Everyone has a locked drawer in their heart: hiding faded love letters, unfinished poems, or the sound of cicadas in a summer's day. There's no need to rush to organize; when the moonlight seeps through the cracks, those dusty fragments will naturally piece together into a starry sky. Regret is the soul's breathing hole; regret is also a norm in life, and contentment brings happiness.

The analysis and operations provided by Zongheng yesterday must have been of high value, right? In such a market with a strong bullish sentiment, choosing to short at a high position turned out to be the optimal solution for yesterday's market operations. During this period, the market gave us two entry opportunities around 86200, which was basically the highest point of last night's market. From the choice of entry position, the target support around 83500 can be said to be an extremely perfect market prediction. Congratulations to friends who have been following Zongheng's operations and successfully profited. For those who missed out or still hold positions, don't worry; market opportunities are always present, and there's no need to overly concern yourself with temporary gains and losses.

Dreams may be distant, but the heart is unafraid; steadfast action will eventually lead to success!

Let’s encourage each other!

Yesterday's market trend indeed validated our judgment, especially the two points emphasized yesterday: the rise lacked volume support, leading to a lack of sustainability for the bulls. The rise broke through previous resistance levels, resulting in a breakdown of short positions. Now that the bulls have failed to continue the rise, it is a typical sign of forced upward movement with insufficient follow-through, making today's market trend quite critical as it will determine the short-term market trend.

From the chart, the daily line closed poorly yesterday, with a long upper shadow and a small bearish doji. This is somewhat fatal for the originally rebound-trending daily line. The bearish doji at the rebound high indicates that if the market continues to decline, it would clearly signal a top formation, leading to a greater space for finding support downward.

On the four-hour level, after five consecutive bearish candles, the original bullish cycle has been disrupted. The current price has returned to the area of moving average convergence. Today is Friday, and if a direction can be chosen again to break out of this area, it would form a trend by early next week. The MACD on the four-hour cycle has once again formed a death cross above the zero line, entering an initial bearish phase. Given the current market operation, it is highly likely that there will be a continued downward process to complete this cycle. It is important to note that if it breaks below the previous low around 81000, it would indicate a mid-term downward structure.

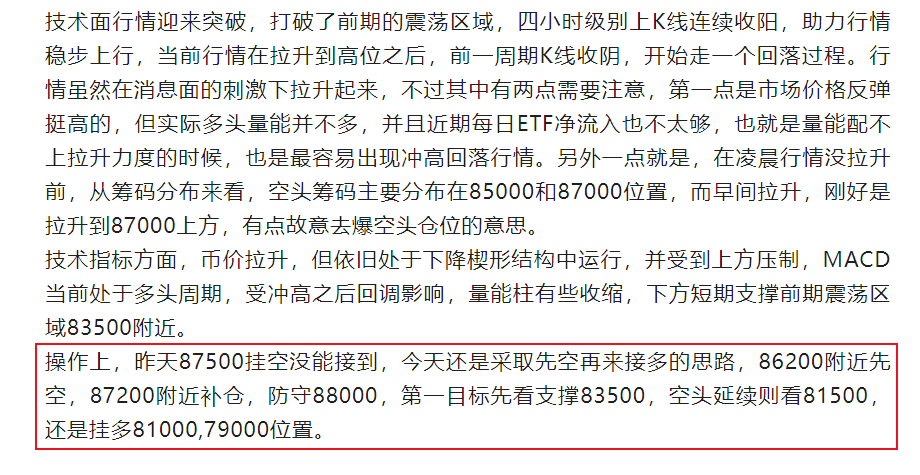

In terms of operations, the focus remains on bearish positions for the day. A layout can be made around 85000, with additional positions at 86000 and a stop-loss at 86700, targeting 82000-81000. If the bearish trend continues, it could drop to 79000. For those who had high short positions yesterday, adjust the stop-loss position to hold. For long positions, a short-term long can be considered below 82000, but ultra-short trades are best executed in real-time during the session, with long positions at 79000 and 77000.

As for Ethereum, the recent trend has been a bit chaotic; sometimes strong, but mostly weak. I was cautious not to short it yesterday, and today I am considering a short around 1990-2000, with a stop-loss at 2080 and a target of 1800.

Currently, the altcoin market is mainly active with MEME coins across various chains. Personally, I believe most MEME coins will go to zero, so one should not invest too much in these on-chain activities due to high risks. If you have a particularly favorable view, a small amount can be played with.

【The above analysis and strategies are for reference only; please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。