Why do others profit from both long and short positions, while I face losses on both?

Written by: Asher, Odaily Planet Daily

This morning's Federal Reserve interest rate decision was still a good opportunity for short-term traders to open positions. The recently popular "Hyperliquid 50x leverage trading whale" also participated, making frenzied trades during this period, turning 690,000 USDC into 1.826 million USDC through long and short BTC trades in just 3 hours, achieving a profit of 164%.

Odaily Planet Daily will first review the high-energy operations of the "Hyperliquid 50x leverage trading whale" during the early morning.

The "Whale Brother" achieved a perfect record during the Federal Reserve interest rate decision, with a 100% win rate

Before the Federal Reserve interest rate decision: Shorting BTC, profit of $215,000

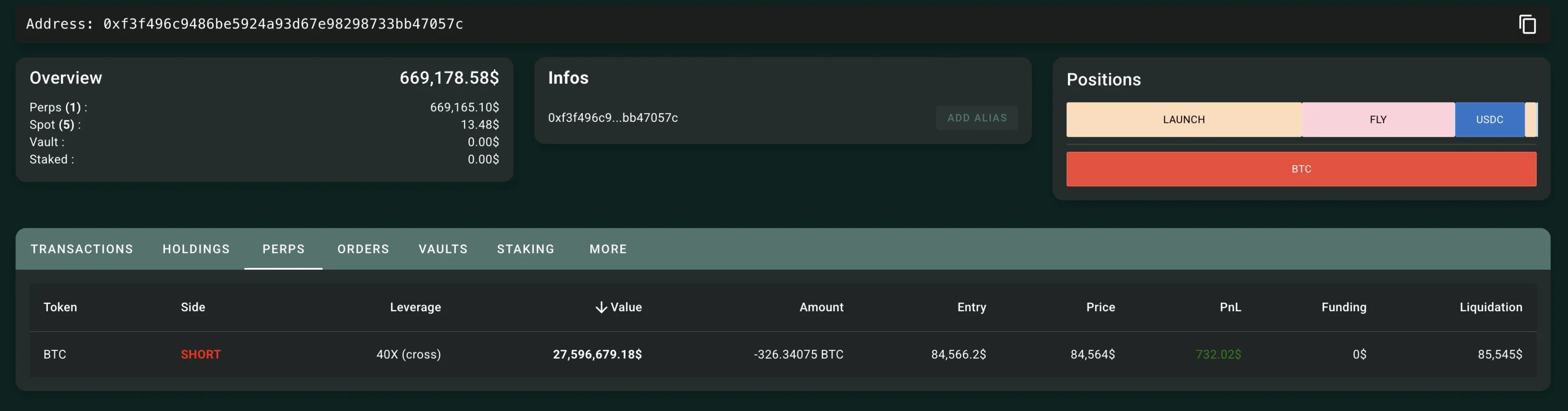

Just after midnight, the "Hyperliquid 50x leverage trading whale" closed his previous long position on MELANIA, earning $87,000, and then opened a short position on BTC, using 690,000 USDC as margin to short 326 BTC (worth about $27.62 million) at an opening price of $84,566, with a liquidation price of $85,545. Then, just before the interest rate decision was announced (around 1:48 AM), he closed the short at a price of $83,927, making a profit of $215,000.

Shorting 326 BTC at $84,566 with 40x leverage

At the time of the Federal Reserve interest rate decision: Shorting BTC again, profit of $250,000

When the interest rate was announced at 2 AM (the federal funds rate target range remained unchanged at 4.25% to 4.50%), the "Hyperliquid 50x leverage trading whale" immediately opened a short position on 256 BTC (worth about $21.6 million) at a price of $84,404 at 2:01 AM, and then quickly closed it 6 minutes later at a price of $83,906, earning $250,000.

After the Federal Reserve interest rate decision: "Profiting from both sides," two trades earning $726,000

Going long on BTC, profit of $620,000: After closing the BTC short position, the "Hyperliquid 50x leverage trading whale" immediately opened a long position on BTC at 2:10 AM, buying 518 BTC (worth about $43.8 million) at a price of $84,500, and then closed it at 2:59 AM at a price of $85,700;

Shorting BTC again, profit of $106,000: After closing the BTC long position, the "Hyperliquid 50x leverage trading whale" immediately opened a short position on BTC at 3 AM, shorting 384 BTC (worth about $32.9 million) at a price of $85,666, and closed it just 2 minutes later at a price of $85,146.

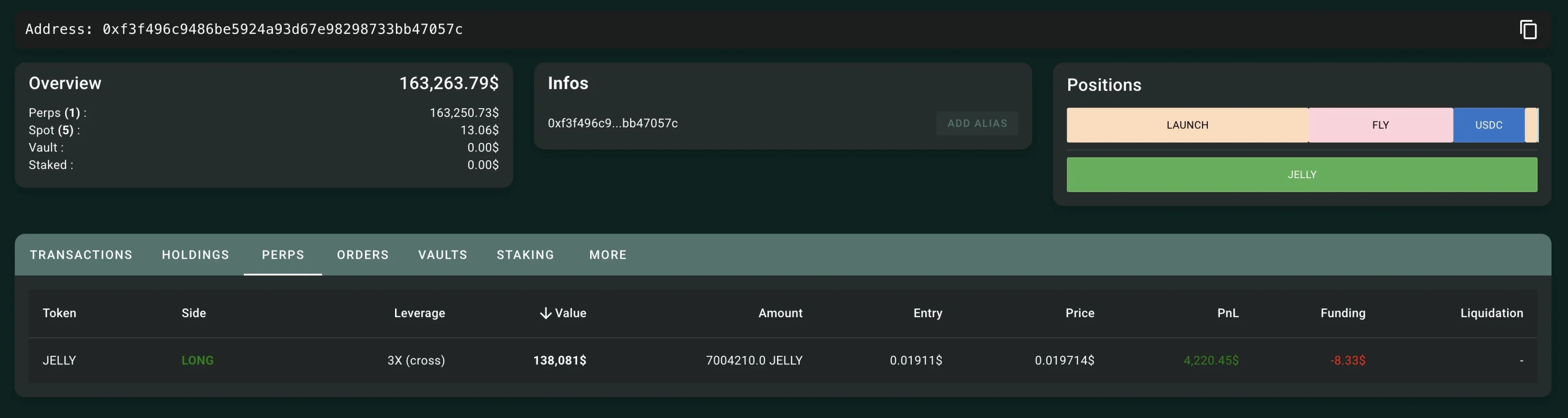

After withdrawing 1.666 million USDC, opened a mini long position on JELLY

At 3 AM, after closing the short position, the "Hyperliquid 50x leverage trading whale" withdrew 1.666 million USDC from the Hyperliquid platform and bought 815 ETH, transferring it to his current main fund storage address (0x51d…921). He then used 46,000 USDC from the remaining 160,000 USDC in Hyperliquid to open a JELLY 3x long ant position.

Opened a JELLY 3x long ant position with 46,000 USDC

This morning, the "Whale Brother's" precise operations around the Federal Reserve interest rate announcement can be considered a textbook example, not only skillfully navigating between long and short positions but even earning applause from the "market makers." Following the last time the "Whale Brother" opened a long position of about $300 million in ETH with 50x leverage, achieving a peak floating profit of over $8 million, he chose to withdraw his principal and most of the profits, actively raising the liquidation price, which ultimately led to a total loss of $3.45 million for HLP (for detailed information, see: Why did the Hyperliquid whale self-destructively close positions? Who bears the millions of dollars in losses?). During this period, apart from a dual long position on LINK that lost $1.27 million, the trades on BTC and ETH continued to "print money." From the current market perspective, short-term trading of BTC and ETH, if one can refer to the "Whale Brother's" strategy, has a considerable probability of profit.

Because of this, this mysterious "Whale Brother" has almost become the focus of the recent market. His seemingly prophetic judgments have led to an astonishing win rate, as if he possesses some insider information. So, who exactly is the "Whale Brother"?

The "Whale Brother" links his personal X account on the DeBank platform, revealing his true identity

"Whale Brother" links personal X account

Just yesterday afternoon, the "Whale Brother" surfaced, changing his account name on the DeBank platform to MELANIA (later renamed to falling), with a personal avatar of the First Lady (suspected to be a signal), and also verified and linked his X account (@qwatio). As of now, his personal X account has reached 11,000 followers.

"Whale Brother" X account information

Whale hunting team fails to target "Whale Brother"

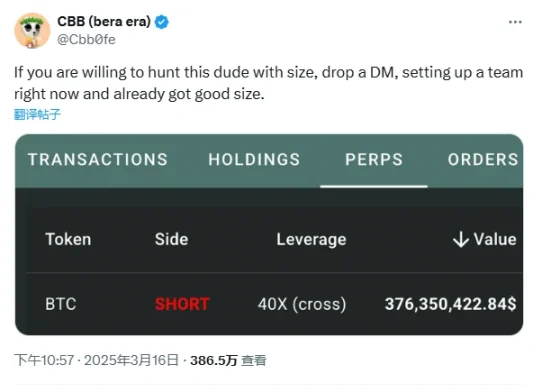

Before the "Whale Brother" revealed his identity, due to the extraordinarily high win rate of his open positions on BTC and ETH, many "whales" became jealous, and some even posted on the X platform to recruit a "whale hunting team," stating: If you are willing to team up with this guy for a big operation, DM me, we are forming a team, and we already have a decent scale.

Post recruiting a "whale hunting team"

At midnight, the sudden surge in BTC seemed to be the work of this "whale hunting team," causing the "Whale Brother's" short position of $6 million in floating profit to be wiped out instantly, even resulting in a loss of $2 million, forcing him to increase his margin by 5 million USDC. However, this hunt still ended in victory for the big player, as the "Whale Brother" ultimately made a profit of $5.101 million after holding for 4 days. The leading KOL CBB (bera era) also posted that although they lost the battle, they hadn't had this much fun in a long time.

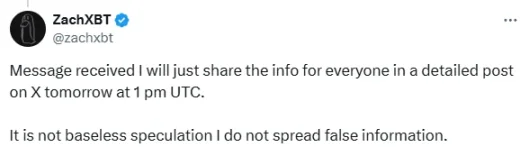

However, shortly after, ZachXBT commented in the thread: "In fact, this is just a cybercriminal gambling with stolen funds." He also stated that he would release more information later and ruled out the possibility of the North Korean hacker group Lazarus Group being involved.

In response to this statement, the "Whale Brother" expressed on the X platform that ZachXBT's accusation (that the Hyperliquid 50x leverage whale is actually a cybercriminal) was disappointing and unexpected, calling it "baseless speculation." He hoped that ZachXBT could at least specify the so-called "stolen funds" and mentioned that their wallet received a large number of transactions from scammers. However, he later deleted all tweets certifying his DeBank account and confronting on-chain detective ZachXBT, and changed his account name from "MELANIA" to "falllling."

ZachXBT: Complete evidence to be released tonight at 9 PM

Shortly after the "Whale Brother" linked his X account, on-chain detective ZachXBT posted on the X platform stating that the X account of the "Hyperliquid 50x leverage whale" was obtained from purchasing from others and that he received $5,000 from a phishing client in January 2025. He also obtained funds from irregular service providers like eXch but insisted that his money was "clean." In response to the "Whale Brother's" tweet, he stated that complete evidence would be released tonight at 9 PM and emphasized that he does not spread false information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。