Author: @BlazingKevin_, the Researcher at BlockBooster

CEX faces a consensus shift in user confidence after the listing of new coins. Although one or two projects may rise against the trend, most projects cannot escape the gravitational pull of a one-sided downward trend. Once this consensus continues to strengthen, gradually shifting from two to three months into a complete bull-bear cycle collective consensus, the user retention rate and user growth rate of CEX may suffer severe blows.

The core contradiction lies in the pricing divergence between users and project parties. Project parties need to recover early costs from retail investors, while a large proportion of VC lock-ups leads to high FDV at launch becoming the norm. The combination of these factors inevitably results in TGE prices exceeding retail investors' psychological expectations.

The strategy of high FDV and low MC was acceptable in previous bull-bear cycles because the "Buy and Hold" consensus ultimately rewarded diamond hands. However, this consensus began to weaken after BTC's ETF approval and was completely destroyed by the Memecoin frenzy over the past year. BTC is deeply tied to the US stock market, becoming a reservoir of dollar assets, and has decoupled from the four-year cycle; the trifecta of Zoo, Agent, and celebrity coins has propelled Memecoins to the altar and then caused them to plummet at lightning speed. Retail investors can no longer adapt to the market-making cycle of VC coins. The market has undergone earth-shattering changes, yet VC coins remain oblivious, riding the death train of inertia. The death spiral is caused by the following three points:

Due to the large lock-up of VC and team shares, only a small portion can circulate early on. The excessively high FDV makes retail investors, who are accustomed to Memecoin valuation methods, extremely uncomfortable.

For this small circulating volume, project parties are still unwilling to let go, secretly recovering a large number of chips through airdrops and ecological incentives. Retail investors have a very poor profit experience from airdrops, leading to a gloomy and pessimistic community atmosphere before the token launch.

Since their shares are locked, they can only recover early costs by dumping chips from the small circulating volume, thus ignoring market sentiment and choosing to open high.

The essence of the death spiral is the lack of long-termism, the complete collapse of the "Buy and Hold" consensus on altcoins. Once the price breaks through key support levels, it will plummet like mercury, and new coins launched do not have support levels; the psychological support level that exists in disguise is the valuation and pricing expectations of the project. For a project with an expected valuation of only 10M, pricing it at 1B results in a situation where the funding cost reaches -2% after opening, and no miracles will occur before reaching expectations. Poor price performance will cause the price to continue to fall even after dropping to 10M. Such projects are increasing, and even if some exceptions occur due to reflexivity midway, the win rate of shorting VC coins at launch may still far exceed 50%. When long-termism disappears, and the prosperity brought by short-termism is muddied by unregulated interest groups, when the bubble bursts, only the people will leave and the tea will cool.

Compared to other industries, crypto is still in its early stages, but the pessimism among practitioners is akin to Ragnarok, as short-termism does not bring faith and value but rather accelerates the depletion of the industry's vitality. Therefore, starting now, we need to return to long-termism.

Myshell Encounters Resistance in Long-Term Pricing Strategy

Returning to the initial point of the article, when VC coins are frustrated, the most hurt are CEXs. Binance took the lead in self-rescue, conducting some experiments on Myshell. Regardless of the outcome, this is a signal that the leading exchange has chosen to change. This experiment maintained good momentum before February 27 but took a sharp turn downward after the listing on Binance. Below is a review of key time points and corresponding market sentiments from the airdrop snapshot on February 12 to the listing on Binance on February 27.

Two Market Sentiment Reversals

Myshell's market sentiment experienced three stages before the Binance listing: airdrop, IDO, and Binance listing. In these three stages, retail investor sentiment underwent drastic changes. First, after the airdrop snapshot was announced, retail investors felt that the airdrop ratio was too low and the number of tokens too few. A massive 30% was allocated to community incentives, but there was no clear indication of the total number of airdrop addresses or the proportion allocated to users or ecological projects, leaving significant room for manipulation. At this point, the market held a negative attitude towards Myshell.

However, during the IDO phase, Myshell achieved a reversal in market sentiment. The pricing divergence is what we consider the core contradiction between retail investors and project parties. Myshell allocated 4% of the total supply to the IDO, benefiting Binance wallet users. The corresponding FDV of only 20 million naturally garnered over 100 times the oversubscription. Retail investor FUD sentiment weakened, but due to the current cycle's shift in consensus regarding project airdrops—distrust—many retail investors remained bearish, leading to the majority of airdrop addresses choosing to sell at TGE. The increase in on-chain holding addresses indicates that over 50% of airdrop addresses opted to sell immediately.

On the day of TGE, according to the $SHELL pool data on dexscreener BSC, the price peaked at $1.64 in the first hour after the TGE on the 13th, with a trading volume of $3.2 million and a circulating market cap of $420 million; the price fell to a maximum of $0.9 in the second hour, with a trading volume of $17 million and a circulating market cap of $240 million. The closing price on the 13th was $0.37, with a circulating market cap of $100 million.

Between the 13th and the 27th, the price maintained between $0.36 and $0.6, corresponding to a market cap of $100 million to $160 million. During this period, $SHELL found support at the low point, showing a trend of rising on reduced volume. The chips sold by airdrop addresses were absorbed by top holding addresses, further increasing chip concentration.

Excessive and Concentrated Expectations Invite Wash Trading

Before listing on Binance, Myshell received positive market evaluations, and the project's market sentiment was relatively optimistic. At the same time, the low opening on-chain and the follow-up of Binance contracts likely washed out a large number of indecisive profit-taking positions, allowing market makers to recover a significant amount of airdrop chips. With a low price before listing and concentrated chips, the conditions for a price surge were inherently present. However, when combined with expectations like "Myshell is the new AI leader on BSC," "Binance investment," and "secondary listing," the low opening became the biggest weakness. The influx of wash trading after TGE became the most steadfast holders before the listing, laying the groundwork for a one-sided market after the listing. The combination of wash trading and market maker dumping completely destroyed Myshell's efforts in benefiting from the IDO.

This is the pain that Myshell and more future VC coins will face when returning to value and practicing long-termism, allowing the roadmap and product to support market capitalization. Wash trading, which has existed since the birth of crypto, has become rampant due to the nourishment of short-termism. When a project has strong expectations, whether it opens low or high, it is trading around those expectations; once those expectations materialize, it will crash.

Balancing Expectations with the Roadmap is Myshell's Current Task

Opening low to benefit users and activating the community is a reasonable direction, but it requires a balanced allocation between expectations and the actual roadmap. Attracting users through expectations, and once those expectations materialize, the fundamentals of the product can help establish a bottom. The price management range of the token should revolve around the reasonable expected maximum market cap and the actual product's minimum market cap.

Project parties returning to long-termism cannot rely solely on IDO benefits to gain market trust; this is just the first step. In the future, attention should also be paid to the transparency conflict between project parties and VCs. Once project parties launch tokens through IDOs, they should no longer rely on listings, which can resolve the transparency conflict between both parties. The on-chain token unlocking process becomes more transparent, ensuring that past conflicts of interest are effectively resolved. On the other hand, traditional CEXs face the dilemma of frequent price crashes after token issuance, leading to a gradual decline in trading volume. Through the transparency of on-chain data, exchanges and market participants can more accurately assess the true situation of projects.

On-chain project parties that open low must be prepared for a period of being unable to list; otherwise, they may easily encounter the wash trading dilemma faced by Myshell. Only by winning the trust of users and the market on-chain can the token price embark on a positive spiral.

Kaito's Middle Way Aligns with the Transition Period of Industry Change

Kaito's airdrop distribution continues the "unwritten rules" of VC coins: reducing the allocation for top users while increasing the number of eligible users, i.e., long-tail distribution. According to the personal weight algorithm, 1 Yap can be exchanged for 5-20 $KAITO, with Ecosystem yappers, Partners, and Yappers sharing 96 million $KAITO, but the detailed proportions have not been disclosed. This strategy allows project parties to maximize the concealment and recovery of chips during the airdrop, and due to the large number of airdrop addresses, the selling pressure at launch is significantly alleviated—compared to concentrated airdrops to top KOLs. Pricing at the 1B point, where both bulls and bears are hesitant, facilitates a smooth turnover of floating chips.

Splitting the Market Becomes the Cornerstone of the Flywheel

Secondly, Kaito designed a positive spiral around NFTs, Yaps, and skaito in the early stages, utilizing the characteristics of market splitting to constrain token prices when necessary. Kaito NFTs saw a continuous price increase before the airdrop snapshot, peaking at 11 ETH, about $30,000. After the snapshot, the price fell, and at TGE, it was valued at $5,800, with the current floor price gradually rising to 2.5 ETH. Each NFT received 2,620 $KAITO, approximately $4,700 (with an average price of $1.8 on February 21), totaling nearly 4 million $KAITO for 1,500 Kaito NFTs.

The weight of sKAITO is positively correlated with the number of staked tokens, staking duration, and voting activity over seven days, while negatively correlated with the voting weight of Yappers and NFT holders.

Source: Kaito

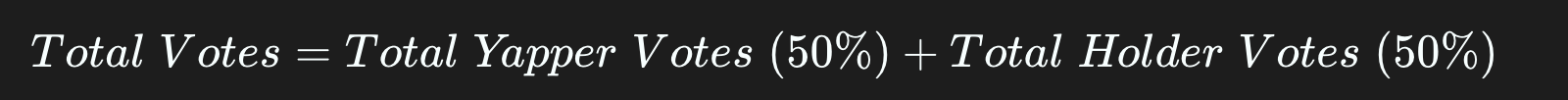

Voting weight consists of Yappers (50%) + Holders sKaito, NFT.

1 Genesis NFT ≈ 45,980

1 sKAITO ≈ 11.79

Each NFT's voting power = 3,900 $KAITO

The voting power of NFTs and sKAITO dynamically changes, depending on the relationship between the total market value of NFTs and the total market value of sKAITO, with voting power gradually leaning towards the side with a higher market value.

Simple calculations show that holding NFTs is cheaper than using sKAITO.

By staking Kaito tokens, users can gain voting rights for governance and project decisions. Currently, each Kaito NFT provides 45,980 voting rights, with each NFT's voting power equivalent to 3,935 $KAITO.

The arbitrage space between NFTs, Yaps, and skaito allows Kaito's price to be somewhat regulated by the market value of NFTs.

Choosing a Growth Method Suitable for Its Own Track is More Critical

In terms of pricing strategy, Kaito's choice is neither good nor bad, which is understandable. Returning to long-termism and allowing products to support market capitalization is a more arduous journey than ever before. Kaito's approach is to achieve a stable return of current market capitalization to product strength through continuous long-term value output.

After the phased collapse of Memecoins, Kaito tends to take over the market attention distribution leadership, competing for Mindshare within a single timeframe. Mindshare is actually disseminated by KOLs, who work for Kaito, and Kaito pays them in yaps. As the importance of Mindshare increases, more and more project parties will join Kaito and pay fees. The continuous increase of KOLs, users, and project parties forms the basis of Kaito's positive spiral, and the success of this spiral depends on the degree of market penetration of Mindshare.

Observing the market acceptance of Mindshare is relatively difficult. Therefore, Kaito provides tools like the Yapper Launchpad, which serves as a product for toc and an evaluation metric for tob. In general, the higher the market value of NFTs and the higher the sKAITO staking rate, the greater Kaito's market share. Correspondingly, yaps will also rise, attracting more KOLs to join.

Summary

Whether project parties choose to lead the transformation like Myshell, adopt a community + VC dual-driven token issuance model, or, like Kaito, recognize their track positioning and achieve value return through continuous long-term value output, both are signs of the industry's innovation moving towards long-termism.

Returning to long-termism is akin to transitioning from luxury to frugality; this is difficult for an unregulated industry. Even more challenging is that valuable innovations in Crypto seem to be limited to DeFi, while long-termism in sectors like NFTs, GameFi, and the Metaverse has provided users with very poor experiences. Thus, facing the "wolf" of long-termism's complete failure in the past and the "tiger" of short-termism's rapid throughput, returning to long-termism now is an anti-human path, but it may be the only way to survive. If you distrust all narratives and harbor hostility towards any technology, then this industry may not allow you to continue growing.

We need to wait, patiently wait, for the moment of qualitative change that belongs to Crypto, which may be initiated by AI Agents or other sectors. However, before that, we need to adhere to long-termism, and in this process, burst the long-standing abscess, adapting to and facing the pain generated by the return to long-termism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。