Tornado Cash Coin Faces Uncertainty as Coinbase Challenges US Treasury

The US Treasury recently removed sanctions on Tornado Cash, a popular crypto mixer, but not everyone is happy about it. Paul Grewal, the Chief Legal Officer of Coinbase, has criticized the move, saying the FOMC is trying to avoid a final court ruling. He warns that without a clear legal decision, the government could put it back on the sanctions list anytime.

Coinbase CLO Criticizes US Treasury for Removing Tornado Cash Without a Final Conclusion

The US Treasury removed sanctions on Tornado Cash , a crypto mixer. But this move upset some people.

Paul Grewal, the chief legal officer of Coinbase, says the Treasury handled the situation the wrong way. He believes they are trying to avoid a final court ruling. This ruling could stop them from adding it to the sanctions list again in the future.

The Treasury asked the court to dismiss the case. They say it is no longer needed because TORN is off the list. But Grewal disagrees. He says without a final decision, they can add Tornado Cash back anytime.

He gave examples of past cases where the government removed sanctions but later put them back. Furthermore, he says there is no legal guarantee that this won’t happen again.

He also stated that without legal assurance, nothing stops the US government from blacklisting it again.

TORN Price Drops After Coinbase’s Criticism

Following Grewal’s remarks, Tornado Cash had experienced a sharp drop, start falling from $12.83 and went up to $11.91 in just an hour.

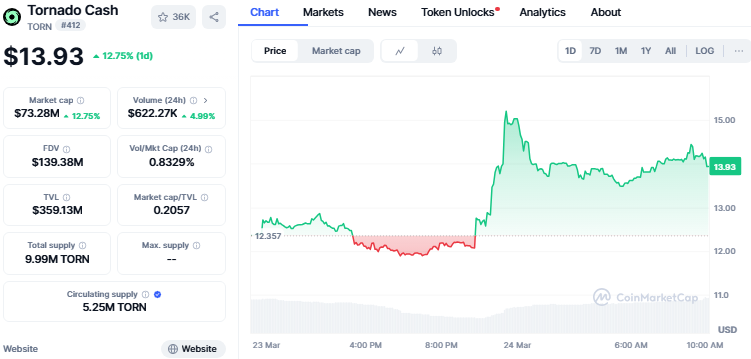

However, it quickly recovered within a few hours and surged up to $15.2 just like the last hype which was $15.26. Currently floating at $13.93 with a good price rise of 12.75 in the last 24 hours. Beside the current price surge, the trade volume is just 4.99% of the last 24 hours. With a market of 573.23 million, rose by 12.75%.

Source: CoinMarketCap

Even after days of the delisting news, the token is showing good growth. After criticism from Coinbase, there was a drop, but it recovered with strong hype. This volatility highlights how sensitive crypto markets are to regulatory news and legal battles.

Tornado Cash is showing good growth, but at the same time, it is highly volatile. Its case is not fully settled yet, which means even a single negative decision by the US Treasury against TORN could lead to a deep drop. However, it has shown potential, as seen in the last hype after the drop caused by Coinbase’s criticism. It might see more hype in the future and become a reliable token to invest in, or misfortune could turn it into a bubble that pops with future US decisions.

What’s Next?

The future of Tornado Cash is still uncertain. While it has been removed from the sanctions list, there is no guarantee it won’t be blacklisted again. The crypto market remains highly sensitive to legal actions, and any negative decision by the US Treasury could cause another drop in TORN’s price. Investors should stay cautious and keep an eye on further developments. Whether it becomes a stable investment or faces more setbacks depends on future regulatory decisions.

Also read: Hamster Kombat GameDev Heroes Daily Cipher March 24 2025: Play

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。