The original text is from decentralised

Translation|Odaily Planet Daily Golem(@web3_golem)

This article examines the state of venture capital in the crypto industry and expectations for the future. All data comes from Funding Tracker.

Current State of Crypto Venture Capital

Rational market participants might think that capital markets also have their highs and lows, just like other cyclical phenomena in nature. However, crypto venture capital seems more like a one-way waterfall—a continuous gravity experiment falling downward. We may be witnessing the final stage of a frenzy that began with the smart contract and ICO funding boom in 2017, which accelerated during the low-interest era of the COVID-19 pandemic and is now returning to more stable levels.

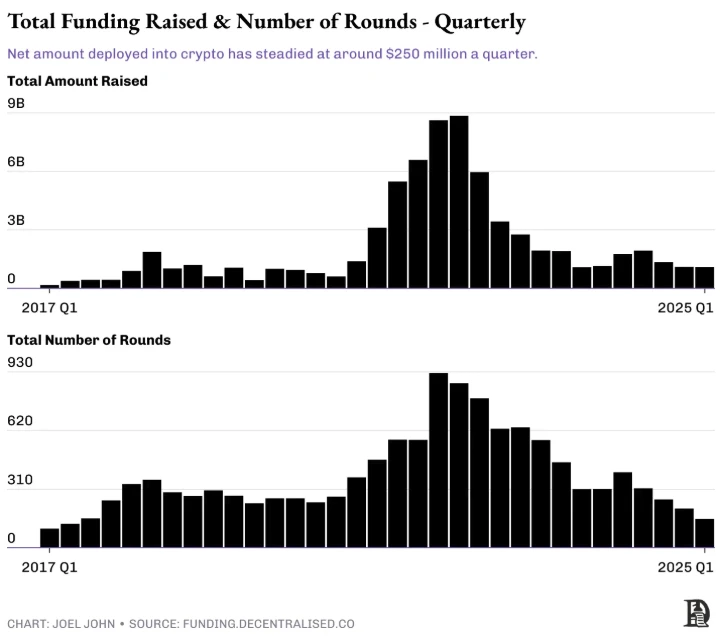

Total Funding and Total Rounds

During the peak in 2022, venture capital in cryptocurrency reached $23 billion, dropping to $6 billion in 2024. There are three reasons for this:

The boom in 2022 led VCs to allocate too much funding to cyclical and highly valued projects. For example, many DeFi and NFT projects failed to deliver returns. OpenSea's peak valuation was $13 billion.

Funds have found it difficult to raise capital again in 2023-2024, and projects listed on exchanges struggle to achieve the valuation premiums seen from 2017 to 2022. The lack of premiums makes it difficult for funds to raise new capital, especially when many investors have not outperformed Bitcoin.

As AI becomes the next focus of technological frontiers, large capital has shifted its allocation priorities. Cryptocurrency has lost the speculative momentum and premiums it once had as the most promising frontier technology.

When examining which startups have developed enough to secure Series C or D funding, another deeper crisis becomes apparent. Many large exits in the crypto industry have come from token listings, but when most token listings are trending negatively, exits for investors become difficult. This comparison becomes evident when considering the number of seed-stage companies continuing to pursue Series A, B, or C funding.

Since 2017, among 7,650 companies that received seed funding, only 1,317 have progressed to Series A (a graduation rate of 17%), only 344 reached Series B, and just 1% entered Series C, with the odds of Series D funding being 1 in 200, comparable to the graduation rates in other industries. However, it is worth noting that many growth-stage companies in the crypto industry bypass traditional follow-on rounds through tokenization, but these data point to two different issues:

Without a healthy token liquidity market, crypto venture capital will stagnate.

Without healthy companies developing to later stages and going public, venture capital preferences will decline.

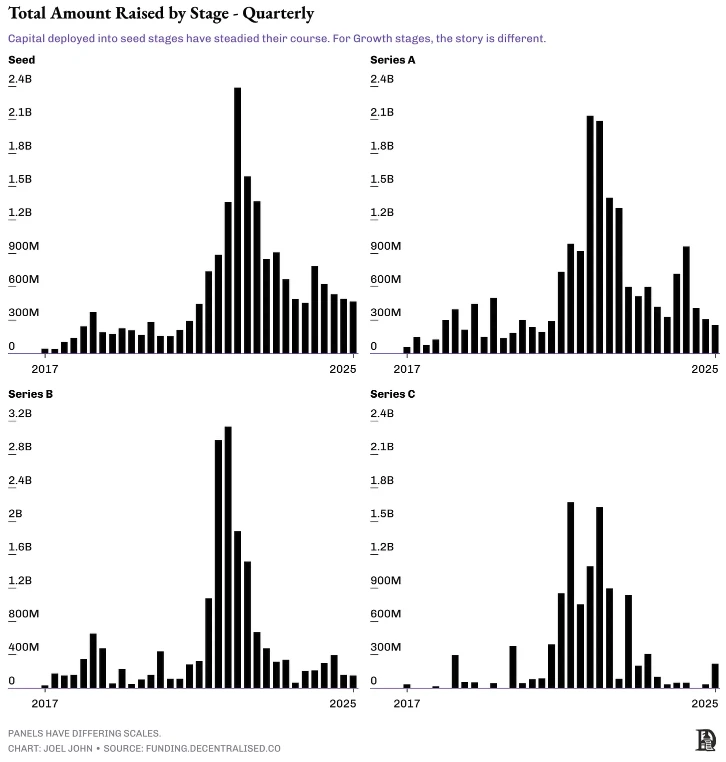

Data from various funding stages seems to reflect the same reality. Although capital entering seed and Series A funding has stabilized, funding for Series B and C remains conservative. Does this mean it is a good time for seed-stage funding? Not entirely.

Total Funding Amounts at Different Stages

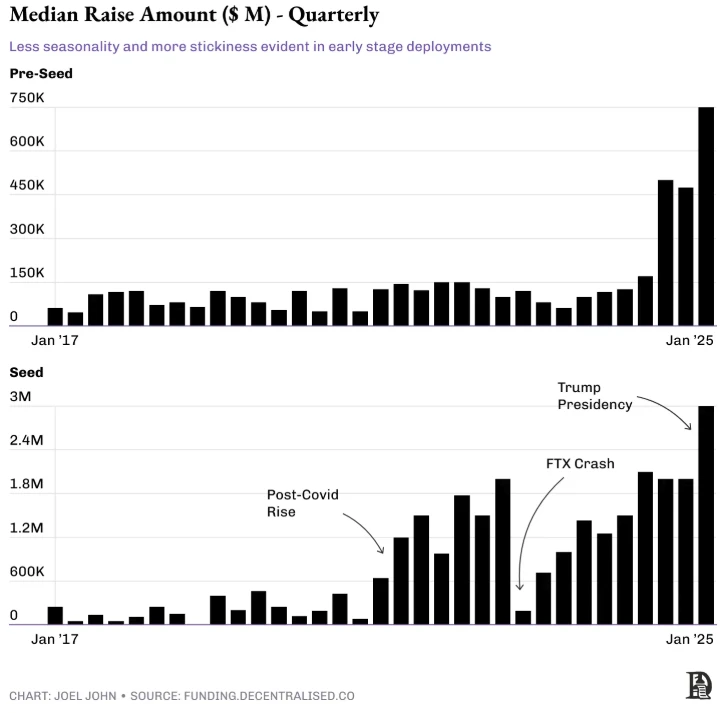

The following data tracks the median funding amounts for Pre-seed and Seed rounds each quarter, which have been steadily increasing over time. Two points are worth noting:

Since the beginning of 2024, the median funding for Pre-seed rounds has significantly increased.

Over the years, the median for Seed round funding has fluctuated with the macro environment.

As demand for early capital decreases, we see companies raising larger Pre-seed and Seed rounds, with the once "friends and family" rounds now being filled earlier by early-stage funds. This pressure has also extended to Seed-stage companies, which have grown since 2022 to compensate for rising labor costs and the longer time to achieve PMF in the crypto industry.

The expansion of fundraising amounts means that companies will have higher (or more diluted) valuations in the early stages, which also means that companies will need higher valuations in the future to provide returns. In the months following Trump's election, Seed round funding data also saw a significant increase. My understanding is that Trump's presidency changed the fundraising environment for GPs (General Partners) in funds, with increased interest from LPs and more traditional allocators, translating into a preference for venture capital in early-stage companies.

Funding Difficulties, Capital Concentrated in a Few Large Companies

What does this mean for founders? There is more capital for early Web3 financing than ever before, but it is pursuing fewer founders, larger scales, and demanding companies to grow faster than in previous cycles.

As traditional sources of liquidity (such as token issuance) are now drying up, founders are spending more time demonstrating their credibility and the potential their businesses can achieve. The days of "50% discount, new round of financing at a high valuation in two weeks" are over. Capital cannot profit from follow-on investments, founders cannot easily secure raises, and employees cannot gain value from their vested tokens.

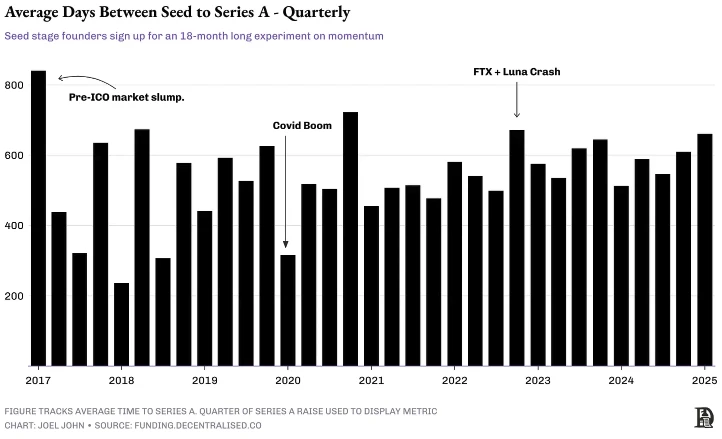

One way to test this argument is through the lens of capital momentum. The following chart measures the average number of days it takes for startups to raise Series A funding since announcing their Seed round. The lower the number, the higher the capital turnover rate. In other words, investors are putting more money into new Seed-stage companies at higher valuations without waiting for the companies to mature.

At the same time, the above chart also shows how public market liquidity affects the private market. One observation is through the perspective of "safety"; whenever there is a pullback in the public market, Series A funding occurs on a large scale, as seen in the sharp decline in Q1 2018, which was repeated in Q1 2020 during the outbreak of COVID-19. When liquidity deployment sounds less optimistic, investors with capital to deploy are incentivized to establish positions in the private market.

But why was the opposite true in Q4 2022 when the FTX collapse occurred? Perhaps it symbolizes the exact point in time when interest in cryptocurrency investment as an asset class was completely eroded. Several large funds lost significant amounts in FTX's $32 billion funding, leading to a decline in interest in the industry. In the following quarters, capital only gathered around a few large companies, and subsequently, most of the capital from LPs flowed into those few large companies, as that was where the most capital could be deployed.

In venture capital, the speed of capital growth outpaces the speed of labor growth. You can invest $1 billion, but you cannot proportionally hire 100 people. Therefore, if you start with a team of 10 people and assume no more hiring, you will be incentivized to secure more investment. This is why we see a large number of late-stage financings for major projects, which are often concentrated on token issuance.

What will the future of crypto venture capital look like?

For six years, I have been tracking this data, and I always reach the same conclusion: raising venture capital will become increasingly difficult. The initial market frenzy easily attracts talent and available capital, but market efficiency dictates that things will become more challenging over time. In 2018, simply being "blockchain" could secure funding, but by 2025, we will begin to focus on project profitability and product-market fit.

The lack of convenient liquidity exit windows means that venture capitalists will have to reassess their views on liquidity and investment. The days of investors expecting liquidity exit opportunities within 18-24 months are long gone. Now, employees must work harder to obtain the same amount of tokens, and these tokens are valued lower. This does not mean there are no profitable companies in the crypto industry; it simply means that, like traditional economies, there will be a few companies that attract the vast majority of economic output in the industry.

If venture capitalists can make venture capital great again—by seeing the nature of founders rather than the tokens they can issue—then the crypto venture capital industry can still move forward. The strategy of signaling in the token market, then hastily issuing tokens and hoping people will buy them on exchanges is no longer viable.

Under such constraints, capital allocators are incentivized to spend more time working with founders who can capture larger shares in an evolving market. The shift from venture capital firms in 2018 only asking "when to issue tokens" to wanting to know how far the market can develop is an education that most capital allocators in web3 must undergo.

However, the question remains: how many founders and investors will persist in seeking the answer to that question?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。