Source: Cointelegraph Original: "{title}"

Volatility Shares will launch two Solana (SOL) futures exchange-traded funds (ETFs) on March 20, namely the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT).

According to filings submitted to the U.S. Securities and Exchange Commission (SEC), the management fee for SOLZ will be 0.95% until June 30, 2026, after which the management fee will increase to 1.15%.

SOLT offers investors two times leverage, with a management fee of 1.85%.

Filings for the Volatility Shares Solana ETF submitted to the SEC. Source: SEC

These filings mark the birth of the first Solana-based ETFs in the U.S., following the launch of Solana futures contracts by the Chicago Mercantile Exchange (CME) Group.

After a leadership change at the SEC and Donald Trump's re-election as President of the United States, asset management firms and ETF companies have submitted a large number of ETF applications to the SEC seeking approval.

Chicago Mercantile Exchange Group launches Solana futures

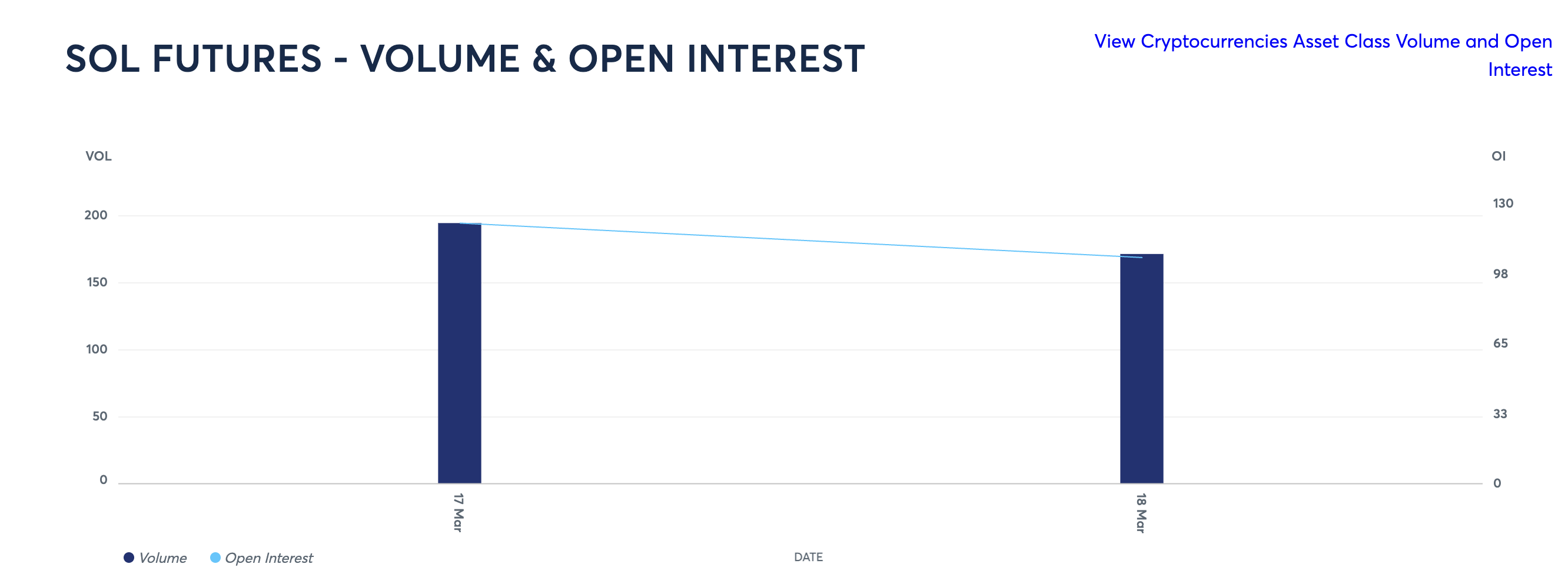

Solana futures went live on March 17, with a first-day trading volume of approximately $12.1 million.

For reference, Bitcoin (BTC) futures had a trading volume of over $102 million on their first day, while Ethereum (ETH) futures exceeded $30 million on their launch day.

Despite the relatively low trading volume, Solana futures contracts help enhance institutional investor demand for this cryptocurrency and facilitate price discovery.

Solana futures trading volume and open interest. Source: Chicago Mercantile Exchange

The launch of Solana futures marks the recognition of Solana ETFs in the U.S., as financial regulators begin to embrace digital assets amid a policy shift.

Chris Chung, founder of the Titan trading platform, stated that the futures contracts from the Chicago Mercantile Exchange indicate that Solana has now become a mature asset capable of attracting institutional investor attention.

Chung added that the launch of Solana futures and ETFs positions Solana as a blockchain network likely to be applied in real-world scenarios such as payments, rather than just a venue for speculative meme coins.

ETFs may also attract investor funds into Solana, driving this altcoin's continued rise, while competing coins without related ETFs may miss this opportunity.

There is a general belief that the launch of Bitcoin ETFs in 2024 has directed institutional funds toward Bitcoin, isolating it from other parts of the cryptocurrency market and hindering the flow of funds from Bitcoin to altcoins, thus breaking the emergence of altcoin season.

Related: Solana CME futures trading volume reaches $12.1 million: Poor launch performance, or is there another strategy?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。