Source: Cointelegraph Original: "{title}"

Data center infrastructure provider Hive Digital is doubling down on its long-term Bitcoin reserve strategy and is using the recent market sell-off to expand its mining capacity and acquisition targets, indicating a growing trend among publicly listed mining companies to retain the Bitcoin they mine.

In an interview with Cointelegraph, Hive Digital's Chief Financial Officer Darcy Daubaras stated that the company remains focused on "retaining a significant portion of the Bitcoin it mines to benefit from potential price increases."

This requires an active asset reserve management approach to optimize liquidity during significant market pullbacks, such as the recent 30% price drop of Bitcoin (BTC). However, Daubaras noted that a long-term holding strategy for Bitcoin is preferable to "relying more on debt or equity dilution to raise funds," a reliance that is common in the mining industry.

As reported by Cointelegraph, due to high interest rates and declining credit ratings, publicly listed mining companies are increasingly turning to equity dilution (i.e., issuing new shares to raise funds), which is part of a broader deleveraging process.

Without these strategies, mining companies are often forced to sell large amounts of the Bitcoin they mine to maintain operations or expand.

While Hive does not oppose selling some of its held Bitcoin (the company has sold Bitcoin to fund the acquisition of Bitfarms' 200-megawatt facility in Paraguay), Daubaras stated that it is better to "selectively sell Bitcoin to fund value-added investments, thus achieving a balance between scaling the business and preparing for long-term success."

Source: Frank Holmes

In the last quarter of 2024, Hive increased its Bitcoin holdings on its balance sheet, raising the number of "held" Bitcoins to 2,805.

The Importance of Diversification and Scalability

Bull markets make it easier for mining companies to accumulate Bitcoin, but achieving long-term success requires finding ways to navigate challenges such as price volatility, increased competition, and rising electricity and hardware costs.

To address these and other challenges, Hive has adjusted its business model to incorporate AI data centers and prioritize the use of renewable energy.

Hive Digital executives told Cointelegraph in September that the company has repurposed some NVIDIA GPUs for AI tasks, generating over $2 per hour, while cryptocurrency mining only yields $0.12 per hour.

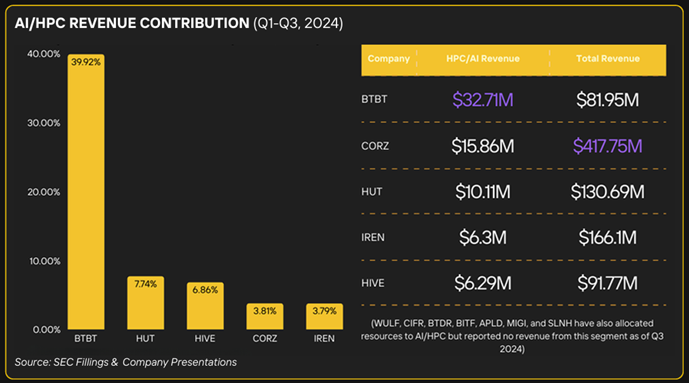

Other mining companies are following suit, including Core Scientific, Hut8, and Bit Digital. Asset management firm CoinShares highlighted the transformation of these companies in a mining report released in October, stating that the decline in Bitcoin mining profits "may explain why mining companies are increasingly inclined to incorporate AI to diversify their revenue sources."

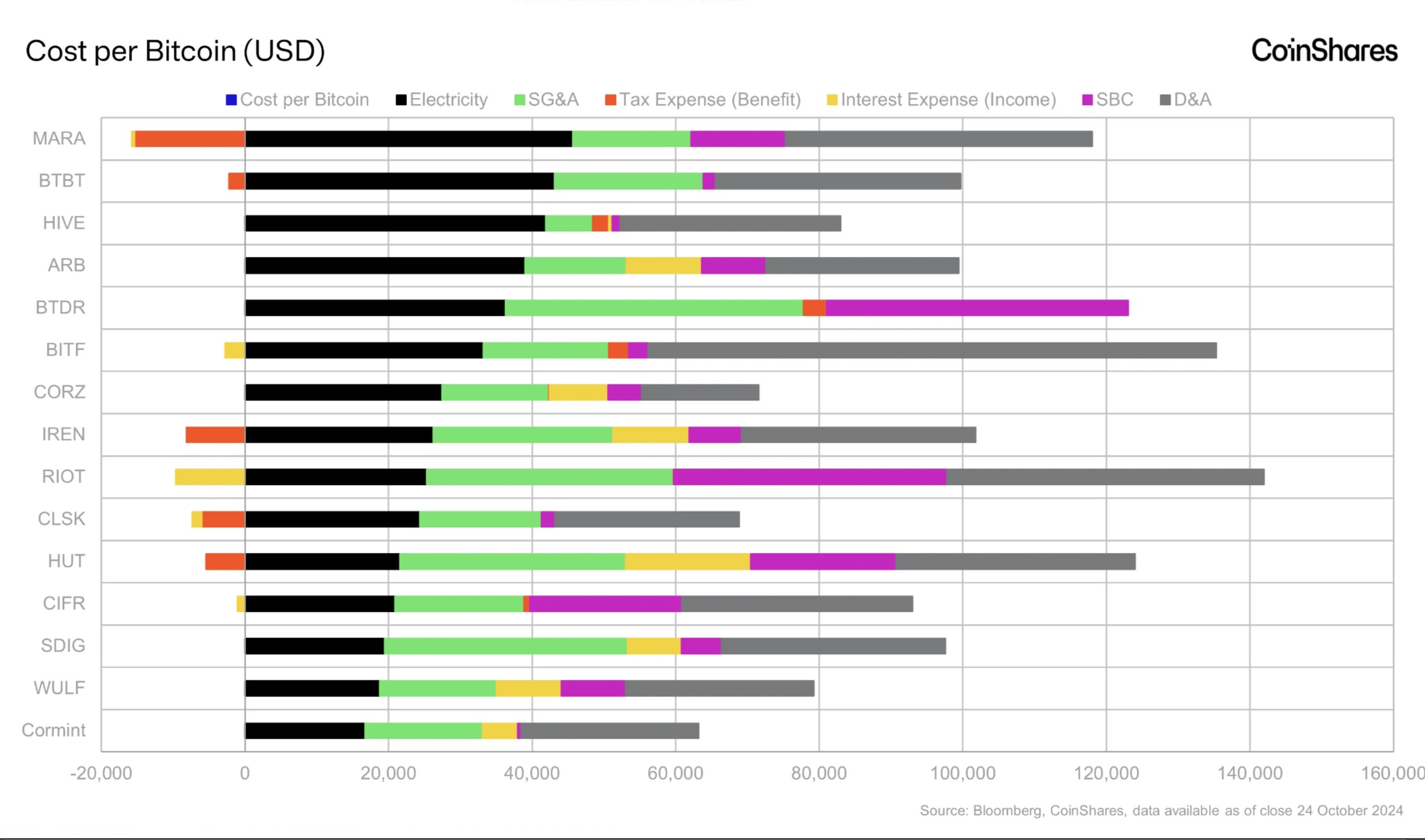

After the Bitcoin halving in April 2024, the cost of mining each Bitcoin has essentially doubled. Source: CoinShares

A report released in January by Digital Mining Solutions and BitcoinMiningStock.io also pointed out that diversification among mining companies is one of the key takeaways. The report identified high-performance computing and AI as areas capable of providing "predictable revenue streams to buffer the volatility of mining operations."

The proportion of revenue from high-performance computing and AI applications in mining companies is increasing. Source: Digital Mining Solutions

Related: Court rules that Bitcoin mining hosting companies cannot prevent tenants from accessing their mining machines.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。