Long Tail is not Ending.

Written by: Zuo Ye

VC is indeed dead; Web2 venture capitalists are unwilling to take risks, only following government industrial guidance funds for co-investment. Web3 seed rounds are praised but not profitable, and VC and FA are further merging, with a consensus forming around starting businesses aimed at Binance. All insights and memos have turned into info to exchange for yap.

From an overall perspective, more and more large VCs are starting to enter projects by issuing tokens, using secondary methods to build primary dreams. This is different from early equity investments, initial token offerings (IXO), and dual stock/token models. The market is rapidly maturing, but it requires further sacrifices from small VCs.

After CZ's return, with an investment-oriented approach, education as a slogan, and tweeting as the essence, he is all in on BNB Chain Meme as the main business. Binance Labs was renamed YZi Labs on January 23, giving it an increasingly family office feel.

The rejection of risk and preference for investment stability is not just about investing in later stages or mature projects; it also reflects the increasingly dull exploratory nature of projects. Taking YZi Labs as an example, we can observe the investment style of turning new money into old money, learning in advance from those who have made money and changed their style.

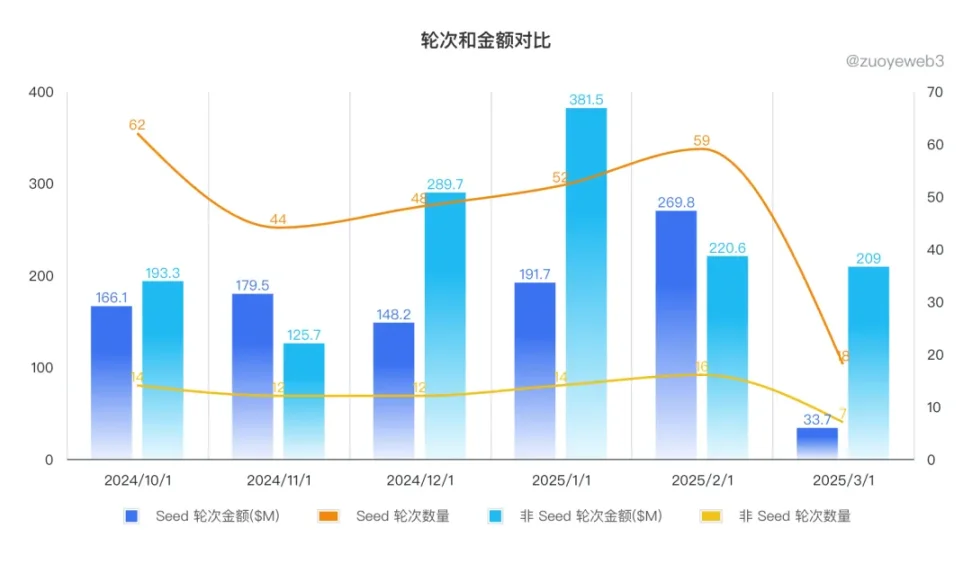

Data source: Decentralised Co., Illustration: @zuoyeweb3

Under normal circumstances, there should be a large number of seed rounds, with subsequent rounds having larger amounts.

However, looking at the data from the past six months, the number of seed rounds compared to A/B/C rounds is not only not overwhelming but also the amounts involved are very close. The disappearance of crypto rounds has become a reality; those who can secure small amounts will continue to do so, while those who cannot will remain empty-handed.

Investing in AI during the cold season, speculating on Meme during the on-chain season

Whether in Web2 or Web3, AI is currently a bit cold, but CZ feels it’s not enough and hopes it can cool down a bit more before taking action, leaving only the true builders and the most devout followers.

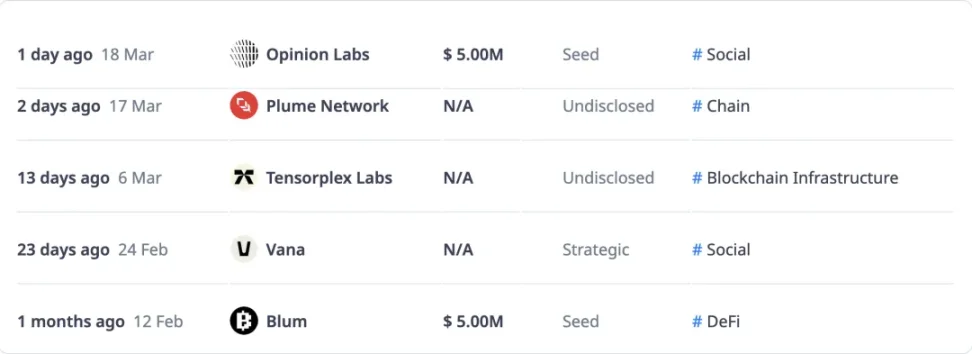

Image description: YZi investment targets, image source: CryptoRank

However, YZi's direction does indeed involve AI. In fact, most projects can relate to AI, thus they can be divided into "using crypto to do AI," such as Vana and Tensorplex Labs, and "using AI to do crypto," such as Plume Network, Blum, and Opinion Labs.

Of course, this is just a forced categorization and has no guiding significance. In the era of AI-assisted postpartum care for sows, there is no need to get tangled up in how necessary AI really is.

Let’s review the characteristics of each project in chronological order.

1. Opinion Labs = Kaito + Polymarket

Opinion Labs is a so-called human opinion-driven prediction market. I boldly speculate that its future direction will be based on predictions and trades from Twitter KOLs, leveraging the InfoFi concept above and the enduring trading attributes below, allowing for both offensive and defensive strategies.

2. Plume Network = Everything can be RWA

RWA is not a new concept, but Plume Network has a very legendary journey. It secured $30 million in funding from top institutions like Galaxy, and surprisingly chose Gate for its IEO this January, before receiving investment from YZi, which caused its token price to rise.

Calm and flexible is the style of dealing with matters in the crypto circle after being polished, seizing the opportunity of the era by issuing tokens early and securing follow-up financing.

3. Tensorplex Labs = LSD + AI

First, I believe decentralized AI is a pseudo-concept. Tensorplex Labs aims to use LSDfi to ensure the decentralization of LLM training and datasets, which has no productive significance. However, in the crypto space's eagerness to do something for AI, it is not uncommon to secure funding from within the circle.

This is significant for future token prices; after all, products are products, and token prices are token prices. Otherwise, ADA and XRP would be deeply ashamed.

4. Vana = AI concept coin that transcends cycles

Securing funding from Polychain in 2021, Paradigm in 2022, Coinbase in 2024, and YZi Labs in 2025, it has successfully landed on Binance Launchpool.

A very typical VC coin from the last cycle, it has no reference significance for current and future projects; one can only say it’s enviable.

5. Blum = The only seed player + trading

This is the most typical investment style of Binance Labs, a trading-oriented DeFi product, and it is a rare seed round player. The most surprising thing is that OKX and YZi jointly invested, akin to brothers weathering storms together, joining forces to go overseas without splitting up.

Please forgive me for not providing much detail on the project mechanisms and token economics, as it holds little significance. What is the fundamental aspect of Meme, what distinguishes a community from a speculative group, and what role does token economics play? I refer to these as the three great unsolved mysteries of the crypto circle.

Embracing family office aesthetics, stability outweighs everything

YZi is quite typical, and the domestic audience is relatively familiar with it. However, after the wealth creation wave from 2017 to 2021, Crypto New Money has gradually transformed into family offices, which are old-fashioned funding institutions that do not seek extremely high returns but care more about project stability.

Two years before CZ, the original contract king, Arthur Hayes, founded his family office Maelstrom, with funds coming from Arthur personally. Similar to CZ recalling Ella Zhang, Maelstrom is operated daily by former BitMEX executive Akshat Vaidya.

It has been proven that Arthur Hayes can develop perpetual contract products more suitable for the crypto market's unique characteristics, and his investment aesthetics are also distinctive, such as the stablecoin Ethena in the post-UST era, which officially initiated the first step of on-chain products countering exchange fees, as well as the cross-era DeFi product Pendle.

A complete story about Arthur Hayes will be presented later; he is an OG worth learning from, even more so than Sun and CZ.

However, similar to YZi, Maelstrom also pursues stability, such as not investing in Meme but rather in Meme-related tools and infrastructure, like Time.Fun, emphasizing that success is not measured by ROI, but by adhering to a stable style.

Yet, YZi's style is far from fixed. In Binance Labs' past achievements, guaranteeing a spot on Binance's main site is an attractive barrier, but now the landlord's family has no surplus grain. By the end of 2024, it has already begun to shift the tokens of invested projects to Gate, ultimately leaving Gate to bear it all.

Unlike Arthur Hayes, who can serve as the spokesperson for Ethena, CZ has not yet deeply bound himself to any project, and YZi has not formed its own investment aesthetic. As mentioned earlier, Binance Labs is very fond of investing in trading-related products, but in the post-DeFi profit era, Ethena and Pendle will only be a minority, while most will be crypto + AI token-selling projects. The scraps of Web2 AI and the small pride of Web3 AI.

As it increasingly distances itself from the Binance ecosystem, YZi's true strength still needs to be tested by the market, which especially tests CZ's personal investment level. From its AI not yet cooling down, to the development of the BNB Chain Meme ecosystem after $TRUMP, I personally feel it is not as exquisite as guiding Ben Zhou to refuse user withdrawals and precisely seize the market share of OKX DEX.

However, this may also be related to CZ's genuine focus on trading platforms rather than trading itself.

Conclusion

The world of yesterday is gone forever.

Crypto venture capital truly set sail from the IXO era, reaching its peak before the collapse of FTX (I always have to mention SBF, who really changed the industry trend single-handedly), and now it is merely completing the finishing processes of established investment projects, enduring the scolding of retail investors, and striving to issue all tokens.

There was never any crypto VC in the world; as investments increased, so did the risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。