Source: Cointelegraph Original: "{title}"

Bitcoin (BTC) price surged to an intraday high of $87,453 during the early hours of the New York trading session, but quickly retraced its gains to $83,655 shortly after U.S. President Trump delivered a video speech at the New York Digital Assets Summit.

Before Trump's video address, rumors circulated on X platform that President Trump would announce a capital gains tax exemption for certain cryptocurrencies or release a favorable statement regarding the U.S. strategic Bitcoin reserves.

Disappointingly for some traders, neither of these rumors came true. Trump merely reiterated his commitment not to sell Bitcoin seized by the government and called on Congress to quickly establish clear stablecoin legislation.

The most assertive statement from President Trump was his reaffirmation of the goal to make the U.S. a leader in all areas of cryptocurrency.

“We will work together to make America the undisputed Bitcoin superpower and the global capital of cryptocurrency.”

As is often the case in the cryptocurrency market, traders apparently believed the rumors that Trump would issue some sort of executive order supporting Bitcoin, and once it became clear that this was not the case, they sold off Bitcoin based on this news.

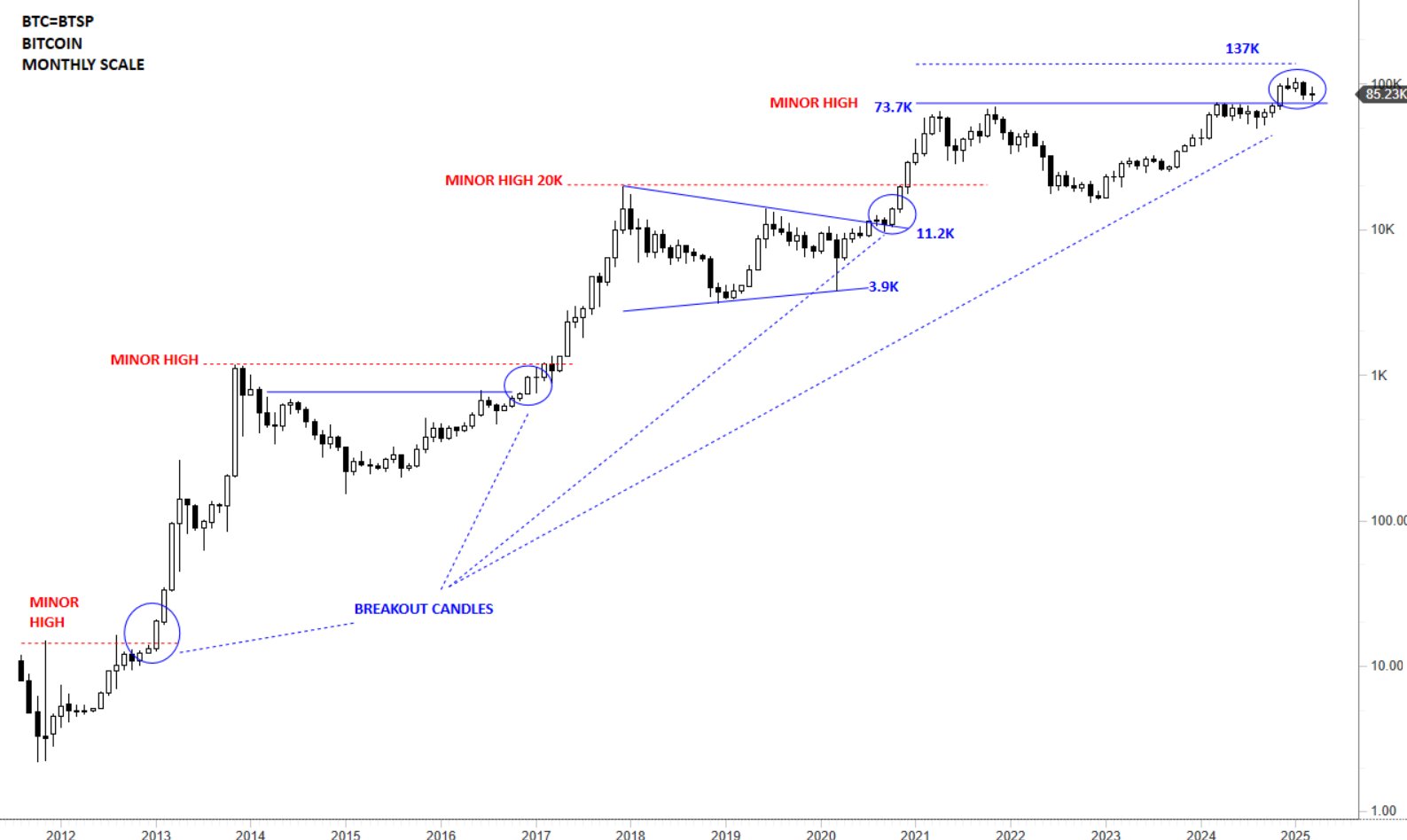

Chartered market technician Aksel Kibar posted on X platform that Bitcoin's price could still potentially retrace to $73,700.

Bitcoin/USD 1-day chart. Source: Aksel Kibar/X

Kibar stated, “The long-term chart of Bitcoin/USD shows that it still seems possible to retrace to the previously broken $73,700 level. The next movement will determine the price trend for the coming months.”

The recent rise in Bitcoin is not solely attributed to expectations surrounding Trump's statement today. On March 19, Bitcoin positively responded to the release of the Federal Open Market Committee (FOMC) meeting minutes and Federal Reserve Chairman Jerome Powell's confirmation that the Fed's quantitative tightening policy would slow down, with the possibility of two rate cuts in 2025.

BitMEX co-founder Arthur Hayes celebrated what he perceives as the Fed's acknowledgment that quantitative tightening will essentially end on April 1, but he warned that while $77,000 may be the bottom for Bitcoin, unexpected volatility could bring more downward pressure on stocks and Bitcoin.

Hayes stated, “JAYPOW did it, quantitative tightening essentially ends on April 1. What we really need to be excited about next is either getting a supplementary leverage ratio (SLR) exemption or restarting quantitative easing (QE). Is $77,000 the bottom for Bitcoin? It could be. But stocks may still experience more pain before Jay fully aligns with Trump’s camp, so stay flexible and keep cash on hand.”

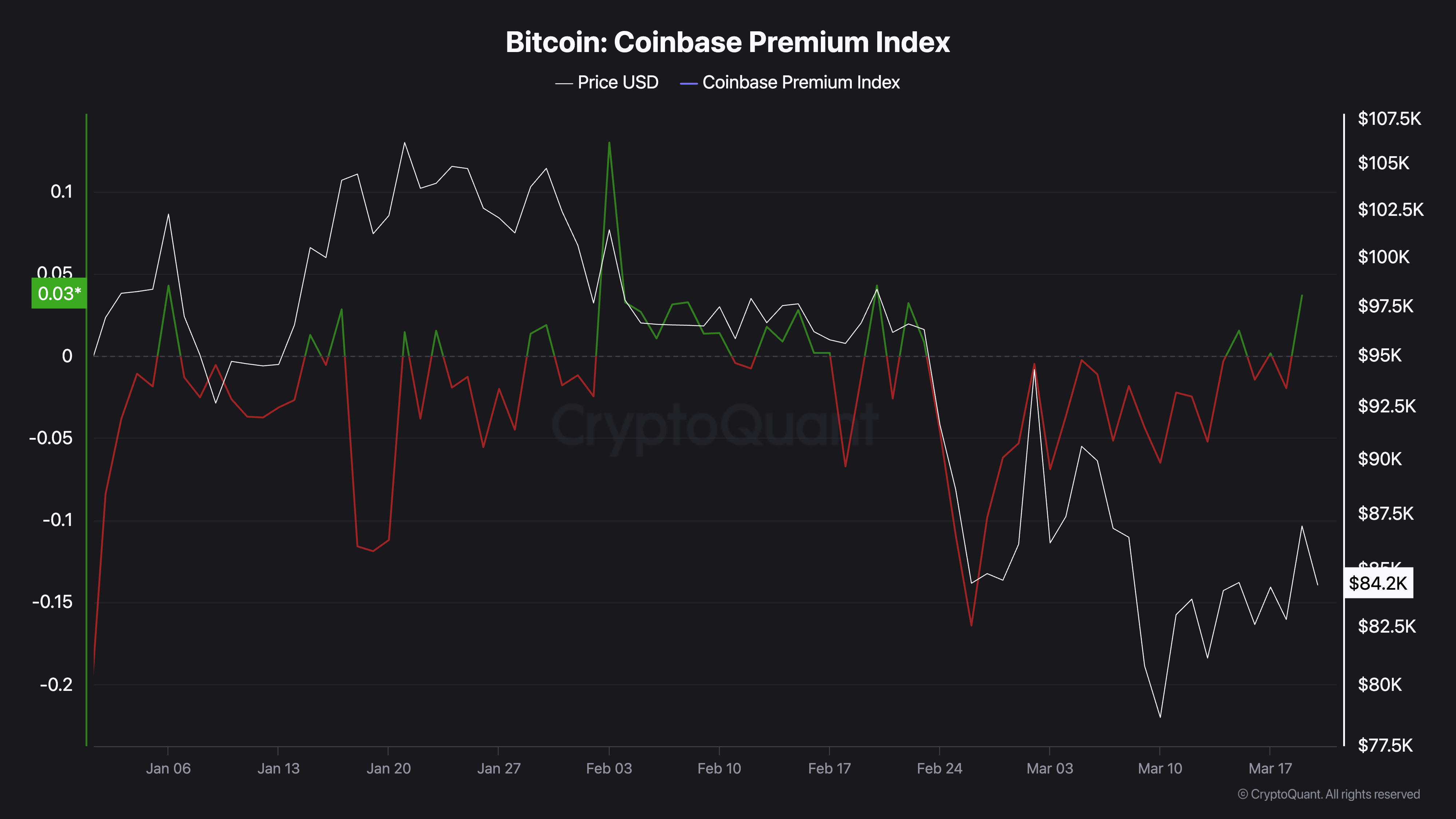

According to Cointelegraph, Bitcoin's recent price movements have largely been driven by trading activity in the futures market, but the reappearance of a premium for Bitcoin on the Coinbase platform may be a sign that spot market demand is returning.

Bitcoin Coinbase premium index. Source: CryptoQuant

Related: Blockchain Association says U.S. Congress is expected to introduce legislation on stablecoins and market structure before August

This article does not contain investment advice or recommendations. Every investment and trading activity carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。