Author: Nancy, PANews

Ethereum is undergoing a prolonged period of growing pains, with prices under continuous pressure, a significant decline in on-chain activity, and ongoing outflows of spot ETF funds… These signs are gradually eroding market confidence in its growth potential. As the regulatory environment for cryptocurrencies in the U.S. quietly changes, several ETF issuers have recently submitted proposals to the SEC for Ethereum ETF staking. For Ethereum, which currently lacks clear demand catalysts, this shift is seen by the market as a key variable for a potential recovery in the short term.

Severe Outflows from ETF Funds, Approval for ETF Staking Expected This Month

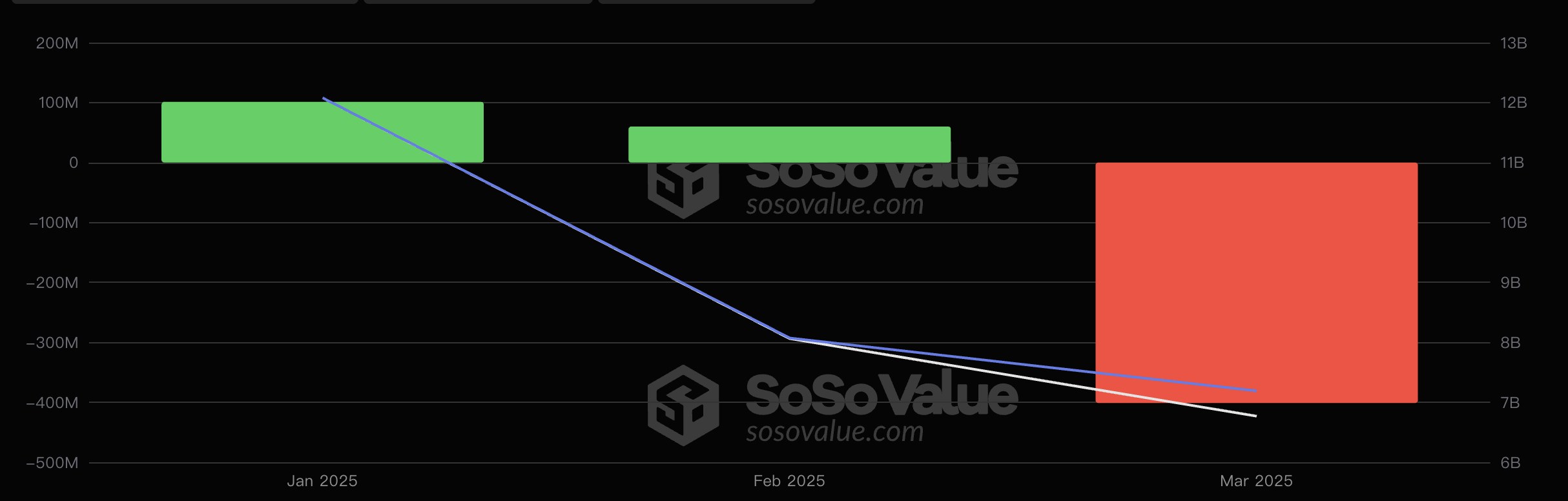

Currently, Ethereum's spot ETF funds are experiencing continuous outflows, further undermining market confidence. According to SoSoValue data, since the beginning of this year, U.S. Ethereum spot ETFs have seen a cumulative net inflow of approximately $160 million in January and February, but in March, there was a net outflow of over $400 million, resulting in a net outflow of nearly $240 million for the year. In contrast, while Bitcoin spot ETFs have also seen significant outflows in the past two months, the overall net inflow for the year still exceeds $790 million, and the net outflow this month has decreased by 74.9% compared to February.

Ethereum ETF Inflow Situation This Year

In this regard, Robert Mitchnick, head of BlackRock's digital asset division, believes that approval for staking could be a "huge leap" for Ethereum ETFs. He recently stated that demand for Ethereum ETFs has been lackluster since their launch in July last year, but if some regulatory issues hindering their development can be resolved, the situation may change. It is widely believed that, compared to the explosive growth of funds tracking Bitcoin, the success of Ethereum ETFs has been "unremarkable." Although this is a "misunderstanding," the inability of these funds to earn staking rewards may be a limiting factor in their development. ETFs are a very attractive tool, but for today's ETH, a non-staking ETF is not ideal; staking rewards are an important component of generating investment returns in this field. This is not a particularly easy problem to solve; it is not as simple as… a new government just giving the green light; there are many quite complex challenges that need to be overcome. If these challenges can be addressed, there will be a significant increase in activity around these ETF products.

In fact, since February of this year, several issuers, including 21Shares, Grayscale, Fidelity, Bitwise, and Franklin, have consecutively submitted proposals for staking Ethereum ETFs. Among them, 21Shares was the earliest institution to submit a related application and received formal acceptance from the SEC on February 20. According to the SEC's approval process, the agency must make a preliminary decision within 45 days of submitting the 19b-4 filing, including whether to accept, reject, or delay. Counting from February 12, the preliminary decision date for 21Shares' Ethereum ETF staking application is March 29, which may be postponed to the next business day, March 31, due to the weekend, and the final ruling must be made within 240 days, expected by October 9.

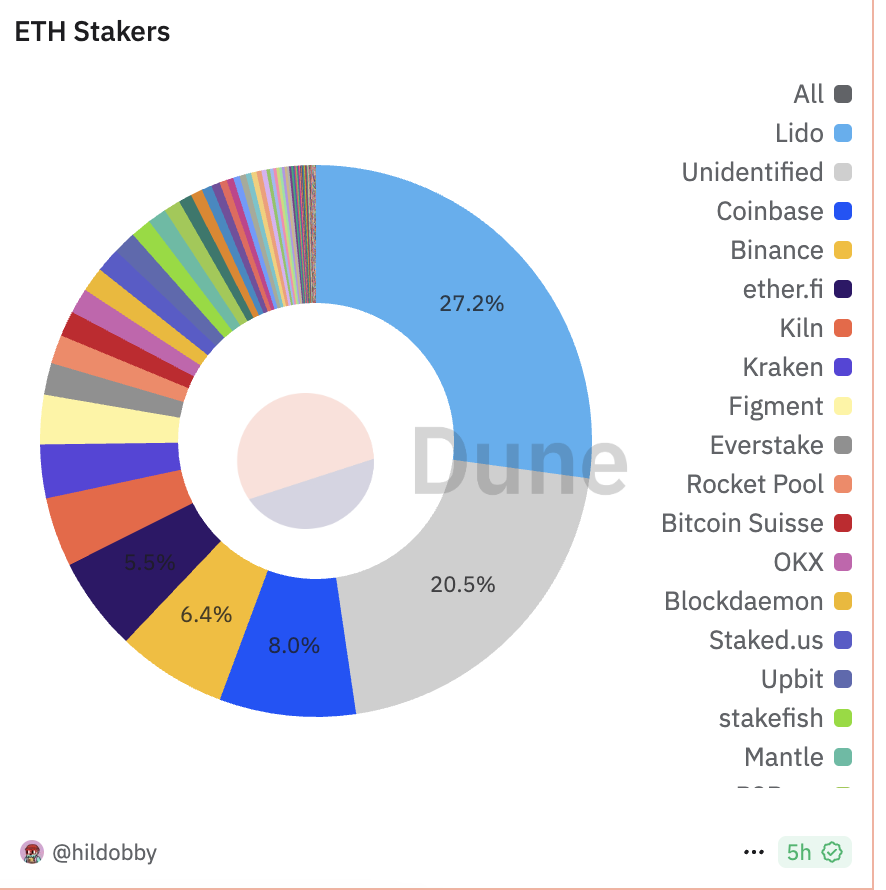

From the market's perspective, the introduction of staking functionality in Ethereum ETFs is seen as having multiple potential advantages. In terms of investment returns, the current annualized yield for Ethereum staking is approximately 3.12%. Compared to Bitcoin spot ETFs, which rely solely on price fluctuations, Ethereum ETFs can generate additional income for held ETH through staking, making this feature particularly attractive to institutional investors and potentially reversing the current weak demand; in terms of price support, staking will reduce the circulating supply of ETH, alleviating selling pressure and possibly driving ETH prices upward. Dune data shows that as of March 24, the total amount of ETH staked on the Ethereum Beacon Chain exceeds 34.199 million ETH, with staked ETH accounting for 27.85% of the total supply. If ETFs join the staking ranks, this proportion will further increase; in terms of network security, ETF participation in staking will increase the number of validators in the Ethereum network, enhancing decentralization and alleviating community concerns about the centralization risks of liquid staking protocols like Lido. Dune data shows that as of March 24, the liquid staking protocol Lido alone accounts for 27.28% of Ethereum's staking share.

However, for the sake of operational simplicity and regulatory compliance, the staking design of Ethereum spot ETFs may weaken their appeal to investment institutions. Taking the staking functionality application document submitted by 21Shares as an example, its staking process is managed by the custodian Coinbase, using a "point-and-click staking" model, which allows for direct staking of the ETH held by the ETF through a simplified interface without transferring assets to third-party protocols (such as Lido or Rocket Pool), thereby reducing security risks during asset transfers. Moreover, all staking rewards generated belong to the ETF trust as income for the issuer, rather than being directly distributed to investors. According to Dune data, compared to centralized exchanges like Coinbase and Binance, liquid staking protocols like Lido and ether.fi remain the mainstream choices for ETH staking. Based on existing information, Ethereum spot ETF issuers have not explicitly allowed for direct sharing of staking rewards with investors; however, under the backdrop of relaxed U.S. regulations and intensified market competition, the possibility of introducing such a mechanism cannot be ruled out.

Furthermore, Ethereum spot ETFs also face challenges regarding staking efficiency. Due to strict limitations on the entry and exit mechanisms for Ethereum staking (a maximum of 8 nodes can enter and 16 nodes can exit per epoch, with an epoch generated every 6.4 minutes), the flexibility of ETFs is restricted, especially during periods of market volatility when investors may not be able to exit in time, potentially exacerbating selling sentiment. For example, the current Ethereum spot ETFs hold approximately $6.77 billion worth of ETH, which, at an ETH price of around $2064, amounts to about 3.28 million ETH. The entry time for staking is approximately 57.69 days, while the exit time is about 28.47 days. This queuing mechanism fails to meet investor needs, and liquid staking platforms that bypass these mechanisms are also excluded from ETF staking.

However, the Pectra upgrade (EIP-7251) raises the staking limit for individual validator nodes from 32 ETH to 2048 ETH, significantly improving staking efficiency. This not only reduces the queuing time for entering and exiting staking but also lowers technical barriers. However, in the latest 153rd Ethereum Core Developers Consensus (ACDC) conference call, developers decided to postpone determining the activation date for the Pectra mainnet, which may be delayed until after May.

In this context, compared to the opening time for staking functionality, issues such as revenue distribution and efficiency are more critical factors affecting the demand for Ethereum spot ETFs.

On-Chain Activity Continues to Dwindle, ETF Staking Struggles to Resolve Ecological Dilemmas

Even if Ethereum spot ETFs introduce staking functionality, their impact on circulating supply and market sentiment is limited, making it difficult to fundamentally reverse the competitive pressures and growth bottlenecks facing the Ethereum ecosystem. Currently, on-chain activity remains sluggish, the L2 diversion effect is intensifying, and challenges from other high-performance public chains are all undermining Ethereum's market dominance.

From the perspective of ETF staking impact, as of now, Ethereum's staking rate is approximately 27.78%, accounting for 2.84% of the total ETH held by U.S. Ethereum spot ETFs. Even if all these ETFs participate in staking, the staking rate would only increase to about 30.62%, an increase of 2.84%. This minor change has little impact on ETH's circulating supply and is still insufficient to become a decisive force driving prices upward.

In contrast, the staking rates of other PoS competitive chains are much higher than Ethereum's, with Sui's staking rate at 77.13%, Aptos at 75.83%, and Solana at 64.39%. While Ethereum has room for staking growth, the scale of ETF funds and staking potential is unlikely to constitute the dominant purchasing power in the market; the symbolic significance of staking functionality outweighs its actual effects.

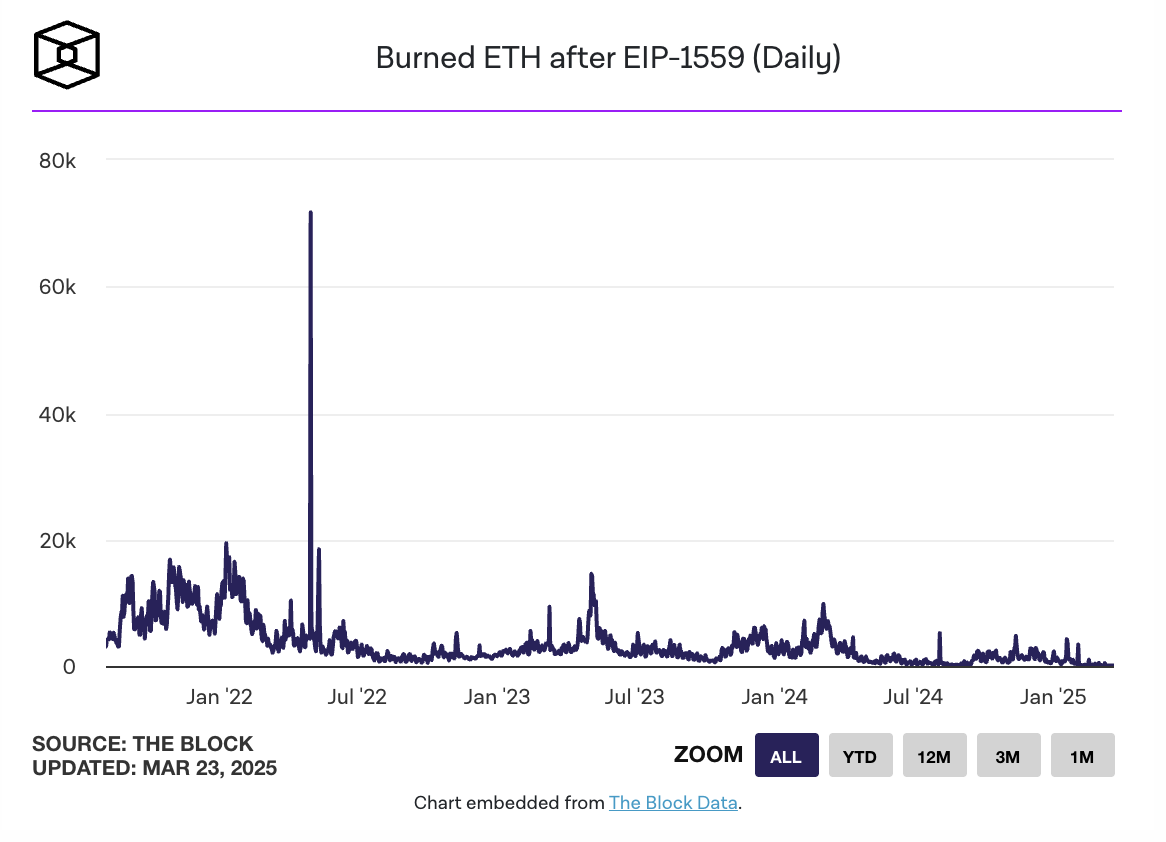

Moreover, the continuous decline in on-chain activity data further highlights the fatigue of the Ethereum ecosystem. According to The Block data, as of March 22, the amount of ETH destroyed due to transaction fees on the Ethereum network has dropped to 53.07 ETH, approximately $106,000, marking a historic low. Ultrasound.money data shows that the annual supply growth rate of ETH over the past seven days is 0.76%. Furthermore, the number of active addresses, transaction volume, and transaction counts on the Ethereum chain have all declined in recent weeks, indicating a waning vitality in the Ethereum ecosystem.

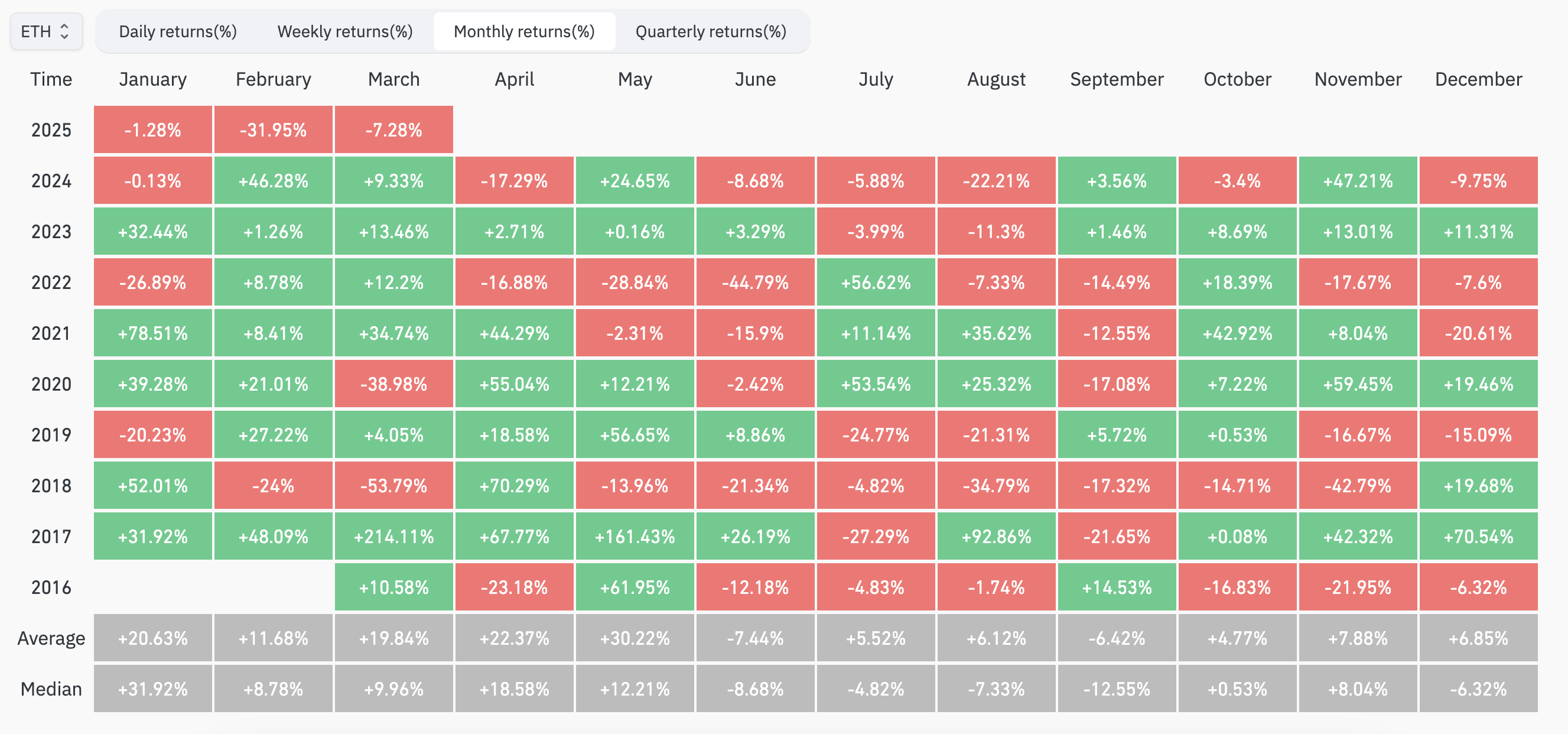

At the same time, Ethereum has recorded its worst performance in Q1 of this year. Coinglass data shows that Ethereum experienced one of its bleakest starts in recent years in the first quarter of 2025, with negative returns for three consecutive months for the first time: January: -1.28% (historical average return: +20.63%, median: +31.92%); February: -31.95% (historical average return: +11.68%, median: +8.78%); March: -7.28% (historical average return: +19.55%, median: +9.96%).

The challenges facing Ethereum stem from multiple structural issues. For instance, while L2 solutions like Arbitrum and Optimism have significantly reduced transaction costs through Rollup technology, they have also diverted transaction volume away from the mainnet, with L2 transactions now exceeding those on the mainnet, leading to a decline in both mainnet gas fees and ETH destruction. More critically, the transaction fees generated by L2 largely remain within their ecosystems (such as the OP token economy of Optimism), rather than flowing back to ETH. Additionally, Ethereum's market share is being eroded by other public chains like Solana due to its insufficient competitiveness in high-performance application scenarios.

Standard Chartered Bank has also recently downgraded its target price for ETH at the end of 2025 from $10,000 to $4,000, presenting several key judgments: L2 expansion weakens ETH's market value: L2 solutions originally intended to enhance Ethereum's scalability (such as Coinbase's Base) have led to a $50 billion evaporation in market value; ETH/BTC ratio expected to continue declining: projected to drop to 0.015 by the end of 2027, the lowest level since 2017; future growth may rely on RWA: if RWA tokenization develops rapidly, ETH may still maintain its 80% market share in security, but the Ethereum Foundation needs to adopt more aggressive business strategies (such as taxing L2), which is unlikely.

In summary, while Ethereum ETF staking can influence ETH supply and holder returns to some extent, it cannot directly address core challenges such as ecological competition, L2 diversion, or low market sentiment. Ethereum still needs to seek deeper breakthroughs in both technology and narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。