Without long-term concerns, there will surely be short-term worries. The same applies to market trends; the rise and fall of the market are not determined by personal subjective will, but are filled with battles between bulls and bears. Therefore, choosing is far more important than effort. Selecting a good mentor will yield great benefits. If you are still trading blindly, every day either stuck in positions or locking them, then by 2025, you should change!

After the interest rate decision and Powell's speech in the early morning, the market reacted as we expected, first showing a rebound. Yesterday, we specifically mentioned that as long as the interest rate decision aligns with market expectations, there would be an initial rebound. The result was evident, with the market rebounding to around 87450. I was also surprised; yesterday, due to the impact of the interest rate decision, I specifically chose to place a limit order at 87500. The rebound came just shy of filling my order. If I had been monitoring the market in real-time, I might have entered above 87000. It seems some friends also entered yesterday, but not many. However, I did some short-term trades last night, and friends in the group should have seen the shares in the Moments. It was okay. Still, I operated cautiously due to the news-driven market, placing limit orders at lower points. Now that the market has returned to normal operations, I will look to grasp better trading opportunities.

Though dreams are distant, the heart is undaunted; steadfast action will eventually lead to success!

Now, let's talk about the early morning interest rate decision. To summarize the key points: In March, the interest rate remains unchanged at 4.25%-4.5%, with a significant downward revision of this year's economic growth forecast by 0.4 percentage points and an upward adjustment of inflation expectations. The dot plot indicates that there will be two rate cuts this year, higher than the market's original expectation of one. The amount of balance sheet reduction has decreased from 25 billion USD to 5 billion USD, with a possibility of stopping the reduction in 2025, which adds some liquidity to the financial market. Coupled with Powell's subsequent speech, which leaned towards dovish remarks, overall, it can be considered a certain benefit, but not overly significant.

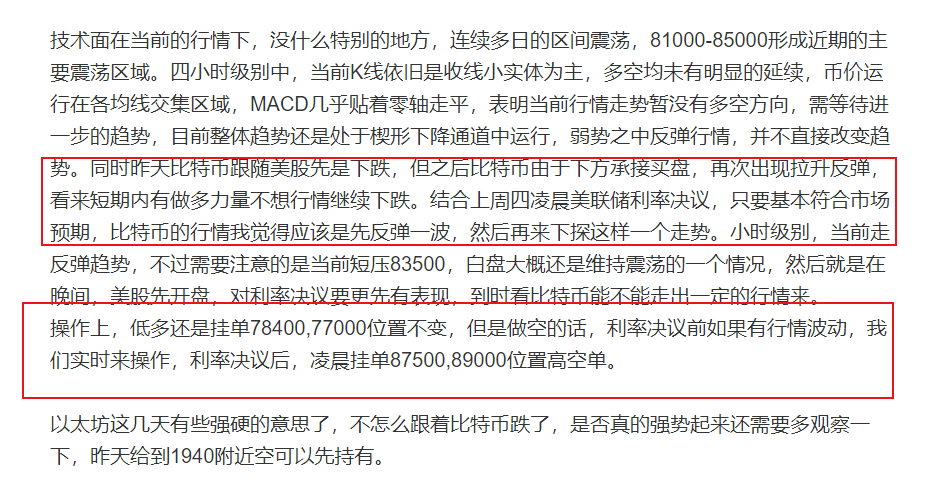

From a technical perspective, the market has broken through the previous consolidation area. The four-hour K-line has continuously closed in the green, supporting a steady upward movement. Currently, after the market has risen to a high, the previous period's K-line closed in the red, indicating a beginning of a retracement process. Although the market has risen due to news stimuli, there are two points to note. The first is that while the market price has rebounded significantly, the actual bullish volume is not substantial, and the recent daily net inflow of ETFs is also insufficient. This means that when the volume does not match the upward momentum, it is most likely to result in a high-to-low reversal. The second point is that before the early morning rise, from the distribution of chips, the bearish chips were mainly concentrated at the 85000 and 87000 levels, and the morning rise just happened to reach above 87000, which seems to intentionally target the liquidation of short positions.

In terms of technical indicators, while the price has risen, it is still operating within a descending wedge structure and is under pressure from above. The MACD is currently in a bullish cycle, but due to the impact of the pullback after the high, the volume bars have somewhat contracted, with short-term support near the previous consolidation area around 83500.

In terms of operations, I was unable to fill my short order at 87500 yesterday. Today, I will still adopt a strategy of shorting first and then going long. I will short near 86200 and add to my position around 87200, with a stop loss at 88000. The first target is to look for support at 83500. If the bearish trend continues, I will look at 81500, and I will still place long orders at 81000 and 79000.

Ethereum showed strength yesterday and led the market with its initial rise, but whether this momentum can be sustained is still uncertain. After being weak for so long, it’s a bit challenging to suddenly strengthen. It’s better to observe first and refrain from trading Ethereum for now.

As for the altcoin market, it can only be said that the secondary market has not shown much improvement. On-chain, the situation is somewhat chaotic. BSC has felt a bit explosive due to a series of recent operations, but the risks on-chain cannot be ignored. If one can adapt to these risks, it might be worth trying. Another point is that "Sun" has also come onto the chain to stir things up. There’s a saying in the crypto circle: as long as Sun enters the market, the market will surely fall, earning him the title of market terminator, which deserves some respect.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。