Author: Meltem Demirors

Translation: Riley, ChainCacher

It all started here. Everything we discussed ten years ago when we began building the world's first Bitcoin investment company, Blockworks, has now come to fruition. So, why isn't the price of Bitcoin one million dollars yet?

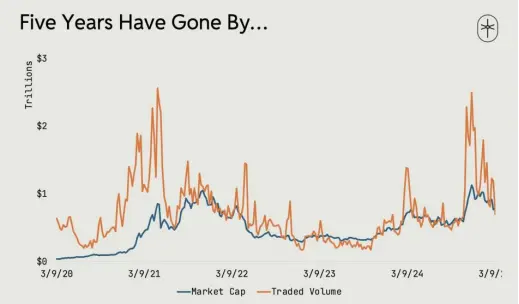

- If we exclude Bitcoin and Ethereum, this is the state of the crypto market over the past five years: the coins may have changed, but the overall data has not. This is a big problem—there has been no growth.

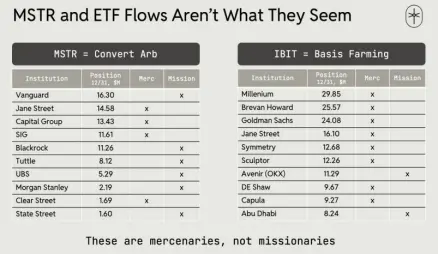

- The market in 2024 is primarily supported by two persistent buyers - MicroStrategy and BlackRock, but these buyers are not evangelists; they are mercenaries. The buyers of MSTR (MicroStrategy) are arbitraging convertible bonds, while the buyers of IBIT (iShares Bitcoin ETF) are arbitraging the basis. Together, they hold 6% of the Bitcoin supply. This is our black swan event.

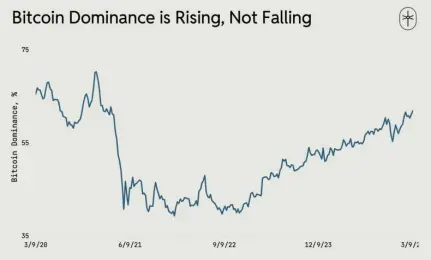

- Despite the promise of innovation and the endless promotion of public chains on Twitter, Bitcoin's market dominance is rising, not falling.

There is only one Bitcoin industry, one Bitcoin story, one Bitcoin market.

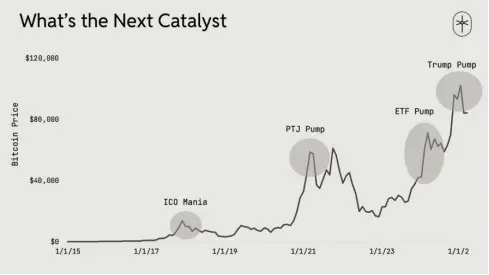

- Let's take a look at Bitcoin. We have experienced many astonishing rebounds driven by narratives and capital flows. But what kind of narrative or capital flow can push us past the peak of "the U.S. government treating Bitcoin as a strategic reserve"?

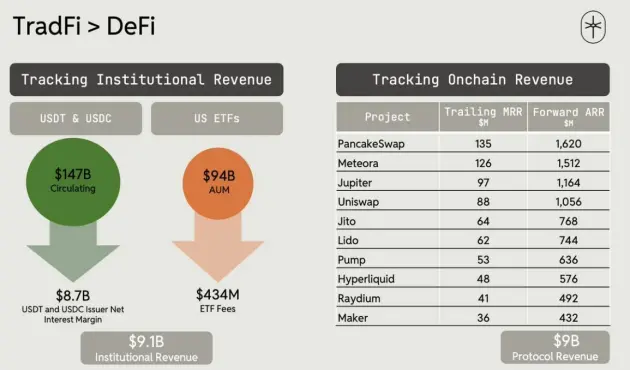

- While decentralized finance (DeFi) shows incredible potential, traditional finance (TradFi) is currently dominating in terms of revenue. It is expected that in the fiscal year 2025, stablecoins and ETFs (exchange-traded funds) will generate $9.1 billion in revenue for institutions. In contrast, DeFi protocols are expected to generate $9 billion in the same period, but this figure largely depends on the trading activity of meme coins.

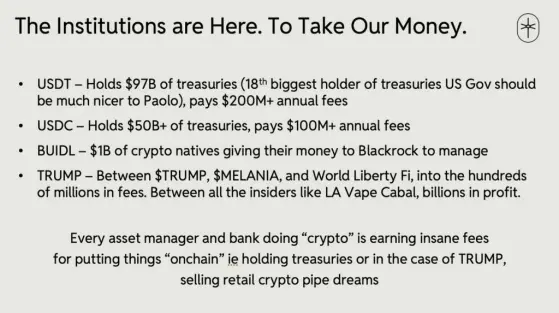

- Institutional investors are flooding in! Yes, they see the opportunity to make money, and they want a piece of the pie. It has nothing to do with personal grudges—it's just business. For Trump, attending the DAS (Digital Asset Summit) is about making a big profit. It has nothing to do with personal grudges—it's just business.

They are mercenaries, not evangelists.

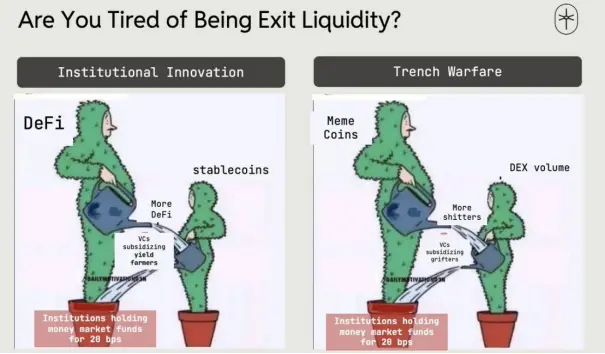

- Those institutional innovators talking about cryptocurrency adoption on Twitter and those frontline warriors discussing meme coins have more in common than you might think.

We need to stop blind worship and start thinking.

Stop the foolishness. (By the way, this includes myself)

- Do you know what the most profound thing in cryptocurrency is?

Proof of Work.

Bitcoin has shown the world how to build a value chain from energy to computation, creating $60 billion in public equity value.

- I have said this many times: Bitcoin has at least accelerated the development of artificial intelligence by a decade. Bitcoin has created a new data center business model, including post-metering hosting, flexible loads, demand response, and hedging with underlying assets. This is a profound transformation.

- I have never expressed this opinion in public, but now it's time to say it: Proof of Stake is a wrong decision. Ethereum could have evolved into a trillion-dollar protocol with a strong energy-to-computation ecosystem. However, the reality is that the MEV (maximum extractable value) mechanism has extracted billions of dollars in value from users and applications.

- Ethereum once led Nvidia's surge, but now it cannot drive the market up.

- We need to return to basics. Many markets have reached a liquidation moment, and cryptocurrency is no exception. You cannot defy the laws of physics. But where do we go from here?

- Our redemption is: energy, computation, cryptocurrency.

It's that simple.

The rest of the story is slowly unfolding—this is our job.

- Ten years ago, I believed in Bitcoin and invested all my time and energy. A group of internet crazies made the global reserve cryptocurrency a reality through memes. Imagine what else we can do.

Having faith is important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。