At the end of 2024, Shanghai Left Bank Xinhui Electronic Technology Co., Ltd. launched the first agricultural industry RWA project in mainland China—“Malux Grape RWA”—and completed a 10 million yuan equity financing. As the first true RWA initiative in mainland China, “Malux Grape” has shown many observing companies the potential for RWA to transition from “concept” to “implementation.”

The Crypto Salad team has recently been researching RWA projects, and we have found that everyone is quite curious about:

What exactly is the “Malux Grape” product? How can we purchase it? Is it worth buying?

Can the “Malux Grape” product circulate in the secondary market? What is the trading situation like?

How was the “Malux Grape RWA” project developed? What is its underlying infrastructure?

Under the legal restrictions in mainland China prohibiting virtual currency exchanges and token issuance financing, what is the compliance path for “Malux Grape”?

Is there anything worth referencing in the “Malux Grape” project for me?

To gain a more complete understanding of the characteristics of the “Malux Grape RWA” project, the Crypto Salad team decided to personally purchase and transfer the digital assets of Malux Grape, conducting research from a consumer perspective to introduce the details and innovations of this product. If the content of this article deviates from the actual situation of the project party, corrections are welcome.

### I. From Grapes to NFTs, What Exactly Is This Project Selling?

1. What kind of product is this?

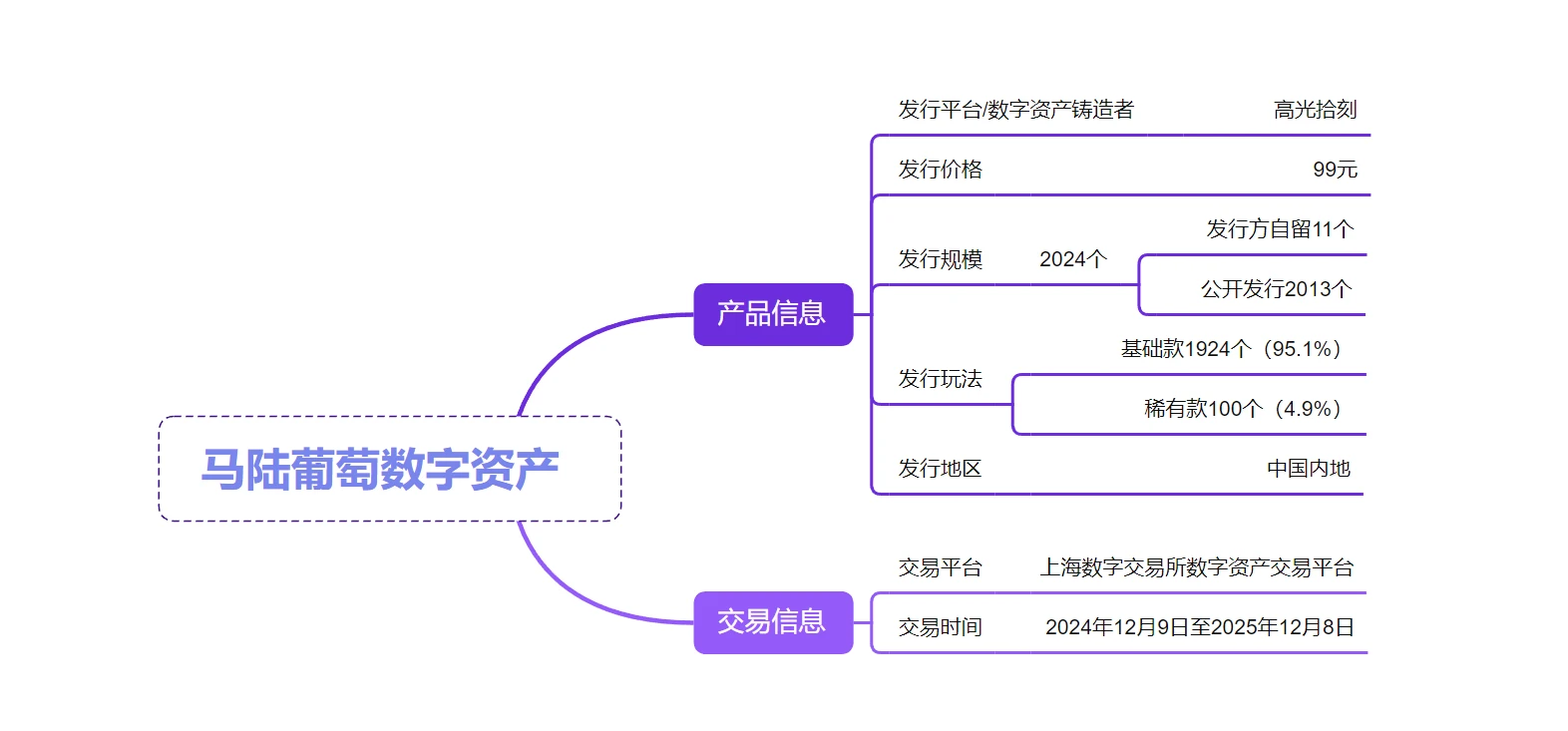

The first agricultural digital asset of Malux Grape was officially issued by Left Bank Xinhui (Shanghai) Data Technology Co., Ltd. on November 25, 2024, and users can only purchase and sell it on the Shanghai Data Exchange digital asset trading platform.

(The above image shows the basic product information of Malux Grape digital assets)

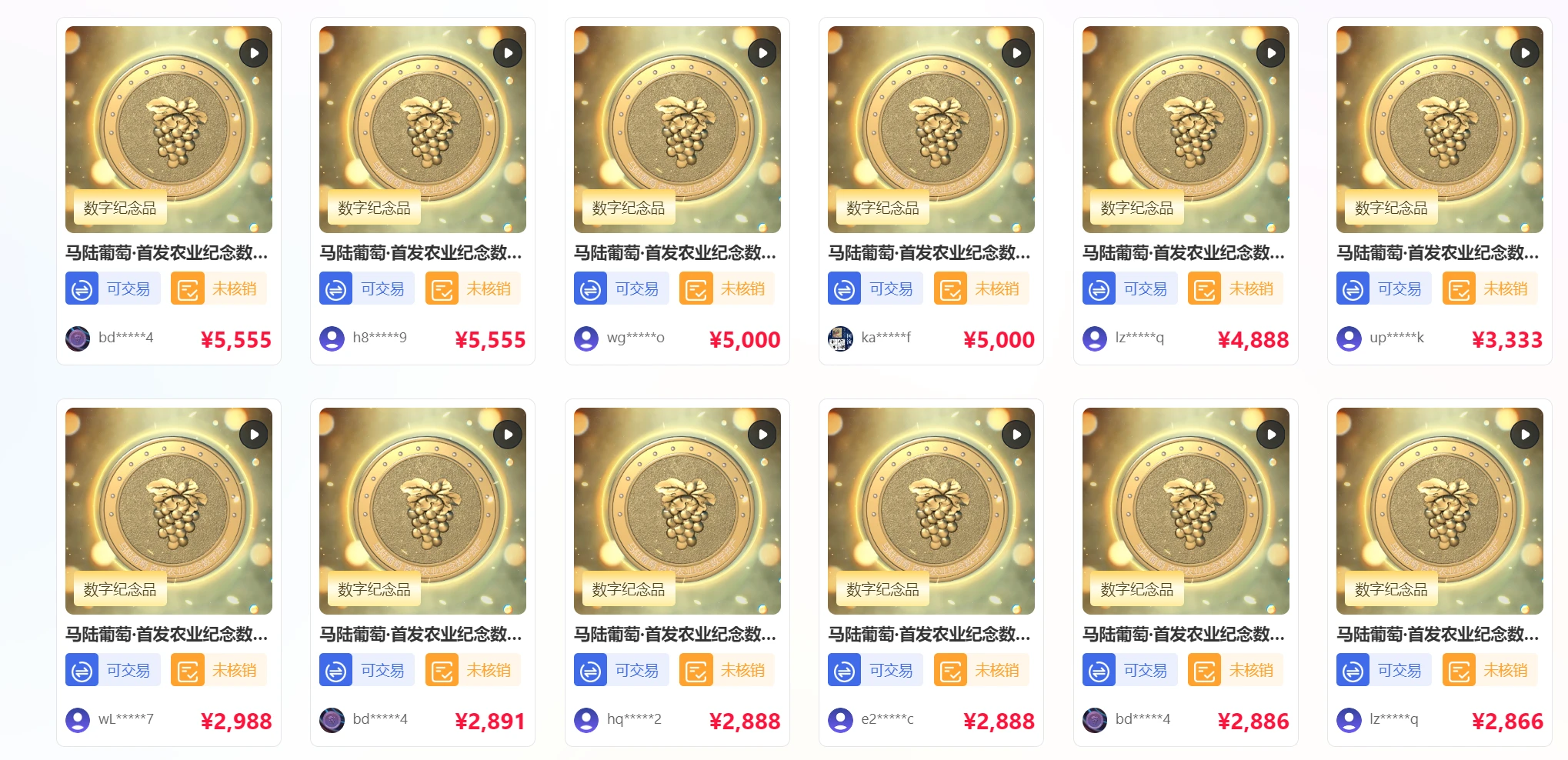

Shortly after its issuance, the project was sold out, so currently, there is only a secondary trading market. From our observations, the pricing of Malux Grape digital assets in the secondary market ranges from 500 to 5500 yuan, showing a polarized trend, although the mainstream pricing range is around 1000 yuan. However, when we look at the recent transaction data, we find that the recent transaction prices are concentrated around 600 yuan. Compared to the initial market pricing of 99 yuan, the current trading price has indeed achieved a certain premium space, but from a dynamic perspective, it is clear that the enthusiasm for Malux Grape digital assets has gradually declined, and the peak of speculative frenzy is long gone, replaced by a more cautious value assessment.

(The above image shows the sales situation of Malux Grape digital assets in the digital trading market)

During the process of trading Malux Grape digital assets, we also noticed that the project party has set clear restrictions on trading time: after December 8, 2025, the digital assets will no longer be tradable, giving holders only one year to trade. We did not find a corresponding answer as to why a countdown was set for trading. However, it can be anticipated that before the one-year deadline, there will certainly be a scenario of concentrated selling by holders, at which point the value of the digital assets will face significant market fluctuations.

Additionally, once the physical rights are successfully redeemed, the digital assets will be canceled by the project party and cannot continue to circulate in the trading market. Holders will still have the right to use the “Malux Planet” interactive space. During the purchasing process, we continuously sought clearer liability clauses to understand how the rights of holders would be protected after the digital assets are “destroyed.” We even boldly hypothesized that if an irresistible force or unexpected event occurs, such as the vineyard being burned down, making the redemption of physical rights impossible, what compensation would the project party provide? However, we have not yet obtained clear answers from public channels and the purchasing process.

In summary, each digital asset issued by the project party has a different price, and considering its indivisibility, unique on-chain identification, and other core characteristics, we can conclude that the digital assets issued by the project party are essentially a form of non-fungible digital collectibles (NFTs). More analysis on this point can be found in Chapter Three of this article.

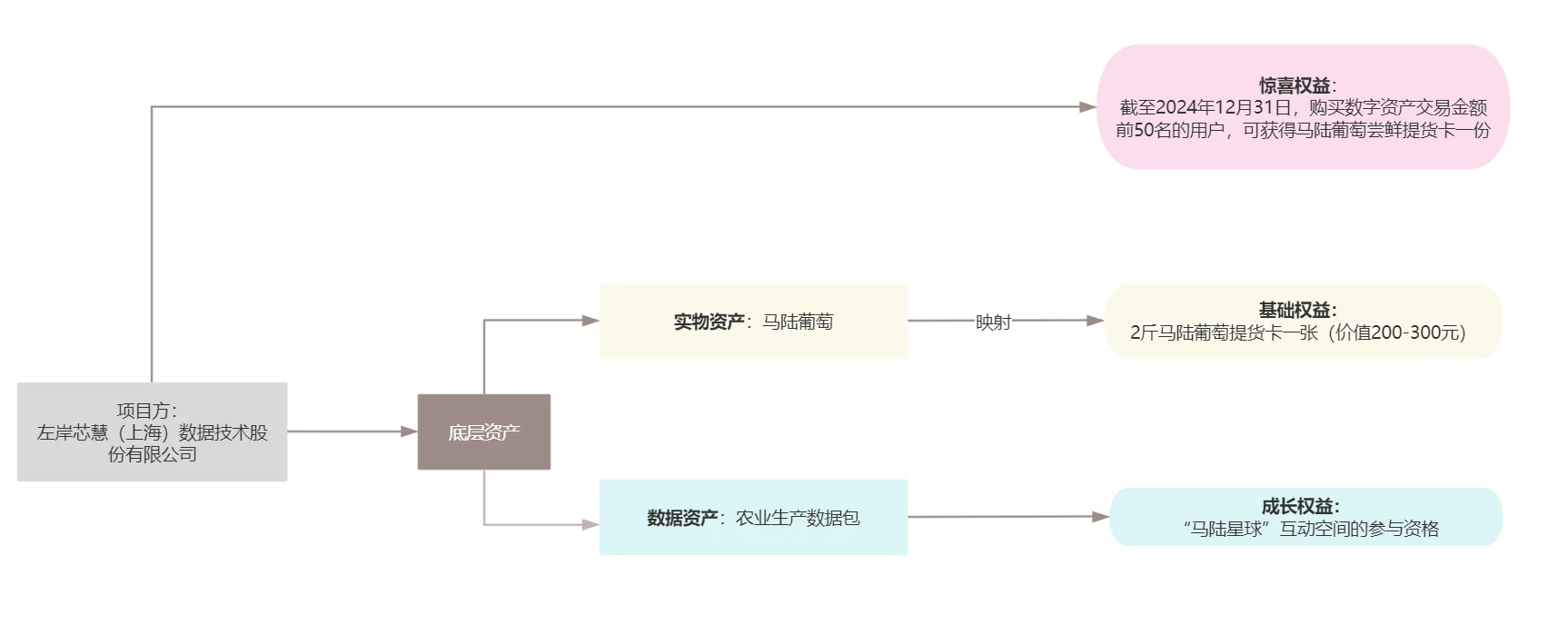

2. What rights can holders obtain? Where do these rights come from?

The feature of RWA projects is to anchor the value of tokens to underlying assets. In other words, the rights of token holders often directly stem from the underlying assets, and the Malux Grape RWA project is no exception.

The underlying assets of the Malux Grape RWA project are the integration of agricultural products and agricultural production data. Among them, the agricultural products are provided by the Malux Professional Grape Cooperative; the agricultural production data mainly includes various data from the grape production process, such as farmer data from the grape planting area, environmental data, collection data, regulatory data, and unstructured data during grape growth.

According to the product introduction of Malux Grape digital assets, users who purchase digital assets can obtain a rights package mapped to the underlying assets, including a basic right and a growth right.

The basic right is a grape pickup card worth 200-300 yuan provided by the Malux Grape Professional Cooperative;

The growth right refers to the qualification to participate in the “Malux Planet” agricultural interactive space.

In addition, the project party also offers a surprise right similar to an “airdrop” for the top 50 purchasers by transaction amount within the specified time, which includes a grape pickup card.

(The above image shows the rights of Malux Grape digital asset holders)

By analyzing the correspondence between the underlying assets and user rights, we find that the physical asset value of the Malux Grape RWA project is relatively fixed, so its appreciation space is also quite limited; the real potential for appreciation lies in this “agricultural production data package.”

Through our personal experience, users can monitor the growth of grapes in the Malux Grape plantation in real-time on the “Malux Planet” interactive space, plant and harvest through mini-games, and sell grapes. The coins earned from trading will automatically convert into points on the Highlight Pick platform, which can be exchanged for physical rewards provided by the project party after December 9, 2025. Crypto Salad attempted to plant its own virtual grapes, and just had to wait 24 hours to harvest the fruits and exchange them for coins. Unfortunately, we were unable to successfully open the monitoring video, and we wonder if anyone else has successfully accessed it to share.

(Left: Digital asset trading quantity leaderboard; Middle: Virtual grape planting; Right: Coin leaderboard)

However, if we measure this platform by the standards of financial products, there is still a significant value gap. First, the points system is not clearly linked to the intrinsic profit mechanism of the digital assets; the digital assets held by users cannot appreciate through point redemption, and their rights are strictly limited to the category of “consumption rewards.” Second, the operations that users can perform on the digital platform are quite limited; planting grapes in the virtual space does not mean that a grape seed has also been sown in the real world. The platform's interactive functions are limited to single operations, and it seems there is no scenario for users to create value in both directions with physical assets.

From this perspective, the agricultural production data collected by the project party has a limited connection with the “Malux Planet” interactive space. According to information publicly disclosed by the project’s technical service provider on its official website, this data will mainly be used for applications such as grape traceability, bank lending, and crop insurance. Therefore, we are quite curious about:

For individual digital asset holders, what value and function does the data collected by the project party actually have?

Furthermore, the project party has not disclosed the specific evaluation methods for data asset value or third-party certification reports; how should we determine the actual value of the data asset package?

At the same time, in our current analysis of the rights content, we have not yet seen a clear path proving that holders can receive profit dividends from the digital assets. So how does the asset appreciation obtained from financing funds benefit the holders?

We have not found reasonable explanations for these questions through public channels. Perhaps, as the project continues to develop, more materials and information will emerge to answer our doubts.

3. What does the project party gain from this process?

Having discussed the rights of holders, let’s talk about what benefits this project brings to the project party. Companies trying RWA are primarily looking to gain a series of benefits, including financing, through the issuance of tokens, thereby increasing the value of underlying assets and even the company itself.

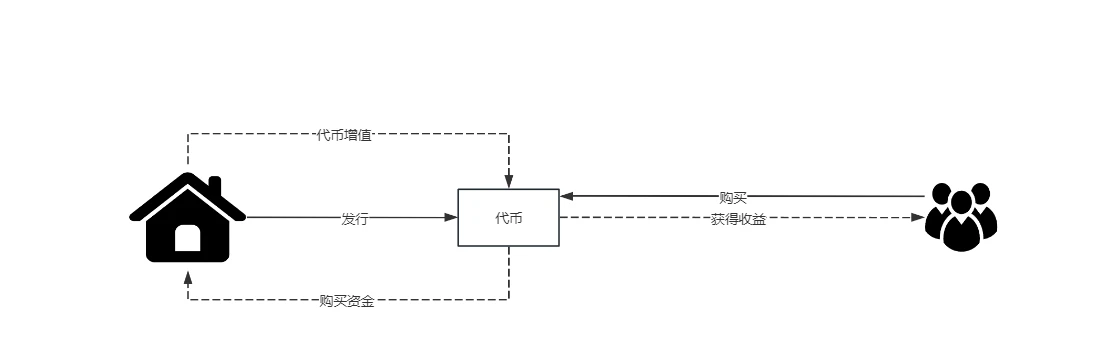

We can also summarize a clear value feedback path from the Malux Grape project:

The project party incentivizes users to purchase more digital assets through airdrop rights, along with the “blind box effect” generated by randomly distributing basic and rare versions, thus obtaining financing from this part. The project party stated that the financing obtained will be used for the construction of intelligent facilities at the Malux Grape planting base and the upgrading of infrastructure.

At the same time, the project party “Left Bank Xinhui,” as a company providing agricultural data collection services, can also gain value as more users join the “Malux Planet” digital platform. On this basis, it can leverage advertising effects to expand the project party's influence. The project party successfully completed a brand narrative upgrade through RWA practice, serving as the first agricultural RWA case in China and acting as a benchmark for the industry. This path can be described as killing three birds with one stone: obtaining financing, providing feedback to the project party, and supporting traditional agricultural assets.

4. What is the technical support for asset on-chain?

According to information from official press releases and media reports, we understand that the Malux Grape digital assets have successfully gone on-chain, relying on a complete blockchain technology ecosystem.

As mentioned earlier, the project party Left Bank Xinhui is a company specializing in data collection services. Based on publicly available information online, we can summarize that the project collects physical growth data of grapes through the deployment of IoT technology, then integrates the data information through the SwiftLink platform developed by Left Bank Xinhui, and uses “multi-chain synchronous AMC” and “data asset shell DAS” technology for structured processing, forming a tradable digital asset package.

From a technical compliance perspective, we can see that the project party strictly adheres to the current regulatory framework: all on-chain operation data is simultaneously stored on the “Pudong Data Chain” data storage platform led by Shanghai Data Group to ensure the authenticity of the data.

Although there is currently limited disclosure of details regarding the SwiftLink platform and core technologies such as “multi-chain synchronous AMC” in public channels, it is undeniable that it has achieved the on-chain of agricultural production data, and the data has been stored on the Shanghai Data Exchange. Based on the state-owned background of the Shanghai Data Exchange, we believe that existing technology can provide reliable technical support for the on-chain of RWA project data.

### II. How Did Malux Grape Achieve 10 Million Yuan in Financing?

The successful financing of the Malux Grape RWA project can be attributed primarily to the establishment of a comprehensive compliance path.

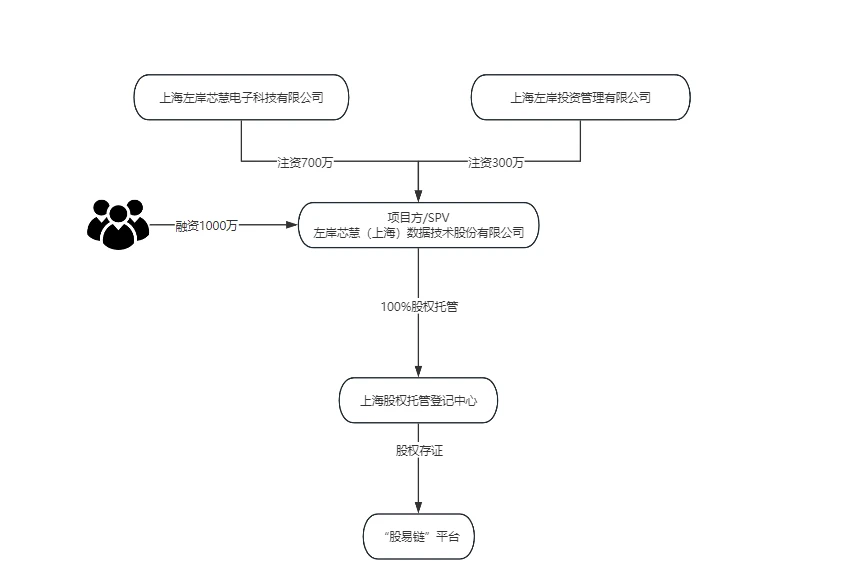

We noted that on October 31, 2023, Shanghai Left Bank Xinhui Electronic Technology Co., Ltd. and Shanghai Left Bank Investment Management Co., Ltd. injected 10 million yuan into the project party, Left Bank Xinhui (Shanghai) Data Technology Co., Ltd., establishing it as a special purpose vehicle (SPV) to isolate the Malux Grape data asset package from other businesses of Left Bank Xinhui.

At the same time, the SPV company, as the financing entity, is only associated with the enterprise itself, and its financing activities are not explicitly linked to the sale of digital assets, thus avoiding the risk of being classified as “securitized.” Additionally, 100% of the project party's equity is held in custody by the Shanghai Equity Custody Registration Center and is stored on the “Guyu Chain” platform.

The “Guyu Chain” platform is a blockchain storage platform independently developed by the Shanghai Data Exchange, focusing on providing digital rights confirmation and storage services for equity, data assets, and more. Its core goal is to transform physical assets (such as equity) in traditional financial markets into verifiable, tamper-proof on-chain digital certificates through blockchain technology. In simple terms, it is a platform for achieving the tokenization of equity on-chain.

(The above image shows the equity structure diagram of the Malux Grape RWA project)

In this process, we can see that the financing obtained by the Malux Grape project differs from traditional RWA financing after token issuance.

In traditional RWA financing models, after the project party completes the initial fundraising through token issuance, it typically needs to connect the tokens to exchanges to achieve secondary market circulation, utilizing liquidity premiums for refinancing, forming a typical “issuance - listing - refinancing” path. In this model, the market circulation of tokens not only provides the project party with a continuous financing channel but also binds the value of underlying assets to the dynamics of the capital market.

However, Malux Grape completed 10 million yuan in equity financing before the issuance of digital assets. Based on the information we can currently obtain from public channels, the project party merely placed the shares in custody, completing the tokenization and storage of equity, but did not enter the public trading market. Perhaps because of this, the project party does not need to disclose financing details, and we cannot learn more about the specifics of the financing, such as who the financing targets are, what the equity distribution is, where the funds from users purchasing digital assets are directed, and what the project party has done with this funding. These are all questions that need to be answered.

Nevertheless, the Malux Grape RWA project not only achieved compliance but also successfully secured 10 million yuan in equity financing, which undoubtedly brings good news to many enterprises. Although the project only publicly issued 2,013 digital assets, with an initial price of 99 yuan per digital asset, the total value that the project party can directly obtain from the sale of digital assets is less than 200,000 yuan. Given the special nature of agricultural assets, the appreciation space is also relatively limited. However, the equity financing obtained by the project amounts to 10 million yuan, fully demonstrating that the benefits generated by current RWA projects can provide positive support for asset provision and technology development for enterprises.

### III. How Does the Malux Grape Project Differ from Overseas RWAs?

The Crypto Salad team has been deeply engaged in the Web3 market in recent years, and after conducting in-depth research on the Malux Grape RWA, we have found that the Malux Grape RWA project is fundamentally different from overseas RWA projects:

1. Digital Assets Are Not Tokens

As mentioned earlier, the digital assets issued by the project party are essentially a form of non-fungible digital collectibles (NFTs), which differ significantly from the RWA tokens issued overseas. The main characteristics of NFTs are that each NFT has uniqueness and indivisibility, and its value is determined by the uniqueness of specific metadata, which clearly distinguishes it from fungible virtual currencies like Bitcoin and Ethereum. In the “Malux Grape” RWA project, each digital asset is prohibited from circulating after redeeming physical assets, meaning it does not possess the attributes of re-trading or re-circulation, nor does it serve as a medium of interchangeable value.

The Malux Grape RWA project also differs from overseas RWA projects in terms of token value recognition. We have previously mentioned the logic of token issuance and financing in overseas RWA projects; here we will elaborate on how tokens bring benefits to holders.

In mainstream overseas RWA practices, token holders can substantively obtain fractional ownership of underlying assets or structured income distribution rights through smart contract confirmation mechanisms. The funds raised through token issuance by the project party are typically directed towards the development and operation of underlying assets or diversified investment portfolio configurations, achieving appreciation goals through enhanced asset operational efficiency and market value growth. In this process, tokens serve as a medium for value transmission, distributing the income generated by underlying assets back to holders in the form of on-chain dividends, token burn deflation, and rights repurchase through pre-set on-chain distribution rules.

(The above image shows a simplified diagram of overseas RWA structures)

However, the Malux Grape RWA project issues NFTs, and holders only receive the right to redeem physical assets (grape pickup cards) and the qualification to participate in the digital platform (game points exchange rewards). Its value is anchored in the consumption attributes of agricultural products and the usage rights of data services, rather than asset ownership or income rights, essentially representing a “de-financialized” compliance design.

The Shanghai Digital Asset Trading Platform has also implemented strict controls over the initiation and holding quantity of transactions: users holding more than 5% of all tradable digital assets can only sell one at a time, and must wait five trading days after a successful transaction before they can sell again, until their holding quantity drops below 5%. This method restricts large-scale sell-offs and prevents “crazy speculation” of digital assets, limiting the appreciation space of digital assets from a liquidity perspective.

In summary, holders of Malux Grape digital assets cannot directly enjoy the benefits of appreciation of underlying assets; they essentially possess a physical pickup card for Malux grapes and a ticket to the digital interactive space.

We believe that the design of the Malux Grape product is closely related to the legal environment in mainland China. The design of the RWA framework must be rooted in the real legal soil. According to the current regulatory framework in our country, activities related to virtual currencies, such as issuing virtual currencies or token financing, are still classified as illegal financial activities and are strictly prohibited, with violators facing the risk of criminal liability.

Within this regulatory framework, since domestic laws do not prohibit the issuance of digital collectibles, the Malux Grape RWA project has chosen this issuance method, providing a reference for compliance paths for other enterprises:

Enterprises must clearly define the attributes of the virtual assets they issue. If issuing digital collectibles, they should strictly adhere to technical standards that are indivisible and lack circulation attributes, creating a clear legal boundary with fungible virtual currencies like Bitcoin and Ethereum.

At the same time, digital collectibles should avoid possessing attributes of financial products and must not include financial assets such as securities or insurance. Additionally, they should be traded through compliant trading platforms, and data and equity should be officially stored.

This cautious product design strategy is not only a proactive exploration of market innovation space but also a necessary respect for legal regulatory boundaries.

2. Different Nature of Exchanges

The intermediary institution for the issuance of Malux Grape RWA is the Shanghai Data Exchange. Overseas virtual asset exchanges typically operate as licensed financial institutions, while the establishment of the Shanghai Data Exchange strictly follows the regulatory requirements of the “Interim Measures for the Management of Data Trading Places in Shanghai,” requiring special approval from the municipal government for establishment, with its business boundaries clearly limited to data circulation services, forming a systemic separation from financial asset trading.

In terms of the technical architecture of the exchange, overseas virtual asset exchanges generally rely on decentralized networks, while the Shanghai Data Exchange adopts a centralized governance model, with its system nodes subject to overall management by government departments. For example, in the Malux Grape RWA project, the path to achieving equity tokenization must undergo dual compliance safeguards: the project party must first complete the rights registration of the target equity at the registration and custody institution under the Shanghai Equity Custody Trading Center, and then achieve on-chain equity through the blockchain storage platform “Guyu Chain.” This progressive design of “physical asset - legal registration - on-chain storage” not only continues the regulatory logic of traditional financial markets but also delineates verifiable compliance boundaries for digital technology innovation.

Although the intermediary institution of the Malux Grape RWA project differs significantly from overseas models, it is essentially an important attempt to explore the feasibility of RWA within the existing regulatory framework, constructing a localized compliance pathway for mainland RWA projects. This practice fully demonstrates that under the current legal framework in mainland China, RWA is not “impossible,” but rather needs to be “redefined” in a way that better fits local regulatory logic. The significance of the Malux Grape project lies not only in paving the way for agricultural assets but also in providing a replicable “regulatory-friendly” model for the development of RWA in mainland China.

### IV. Purchase Process Introduction: How Can Retail Investors Now Buy Malux Grape RWA Products?

If readers wish to purchase Malux Grape RWA products now, they can refer to the following purchasing process:

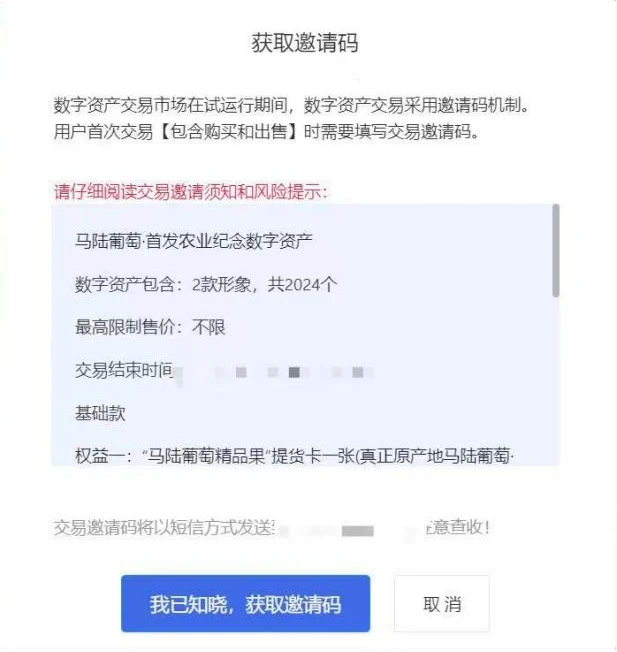

1) Log in to the “Digital Asset Trading Market” to complete registration and answer knowledge questions to enter the market.

2) Complete real-name authentication in the digital trading market.

3) Register on the issuance platform—Highlight Pick—and complete identity verification.

4) Register for the Shande wallet, complete identity verification, and bind a bank card.

5) Obtain an invitation code and complete the purchase.

### V. What Industry Effects Can Malux Grape RWA Bring?

In the wave of deep integration between the digital economy and the real economy, the Malux Grape RWA project has created a successful model for the transformation and upgrading of traditional industries. This attempt is not only a successful exploration for mainland enterprises to approach RWA projects but will also stimulate multiple positive demonstration effects both within and outside the industry.

The Malux Grape RWA project can provide a replicable digital template for a large number of "silent" traditional assets. The "breaking the circle" experience of Malux Grape can also serve as a reference for China's traditional time-honored brands and even intangible cultural heritage. Perhaps in the near future, we will see RWA projects for regional specialty products such as Qibao lamb, Nanxiang soup dumplings, and even Su embroidery. Through the RWA framework, leveraging smart contracts and cross-chain interactions, it is possible to enhance brand premiums while building a win-win ecosystem for cultural inheritance and commercial value.

Shanghai also provides a unique soil for such innovations. We believe that Shanghai is the most suitable city in the country for exploring RWA projects. As a pioneer in the domestic digital economy, Shanghai has taken the lead in laying out the blockchain market and has proposed an implementation plan for advancing the urban blockchain digital infrastructure system project between 2023 and 2025, providing dual support in policy and technology for RWA projects.

Meanwhile, after issuing licenses to virtual asset exchanges, Hong Kong is about to release its second virtual asset policy declaration. With its status as an international capital hub and an open virtual asset business environment, Hong Kong is becoming a bridge connecting high-quality mainland assets with global investors.

The synergy between Shanghai and Hong Kong not only helps local assets "go global" but also opens up channels for "bringing in" international resources. The Crypto Salad team has been deeply engaged in cross-border and overseas ventures for many years, and we believe that in the near future, we will be able to see a clearer bright future for RWA projects. The attempt of Malux Grape is a microcosm of traditional agriculture embracing digitalization and has drawn a compliance red line for domestic RWA exploration. It may not be perfect, but every step it takes is paving the way for future entrants.

Special Statement: This original article represents the personal views of the author and does not constitute legal advice or opinions on specific matters. For reprints, please feel free to contact Crypto Salad.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。