The essence of trading is not to predict the market, but to choose the right tools to respond to different market conditions.

Market conditions are unpredictable; just when you cut losses, the market rebounds, and just when you bottom out, it crashes again. The cycle of false breakouts and fake breakdowns can drive traders to despair. How can you trade elegantly and profitably in a volatile market? You must understand these OKX strategies!

First, clarify your trading style—are you a short-term hunter or a steady arbitrage player? Short-term traders can use contracts, grid trading, options, and other tools to quickly enter and exit, seizing arbitrage opportunities from market fluctuations; while steady arbitrage players can choose tools like dual currency winning, shark fin, and dollar-cost averaging strategies to steadily accumulate profits in a volatile market, even easily achieving low buy and high sell. Secondly, stop relying on "guessing the market," and instead earn profits through strategies. Whether using grid trading and Martingale strategies for automatic high selling and low buying for short-term arbitrage; or choosing dual currency winning and bottom-fishing take-profit strategies to lock in stable profits within a volatile range; or adopting shark fin and options strategies to capture lucrative opportunities during market breakouts, effective risk management through stop-loss and take-profit functions helps you avoid traps.

Next, we will delve into the gameplay and applicable scenarios of these strategies, and comprehensively analyze the pros and cons of OKX's seven major trading tools to help you find the trading method that suits you best. Regardless of the strategy chosen, selecting the right tools is always more important than blind operations; only by matching your trading style can you respond calmly to market fluctuations.

1. You want low-threshold arbitrage

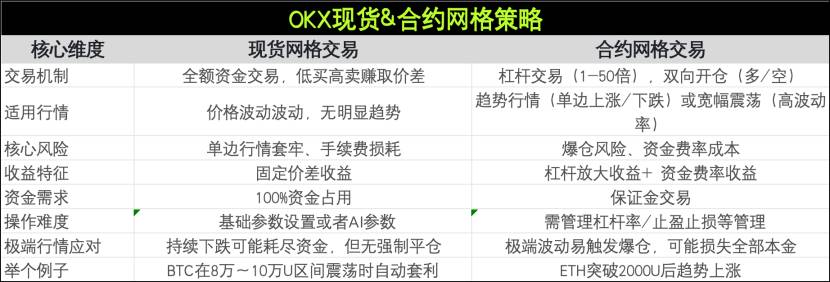

OKX spot grid is suitable for conservative users, while contract grid is suitable for advanced users, as contract grids have higher capital utilization but come with liquidation risks, so strict risk control is necessary. The investment cost can start from 0 USDT, making the participation threshold low. Grid trading is an automated quantitative trading strategy that captures arbitrage opportunities from market fluctuations by dividing multiple grids within a preset price range to buy low and sell high. Depending on the application scenario, contract grids are further subdivided into long, short, and neutral modes to adapt to different market trends. OKX's spot & contract grids support custom parameters or AI parameters, allowing users to invest with just one click, making it very convenient.

2. You want to profit from bottom-fishing rebounds

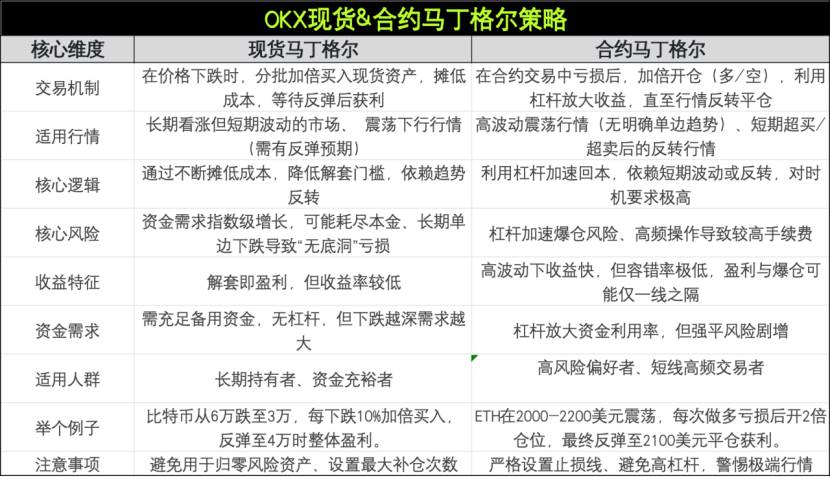

OKX offers both spot and contract Martingale strategies. As a higher-risk strategy, Martingale is essentially a "counter-trend doubling down" strategy, which beginners should use with caution! Mature traders need to layout trend judgments and strict risk control. The Martingale strategy, fully known as Dollar Cost Averaging (DCA), is a trading method that emphasizes position management, with the core idea being "averaging down on losses and resetting on profits." Its main feature is to double the trading amount after each loss until a win is achieved. The basic assumption of this strategy is that as long as the capital is large enough, the eventual win will compensate for all previous losses and yield profits.

3. You want to earn interest without monitoring the market

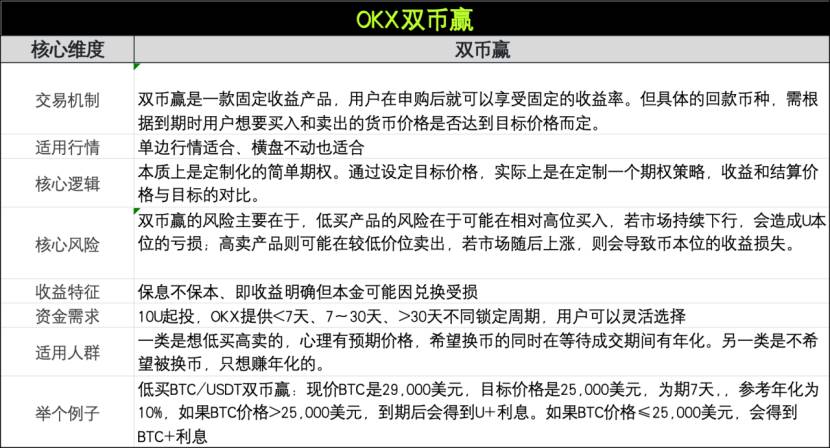

Dual currency winning is suitable for those uncertain about market direction but wishing to earn returns, as well as users who do not want to engage in high-frequency trading. Dual currency winning is a structured product created by OKX that helps users earn additional returns while buying or selling digital currencies at target prices. Users can subscribe to dual currency winning to trade mainstream currency pairs, such as BTC - USDT and ETH - USDT, thereby enjoying stable returns from either currency. However, it is worth noting that upon triggering the rights, it may convert to another asset. To this end, OKX has launched ETH/BTC coin-based dual currency winning, supporting BTC and ETH for subscription, achieving low buy and high sell. Compared to USDT-based dual currency winning, it offers a new way to earn returns, zero fees for converting between two major cryptocurrencies, continuous interest, and alleviates concerns about missing market opportunities due to conversion to USDT, among other core highlights, helping users hold coins worry-free.

4. You want to avoid losing principal

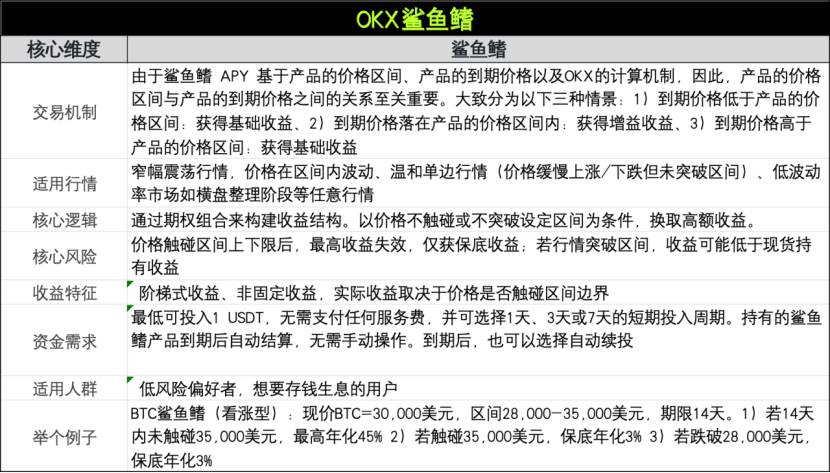

OKX shark fin is suitable for users who do not mind earning more or less but do not want to bear the loss of principal. Its core feature is to enjoy guaranteed returns while participating in the market, earning floating/additional returns from market movements. It tracks currency price fluctuations, allowing users to earn annualized returns on assets like USDT, BETH, and OKSOL during market volatility. If the market reaches the expected conditions, higher additional returns can be unlocked. OKX shark fin offers flexible investment periods of 1 day, 3 days, and 7 days, requiring no market monitoring, allowing users to choose freely based on market predictions and capital arrangements, easily obtaining stable returns. OKX provides both bullish and bearish shark fins, allowing users to buy both types simultaneously to cover bidirectional fluctuations, increasing costs but diversifying risks. Additionally, participation can occur during spikes in the fear index, with the platform offering the highest annualized returns under high volatility. In summary, shark fin is suitable as a "cash management tool," using idle funds to earn returns when the volatility range is clear, but strict position management is still necessary.

5. You want to earn both price appreciation and interest income

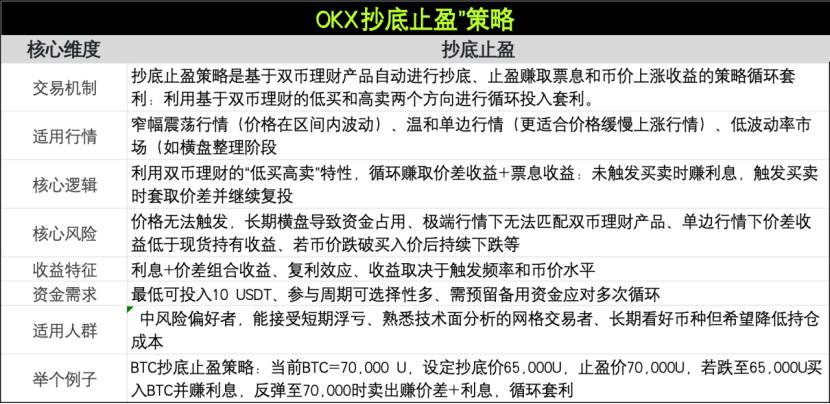

The OKX bottom-fishing take-profit strategy is a cyclical arbitrage strategy that automatically performs bottom-fishing and take-profit to earn interest and price appreciation returns based on dual currency financial products: utilizing low buying and high selling directions based on dual currency finance for cyclical investment arbitrage. USDT-based returns: Invest in USDT, use dual currency finance to buy low, and after successfully buying low, take profit to earn interest income while benefiting from price differences. This strategy currently only supports BTC and ETH, but the system can flexibly match based on the user's target price, minimum annualized return, and maximum investment period. Additionally, the OKX bottom-fishing take-profit strategy offers both a standard mode and an advanced mode. The standard mode sets the price at a fixed absolute value, such as 75,000 USDT, suitable for scenarios with clear support/resistance levels, with low flexibility. The advanced mode sets the price at a dynamic ratio, such as a 5% drop from the market price, suitable for scenarios without clear points but with predicted fluctuation ratios, offering high flexibility.

Choose the right tools based on market conditions

The essence of trading is not to predict the market, but to choose the right tools to respond to different market conditions. In a volatile market, blindly chasing highs and cutting losses will only cause your account to soar—not in profits, but in explosions. Smart traders do not gamble against the market but use tools to turn every market fluctuation into their opportunity. For example, OKX's spot grid is suitable for laid-back players who do not want to monitor the market but wish to earn some fluctuation returns; the contract grid is an advanced tool with high capital utilization but requires strict risk control. Dual currency winning allows holders to no longer "lie down and lose," as they can earn additional returns regardless of market rises or falls; while shark fin is a boon for conservative users, where earning more or less does not matter, preserving principal is the key.

There are three types of people in the market: the first relies on luck, experiencing rollercoaster profits and losses; the second relies on knowledge, combining technical analysis with strategy execution; the third relies on tools, making complex trading patterns systematic and automated to maximize returns. The first two types compete on emotions and experience, while the third represents the victory of "tool users." The diverse strategies and structured products offered by OKX allow you to no longer be driven by emotions but let tools help you execute your plans. For instance, USDT-based dual currency winning is suitable for traders who want to "earn stable returns while waiting for entry opportunities," while grid trading is suitable for users looking to continuously arbitrage and steadily obtain profits from market fluctuations.

"The market does not lose money; only retail investors do." While this statement may sting, it highlights a reality: the gap between speculation and trading is wider than the transition from bull to bear markets. If you are still relying on "guessing trades," your competitors may have already calculated every trade with precision using strategies. Choosing the right tools is the first step to turning the market into a cash machine. OKX has provided a wealth of strategic tools; whether for steady arbitrage or high-risk speculation, there is always one that suits you. Rather than relying on luck, use tools to tilt the odds in your favor.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。