Key Points

The total market capitalization of global cryptocurrencies is $2.9 trillion, down from $3.33 trillion last week, representing a decline of 12.9% this week. As of the time of writing, the cumulative net inflow for Bitcoin spot ETFs in the U.S. is approximately $36.05 billion, with a net inflow of $744 million this week; the cumulative net inflow for Ethereum spot ETFs in the U.S. is approximately $2.42 billion, with a net outflow of $102 million this week.

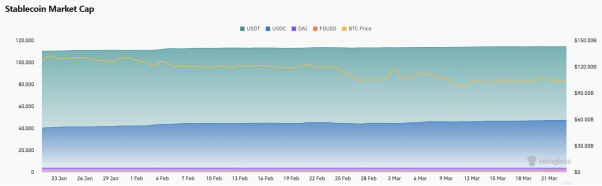

The total market capitalization of stablecoins is $239 billion, with USDT having a market capitalization of $143.5 billion, accounting for 60.04% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $59.6 billion, accounting for 24.94%; and DAI with a market capitalization of $5.37 billion, accounting for 2.25%.

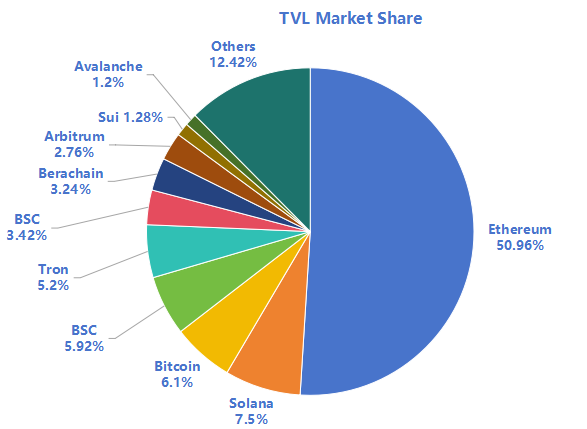

According to DeFiLlama data, the total TVL (Total Value Locked) in DeFi this week is $91.7 billion, down 15.9% from last week. By public chain classification, the top three public chains by TVL are Ethereum, accounting for 50.96%; Solana, accounting for 7.5%; and Bitcoin, accounting for 6.1%.

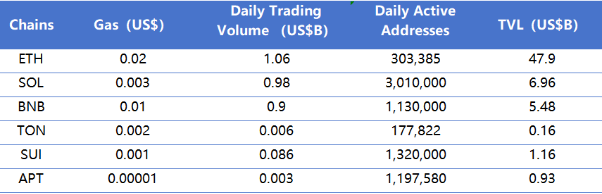

From on-chain data, the daily transaction volume of Layer 1 public chains shows an overall downward trend this week, with BNB showing the most significant decline, down 55% from last week. In terms of transaction fees, SUI has decreased by 66.7% compared to last week. In terms of daily active addresses, all public chains except TON have shown slight growth, with SOL showing a significant growth trend, up 24.2% from last week; the overall TVL of public chains this week has not changed much. The total TVL of Ethereum Layer 2 is $32.03 billion, with an overall increase of 3.43% compared to last week.

Innovative projects to watch: Converge, co-developed by Ethena and Securitize, is a purpose-built EVM blockchain optimized for retail and institutional DeFi; Gas Network is a distributed oracle platform providing real-time gas price data across blockchains. By bringing gas price data from providers on-chain, Gas Network is helping to drive interoperability; spawn.co enables no-code operations through artificial intelligence, helping users turn ideas into reality without an IDE or coding. The project has not yet officially launched but has garnered some community attention.

- Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Ratio

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

7. Stablecoin Market Capitalization and Issuance Situation

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Coming Next Week

3. Important Investments and Financing from Last Week

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Share

The total market capitalization of cryptocurrencies is $2.9 trillion, down from $3.33 trillion last week, representing a decrease of 12.9% this week.

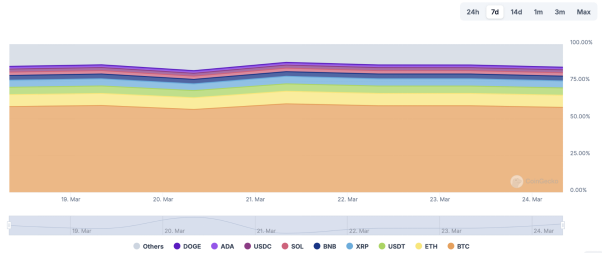

Data Source: cryptorank

As of the time of publication, Bitcoin's market capitalization is $1.7 trillion, accounting for 58.73% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $239 billion, accounting for 8.23% of the total cryptocurrency market capitalization.

Data Source: coingeck

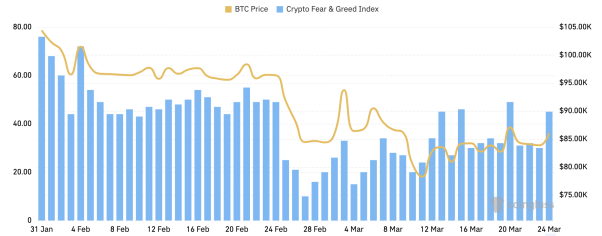

2. Fear Index

The cryptocurrency fear index is at 45, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of publication, the total net inflow of the U.S. Bitcoin spot ETF is approximately $36.05 billion, with a net inflow of $744 million this week; the total net inflow of the U.S. Ethereum spot ETF is approximately $2.42 billion, with a net outflow of $102 million this week.

Data Source: sosovalue

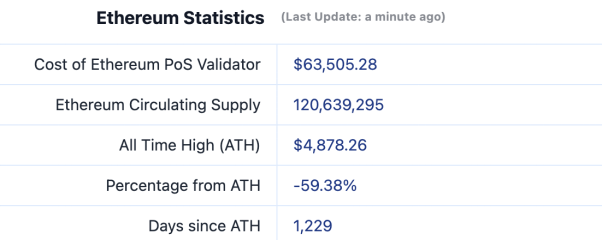

4. ETH/BTC and ETH/USD Exchange Ratios

ETHUSD: Current price $1,984, historical highest price $4,878, approximately 59.38% down from the highest price.

ETHBTC: Currently at 0.023712, historical highest at 0.1238.

Data Source: ratiogang

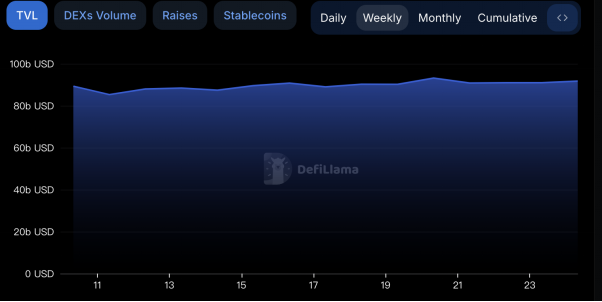

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $91.7 billion, representing a decrease of 15.9% from last week.

Data Source: defillama

Divided by public chains, the top three chains by TVL are Ethereum with a share of 50.96%; Solana with a share of 7.5%; and Bitcoin with a share of 6.1%.

Data Source: CoinW Research Institute, defillama

Data as of March 23, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of March 23, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the daily transaction volume across public chains is on a downward trend, with BNB showing the most significant decline, down 55% from last week. In terms of transaction fees, SUI has decreased by 66.7% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, all public chains except TON have shown slight growth, with SOL showing a significant increase of 24.2% compared to last week; the overall TVL change across public chains this week is minimal.

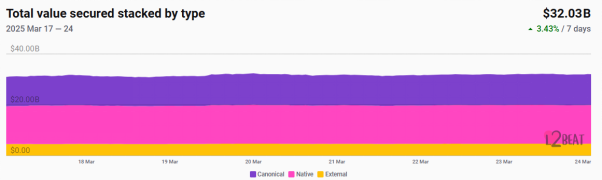

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $32.03 billion, with an overall increase of 3.43% compared to last week.

Data Source: L2Beat

Data as of March 23, 2025

Arbitrum and Base occupy the top positions with market shares of 27.76% and 26.38%, respectively, but both have seen a decline in overall share.

Data Source: footprint

Data as of March 23, 2025

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $239 billion. Among them, USDT has a market capitalization of $143.5 billion, accounting for 60.04% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $59.6 billion, accounting for 24.94%; and DAI with a market capitalization of $5.37 billion, accounting for 2.25%.

Data Source: CoinW Research Institute, Coinglass

Data as of March 23, 2025

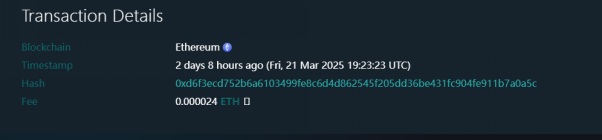

According to Whale Alert data, USDC Treasury has issued a total of 2.22 billion USDC this week, representing an increase of approximately 52.7% compared to the total issuance of stablecoins last week.

Data Source: Whale Alert

Data as of March 23, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Growth This Week

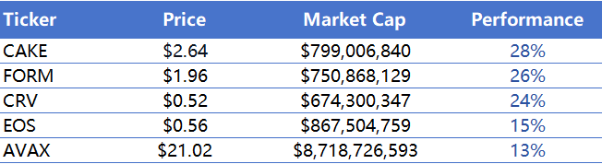

The top five VC coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 23, 2025

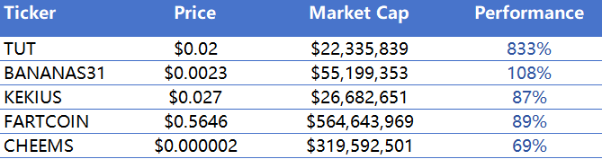

The top five Meme coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 23, 2025

2. New Project Insights

Converge: Co-developed by Ethena and Securitize, it is a purpose-built EVM blockchain optimized for retail and institutional DeFi. In addition to providing standard DeFi applications for retail investors, Converge will also offer a suite of applications and products co-developed with partners, specifically designed for institutional investors, helping to provide compliant DeFi innovations and capital efficiency access for institutional capital.

Gas Network: A distributed oracle platform providing real-time gas price data across blockchains. By bringing gas price data from providers on-chain, Gas Network is helping to drive interoperability.

spawn.co: Achieving no-code operations through artificial intelligence, helping users turn ideas into reality without an IDE or coding. The project is not yet officially launched but has garnered some community attention.

III. Industry News

1. Major Industry Events This Week

The decentralized lending protocol Beraborrow on Berachain will conduct a public token sale on March 28, with 2.5% of the total supply of the POLLEN token being offered through Fjord Foundry at a $42 million FDV, with Beraborrow planning to raise $1 million. In Beraborrow's token economic model, the maximum supply of POLLEN is designed to be 420 million tokens, with 37.4% allocated to the community, 31.6% to investors, 18% to the team and advisors, 5% to liquidity pools and project reserves, 2.5% for public offerings, and 0.5% for community rounds.

The Beta version of swarms' Launchpad has been launched, allowing users to tokenize their AI agents to generate income and earn swarms token rewards by providing valuable AI agents to the market.

Layer3, a full-chain infrastructure, announced that its Season 3 activities will end at the end of March, and it will launch Layer3 v3. This phase of activities includes incorporating S3 activities on EVM-compatible chains into Ethereum and incorporating activities on Solana into Solana's S1, with Layer3 v3 enhancing the utility of L3 tokens.

The re-staking protocol Puffer Finance announced that the AI smart layer Rivalz Network will allocate 15 million RIZ tokens to PUFFER Season 2 participants in stages 4 and 5.

Bedrock announced its token economic model, with a total supply of 1 billion tokens, 20% allocated to the community, of which 5.5% has been airdropped, and 14.5% reserved for future airdrops; 18.5% allocated to the market and partners; 20% to strategic investors; 20% to the founding team; 12.5% to seed round investors; 5% to Binance IDO; and 4% to liquidity providers. No team or investor tokens will be unlocked in the first year. Additionally, token claims are expected to open on March 20 and last for 90 days. Users can stake BR to earn veBR, enhancing community governance capabilities and staking rewards.

2. Major Events Coming Next Week

The Bitcoin Ordinals collection of Taproot Wizards will go on sale on March 25. This collection includes 2,121 Wizard NFTs, inspired by the Bitcoin wizard meme that appeared on Reddit in 2013. The sale of this collection is divided into two phases: first, Wizard NFTs will be sold to whitelisted individuals at a price of 0.2 BTC, followed by a public minting through a Dutch auction, with a starting price above 0.2 BTC.

The AI+ZK public chain Polyhedra has announced its staking program, allowing users to stake indefinitely and continuously earn rewards. Additionally, all ZKJ staking users will be eligible for airdrop rewards from future EXPchain ecosystem projects. Since the launch of the ZKJ staking program on July 15, 2024, the APR calculated based on a 52-week staking cycle is 159%. After this update, users can continue staking for a period not exceeding 52 weeks and enhance their Staking Power by extending the staking cycle, participating in community governance to earn higher rewards.

BoostVC, Draper Associates, and Thesis have launched the second phase of the BitcoinFi accelerator, where participants can receive $150,000 in initial funding in exchange for 5% equity, along with mentorship and technical support, as well as access to market expansion (GTM) and venture capital (VC) networking. Applications will close on March 28.

3. Important Financing from Last Week

NinjaTrader raised $1.5 billion, with investment from Kraken. NinjaTrader is a futures trading platform that provides traders with an affordable way to access the futures market. The NinjaTrader platform offers a comprehensive set of futures trading features, including advanced charting, market analysis, trading simulation, and trading system development. (March 20, 2025)

Walrus raised $140 million, with investments from Andreessen Horowitz, Electric Capital, Standard Crypto, Comma3 Ventures, Franklin Templeton, Lvna Capital, and others. Walrus is a distributed storage and data availability protocol specifically designed for large binary files or "blobs." Walrus focuses on providing robust and cost-effective solutions for storing unstructured content on distributed storage nodes while ensuring high availability and reliability even in the presence of Byzantine faults. (March 20, 2025)

The Open Network raised $400 million, with investments from Sequoia Capital, CoinFund, Hypersphere Ventures, Ribbit Capital, Kingsway Capital, Draper Associates, and others. The Open Network is a fully decentralized Layer-1 blockchain designed by Telegram. It offers ultra-fast transaction speeds, minimal fees, user-friendly applications, and is environmentally friendly. (March 20, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。