Source: Cointelegraph Original: "{title}"

Ethereum's native token, Ether (ETH), has lost half of its value over the past three months, plummeting from $4,100 in December 2024 to around $1,750 in March 2025. Nevertheless, it is now in a favorable position for a significant price rebound.

Ether price expected to rebound 65% by June

From a technical perspective, Ether's price is eyeing a potential breakout as it retests a long-term support range. Historically, rebounds from this support level have triggered explosive upward trends—most notably achieving over 2,000% and 360% gains in past cycles.

ETH/USD two-week price chart. Source: TradingView

As of March 23, the ETH/USD trading pair is hovering around $2,000, close to the aforementioned support area. If it rebounds from this range, its price could rise to $3,400 by June, representing a 65% increase from the current price.

This price level aligns with the lower boundary of Ether's current downward channel resistance.

Source: Ted Pillows

Conversely, if the price breaks below this support range, it could push Ether's price toward the 200-week biweekly exponential moving average (200-2W EMA; blue curve in the first chart), approximately $1,560.

BlackRock's cryptocurrency fund holds over $1 billion in Ether

As institutional confidence in Ethereum grows, the bullish outlook for Ether seems increasingly clear.

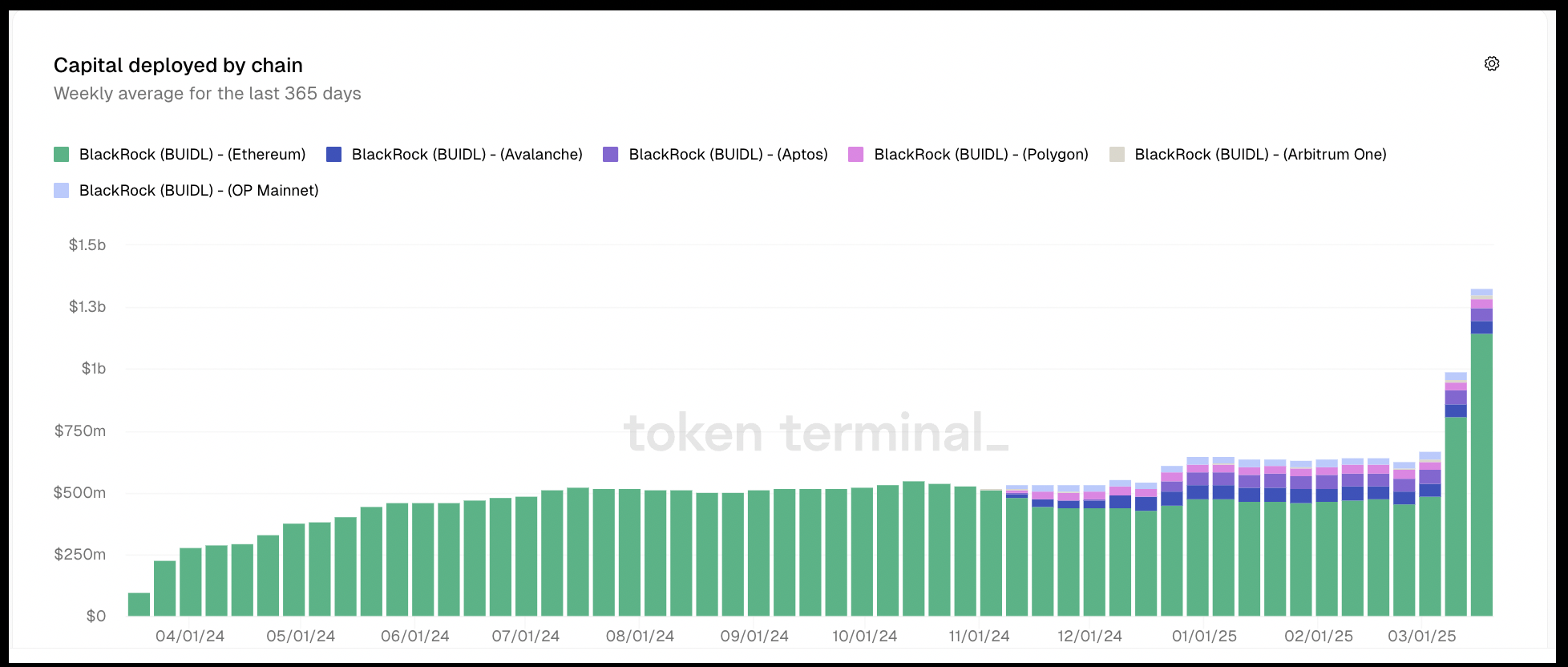

According to data from Token Terminal, BlackRock's BUIDL fund currently holds approximately $1.145 billion worth of Ether, setting a new record, up from about $990 million a week ago.

Funding situation of BlackRock's BUIDL fund. Source: Token Terminal

The fund primarily focuses on tokenized real-world assets (RWA), with Ethereum remaining its main foundational layer. Although the fund has diversified its allocations across blockchains like Avalanche, Polygon, Aptos, Arbitrum, and Optimism, Ethereum remains its core allocation.

BlackRock's recent increase in Ether holdings indicates that institutional confidence in Ethereum as a leading platform for tokenizing real-world assets is on the rise.

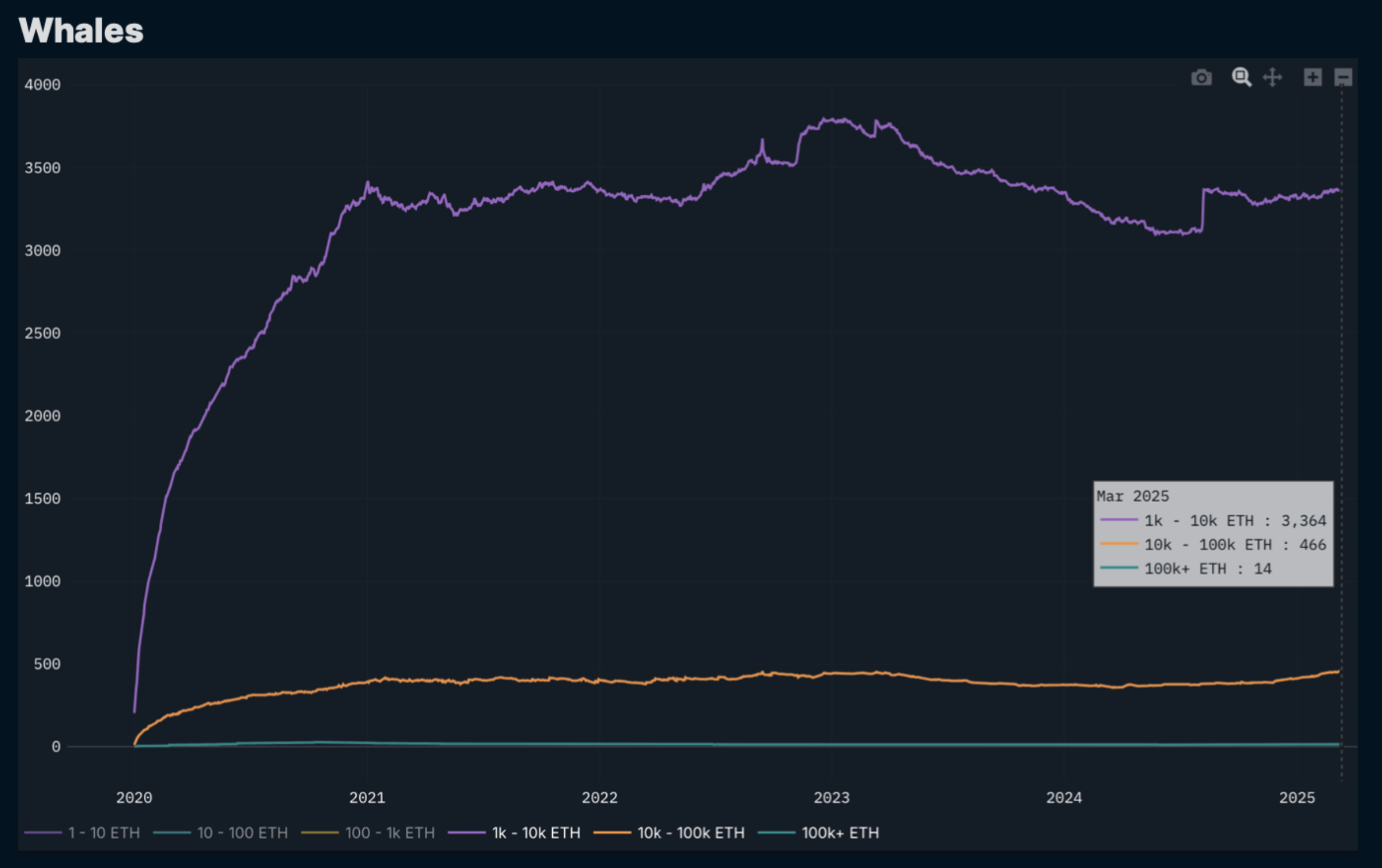

The bullish outlook for Ethereum coincides with a significant increase in holdings by whale investors.

Latest on-chain data from the analytics platform Nansen shows that since March 12, 2024, addresses holding between 1,000 and 10,000 Ether have increased their holdings by 5.65%, while the group holding between 10,000 and 100,000 Ether has seen a 28.73% increase.

Ethereum whale investors' holdings. Source: Nansen

Although the number of addresses holding over 100,000 Ether has remained relatively stable, this accumulation trend highlights the growing confidence among large investors.

Related: Analyst: Ethereum price trapped in a "curse-like" downtrend, may continue until 2025

This article does not contain investment advice or recommendations. Every investment and trading activity carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。