Today, I unexpectedly wasted so much time on an assignment. Recently, after the update of GlassNode, the JSON files have become exceptionally large. It's slightly better when I'm at home, but even with 64 GB of memory, EXCEL is lagging terribly. Once I go out, my three-year-old Pro feels like a tractor, and everything else opens without issues; it's just EXCEL that is a complete mess. Simply importing this data can take half an hour.

The market sentiment has not been friendly in the past couple of days. The Federal Reserve's final decision has not synchronized with the market. Although reducing the balance sheet seems to release some liquidity, the essence of the Federal Reserve is to extend the duration of the balance sheet reduction. Therefore, this "good news" is not well received by investors, not to mention that the market's expectation of three rate cuts has reverted back to two.

Although Powell has consistently denied that the U.S. economy will fall into recession, he did mention that the growth of the U.S. economy is starting to slow down. Today, Williams also stated that the risks of inflation and employment are increasing and that he is not in a hurry to express his stance on the next rate cut. Thus, it seems we may have to accept that interest rate adjustments could be a matter for the end of the year, and the economy may not be smooth sailing.

Next week, there are two macro data releases: one is the core PCE, and the other is the University of Michigan's inflation indicator. The market's expectations are not very optimistic. On April 2, two things will happen: one is the official implementation of the U.S. reciprocal tariffs, and the other is that the U.S. House Financial Services Committee plans to review the stablecoin bill on April 2. It is now clear that stablecoins are a key focus for the U.S. as it enters the first phase of cryptocurrency.

Looking at the data for Bitcoin itself, investor sentiment has stabilized somewhat after a brief fluctuation, with no further signs of panic. The turnover rate has slightly decreased, but since the expected results have not been achieved, there will be more short-term loss investors exiting the market.

From the current market sentiment, investors have begun to accept that inflation will fluctuate for a long time, tariffs may affect inflation, and the U.S. economy may decline, among other data. This is also what I have been emphasizing: we need to judge the current market through macro sentiment and liquidity. If the market rises, we need to determine whether it is a rebound or a reversal. At least from now on, there are still not enough conditions for a reversal.

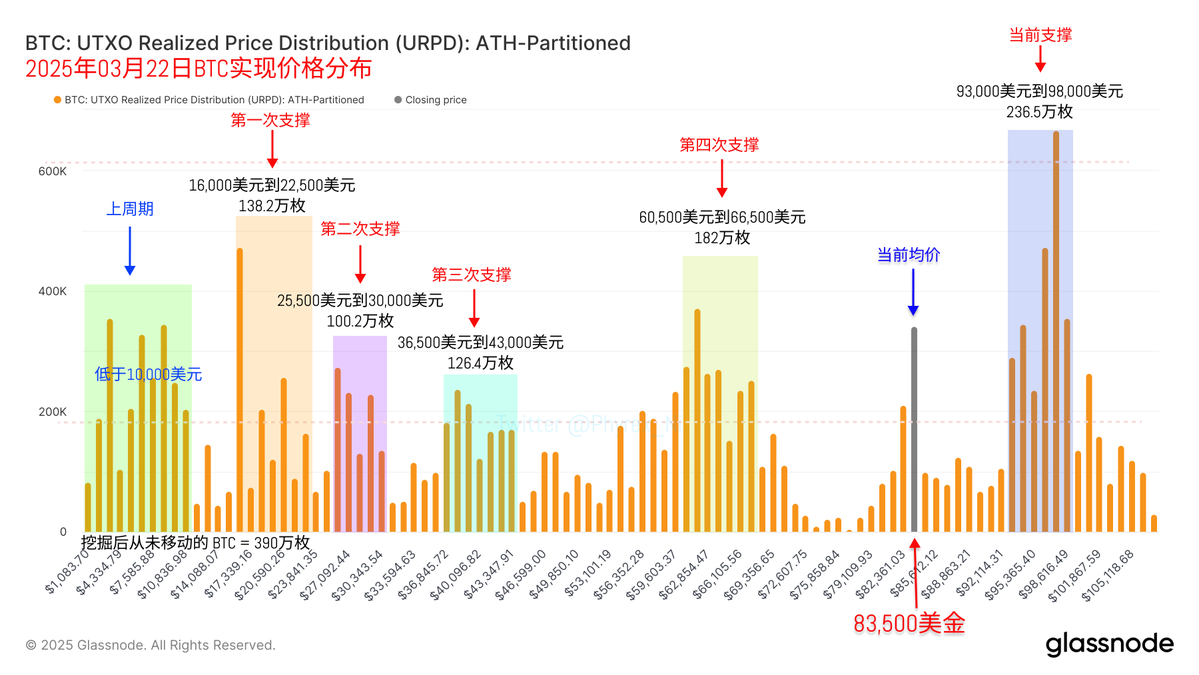

Although the dense chips between $93,000 and $98,000 remain very solid, the turnover in this range is already very low. However, around $83,000, there is an attempt to form a new bottom. If this succeeds, it would not be good news for BTC's short-term price.

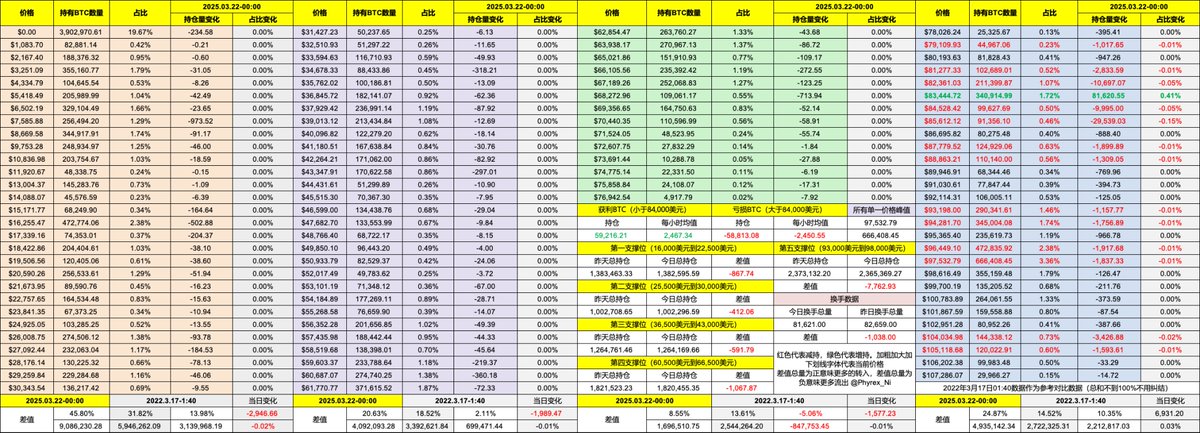

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。