March 17 to March 21, signaling renewed investor confidence. Conversely, ether ETFs continued their fourth consecutive week of outflows, shedding $102.89 million.

Bitcoin ETFs Rebound with $744 Million Weekly Inflow As Ether ETFs Extend Weekly Outflow Streak

After enduring five weeks of continuous outflows, bitcoin ETFs experienced a strong resurgence from March 17 to March 21, with net inflows totaling $744.35 million. This marked a significant turnaround, highlighting renewed investor confidence in bitcoin. In stark contrast, ether ETFs continued their downward trajectory, recording net outflows of $102.89 million for the same period, extending their streak to four consecutive weeks of outflows.

The week commenced on a high note for bitcoin ETFs, with Monday, Mar. 17, witnessing the largest single-day inflow of $274.59 million. This positive momentum persisted throughout the week, culminating in a total net inflow of $744.35 million.

Source: Sosovalue

Blackrock’s IBIT led the pack with a substantial weekly net inflow of $537.51 million while Fidelity’s FBTC secured a commendable $136.46 million in net inflows for the week.

Ark 21shares’ ARKB attracted $79.53 million, reflecting growing investor interest with Grayscale’s BTC adding $23.98 million to its BTC assets under management. Vaneck’s HODL rounded up the inflows with an $11.9 million contribution.

Conversely, some bitcoin ETFs faced outflows with a $24.47 million outflow for Grayscale’s GBTC, $10.24 million for Invesco’s BTCO, $7.31 million for Franklin’s EZBC, and $3.01 million decline for Bitwise’s BITB.

On the other side of the ETF divide, ether ETFs continued to grapple with negative investor sentiment, marking their fourth consecutive week of net outflows totaling $102.89 million. The most pronounced outflow occurred on Tuesday, March 18, with $52.82 million exiting the funds.

Source: Sosovalue

Key outflows included BlackRock’s ETHA which led the downturn with a $74 million outflow. Grayscale’s ETH reported a $23.67 million reduction and Fidelity’s FETH experienced an $8.8 million outflow.

However, not all was bleak for ether ETFs. Grayscale’s ETHE bucked the trend by securing a modest inflow of $2.87 million.

The resurgence of bitcoin ETF inflows suggests a renewed investor confidence in bitcoin, with the possibility for another sustained period of inflows on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。