Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.83 trillion, with BTC accounting for 60.6%, which is $1.72 trillion. The market cap of stablecoins is $230.3 billion, with a 7-day increase of 0.87%, of which USDT accounts for 62.46%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $83,936; ETH has also shown range-bound fluctuations, currently priced at $1,967.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: FORM with a 7-day increase of 109.18%, CAKE with a 7-day increase of 47.98%, AUCTION with a 7-day increase of 79.15%, and ZRO with a 7-day increase of 78.05%.

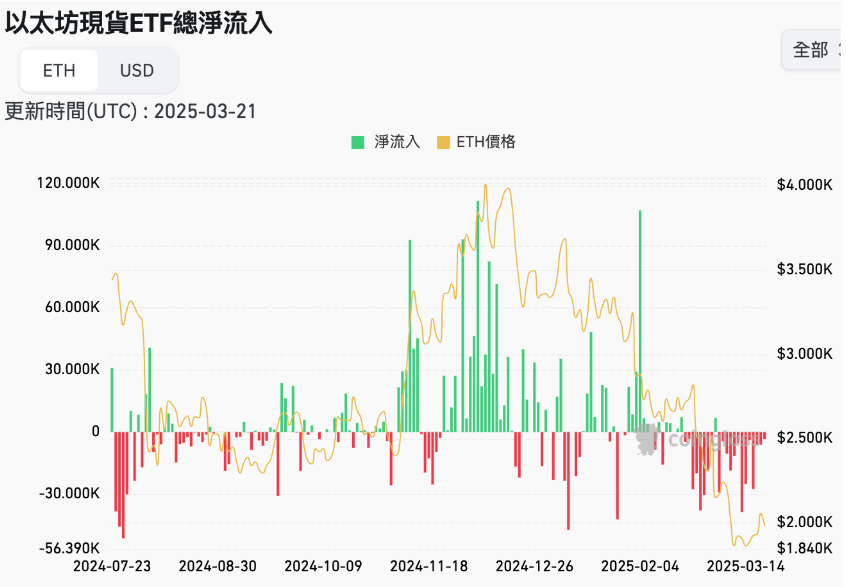

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $639.9 million; the net outflow for Ethereum spot ETFs in the U.S. was $91 million.

On March 21, the "Fear & Greed Index" was at 31 (lower than last week), with this week's sentiment: 5 days of fear and 2 days of neutrality.

Market Prediction: This week, the market has shown range-bound fluctuations, with sentiment shifting from extreme fear to fear. On-chain stablecoins have seen a slight increase in issuance, while the U.S. spot Bitcoin ETF has shown net inflows, and the Ethereum ETF has shown net outflows. The activity on the BSC chain has significantly increased, sparking a wave of BSC MEME trends. The Federal Reserve confirmed this week to maintain interest rates in March, with market fears of a U.S. economic downturn. Predictive data shows continued hope for interest rate cuts in the second half of the year.

It is expected that the market will form a phase bottom in the short term and maintain range-bound fluctuations. Attention can be paid to popular new projects on chains like BSC, Tron, and Base, as well as focusing on the “Hotcoin New Coin List” to unlock more wealth opportunities.

Understanding Now

Review of Major Events of the Week

On March 16, on-chain data showed that the current number of Monad testnet addresses exceeded 14.55 million, with daily active users reaching 2.0198 million on March 15;

On March 18, WLFI's "Macro Strategy" allocated various digital assets in its strategic reserve plan, including BTC, ETH, TRX, LINK, SUI, and ONDO tokens. The "Macro Strategy" may partially support WLFI in funding innovative projects, promoting ecosystem growth, and creating new opportunities in the rapidly developing DeFi space;

On March 17, Strategy purchased 130 Bitcoins at an average price of $82,981 each (totaling $10.7 million) between March 10 and March 16;

On March 19, according to Arkham monitoring, Justin Sun's address staked 60,000 ETH to Lido yesterday, approximately $116 million;

On March 19, Raydium is launching a token launch platform similar to pump.fun, named LaunchLab. The announcement of the LaunchLab platform comes less than a month after the popular Solana Meme coin launchpad pump.fun was reported to be developing its own AMM;

On March 20, according to a staking report released by Coinbase, Coinbase currently has 3.84 million ETH staked as an Ethereum staking node, accounting for 11.42% of the total staked amount, making it the largest Ethereum node operator;

On March 19, according to Defillama data, Jupiter's revenue in February reached $31.7 million, setting a new historical high;

On March 21, data from cryptocurrency market analysis firm Santiment showed that due to the many DeFi and staking options available in the market, Ethereum holders have now reduced the available supply on trading platforms to 8.97 million, the lowest level in nearly 10 years (the previous low was in November 2015). Compared to just 7 weeks ago, the ETH on trading platforms has decreased by 16.4%;

On March 21, according to official news, the Japanese listed company Metaplanet announced the establishment of its strategic advisory committee and appointed Eric Trump, the second son of Donald Trump, as a member of the strategic advisory committee.

Macroeconomics

On March 17, according to South Korean Economic TV, the Bank of Korea clearly stated that it "has never considered including Bitcoin in its foreign exchange reserves";

On March 18, U.S. President Trump announced on Truth Social the appointment of current Federal Reserve Governor Michelle Bowman as the new Vice Chair for Supervision of the Federal Reserve;

On March 18, the probability on Polymarket that "the Federal Reserve will end quantitative tightening before May" reached 100%, with a cumulative trading volume exceeding $6.25 million;

On March 19, the Bank of Japan maintained its benchmark interest rate at 0.5%, in line with market expectations;

On March 20, the Federal Reserve maintained its benchmark interest rate at 4.25%-4.50%, in line with market expectations.

ETF

According to statistics, from March 17 to March 21, the net inflow for U.S. Bitcoin spot ETFs was $639.9 million; as of March 21, GBTC (Grayscale) had a total outflow of $22.48 billion, currently holding $16.256 billion, while IBIT (BlackRock) currently holds $47.885 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $96.294 billion.

The net outflow for U.S. Ethereum spot ETFs was $91 million.

Envisioning the Future

Upcoming Events

Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025, in Bangkok, Thailand;

The 2025 Hong Kong Web3 Carnival will be held from April 6 to 9, 2025, at the Hong Kong Convention and Exhibition Centre, Hall 5BCDE.

Project Progress

U.S. Bitcoin miner CleanSpark will join the S&P SmallCap 600 Index before the market opens on March 24. This index includes small U.S. listed companies with a market capitalization of over $1 billion and meeting specific financial standards. CleanSpark is the second crypto miner added to this index after Marathon Digital was added last year;

The Berachain airdrop claim portal will reopen at 22:00 Beijing time on March 24;

The Bitcoin Ordinals collection of Taproot Wizards will go on sale on March 25. This collection includes 2,121 Wizard NFTs, inspired by the Bitcoin wizard meme that appeared on Reddit in 2013. The sale of this collection will be divided into two phases: first, Wizard NFTs will be sold to those on the whitelist at a price of 0.2 BTC, followed by a public minting through a Dutch auction, starting at a price above 0.2 BTC;

Celo will activate a hard fork to transition to Ethereum L2 at 11:00 on March 26. After the upgrade, Celo L2 will reduce block time from 5 seconds to just 1 second. Celo's complete history and block height will remain unchanged, allowing users to look up past transactions;

The IRIS Network mainnet is scheduled for a version 4.0 upgrade on March 30. This upgrade will introduce cross-chain NFT functionality, enhance cross-chain interoperability, and optimize network performance. Validators and node operators need to prepare for the upgrade to ensure a smooth transition for the network;

Investment management company VanEck will waive management fees for the Bitcoin spot ETF HODL from March 13 to March 31, 2025. If the amount exceeds $150 million before the deadline, the management fee for the excess will be 0.2%. After March 31, 2025, the management fee will revert to 0.2%.

Important Events

On March 24, the Eurozone and the UK will release the preliminary value of the March manufacturing PMI;

On March 27, the U.S. will announce the number of initial jobless claims for the week;

On March 28, the U.S. will announce the year-on-year core PCE price index for February.

Token Unlocking

Axelar (ALX) will unlock 13.51 million tokens on March 27, valued at approximately $5.37 million, accounting for 1.13% of the circulating supply;

Jupiter (JUP) will unlock 100 million tokens on March 27, valued at approximately $52 million, accounting for 1% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend judgment + value excavation + real-time tracking" integrated service system, providing precise market interpretations and practical strategies for investors at different levels through in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring, combined with weekly live broadcasts of "Hotcoin Selected" strategies and daily news updates from "Blockchain Today". Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。