Author: Nianqing, ChainCatcher

Recently, significant progress has been made in the regulation of stablecoins in the United States. The U.S. Senate Banking Committee passed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (referred to as the "GENIUS Act") with a vote of 18 to 6. Embracing compliance has become a trend for stablecoins.

Although most stablecoins are issued on Layer 1 blockchains such as Ethereum, Tron, and BSC, these public chains themselves do not have compliance mechanisms. This may deter some traditional financial institutions. Currently, some public chains focused on payments, such as Stellar, have built-in account control and anchoring mechanisms to support KYC. As regulations tighten, more public chains with built-in KYC/AML mechanisms may emerge to meet global compliance needs.

Recently, the public chain Keeta, which focuses on RWA and stablecoin payments, conducted its TGE on the Base network. It has garnered relatively little attention domestically, but Keeta is quite popular overseas. In early March, due to the project's decision to issue tokens abruptly without prior marketing, it was met with skepticism, with many claiming it was a scam project due to a Twitter hack. Subsequently, the project team began releasing a white paper and marketing, with the team and founder Ty Schenk diligently hosting Spaces and answering questions on Twitter. The FUD (fear, uncertainty, doubt) began to subside.

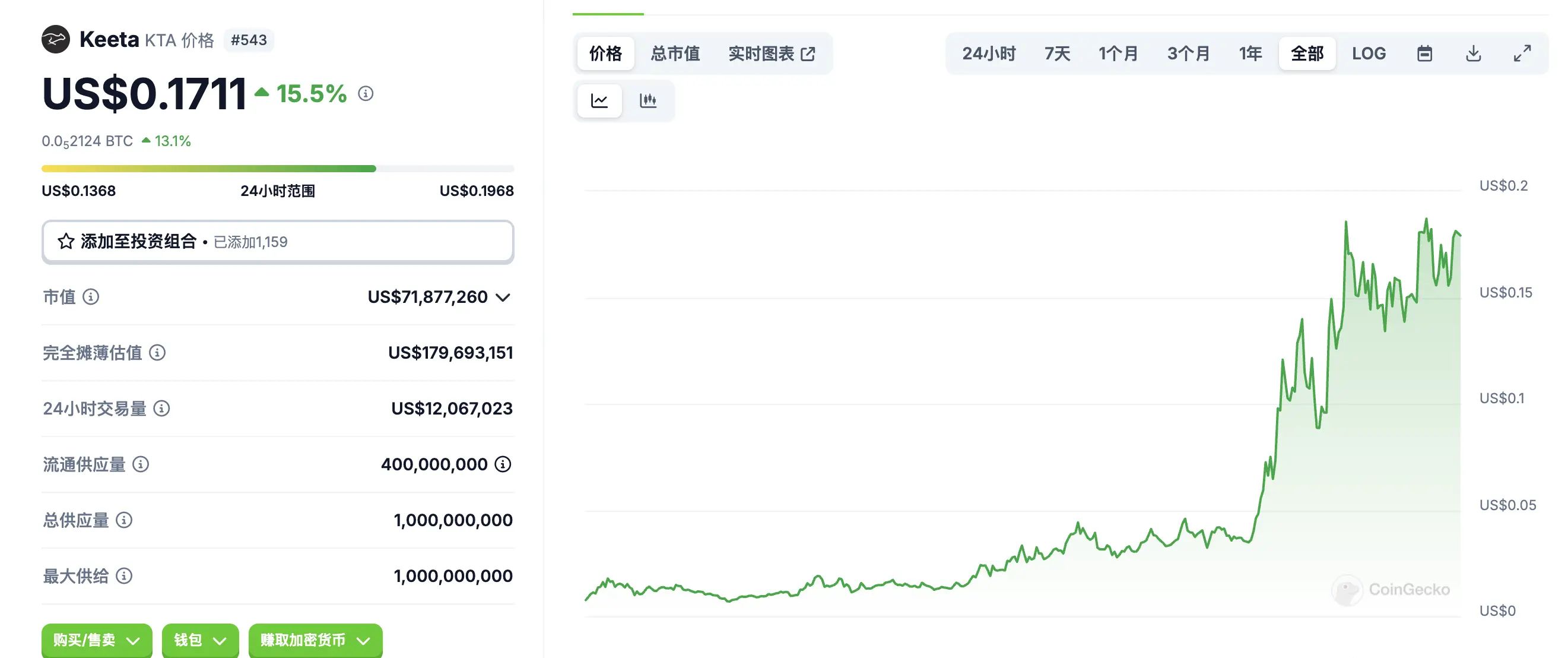

On March 17, Keeta's token KTA surged significantly, with a daily increase of over 50%. Since its launch on March 6, KTA has risen over 2500%. Currently, its TVL exceeds $70 million, with approximately 6,500 token-holding addresses. Keeta's operation can be described as "quietly TGE and then stunning everyone."

First, what is Keeta?

Keeta is a next-generation DAG (Directed Acyclic Graph) delegated proof-of-stake (dPoS) blockchain system that enables instant, compliant, and low-cost cross-border payments to eliminate TradFi bottlenecks. According to the white paper, Keeta aims to achieve two core competitive advantages: "extremely fast speed" and "regulatory compliance."

"Extremely fast speed"

Keeta promises to support up to 10 million transactions per second (TPS) and achieve a transaction settlement speed of 400 milliseconds. This high throughput and low latency design make it suitable for large-scale payment and asset trading scenarios.

10 million TPS is indeed an exaggerated figure; most high-performance new chains only dare to promise up to 100,000 TPS (some in the community have commented that this figure is akin to reading a science fiction novel).

According to Keeta's white paper, the assurance of Keeta's high performance is mainly due to: (1) no memory pool; (2) client-guided validation skipping the queue; (3) two-phase voting to ensure speed/security; (4) cloud servers (such as Google Cloud or AWS).

A clear drawback of this underlying technology is its heavy reliance on centralized cloud service providers. Additionally, 10 million TPS may not be testable in real application environments (even if it's an exaggeration, there's no way to verify it).

Built-in compliance mechanisms

Keeta officially claims to be "the first blockchain network fully compliant with traditional financial regulations," improving efficiency through automated compliance screening and ensuring that all transactions comply with local laws through built-in anti-money laundering (AML), Bank Secrecy Act (BSA), and know your customer (KYC) protocols.

Token issuers can set any rules, such as whitelisting individuals, enforcing transaction limits, or requiring specific certifications, which will be supported by the network. Moreover, token issuers have complete control over the governance of their stablecoins, such as adjusting token policies, implementing new rules, or even modifying identity requirements, ensuring ample flexibility.

To support requirements like identity verification, Keeta's on-chain certificates can achieve instant verification without third parties. Trusted KYC providers on the network can provide certificates to verify specific attributes of individuals, such as age or location. A single certificate can be used for instant verification of personal identity among multiple parties.

Additionally, to support the cross-network flow of fiat-backed stablecoins, Keeta's anchoring system can connect to traditional payment channels (such as ACH, SEPA, and SWIFT) without sacrificing security or compliance. Other blockchain networks can also connect as anchoring systems, enabling atomic swaps between stablecoins and native assets of the anchoring networks.

Team and funding situation

In 2023, Keeta raised $17 million in seed funding with a fully diluted valuation (FDV) of $75 million, with former Google CEO Eric Schmidt also participating in this round of financing. According to some early reports, Keeta initially served enterprises directly, focusing on B2B business, and was invited to provide services in the U.S., Canada, Mexico, Brazil, the UK, and the EU. However, unlike SWIFT, Keeta aims to serve a broader user base for payments under $1 million.

Keeta's co-founder and CEO Ty Schenk has been a software engineer since his teens, and before founding Keeta, his main work was related to crypto payments.

Keeta's CTO Roy Keene was the former chief developer of Nano, who chose to leave to change Nano's incentive mechanism and institutional adoption and create a new project.

Keeta token economics

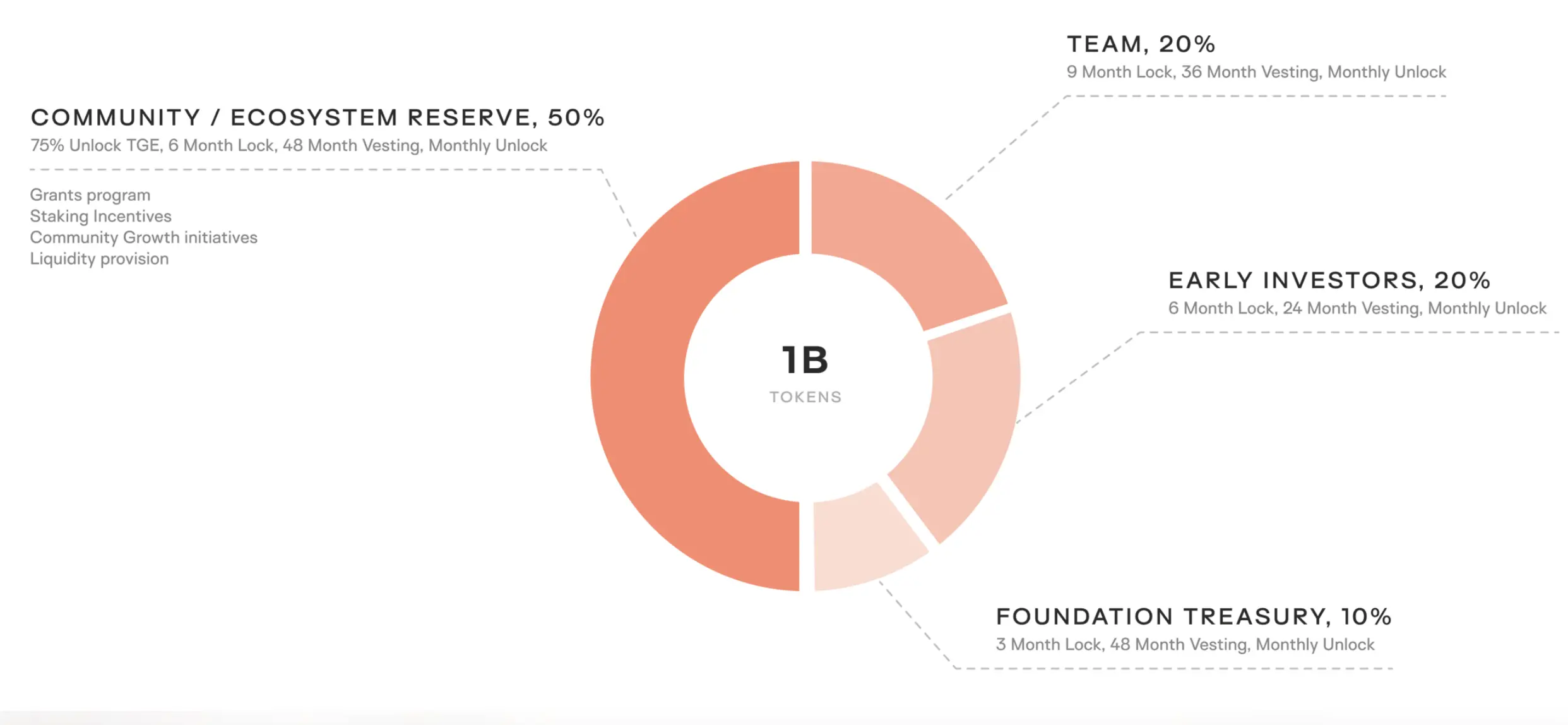

The image shows that Keeta's total token supply is 1 billion, with token distribution divided into four main parts:

- Community/Ecosystem Reserve: 50%

- Team: 20%

- Early Investors: 20%

- Foundation Reserve: 10%

Each part of the tokens has specific lock-up (Lock) and vesting plans, as follows:

- Community/Ecosystem Reserve: 75% unlocked at TGE (Token Generation Event), 6 months lock-up, 48 months vesting, unlocked monthly.

- Team: 9 months lock-up, 36 months vesting, unlocked monthly.

- Early Investors: 6 months lock-up, 24 months vesting, unlocked monthly.

- Foundation Reserve: 3 months lock-up, 48 months vesting, unlocked monthly.

Additionally, the uses of the Community/Ecosystem Reserve include: staking rewards, community growth programs, liquidity provision.

KTA's initial price on Base's DEX Aerodrome was approximately $0.0076, likely calculated based on the previous valuation of $75 million. Currently, 400 million tokens are in circulation, with a fully diluted valuation of $168 million.

Project planning and roadmap

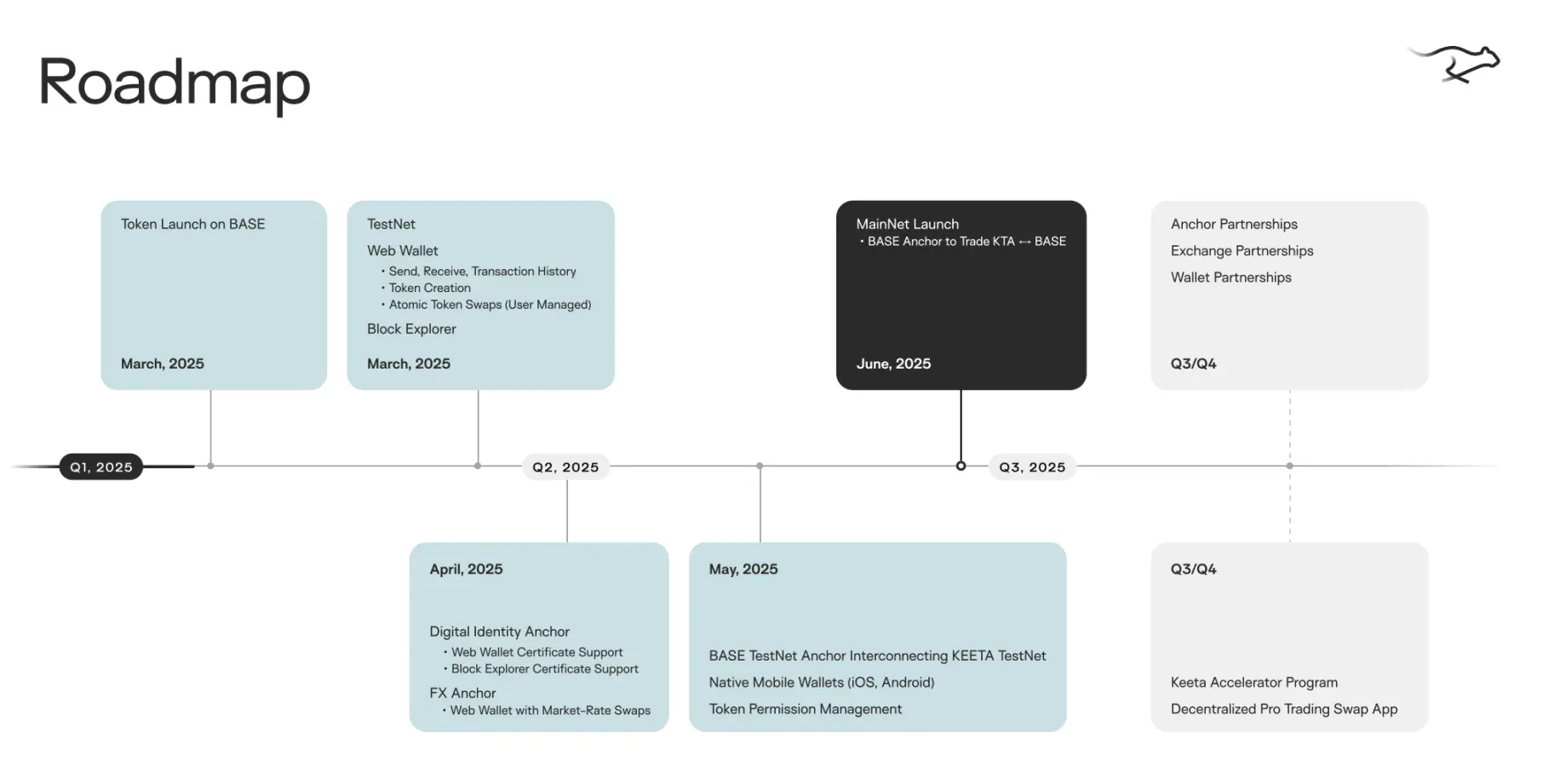

According to the roadmap, the Keeta Network testnet will be launched at the end of this month, accompanied by a web wallet and block explorer. The mainnet is set to launch in June, and more testnet features will be rolled out in the months leading up to the mainnet release. For example, digital identity anchors, web wallet certificate support, block explorer certificate support, and native mobile wallet.

Why did an L1 choose to conduct TGE on L2 Base?

This is currently the biggest controversy facing Keeta. Some in the community question why the Keeta team, which has its own Layer 1, chose to conduct TGE on Base, seeing it as unnecessary, especially since assets will need to be anchored back to their own chain after the mainnet goes live.

The team has responded to related concerns on multiple occasions, stating that the fair launch is due to their emphasis on community building, hoping the community can participate early in the project's development and growth. Additionally, compared to Keeta, which has no user base yet, Base has a larger dissemination foundation and traffic, and the gas fees are cheaper than the Ethereum mainnet. The KTA token will remain on Base until the mainnet launches, at which point it will become the native token on Keeta L1 using the new anchoring features.

Conclusion: Token and business appear somewhat disconnected

Although with the implementation of U.S. regulations, the compliance-oriented stablecoin infrastructure will have tremendous development potential, the crypto payment space is already quite crowded. With the entry of traditional payments, there may be further downward pressure on startups.

Moreover, a key issue is that Keeta's actual business leans more towards traditional financial system B2B operations. Its token price may face a disconnection from actual business, similar to payment networks like Stellar and Ripple.

For instance, Ripple's XRP has historically lacked practical use in its operations, and its future role in its ecosystem remains unclear. Compared to its software business, what truly made Ripple profitable was selling tokens. In 2019, an external media site analyzed Ripple's total revenue, revealing that 80% came from token sales.

In this context, how will Keeta empower KTA? Will it follow in Ripple's footsteps?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。