1. Market Observation

Keywords: BNB, ETH, BTC

The BSC ecosystem and Solana ecosystem continue to compete for on-chain popularity, with CZ starting to promote ecological projects, using BNB to long mubarak on APX Finance. This has led to significant increases in APX and mubarak. Notably, Wintermute may become the market maker for the BSC ecosystem meme coin mubarak, having withdrawn a total of 6.04 million tokens from Gate over the past four days.

The Solana ecosystem is also taking action, with Moonshot quietly launching three new MEME tokens: TITCOIN, FAT, and ROUTINE after a long period of inactivity. Trump called for TRUMP and criticized his portrait as too ugly, leading to the emergence of the Downald token on the Solana chain, which reached a market cap of approximately $14.5 million. Bitcoin ended last week with a bullish candle, closing at around $86,000, but market opinions remain divided. In terms of short-term outlook, Bitget Research's chief analyst Ryan Lee pointed out last weekend that $85,000 will be a key psychological level; if the closing price cannot break this level this week, Bitcoin may face further downward pressure next week. For the mid-term outlook, BitMEX co-founder Arthur Hayes proposed a "rise then fall" perspective, predicting that Bitcoin will first reach $110,000 before retracing to the $76,500 level. However, trader Eugene stated that the market has entered the fifth phase, characterized by losses for bulls, price consolidation, and shrinking volume and volatility. In this phase, some stronger altcoins have reached their bottoms, but it remains uncertain whether the bottoms for most assets have been established.

Developments in regulation are also attracting attention, with Senator Cynthia Lummis proposing a Bitcoin bill for 2025 that advocates for the U.S. to acquire 1 million Bitcoins within five years, accounting for about 5% of the total supply. The SEC chair qualification hearing on Thursday is worth noting, as it may involve cryptocurrency-related content. VanEck's director of digital asset research, Matthew Sigel, mentioned that Bloomberg legal analysts believe there is a 30% chance the federal government will purchase Bitcoin this year.

On the macroeconomic front, the market is closely monitoring several key indicators. Nexo analyst Iliya Kalchev emphasized that the consumer confidence index, Q4 GDP, initial jobless claims, and upcoming PCE inflation data will all influence the Federal Reserve's interest rate cut decisions. The Fed hinted at ignoring short-term inflation pressures during its March 18-19 meeting, laying the groundwork for potential future easing policies. Nansen research analyst Nicolai Sondergaard stated that global tariff concerns will continue to pressure the market until tariff-related issues are resolved between April 2 and July.

2. Key Data (as of March 24, 13:30 HKT)

Bitcoin: $86,928.38 (Year-to-date -7.13%), daily spot trading volume $17.58 billion

Ethereum: $2,050.00 (Year-to-date -38.54%), daily spot trading volume $9.255 billion

Fear and Greed Index: 45 (Neutral)

Average GAS: BTC 1.47 sat/vB, ETH 0.43 Gwei

Market Share: BTC 60.7%, ETH 8.7%

Upbit 24-hour trading volume ranking: AUCTION, XRP, W, ZETA, BTC

24-hour BTC long/short ratio: 1.0496

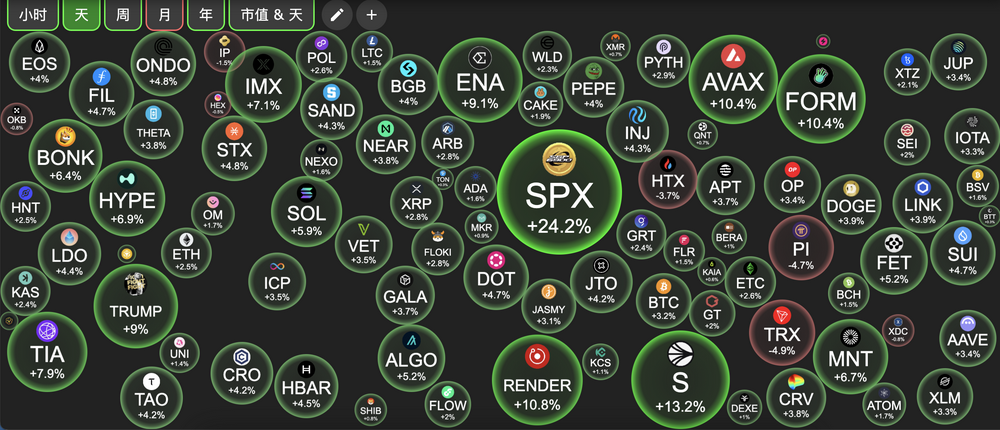

Sector performance: AI sector up 5.57%, DePIN sector up 4.73%

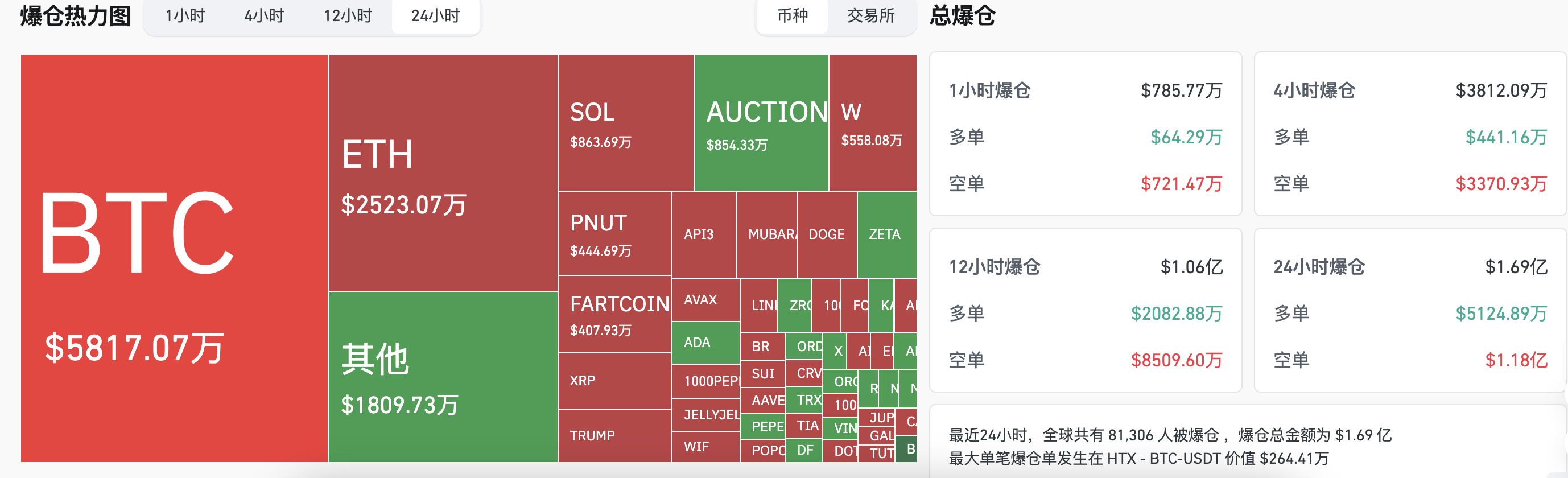

24-hour liquidation data: A total of 81,306 people were liquidated globally, with a total liquidation amount of $169 million, including $58.17 million in BTC and $25.23 million in ETH.

3. ETF Flows (as of March 21 EST)

Bitcoin ETF: $83.09 million

Ethereum ETF: -$18.63 million

4. Today's Outlook

Binance and Huobi HTX launch Nillion (NIL) spot trading pairs

Babylon Genesis Pre-Launch Meetup: Taipei (feat. Zeus Network) will be held on March 24, 2025

Bithumb plans to terminate trading support for Bitcoin Gold (BTG) and VALOR tokens

Today's Top 500 Market Cap Gainers: BugsCoin (BGSC) up 36.16%, Mubarak up 26.52%, Ankr (ANKR) up 25.43%, SPX6900 up 23.01%, StormX (STMX) up 22.63%

5. Hot News

Wintermute may have become the market maker for the meme coin mubarak

Suspected Binance Wallet employee profits over $110,000 through trading UUU on the BSC chain

Data: This week, the U.S. Bitcoin ETF purchased 8,775 BTC, while miner output was only 3,150 BTC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。