Always maintain a good mindset; believe you can do it, and even if you can't, it's still okay. When investments go bad to a certain extent, it becomes very difficult to recover because mindset affects performance. Therefore, at any time, before making a trade, it's essential to manage your emotions well. Don't worry about an unclear future; instead, focus on working hard for a clear present.

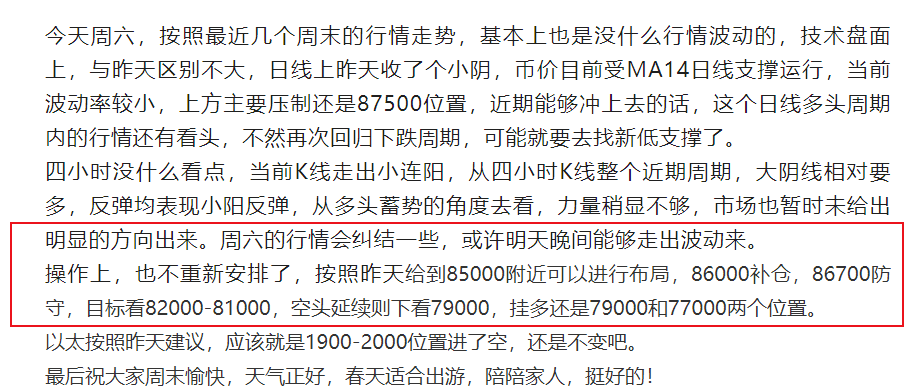

The market is fluctuating, ultimately resulting in an upward trend. Yesterday, on Sunday, due to some matters, I didn't have time to write the article. Additionally, since Saturday saw fluctuations around 84000, the originally planned short position at 85000 was not rearranged. Today, as the market began to rise, it also hit our stop-loss position for the short position. After averaging down, the average price was around 85500, and the stop-loss at 86700 resulted in a loss of 1200 points. The market indeed changes every day; a slight relaxation can lead to overlooking changes in trends. This trade has indeed taken a bit too long in terms of time cycle. There are both losses and gains in investing; no one wants to see losses, but what we can do is to earn more in the future.

Returning to the technical analysis, the weekly chart has shown two consecutive weeks of bullish candles, but the K-line body is not too large, indicating that the strength is not particularly strong. It remains within the previous bearish cycle. Currently, the weekly resistance is around 88300. From the distribution of chips, there are three relatively dense liquidation liquidity areas re-gathered on the current chart, namely 88000, 83000, and 80000, which also constitute the most important positions for this week. As for whether the liquidation will be upward or downward, we cannot know. However, according to recent liquidation patterns and trends, whether the market first liquidates upward or downward, there is a high possibility of a secondary liquidation of liquidity in the opposite direction. This situation has been very evident since February.

On the daily chart, there is a bullish trend with consecutive bullish candles, and the K-line center of gravity is gradually rising, with the low points continuously increasing. The overall trend is showing a structure of fluctuating upward in the short term. The four-hour chart shows a strong performance, with a clear upward trend and a breakout from a descending wedge, providing market bulls with confidence in the short term. The MACD is in the early stage of the bullish trend, still supporting the bullish strength, and other indicators are diverging upward. Combining the performances across various time frames, it seems that in the short term, the bulls are moving upward. Taking advantage of this momentum, the primary action will likely be to clear the short positions above, which may lead to a breakthrough above 88000, followed by a pullback. Additionally, the current weakness in the U.S. stock market and the upcoming tariff policy impact, with April 2 being the day for the full announcement of increased tariffs, all bring uncertainties to the continuous rise of Bitcoin. Therefore, I do not believe Bitcoin can maintain a strong position independently.

In terms of operations, I do not recommend chasing long positions at the current level. For short positions, since there may be a false breakout at 88000, I suggest positioning around 88600, averaging down at 89600, with a stop-loss at 90200, and targeting a pullback to around 84000.

For Ethereum, it similarly follows the trend of Bitcoin. Positioning for a short around 2120, with a stop-loss at 2180, targeting around 2000-1900.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time, making the information potentially outdated. Specific operations should follow real-time strategies. Feel free to contact and discuss the market.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。