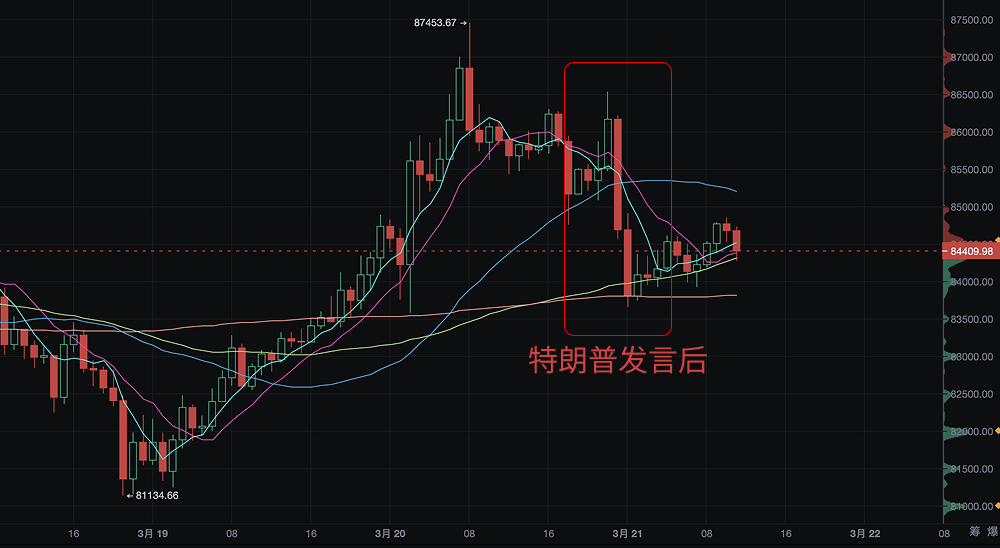

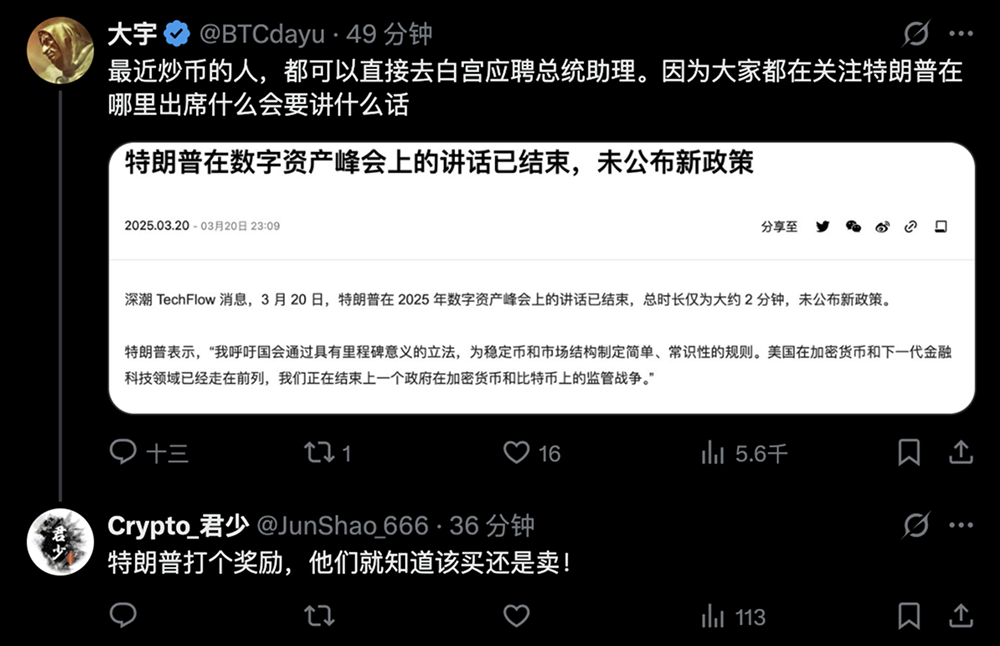

On the night of March 20, 2025, at 11 PM, U.S. President Donald Trump delivered a speech at the 2025 Digital Assets Summit. However, following the speech, Bitcoin experienced a noticeable short-term pullback, with prices quickly dropping from their peak, leading to increased market volatility. This trend indicates that Trump's every move is profoundly influencing market expectations for Bitcoin, as investors reassess the impact of policy signals on the crypto market. The candlestick chart shows significant selling pressure after the speech, suggesting that major funds may have taken the opportunity to sell off, causing Bitcoin's price to slide from its high.

Candlestick Pattern Analysis

From the candlestick chart, Bitcoin's price has recently shown a high-level consolidation pattern, briefly breaking through $87,453 but then retreating, currently stabilizing around $84,000. A short-term triangular convergence pattern is forming, indicating that the market is searching for a breakout direction.

- Key support level: $83,200 (lower edge of the VPVR high trading volume area)

- Key resistance level: $85,500 (upper dense trading area)

Trend structure: Short-term consolidation, potential breakout direction

Recent candlestick fluctuations indicate intense battles between bulls and bears, with frequent short-term capital movements. The rise following Trump's speech last night failed to stabilize, showing that the market still needs time to digest the positive policy signals.

Capital Flow Analysis

OBV (On-Balance Volume) Indicator: Currently, OBV shows a slight decline, indicating that capital inflow has weakened, and short-term bullish momentum has not formed sustained energy.

Large Order Tracking: In the past 24 hours, there was a surge in large capital inflows after the speech, but some funds are currently escaping at high levels, indicating that short-term capital is relatively cautious.

Technical Indicator Analysis

- MACD (Moving Average Convergence Divergence): The DIF line (-155.32) is below the DEA line (-118.81), and the MACD histogram remains green but shows a shortening trend, indicating that the downward momentum is weakening, and the market is likely to enter a consolidation phase.

- RSI (Relative Strength Index): The RSI(12,24) indicator is currently around 44.35, below 50, in a neutral to weak area, indicating that short-term market sentiment remains cautious.

- KDJ (Stochastic Indicator): The K value (61.28) and D value (51.73) are turning upwards, while the J value (80.39) is high, indicating a risk of short-term overbought conditions and potential for a short-term pullback.

Today's Trend Prediction

Considering the technical aspects, capital flow, and market sentiment, Bitcoin is expected to exhibit the following trends today:

Short-term consolidation: Currently, Bitcoin is fluctuating around $84,000. Since the VPVR trading volume dense area is between $83,200 and $85,500, the price may continue to oscillate within this range.

If it breaks above $85,500: A new round of upward momentum may emerge, targeting the $87,000 to $88,000 area.

If it falls below $83,200: The market may further test the bottom, probing the $81,000 support level.

Trump's speech impact is temporary: The market in the short term is still dominated by capital inflow conditions and macroeconomic factors, and attention should be paid to the subsequent implementation of policies.

Conclusion

Market sentiment remains cautious, and short-term traders should focus on the breakout situation in the $83,200 to $85,500 range, choosing a direction before following the trend. Combining technical indicators and capital flow conditions, short-term strategies should remain flexible to avoid excessive chasing of highs and lows.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。