In the past week, global financial markets have experienced significant volatility due to the Federal Reserve's decision to maintain interest rates and update economic forecasts, as well as the Trump administration's plan to implement reciprocal tariffs. This has particularly affected the digital currency market, such as Bitcoin, where investor sentiment has fluctuated frequently, increasing market uncertainty in the short term.

Bitcoin Candlestick Pattern Analysis

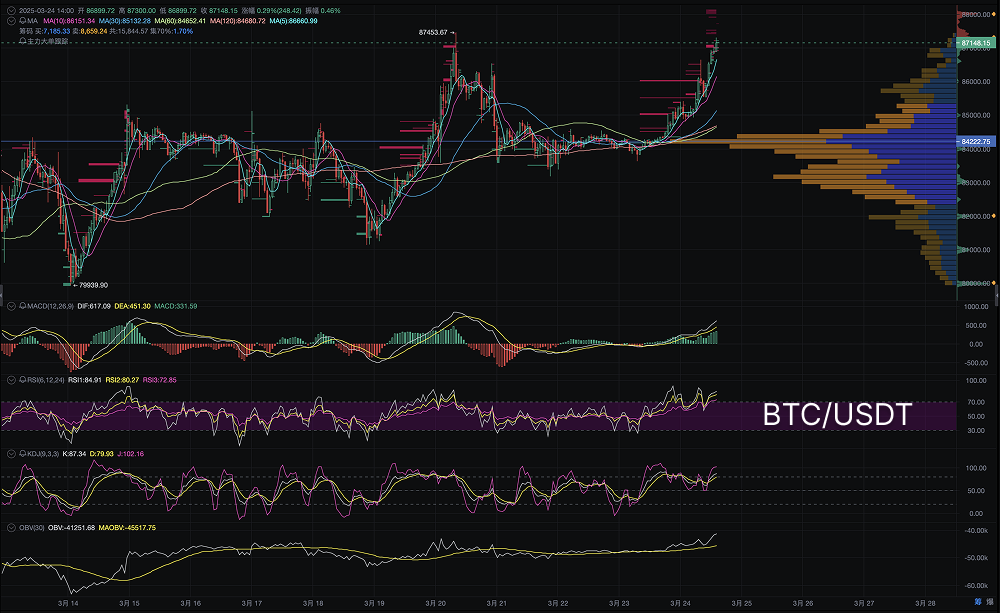

From the chart, Bitcoin has recently shown a strong upward trend. The price quickly rebounded after breaking through $86,000, reaching a high of $87,453.67 before experiencing a slight pullback. Currently, the price is stabilizing around $87,148.15, with overall volatility being high and market sentiment very active.

Candlestick breakout pattern: The current candlestick shows a clear breakout pattern, especially above the important support level of $85,000, where the price surged quickly to reach a historical high. Such breakouts typically indicate strong bullish momentum in the market, but the subsequent price pullback suggests that the market may face short-term pressure.

Consolidation and correction: After reaching the high of $87,453.67, Bitcoin has shown slight consolidation, with long upper shadows indicating increased selling pressure above, suggesting that a correction may be imminent in the short term.

Large Capital Flow and Chip Distribution Analysis

OBV Indicator (On-Balance Volume): The OBV indicator has been rising continuously, indicating significant inflows of large capital into the market, especially when the price breaks through key levels, the OBV indicator rises sharply, further validating the strength of the main capital. This suggests that market funds are active, and bullish sentiment is likely to continue in the short term. Chip distribution:

According to the chart, the current concentrated chip area is around $84,222.75. There is strong support at this level, meaning that if the price pulls back to this area, there may be rapid absorption of funds, preventing a significant price drop. On the other hand, as the price approaches the high of $87,453.67, there is strong selling pressure above, which may lead to short-term rebound pressure upon breaking through.

Technical Indicator Analysis

MACD Indicator:

- DIF Line: The current DIF line is 451.30, still in the strong zone, indicating that the market's upward momentum has not diminished.

- DEA Line: The DEA line is 331.59. Although there is a significant gap between it and the DIF line, the red bars remain prominent, indicating that bullish momentum still dominates the market.

RSI Indicator: The RSI value is 80.27, close to the overbought zone of 90, indicating that the market's rise has entered an overheating phase, and a technical pullback may be imminent in the short term. Especially when approaching above 80, the risk of price correction increases. If the RSI value falls below 70, it may signal an adjustment in the market.

KDJ Indicator:

- K Line: The K line is 87.34, close to the overbought zone, indicating that the market is in a high buying area.

- D Line: The D line is 79.93, still in the strong zone, but showing signs of potential short-term overheating in the market.

- J Line: The J line is 102.16, an extremely high value further confirming the market's overheating situation. If the J line falls and forms a death cross, it may signal a price reversal or adjustment. OBV (On-Balance Volume):

The OBV value is -41,251.68. Although it is in the negative zone, its fluctuations indicate significant market volatility. As the price continues to rise, if the OBV can continue to increase, it may drive Bitcoin further upward.

Today's Trend Prediction

Short-term consolidation is likely:

The current price is approaching the high of $87,453.67, and technical indicators show that the market is in the overbought zone, increasing the risk of a pullback. If Bitcoin fails to break through this resistance level in the short term, a pullback is expected, with support around $86,000. If the price breaks below this support level, it may further test the support area of $84,222.75. Potential for breakout recovery:

If Bitcoin can successfully break through the resistance level of $87,453.67, the market is expected to continue developing towards $88,000. However, it is important to note that the risk of a pullback after the breakout still exists, and investors should remain cautious to avoid chasing highs.

Investment Strategy Recommendations

- Short-term operation strategy: Consider buying on dips when the price pulls back to around $86,000, as there is still some potential for short-term upside. If the price breaks through $87,453.67, consider increasing positions, with a short-term target of $88,000.

- Medium to long-term investment strategy: If the pullback support around $84,222.75 is confirmed, consider medium to long-term positioning, but be wary of potential market risk factors and build positions in batches.

- Risk management: Control positions to avoid excessive chasing in the overbought zone, and set reasonable stop-loss levels to prevent sudden events from having a significant impact on the market.

In summary, Bitcoin is currently in a relatively complex market environment. Although there is some potential for upside in the short term, technical indicators and external factors suggest that the market may enter a correction phase. Investors need to closely monitor changes in technical and macro environments and adjust strategies flexibly.

This article only represents the author's personal views and does not reflect the position or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。