Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $744 Million

Last week, the U.S. Bitcoin spot ETFs had a five-day average net inflow of $744 million, bringing the total net inflow to $744 million and total assets under management to $94.35 billion.

Five ETFs experienced net inflows last week, primarily from IBIT, FBTC, and ARKB, which saw inflows of $537 million, $136 million, and $79.5 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Outflow of $102 Million

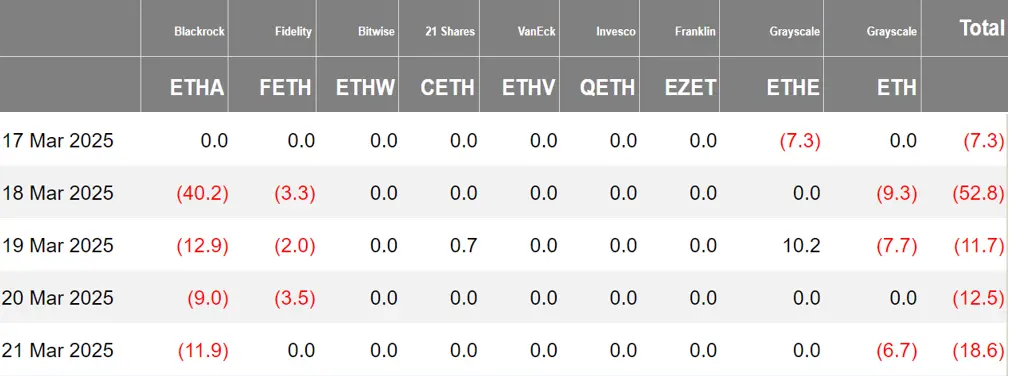

Last week, the U.S. Ethereum spot ETFs had a five-day average net outflow of $102 million, with total assets under management reaching $6.77 billion.

The outflow was mainly from BlackRock's ETHA, which saw a net outflow of $64 million. A total of four Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 9.93 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs had a net inflow of 9.93 Bitcoins, with total assets under management reaching $35.7 million. The holdings of the issuer, Harvest Bitcoin, remained at 357 Bitcoins, while Huaxia also maintained 2,250 Bitcoins.

The Hong Kong Ethereum spot ETFs had a net inflow of 197.56 ETH, with total assets under management of $3.924 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of March 21, the nominal total trading volume of U.S. Bitcoin spot ETF options was $394 million, with a nominal total long-short ratio of 2.07.

As of March 20, the nominal total open interest of U.S. Bitcoin spot ETF options reached $12.23 billion, with a nominal total long-short ratio of 2.31.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 52.21%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Hashdex Submits Index Change Amendment to SEC, Plans to Add Litecoin and Other Tokens to Its ETF

Hashdex Nasdaq Crypto Index US ETF submitted its first effective amendment to the SEC on Form S-1, with document number 333-280990, submitted on March 14, 2025.

The document shows that before the index change date, the index components included Bitcoin and Ethereum. After the index change date, the index components are expected to include Bitcoin, Ethereum, SOL, XRP, ADA, LINK, AVAX, LTC, and UNI. Each index component operates on its respective network.

Volatility Shares to Launch Two Solana Futures ETFs on March 20

According to Cointelegraph, Volatility Shares will launch two Solana (SOL)-based futures ETFs on March 20, namely Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT).

According to SEC filings, the management fee for Volatility Shares Solana ETF (SOLZ) is 0.95% until June 30, 2026, after which the management fee will increase to 1.15%. The Volatility Shares 2X Solana ETF will offer investors 2x leverage, with a management fee of 1.85%.

This application marks the first Solana-based ETF in the U.S., following the launch of SOL futures contracts by the Chicago Mercantile Exchange (CME) Group.

SEC Confirms Receipt of 21Shares Spot Polkadot ETF Application

According to an announcement from the SEC, the Nasdaq Stock Exchange has submitted a rule change proposal to list and trade shares of the 21Shares spot Polkadot ETF under Nasdaq Rule 5711(d) ("Commodity Trust Shares"). The SEC has officially accepted the application and is seeking public comments.

NYSE Submits Proposal to SEC Allowing Bitwise Ethereum ETF to Stake

Canary Submits S-1 Application for PENGU ETF to SEC

Nasdaq Submits Polkadot ETF Application for 21Shares

Canary Submits S-1 Form for SUI ETF to SEC

Views and Analysis on Crypto ETFs

Matrixport: Futures Cool Down, While Bitcoin ETFs Hold Steady, Market Awaits New Catalysts

Matrixport released a chart today stating that by mid-December 2024, the inflow of funds into Bitcoin ETFs and the open interest in Bitcoin futures contracts both reached approximately $35 billion. Subsequently, futures positions significantly declined, while Bitcoin ETF fund flows remained relatively stable.

This indicates that short-term traders are exiting, possibly selling their positions to long-term investors. Currently, both funding rates and market trading volumes are low, and unless new macro catalysts emerge, the likelihood of significant growth in Bitcoin ETF funds is minimal.

Ripple CEO: XRP ETF Expected to Launch by End of 2025

Ripple CEO Brad Garlinghouse stated in an interview with Bloomberg that he expects the XRP exchange-traded fund (ETF) to launch by the end of 2025 after the legal dispute between Ripple and the SEC is resolved.

Brad stated, "I am confident about the ETF, and at the same time, an IPO for Ripple Labs is not out of the question."

Analyst: Bitcoin and Ethereum ETFs Show Diverging Fund Flows

BRN analyst Valentin Fournier analyzed that the inflow rate for Bitcoin and Ethereum ETFs has slowed down, but this is not necessarily bad news, as overall trading activity remains active. However, the fund flows for the two assets are showing a diverging trend, for example, the Bitcoin ETF saw an inflow of $11.8 million the previous day, while the Ethereum ETF experienced an outflow of $11.7 million. Although inflows have temporarily decreased, sustained high trading volumes indicate ongoing market participation rather than waning interest.

BlackRock Digital Asset Head: Approval for Staking Could Be a "Huge Leap" for Ethereum ETFs

Robert Mitchnick, head of BlackRock's digital asset division, stated that demand for Ethereum ETFs has been lackluster since their launch last July, but if some regulatory issues hindering their development can be "resolved," the situation may change. Mitchnick mentioned at a digital asset summit in New York City on Thursday that the success of Ethereum ETFs appears "underwhelming" compared to the explosive growth of Bitcoin funds. While he believes this is a "misunderstanding," he also acknowledged that the inability to earn staking rewards within the fund could be a limiting factor.

He said, "Clearly, the potential evolution of Ethereum ETFs has entered the next phase. It has proven that ETFs are a very attractive tool, allowing many different types of investors to hold Bitcoin through them. Undoubtedly, for Ethereum, without staking, ETFs seem less perfect. Staking rewards are an important way to earn investment returns in this space, and all Ethereum ETFs launched so far have not included staking."

Staking is a way for investors to earn passive income by locking tokens on the network for a period of time. This allows them to "put their crypto assets to work" if they do not plan to sell their cryptocurrencies soon. However, Mitchnick does not expect a simple solution.

He explained, "This is not a particularly simple issue. It's not as if the U.S. government approves a certain plan and then it's 'done,' and everyone can start. There are many quite complex challenges that need to be overcome to resolve this issue, but if these problems can be addressed, we will see a leap in activity around these products."

Analyst: SEC May Approve Multiple Altcoin ETFs by Q2 2025

BeInCrypto analysts predict that since the SEC announced today that PoW mining does not constitute a securities offering and is not subject to securities regulations, the SEC may approve multiple altcoin ETFs by Q2 2025. This regulatory clarity could change the chances of approval for some PoW crypto asset ETFs. For example, Litecoin, which falls into this category, is now likely to be approved.

Analysts also noted that the SEC previously announced in February that meme coins do not constitute securities, which may be due to regulatory hurdles faced by the Dogecoin ETF. The SEC may declare that all these assets are not securities, laying the groundwork for future ETF applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。