1. Understanding Decentralized Derivatives Protocols

1.1 Definition

A decentralized derivatives protocol is a financial tool based on blockchain technology that allows users to trade derivatives without the need for traditional centralized intermediaries. Derivatives are financial contracts based on underlying assets (such as BTC), with their value derived from the price fluctuations of the underlying assets. Decentralized derivatives protocols utilize smart contracts to automate trade execution, settlement, and clearing processes, operating on public blockchain networks to ensure rules are transparent and immutable.

Unlike centralized exchanges (such as Binance or Coinbase), decentralized derivatives protocols do not rely on a single entity to manage user funds or match trades, but instead achieve decentralized market operations through distributed networks and algorithms. Perpetual futures are currently the most popular product type in decentralized derivatives protocols, allowing users to leverage bets on the price movements of crypto assets without an expiration date.

1.2 Features

Decentralized derivatives protocols have the following core features:

Decentralization: There is no centralized controlling entity; all trades are completed directly on the blockchain, reducing single points of failure and censorship risks.

Transparency: Trade records and contract terms are stored on the blockchain, publicly accessible for anyone to verify the fairness of transactions.

Security: User funds and data are protected through smart contracts and cryptographic technology, lowering the risk of hacking or internal fraud.

Accessibility: Global users can participate with just a crypto wallet, without needing KYC (Know Your Customer) or permission from traditional financial systems.

Innovation: Supports a variety of financial products, such as perpetual contracts, options, synthetic assets, etc., providing users with flexible trading strategies.

These features make decentralized derivatives protocols attractive not only to retail traders but also increasingly to institutional investors.

2. Operating Mechanisms of Decentralized Derivatives Protocols

The operation of decentralized derivatives protocols relies on blockchain technology and various market mechanism designs to achieve liquidity provision, price discovery, and trade execution. Here are some common operating mechanisms:

2.1 Automated Market Maker (AMM)

Automated Market Makers (AMM) replace traditional buy and sell order matching with algorithms and liquidity pools. Users deposit assets into liquidity pools, and the funds in the pool automatically adjust prices based on preset mathematical formulas (such as the constant product formula). The advantage of AMM is that trades can be completed without waiting for a counterparty, making it suitable for markets with lower liquidity.

Representative Projects: Jupiter, GMX.

Advantages: Simple and efficient, suitable for small trades and highly volatile markets.

Disadvantages: May experience slippage, and price discovery efficiency is lower than that of order books.

2.2 Order Book Model

The Order Book Model is similar to traditional financial exchanges, where buyers and sellers submit limit orders, and the system matches trades. This mechanism is widely used in centralized exchanges but needs to address on-chain transaction speed and cost limitations in decentralized environments.

Representative Projects: Hyperliquid

Advantages: Provides more precise price discovery, suitable for professional traders.

Disadvantages: High on-chain performance requirements may lead to trade delays or high fees.

2.3 Hybrid Model

The hybrid model combines the advantages of AMM and order books, attempting to find a balance between liquidity and trading efficiency. For example, a protocol may use AMM to provide base liquidity while optimizing price discovery through an order book.

Representative Projects: Vertex.

Advantages: Highly flexible, adaptable to various market conditions.

Disadvantages: Higher implementation complexity, and user experience may not be uniform.

2.4 On-chain/Off-chain Hybrid

Some protocols execute order matching off-chain to improve speed while keeping settlement and fund management on-chain to ensure security. This approach leverages the efficiency of centralized systems while retaining the trust mechanisms of decentralization.

Representative Projects: dYdX (V4).

Advantages: Fast transaction speeds and low fees.

Disadvantages: Off-chain components may introduce a certain degree of centralization risk.

3. Current Status of Decentralized Derivatives Protocols

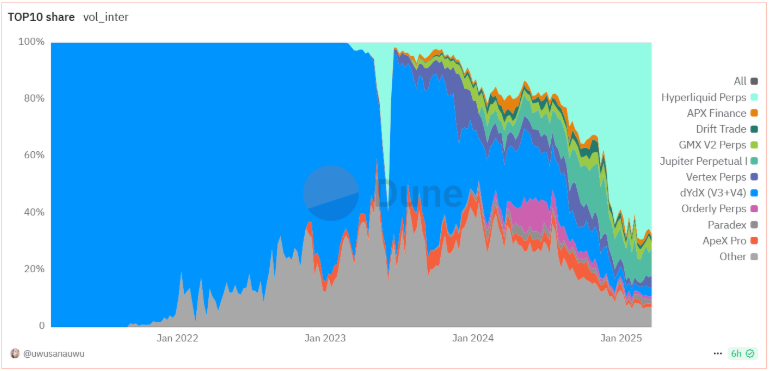

Source: https://dune.com/uwusanauwu/perps

Historically, centralized trading platforms have dominated perpetual contract trading due to high liquidity and stable trading experiences. dYdX, as an early leader in decentralized perpetual contract trading platforms, has captured a certain market share in the decentralized perpetual contract market with its innovative order book model, becoming a pioneer in the market.

With the rise of decentralized finance, user demand for decentralized trading has gradually increased. Emerging platforms like GMX, utilizing the AMM model and liquidity pool mechanisms, provide simple and efficient trading experiences, attracting a large number of users and funds. Jupiter has emerged as an important decentralized derivatives protocol within the Solana ecosystem. The market competition intensified in 2023, with the emerging platform Hyperliquid gaining prominence due to its high performance and low-latency trading experience, attracting many professional traders and gradually becoming a market leader. Meanwhile, dYdX's market share has begun to decline, partly due to the rapid rise of competitors and challenges encountered during its migration to the Cosmos ecosystem.

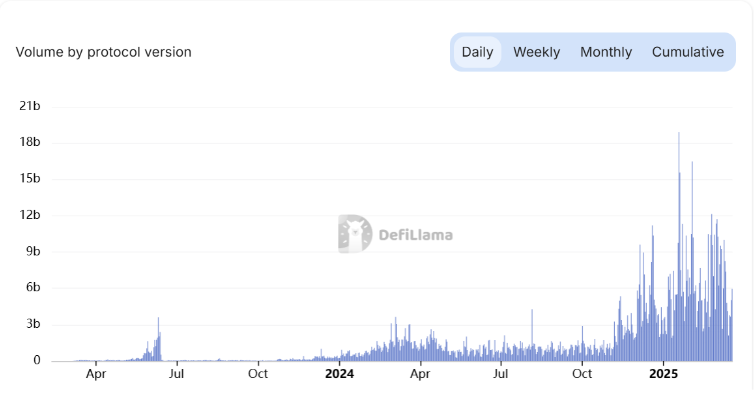

Source: https://defillama.com/perps/hyperliquid

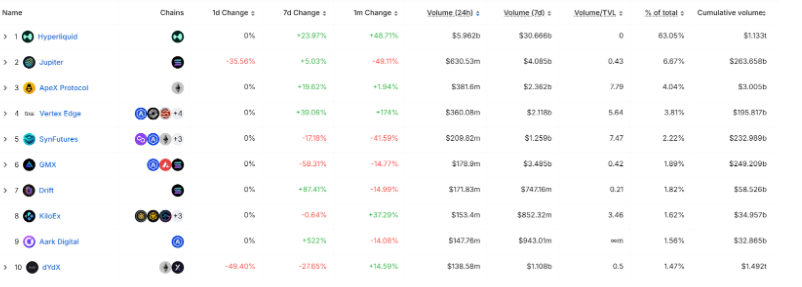

As of March 20, the 24-hour trading volume of decentralized perpetual contracts reached $9.4 billion, with Hyperliquid's market share in decentralized derivatives protocols reaching 63%, ranking 15th in trading volume among centralized exchanges.

Source: https://defillama.com/perps

4. Overview and Analysis of Representative Projects

4.1 Hyperliquid

Introduction: Hyperliquid operates entirely on its own Layer 1 blockchain, using an order book model. It provides liquidity and clearing support through the official HLP treasury. Users can deposit funds into HLP and share in the profits from trading fees, funding fees, and clearing fees. HLP essentially acts as a counterparty for some trades. Hyperliquid's TPS (200,000) and low latency (0.2 seconds) processing capabilities are close to CEX levels. The maximum leverage supported by Hyperliquid is 50x, but due to a mysterious whale's liquidation arbitrage operation on March 12, which resulted in approximately $4 million in losses for HLP, Hyperliquid announced a reduction in maximum leverage for BTC and ETH to 40x and 25x, respectively.

Features:

Gas-free trading, reducing user costs.

Dedicated blockchain design, offering on-chain transparency and high throughput.

Currently the largest decentralized perpetual exchange by trading volume.

Applicable Scenarios: Suitable for professional traders seeking low costs and high efficiency.

4.2 Jupiter

Introduction: Jupiter is a DEX aggregator based on Solana, also supporting decentralized perpetual contract trading with leverage up to 100x. The Jupiter liquidity provider (JLP) pool acts as a counterparty for traders. When traders open leveraged positions, they borrow tokens from this pool, with 75% of the fees generated from trades distributed to liquidity providers. Currently, only five assets are supported: SOL, ETH, WBTC, USDC, USDT.

Features:

Utilizes Solana's high speed and low fees to provide an experience close to centralized exchanges.

Supports a variety of trading pairs and leveraged trading.

Deeply integrated with the Solana ecosystem, attracting a large number of ecosystem users.

Applicable Scenarios: Suitable for Solana ecosystem users and novice traders.

4.3 GMX

Introduction: GMX is a multi-chain decentralized perpetual exchange deployed on Arbitrum and Avalanche, using the AMM model and offering leverage up to 100x, currently supporting 67 perpetual contracts. It provides liquidity through a community-owned multi-asset liquidity pool (GLP pool). Liquidity providers can earn GLP tokens by staking a single asset, representing their stake in the pool. Platform fees come from user swaps and leveraged trades, with 30% rewarding GMX stakers and 70% distributed to GLP holders. GMX V2 replaces the GLP pool with an isolated GM pool and incentivizes through funding fees, borrowing fees, trading fees, price impact, etc.

Features:

Liquidity pool design allows users to earn returns by providing liquidity.

Low trading fees (0.05%-0.07%), with a portion of fees distributed to liquidity providers.

Strong TVL performance, indicating user trust in its liquidity.

Applicable Scenarios: Suitable for traders looking to profit through liquidity mining.

4.4 dYdX

Introduction: dYdX was established in 2018, initially operating on Ethereum Layer 2 (supported by StarkWare), but migrated to its own blockchain, dYdX Chain, based on the Cosmos SDK and Tendermint Proof-of-Stake consensus protocol in 2023. The V4 on-chain/off-chain hybrid model enhances speed through off-chain order matching while ensuring security with on-chain settlement. Order matching is completed off-chain by validators and stored in an in-memory order book, while settlement is executed on-chain. There are no gas fees for placing or canceling orders, with fees only charged when orders are filled, reducing trading costs.

Features:

The V4 version introduces a decentralized off-chain order book and on-chain settlement.

Supports up to 20x leverage and 199 assets.

Low trading fees (0.02% maker, 0.05% taker) attract high-frequency traders.

Applicable Scenarios: Suitable for users seeking high leverage and a professional trading experience.

4.5 Vertex

Introduction: Vertex is a multi-chain decentralized exchange that combines a centralized limit order book (CLOB) and an AMM hybrid model, integrating order book and automated market maker (AMM) mechanisms. Its order book uses a price/time priority algorithm to ensure orders are executed at the best price, whether quoted by AMM or market makers.

Features:

Layer 2 technology reduces fees and MEV (Miner Extractable Value) risks.

Supports up to 20x leverage and 54 assets.

Emphasizes an institutional-grade trading experience.

Applicable Scenarios: Suitable for professional traders who require efficient order matching.

5. Opportunities and Challenges of Decentralized Derivatives Protocols

As an important branch of DeFi, decentralized derivatives protocols are in a phase of rapid development. Market growth, technological advancements, and global accessibility provide vast development space, but challenges such as regulatory uncertainty, technological risks, and insufficient liquidity cannot be ignored.

Opportunities

Market Growth Potential: With the maturation of the cryptocurrency market and the participation of institutional investors, the demand for derivatives trading continues to grow. Decentralized protocols, with their transparency and security, are expected to further attract users and capture market share from centralized exchanges.

Driven by Technological Advancements: Layer 2 solutions (such as Arbitrum, Optimism) and high-performance public chains (such as Solana, Sui) significantly enhance trading speed and reduce costs. For example, Hyperliquid achieves 20,000 transactions per second through its Layer 1 blockchain, approaching centralized exchange performance. In the future, the maturation of cross-chain technology and interoperability protocols will further promote asset flow and market expansion.

Innovative Products and Services: Decentralized protocols can quickly launch a variety of financial products, such as perpetual contracts, synthetic assets, and options, to meet user needs. In the future, protocols may expand into traditional financial derivatives, further broadening market coverage.

Community Governance and Participation: Decentralized governance models (DAOs) enhance user engagement and loyalty. For example, dYdX implements community decision-making through the dYdX DAO, allowing users to vote and influence protocol development. This model not only increases user stickiness but also promotes healthy ecosystem growth.

Global Accessibility: Decentralized protocols do not require KYC (Know Your Customer), allowing global users to participate with just a crypto wallet, greatly expanding market size. This feature provides financial freedom and opportunities, especially in regions with inadequate traditional financial services.

Challenges

Regulatory Uncertainty: Significant differences in regulatory policies across countries and regions may limit the development of protocols and pose legal risks for protocol operations and token issuance. Protocols need to seek a balance between decentralized ideals and compliance requirements, increasing operational difficulty.

Technological Risks and Security Concerns: Smart contract vulnerabilities and blockchain network congestion are major risks. For example, the recent Hyperliquid liquidation incident resulted in approximately $4 million in losses, highlighting the threat of technological risks. Additionally, network congestion may lead to trade delays and high costs, affecting user experience.

Insufficient Liquidity: Compared to centralized exchanges, decentralized protocols support fewer assets and generally have lower liquidity, especially in long-tail asset markets. Fragmented liquidity may lead to significant slippage and low price discovery efficiency.

Intensifying Competition: As more protocols enter the market, competition is becoming increasingly fierce. For example, Hyperliquid leads with high performance, but Jupiter and Vertex are also focusing on technological innovation. Protocols need to continue innovating to maintain a competitive edge, or they may face user attrition.

6. Conclusion

Decentralized derivatives protocols, as an important innovation in the DeFi space, are reshaping the traditional financial derivatives market through blockchain technology and smart contracts, providing users with a transparent, secure, and globally accessible trading experience. Hyperliquid stands out among many protocols with its high-performance Layer 1 blockchain, gas-free order book model, and trading speed and experience close to centralized exchanges, becoming a market leader. dYdX and GMX, as mature players, maintain competitiveness based on their strong user base and TVL, while Jupiter and Vertex demonstrate potential through ecosystem integration and technological innovation. However, compared to centralized trading platforms, decentralized derivatives protocols are still limited by a smaller variety of assets, blockchain network performance bottlenecks, and insufficient liquidity. Looking ahead, as Layer 2 technology and high-performance public chains advance and user demand grows, this sector is expected to further challenge the position of centralized exchanges by launching more innovative products, optimizing user experience, and gradually adapting to regulatory requirements, driving the continuous evolution of the crypto financial ecosystem.

About Us

Hotcoin Research, as the core research and investment center of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We build a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring, combined with weekly updates of the "Hotcoin Selected" strategy live broadcast and "Blockchain Today" daily news briefings, providing precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。