FOMC Meeting Keeps Rates Unchanged: Boosting Crypto Market Sentiment

US Fed Keeps Interest Rates Unchanged

The US Federal Reserve has kept interest rates between 4.25% and 4.5% after the March FOMC meeting. This decision was expected, with CME data showing a 98% chance of no change.

Stable rates are usually not good for crypto. However, the FOMC meeting announced it will slow its balance sheet runoff starting April 1. This could lead to more money in the markets through quantitative easing (QE). For Bitcoin and other cryptocurrencies, this is a good sign. More money could flow into digital assets, helping prices rise.

This is good news for the crypto market, as increased liquidity often boosts investor confidence and demand. More money could flow into these markets. LSEG estimates show that US interest rate futures expect a 56-point cut this year after the Fed kept rates the same. However, the US Fed warned that the economy is becoming more uncertain. Four Fed officials believe there will be no rate cuts in 2025, which is bearish for the crypto market.

Despite the decision, investors are still trying to understand whether the US Central Bank is leaning towards hawkish or dovish policies. Many will be closely watching Fed Chair Jerome Powell’s speech for hints on the future path of interest Charges.

Bitcoin Surges to $87K After FOMC Meeting Holds Rates Steady

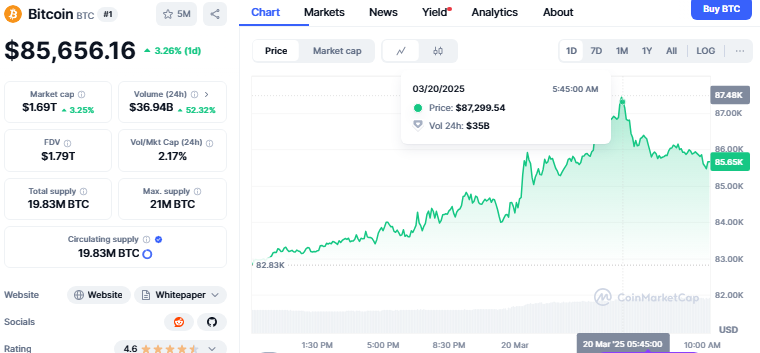

Bitcoin's price soared to $87,000 after the US FOMC meeting decided to keep interest Charges between 4.25% and 4.5%. Despite keeping interest rates unchanged, traders remain bullish on BTC. Market sentiment suggests confidence in further price gains.

Crypto analyst Titan of Crypto pointed out that Bitcoin is forming a bullish pattern. He noted that a right-angled descending broadening wedge is appearing on BTC’s daily chart, which could signal further gains.

Bitcoin is currently trading at $85,656.16 and has experienced a 3.28% daily increase in value. However, data shows that it has had a 2.6% weekly gain in value. The slight recovery in Bitcoin shows that the bulls could be building the momentum for a rebound above the $95,000 mark.

Effect of FOMC Meeting on Altcoins

The recent FOMC meeting affected major altcoins like Ethereum and XRP. While traders reduced derivatives' activity, both tokens showed signs of stability and possible recovery.

Ethereum’s price rose 5% to $2,020.16. Analysts predict it could reach $4,000 in a highly bullish scenario. On-chain data shows a drop in exchange reserves, suggesting whales are accumulating ETH in cold wallets. This could support further price growth.

XRP traders have reduced derivatives activity, but data shows an increase in active addresses. The XRP price is forecasted to rise 8%, testing resistance at $2.56. The Relative Strength Index (RSI) is trending upwards, supporting a potential price increase.

What’s Next?

Traders are watching the upcoming FOMC minutes and Fed Chair Jerome Powell’s comments. These will give clues about future interest rate decisions.

Bitcoin has responded well to the charges stable. The chance of two rate cuts in 2025 could push prices higher. Market optimism remains strong.

While keeping rates unchanged, the Fed announced plans to slow its quantitative tightening (QT). The monthly Treasury securities redemption cap will drop from $25 billion to $5 billion.

If economic conditions remain favorable, the crypto rally could continue. Traders will closely monitor market trends for the next big move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。