No one in the investment market is absolutely free from fear and greed; humans are emotional beings. It's not about fearing mistakes, but rather fearing the absence of mistakes. True calmness comes from inner peace, which is unrelated to right or wrong. When right, one should not be restless; when wrong, one should not be pessimistic, continuously self-correcting.

Hello everyone, I am trader Gege. Continuing from the last article, the trend of Bitcoin aligns with the previous expectations. The points given were all touched upon, so I won't repeat them. For the corresponding market trends, you can refer to yesterday's article. In terms of strategy, the market continued to rise yesterday without significant pullbacks. The short positions were relatively accurate; entering around $85,000 with a $500 margin only saw a drop of about $1,000. The short position at the breakout of $87,500 was very precise, but after reaching that point, a pullback occurred. The strategy positions are accurate, but currently, there isn't much room, so I won't elaborate further.

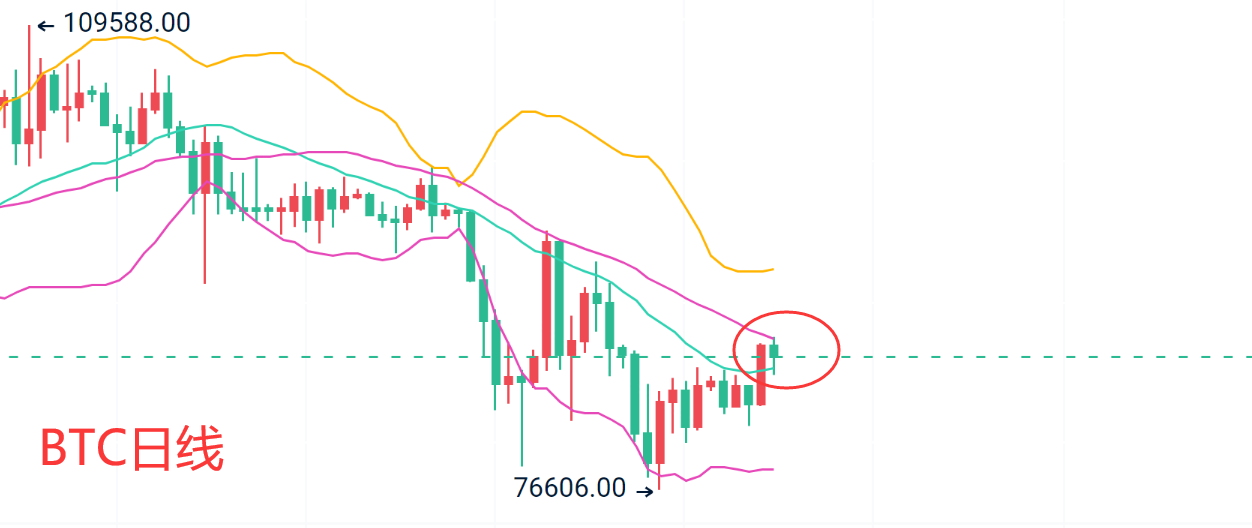

Bitcoin has temporarily broken through the previous weekly candle, and the probability of touching the MA7 next is quite high. However, it is worth noting that when approaching the MA7, bulls should be cautious. The rest will depend on the closing line. Yesterday's daily candle closed as a bullish candle with no upper or lower shadows, breaking through the resistance of the middle track and EMA200. Without any unexpected news, this technical setup is favorable for bulls. Next, we will focus on how today's candle closes. If it can continue to close bullishly and stay above MA30, then this upward trend will continue to test the $89,000 level or even $91,000. Conversely, it will test the middle track and MA7 again.

On the 4H level, as mentioned yesterday, we are watching the EMA200 above, which corresponds to the daily MA30. Therefore, we should pay attention to the breakout situation of this line in the short term. The daily level of Bitcoin is facing resistance at the middle track, so the overall technical setup can be referenced against Bitcoin. We will look at the daily closing situation; if it can break and stabilize, then we can continue to look towards the MA30 area, which is the $2,200-$2,300 level mentioned yesterday. Otherwise, it will first pull back to test the MA7 area. As long as the 4H level does not effectively break below MA60, the short-term situation remains bullish.

Bitcoin's short-term strategy still maintains the approach of pulling back to buy. Short positions are also provided for reference. For Bitcoin, the short-term suggestion is to buy around $85,300-$84,800. Short positions can be entered again at $87,500-$88,500, with a breakout at $89,000-$89,800. For Ethereum, the short-term suggestion is to buy around $1,980-$1,940, with short positions to be entered if the previous high is not broken, around $2,050 with a $20 margin, and a breakout at $2,150-$2,200.

The suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss spaces accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will see you next time. I wish everyone success and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。