Source: Cointelegraph Original: "{title}"

Update (March 20, 4:41 PM UTC): This article has been updated to clarify that the token sale is not aimed at the TON Foundation.

The Open Network Foundation (also known as the TON Foundation) stated that several venture capital firms have invested over $400 million in the TON blockchain, indicating a growing interest in the Telegram instant messaging ecosystem.

Sequoia Capital, Ribbit, Benchmark, Draper Associates, Kingsway, Vy Capital, Libertus Capital, CoinFund, SkyBridge, Hypersphere, and Karatage participated in this investment by purchasing the native cryptocurrency of the Open Network, Toncoin (abbreviated as TON).

The TON Foundation described this token purchase as a strategic partnership that will help expand the TON ecosystem, but did not provide further details.

The TON blockchain is a decentralized network that supports the development of mini-applications for the Telegram ecosystem. Although TON was initially developed by the founder of Telegram, it now operates as an independent blockchain.

As of January, Toncoin is the only cryptocurrency accepted by Telegram for application services.

Over the past year, the TON blockchain has seen significant growth, with the number of native accounts increasing from 4 million to 41 million. The TON Foundation claims that Toncoin has over 121 million independent holders.

According to the announcement, the TON Foundation aims to onboard 30% of Telegram's active users onto the blockchain within the next three years.

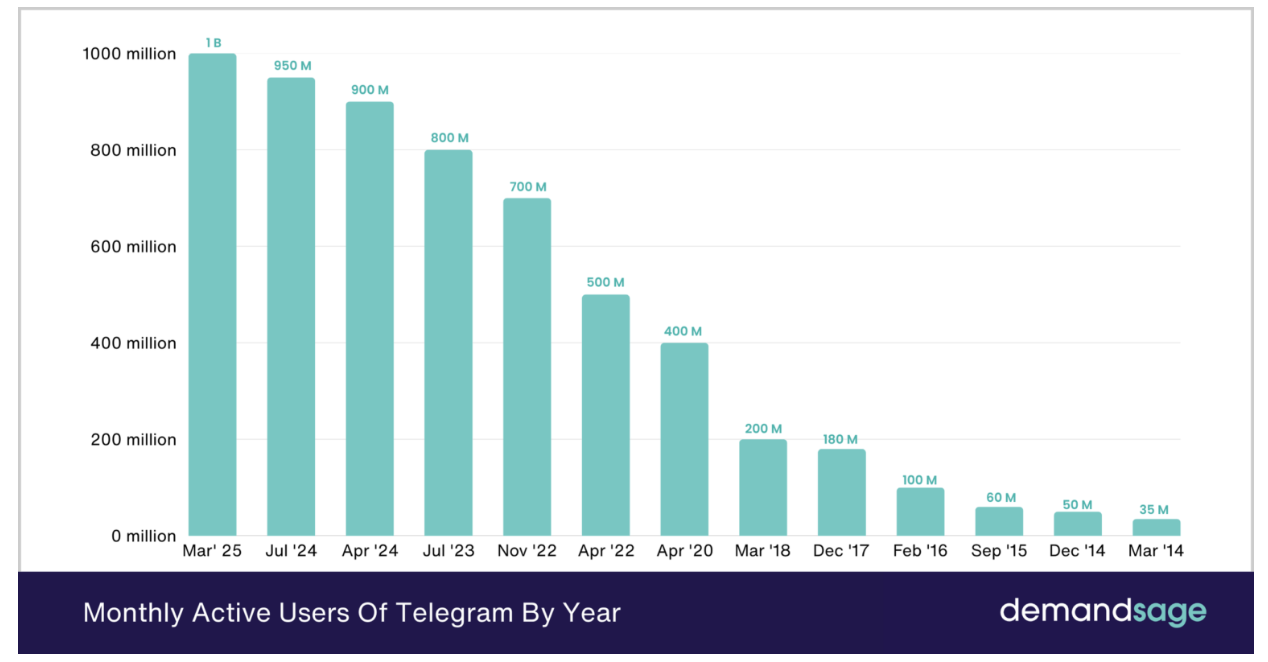

As of March, Telegram has 1 billion monthly active users, doubling its user base in less than three years. Source: Demandsage

Benchmark partner Peter Fenton stated that Telegram's user base is expected to exceed 1.5 billion by 2030.

Increase in Venture Capital Deals

As the blockchain industry gains new recognition in the U.S. and other markets, venture capital funding continues to flow into blockchain projects.

According to Simon Wu, a partner at San Francisco-based venture capital firm Cathay Innovation, cryptocurrency and blockchain projects "are being recognized as viable solutions, especially in financial areas such as asset management, trading, and tokenization."

With increased recognition comes increased funding.

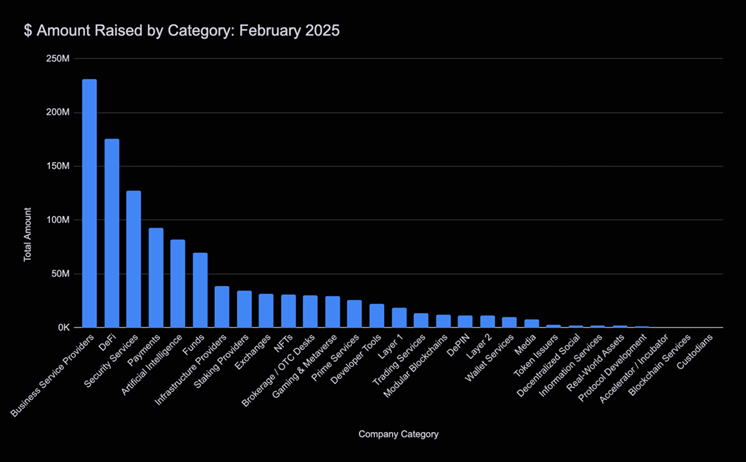

Cointelegraph reported earlier this month that due to renewed interest in decentralized financial services, the total amount of cryptocurrency venture capital deals in February exceeded $1.1 billion.

In February, blockchain projects focused on business services and DeFi attracted the majority of venture capital funding. Source: The TIE

The latest Cointelegraph venture capital overview also shows a growing interest in decentralized physical infrastructure networks and real-world assets.

Related: Telegram Wallet to Launch 50 Tokens and Introduce Yield Program

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。