Macroeconomic Interpretation: In the dovish statement from Federal Reserve Chairman Powell early in the morning, Wall Street and the crypto market performed a duet tango. As the policy interest rate remained fixed in the 4.25%-4.5% range, the decision to slow down the balance sheet reduction was like injecting adrenaline into the financial system—U.S. stock indices danced in response, with the Nasdaq tech sector, led by Nvidia and Tesla, expanding its gains to 1.41%. This timely liquidity boost also saved the crypto world, with Bitcoin climbing to a peak of $87,453 amidst fluctuations, Ethereum reclaiming the $2,000 mark, and XRP surging over 11% in a single day due to the SEC's dramatic withdrawal of its appeal against Ripple, as if the crypto market suddenly mastered a collective skill, showcasing their talents.

However, behind this revelry, Moody's chief economist issued a warning that while the probability of a current economic recession is not yet over 50%, Trump's tariff stick could rewrite the script at any moment—if reciprocal tariffs persist for 3-5 months, the U.S. economy could fall into a "designer custom recession." This darkly humorous prediction resonates oddly with the Federal Reserve's latest economic forecast: expectations for economic growth have been downgraded, while inflation expectations have risen against the trend, resembling a "stagflation duet" on the economic stage. Market expectation analysis, however, detects an opportunity for Bitcoin, as the Federal Reserve's balance sheet reduction pace plummeted from $25 billion per month to $5 billion, coinciding with the dollar's three-day decline marking the third-largest record since 2015. This combination of liquidity could compose a new high for Bitcoin in the next 90 days.

The market seems to be validating the law of "crisis driving innovation." BlackRock's head of digital assets sharply refuted the notion of simply categorizing Bitcoin as a risk asset, emphasizing its global, scarce, and non-sovereign characteristics that are reconstructing the value storage paradigm. This heavyweight player's assertion is supported by on-chain data: Coinank monitoring shows that Bitcoin whales suddenly entered "hoarding mode" in March, increasing their holdings by 62,000 coins compared to the beginning of the month, a move that reverses the annual reduction trend, as if the whales collectively signed a Bitcoin faith declaration.

The XRP ecosystem is playing out a "Tale of Two Cities." Ripple's CEO has hinted at launching an XRP ETF by the end of 2025, and data shows that addresses holding over a million XRP have increased their holdings by 6.5% in two months, bringing the total to 46.4 billion coins. The collective actions of these "crypto aristocrats" resonate with a 600% surge in network activity, reminiscent of Dickens' famous line—this is the best of times, and it is also the time that tests faith the most.

As Trump named April 2nd "American Liberation Day" on social media, calling for the Federal Reserve to cut interest rates to save the economy dragged down by tariffs, the market's long and short game has already entered a quantum superposition state. Bitcoin's price fluctuations resemble waves on the sea, with its ultimate scarcity of 21 million coins, censorship-resistant transaction mechanism, and global liquidity being the deep seabed. This "core stability" and the Federal Reserve's dot plot showing expectations for two rate cuts, along with the People's Bank of China's liquidity tools, form a cross-temporal dialogue, suggesting that crypto assets are transforming from marginal experiments into stress tests for the mainstream financial system.

Bitcoin could continue to write legends due to loose liquidity or become a safe haven in the event of a hard economic landing. But just like the uncertainty principle in quantum physics, the charm of the crypto market lies in its unpredictability—while Wall Street analysts grope in the fog of stagflation, hash calculations on the blockchain are silently weaving a financial rhapsody of this era at billions of times per second. Perhaps we are all observers and participants in this great experiment.

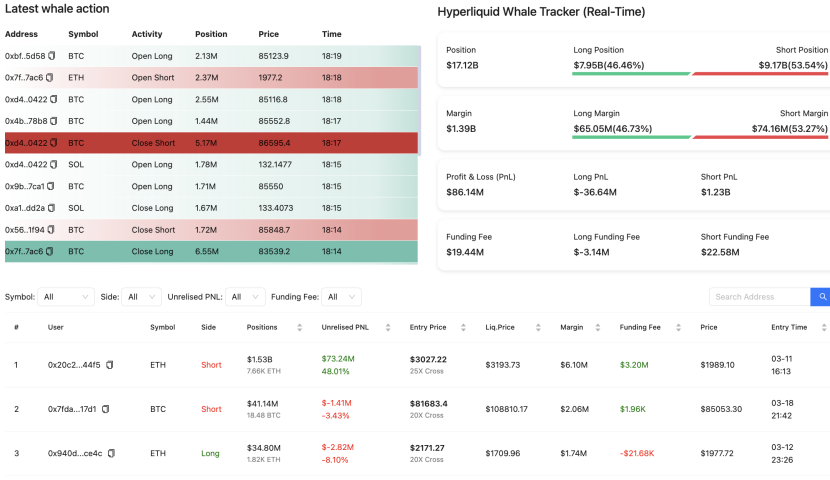

Data Analysis: According to Coinank monitoring data, #Hyperliquid whales engaged in high-frequency trading around the Federal Reserve's interest rate announcement event, operating before 3 AM, profiting on both long and short positions on #BTC, turning a principal of 690,000 USDC into 1,826,000 USDC, yielding a profit of 164%.

We believe that Hyperliquid whales' high-frequency long and short operations during the Federal Reserve's interest rate decision captured the liquidity gaps and volatility expansions before and after the policy announcement, achieving a 164% return on a principal of 690,000 USDC, which is essentially a precise arbitrage of market expectation discrepancies and order book imbalances.

The effectiveness of the strategy is rooted in three advantages: first, the low slippage characteristics of decentralized derivatives platforms reduce the market price impact of large orders by about 40% compared to traditional CEX; second, the implied volatility of BTC surged sharply before and after the interest rate decision (IV jumped from 55% to 82%), creating space for inter-period spread strategies; third, the algorithm-driven instantaneous position switching ability allows for dual-direction profit-taking within 15 minutes, avoiding liquidity withdrawal risks after policy implementation.

In terms of market impact, such high-frequency arbitrage has intensified short-term price volatility but objectively improved market pricing efficiency—whales quickly correct pricing errors (such as mismatches between the dot plot and market expectations), shortening the information digestion cycle. However, this may also squeeze the profit space for retail traders, leading to a "liquidity siphoning effect."

In the future, as AI strategies penetrate on-chain trading, the long and short game around macro events will become increasingly complex. But two major risks must be heeded: first, potential regulatory restrictions on leverage for decentralized platforms; second, chain liquidation cascading triggered by black swan events. The sustainability of such strategies highly depends on the volatility dividends during market inefficiencies, and investors need to seek a balance between risk models and execution speed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。