Today, EOS has been renamed to Vaulta.

The once-celebrated public blockchain, which raised funds for an entire year seven years ago and was regarded as one of the earliest "Ethereum killers," has finally given up on its dream of achieving a million TPS and announced a shift towards Web3 banking services. The grand ambition of raising $4.2 billion, the excitement of campaigning for 21 supernodes, and the utopian declaration of a million TPS—these fragments piece together the most expensive idealistic experiment in blockchain history.

Seven years later, apart from the old investors, no one mentions this "ancient public chain," which now ranks 97th in market capitalization. In the days to come, EOS will no longer be a high-performance public chain but will reinvent itself, attempting to pivot towards Web3 banking services—it has abandoned its former dreams, even relinquishing its name.

Let us use this article to document the craziest product of the ICO era, which burned so much money and left behind a poignant story.

A Tower of Babel Built with Code and Dollars

In 2017, the blockchain industry was in the midst of its most frenzied rise. Bitcoin broke the $1,000 mark at the beginning of the year and soared to $20,000 by the end of the year. Ethereum's smart contracts completely transformed the crypto world, and ICOs (Initial Coin Offerings) became the hottest fundraising method, with hundreds of projects flooding the market, all vying to build a "decentralized future."

Amid this capital frenzy, EOS emerged under the banner of "Blockchain 3.0," holding high the flag of "replacing Ethereum." Its white paper depicted an ideal nation: a million TPS (transactions per second), completely solving the scalability issues of Bitcoin and Ethereum; zero transaction fees, allowing ordinary users to avoid expensive gas fees, with on-chain transactions as smooth as cloud applications; ultra-fast block production, with 21 supernodes responsible for packaging transactions, no longer hindered by miner competition; a blockchain supercomputer, making decentralized applications (DApps) a reality.

Founder BM (Dan Larimer) was the biggest draw of EOS. To the tech crowd, he was a genius—having suggested to Satoshi Nakamoto to change the consensus mechanism just a year after Bitcoin's birth, believing that PoW (Proof of Work) was inefficient. Later, he founded BitShares and Steemit, becoming one of the most well-known engineers in the crypto space. But BM was not just a tech geek; he had a utopian idealism, believing that blockchain could change everything, and EOS would be the ultimate solution for human social structure.

With a genius CTO and a top-notch marketing team, the ambition of this story was already laid out. On June 26, 2017, EOS began its crowdfunding, planning to last for a year (in contrast, the vast majority of ICOs had fundraising cycles of only a few weeks to a few months).

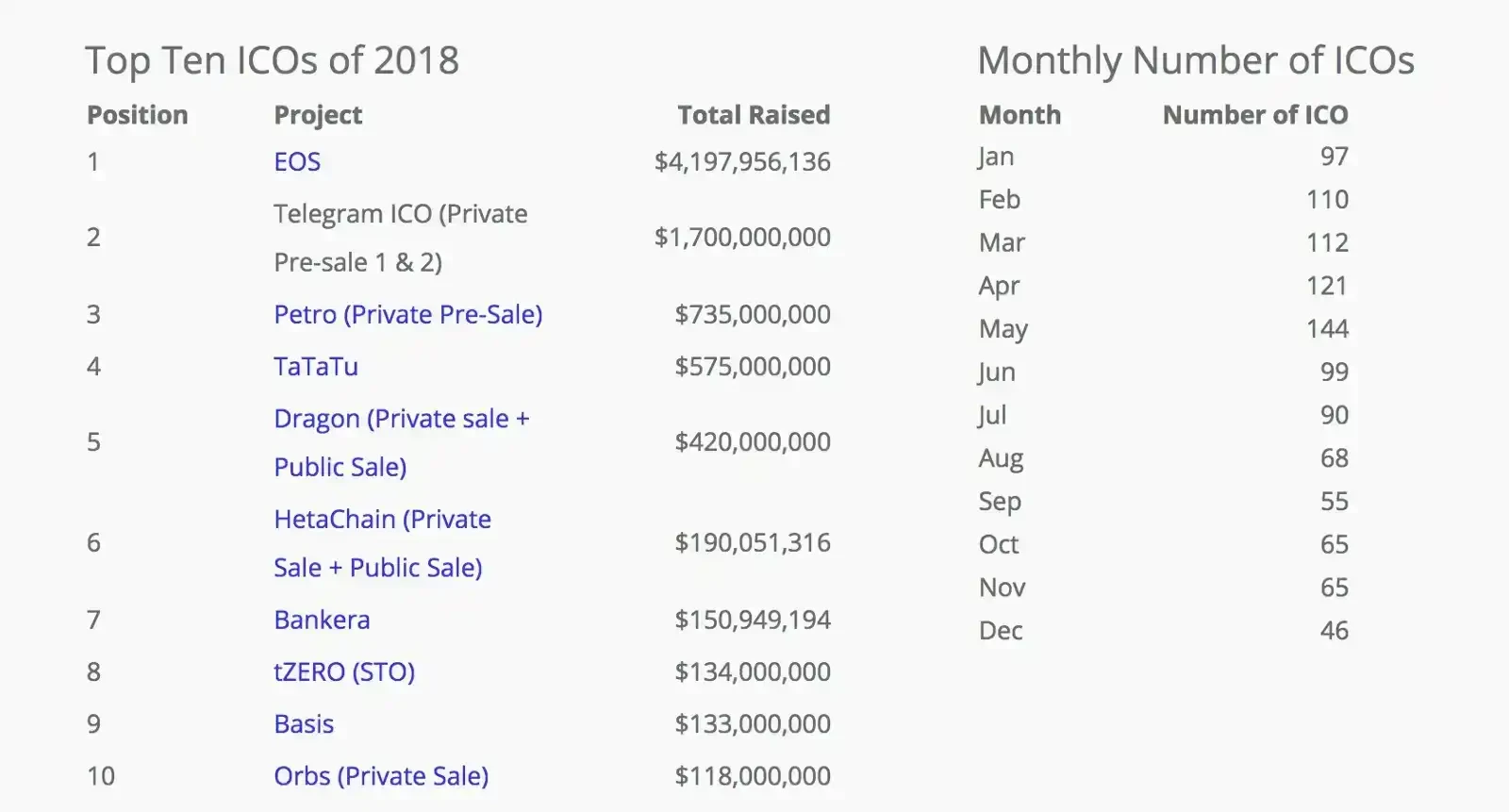

Global investors flocked in, raising $185 million within 24 hours. Ultimately, EOS successfully raised $4.2 billion, becoming the largest fundraising event in crypto history, far surpassing all projects at the time, including Ethereum's $18.5 million.

Top 10 ICO Projects of 2018

With $4.2 billion, EOS became a super capital entity in the crypto space.

In April 2018, EOS's price surged from $5 to $23, a monthly increase of 360%, with its market capitalization ranking among the top five globally, second only to Bitcoin, Ethereum, Ripple, and Bitcoin Cash. The media went wild, with headlines like "EOS will become the first trillion-dollar cryptocurrency" and "BM is the next Satoshi Nakamoto." Ethereum developers began to feel anxious, fearing that EOS's rise would lead to Ethereum's decline.

That year, before EOS even launched its mainnet, it had already become the hottest star in the crypto space. Driven by FOMO (fear of missing out), EOS was seen as the "next-generation Ethereum," with some even predicting it would reach $1,000.

The supernode elections became a global hotspot, with figures like Li Xiaolai and Lao Mao making high-profile entries, while exchanges, mining pools, Wenzhou capital, and even traditional funds rushed in—this election was dubbed the "Wall Street IPO of blockchain." Nodes from China, the U.S., and South Korea engaged in a "crypto national war," with the Korean community declaring, "If you don't invest, you're not Korean." Li Xiaolai's Coin Capital held four node voting warehouses, and the Wenzhou gang entered the market with eight-digit EOS purchases.

With $4.2 billion raised, a star project, a dark horse public chain, and all eyes on it, BM was picked up at the airport in Hong Kong by project representatives in luxury cars. Everything seemed so beautiful, yet beneath the feast, everything was built on a Tower of Babel made of code and dollars.

EOS Only Peaks at the Start

Amid the frenzy, problems had already begun to quietly emerge:

EOS's voting system was criticized for being easily controlled by large holders, and the decentralization of supernodes was questioned; after the mainnet launch, multiple technical issues arose, leading developers to question EOS's stability; the deep involvement of exchanges and capital giants made the supernode elections unfair, and different voices began to emerge in the community; after the mainnet went live, BM frequently altered the governance mechanism, causing chaos in the community.

But at that time, the market was still immersed in celebration, and all doubts were overshadowed by the slogan "EOS is about to change the world." In that golden age, everyone believed EOS would become the future ruler, even the ultimate form of the blockchain industry. However, reality is often harsher than dreams, and no one anticipated that this once-promising project would fall from grace in just a few years.

The Disillusionment of Technology: From "Million TPS" to "Distributed Database"

At that time, the biggest problem in blockchain was scalability—how to conduct more transactions in a second. The Bitcoin network could handle 5 or 6 transactions per second, while Ethereum was slightly better, with about 20 transactions per second. However, these figures were far from meeting the usage requirements of blockchain.

In this context, EOS's claim of a million TPS drove everyone wild. It’s worth noting that during the Tmall Double 11 shopping festival, the peak transaction volume was over a hundred thousand per second.

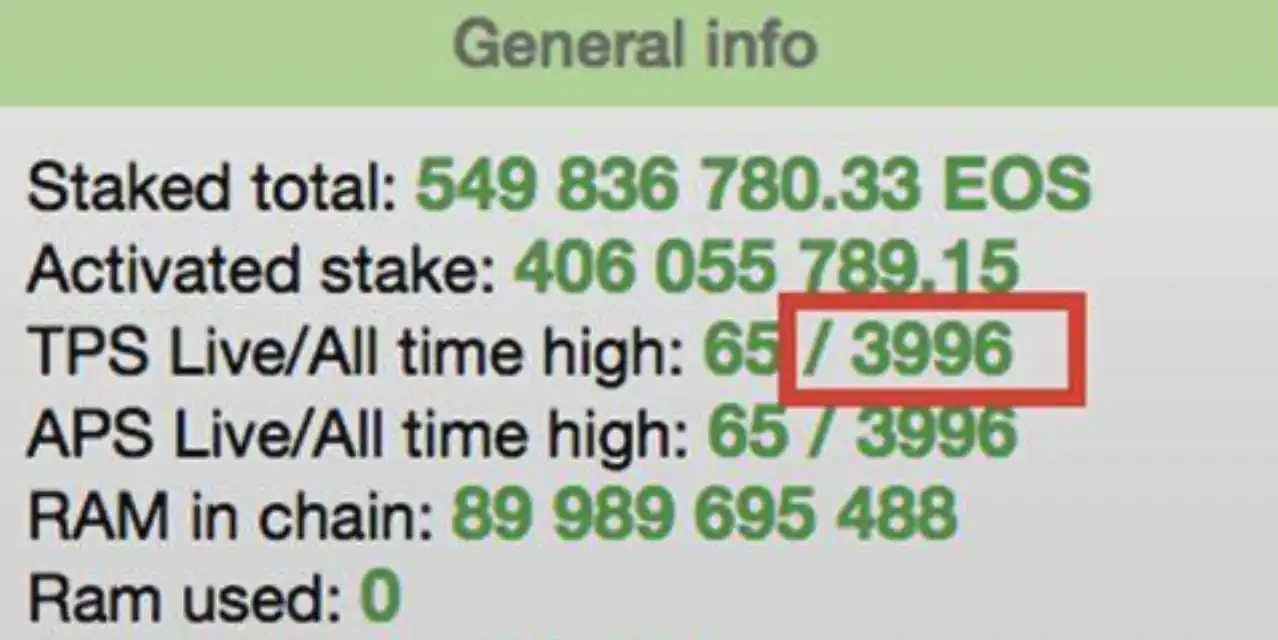

However, four months after the EOS main chain launched, the highest TPS was only 3,996, which was far from the promised million.

While EOS fell far below expectations, Ethereum gradually improved its performance through Layer 2 scaling solutions, and competitors like BNB Chain and Solana quickly rose, completely erasing EOS's "performance advantage."

People discovered that the so-called "million TPS" was a carefully designed word trick—BM quietly added a premise to this number: it must rely on an infinitely scalable sidechain ecosystem. According to his vision, if one chain could handle 4,000 transactions, then 100 sidechains running in parallel could achieve 400,000 TPS. But the reality was that by 2023, the EOS ecosystem had only three sidechains launched, two of which had become "ghost chains" due to developers leaving. BM's response to this was to turn to Twitter and announce that he was "researching anti-inflation algorithms," while EOS's market cap had already dropped out of the top 20.

The core problem with EOS was its difficulty of use.

Initially, EOS hit the user pain point with free transfers. Users quickly realized that while EOS transfers did not require transaction fees, they had to use tokens to stake for CPU resources. When the network was congested, transferring 10 EOS required staking CPU worth 5 EOS—this essentially froze users' funds. During a DApp traffic peak in 2020, 2,000 EOS could only be exchanged for 1.3 seconds of CPU time, forcing ordinary users to repeat the process multiple times to complete a transfer.

Moreover, BM set a RAM supply cap, leading to market speculation on RAM, causing RAM prices to skyrocket by 100 times, forcing developers to spend exorbitant costs to purchase storage resources. In 2018, some speculators began hoarding RAM, and within a few months, RAM prices surged from 0.01 EOS/KB to 0.9 EOS/KB, severely impacting DApp development, with many new projects abandoning EOS altogether.

Ultimately, this resource management model made EOS's user experience worse than Ethereum's: on Ethereum, users could directly pay gas fees to complete transactions; but on EOS, users had to first learn a complex resource staking mechanism and even spend a lot of money to purchase CPU and RAM, severely hindering the development of the DApp ecosystem.

From today's perspective, it is difficult to understand how, under such poor user experience, EOS experienced a surge at the end of 2018 and the beginning of 2019: DApps focused on on-chain gambling were very popular on EOS.

Data from December 24, 2018, showed that in the past week, a comprehensive comparison of the DApp ecosystems of the three major public chains—ETH, EOS, and TRON—revealed: Total users (people): EOS (75,346) > TRON (45,777) > ETH (33,495); Total transactions (count): EOS (23,878,369) > TRON (13,803,322) > ETH (413,019); Total transaction volume (USD): EOS (345,489,773) > TRON (135,201,171) > ETH (44,272,856);

This indicates that at that time, EOS was indeed highly regarded by the community, and its ecological prosperity surpassed that of ETH and TRON. Perhaps it was this "dream" that makes today's old players in the crypto space reminisce about EOS with such regret.

Governance Collapse: Bribery, Centralization, and Community Division

Of course, discussing governance now might elicit a chuckle, but at the time, EOS's governance was highly anticipated. BM firmly believed that under his careful design, the 21 nodes would allow this network to far surpass Ethereum.

He thought this network would have 2/3 good people, with everyone acting benevolently, and any node that acted maliciously would be voted out by users—this was a perfect utopia. The reality proved he was too naive.

Three months after the EOS mainnet launched, bribery among nodes had become an unspoken rule. To obtain EOS block rewards, no one could stop the mutual voting between large holders and nodes, and that was not the most outrageous part; the nodes themselves acting maliciously was the absurdity.

The mechanism of EOS involves 21 supernodes taking turns to produce blocks. At one point, a user's funds were stolen by a hacker, and the solution was for the 21 nodes to blacklist the hacker's address, preventing the hacker from transferring funds. This was a normal and straightforward operation, but one node failed to implement the blacklist. As a result, during the time this node was producing blocks, the hacker transferred the funds away, as if nothing had happened.

BM attempted to constrain these behaviors through the EOS constitution but quickly discovered that the constitution had no binding power: since the supernodes themselves were beneficiaries of bribery, they had no incentive to enforce the rules set forth in the constitution. The arbitration mechanism was completely ineffective, lacking any real authority.

In 2019, BM completely abandoned constitutional governance, announcing that the EOS community should evolve freely and that he would no longer interfere with the election methods of supernodes. By 2020, EOS's supernodes had devolved into a battleground for exchanges, mining pools, and capital consortiums, rendering the votes of ordinary token holders meaningless. DPoS was supposed to be a model of decentralized governance, but it turned into a version of oligarchic politics in the crypto space.

EOS also encountered a major issue regarding governance: before the EOS mainnet launched, BM proposed an innovative "EOS Constitution," hoping to use code and rules to regulate behavior on the network. However, within just a few months, the constitution underwent multiple revisions, and community dissatisfaction grew. In June 2018, the initial constitution allowed supernodes to arbitrate transactions, but due to abuse of power, BM decided to amend the constitution weeks later to prohibit nodes from interfering with transactions. In 2019, BM suddenly proposed abolishing the constitution in favor of "user contract governance," leading the community into chaos, unsure of how EOS's governance rules would evolve. This constantly changing governance model caused developers and investors to completely lose trust in EOS.

During this crisis, BM and Block.one (the parent company of EOS) gradually shifted their focus from the EOS main chain to the EOSIO software: BM believed that "the future of blockchain lies in enterprise-level applications," and thus began promoting EOSIO, allowing companies to build their own private chains instead of focusing on optimizing the EOS public chain. Core updates to the EOS main chain nearly came to a halt, with many critical upgrades (such as cross-chain capabilities and storage expansion) delayed indefinitely.

The result was a sharp decline in EOS's developer ecosystem: while the Ethereum community remained active with the explosion of DeFi, NFTs, and other applications, the number of DApp developers on EOS gradually decreased. By 2022, EOS was losing nearly 100 developers each month, and some EOS browsers and wallet projects shut down entirely.

External Strangulation: Mining Crises, Bear Markets, and Block.one's Silence

By the end of 2019, the price of EOS fell below $5, hitting a low of $1.80 the following year, a drop of over 90% from its historical peak of $23. As supernodes faced existential crises, developers fled, and market liquidity dried up, the EOS ecosystem desperately needed rescue from its parent company, Block.one.

We all know that Block.one raised $4.2 billion in its early days, becoming the largest fundraising event in crypto history. Logically, this funding should have supported the long-term development of EOS, aiding developers and driving technological innovation to ensure the ecosystem's continued growth. However, when EOS ecosystem developers pleaded for funding, Block.one offered a mere $50,000 check—an amount insufficient to cover two months' salary for a Silicon Valley programmer.

"Where did the $4.2 billion go?" the community questioned.

In an email dated March 19, 2019, BM revealed part of the answer to Block.one shareholders: as of February 2019, Block.one's total assets (including cash and invested funds) amounted to $3 billion.

Of this $3 billion, approximately $2.2 billion was invested in U.S. government bonds, referred to in the email as "liquid fiat assets."

Some of the invested funds can be traced through public information: gaming company Forte, NFT platform Immutable, and a resort hotel in Puerto Rico, among others. In summary, the companies in which they invested had little to do with EOS.

Before Bullish became the core business, Block.one still had a trump card: the social product Voice, deployed based on EOSIO smart contracts, which was the only product with a business relationship to EOS. To develop Voice, Block.one invested $150 million, with the largest expenditure being $30 million to purchase a domain name from MicroStrategy, a publicly traded company that holds the most Bitcoin.

However, it seemed to be a curse of fate; Voice's first launch event lasted half an hour, and the content fell short of expectations, leading to a wave of disappointment and a subsequent drop in EOS's price. More than half a year later, when the Voice iOS version launched on the Apple Store, it encountered various bugs and issues, with the Voice official website displaying "Error 1020," claiming the site was "using security services to protect itself from online attacks." EOS holders were left utterly disappointed, and Voice finally announced in September 2023 that it would gradually shut down.

Projects launched by Block.one

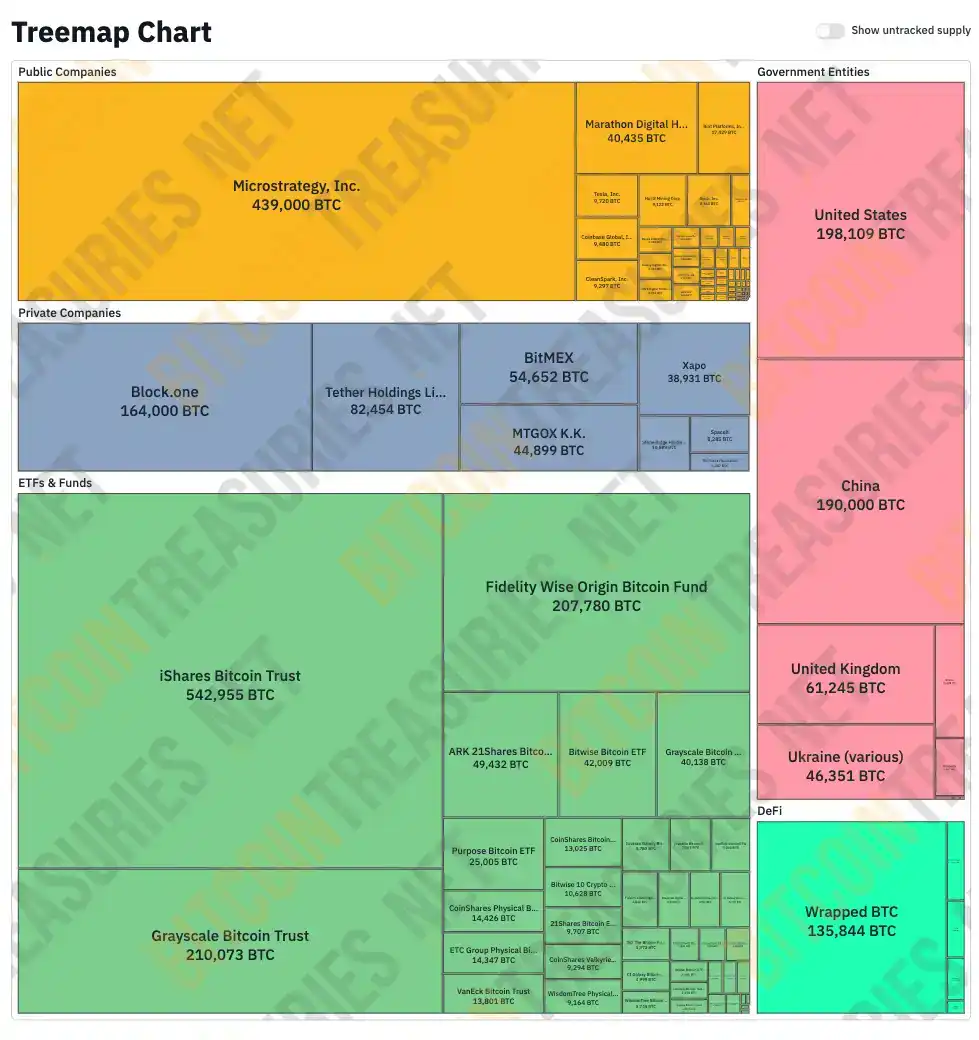

The thunderous announcements from Block.one often resulted in little action, and after this, Block.one ceased making significant investments and began to lie low. Today, Block.one holds 164,000 Bitcoins, meaning its wealth has grown from $3 billion in 2019 to $16 billion now, a fivefold increase, making it a master of liquidity management.

With no actual support plans for DeFi, NFTs, or DApp ecosystems, in contrast, the Ethereum Foundation and Solana Foundation continuously subsidized developers and promoted technological innovation, while Block.one did almost nothing.

An early investor in EOS angrily questioned on Reddit: "We invested in EOS because it promised to revolutionize blockchain, not so Block.one could take this money to speculate on Bitcoin!"

Although Block.one currently holds the second-largest amount of Bitcoin after MicroStrategy, with a total of 160,000 BTC valued at $16 billion, EOS, which received no support from these raised funds, continued its downward trajectory.

The governance chaos at Block.one is even more shocking; Block.one increasingly resembles a "family business" centered around CEO Brendan Blumer, with BM not being part of this family.

Sister as CMO: CEO Brendan Blumer's sister, Abby, was parachuted in as Chief Marketing Officer, with her only visible "achievement" being changing the EOS brand color from tech blue to a "softer Morandi gray."

Mother in charge of venture capital: Blumer's mother, Nancy, heads the EOSVC venture capital fund, which invested in the social application Voice, which had fewer than 10,000 users after a year but cost $150 million.

BM as a puppet: Founder BM revealed on Twitter that he had "no decision-making power" and could only watch as the team poured resources into the enterprise toolkit EOSIO—a project customized for giants like Walmart, which had no connection to the EOS mainnet.

In 2021, the community initiated a "fork uprising" in an attempt to sever Block.one's control. The EOS Foundation, representing the community, began negotiations with Block.one. However, over the course of a month, various proposals were discussed, but no consensus was reached. Ultimately, the EOS Foundation, along with 17 nodes, revoked Block.one's power status, expelling it from the EOS management team. Without its parent company, EOS increasingly resembled a DAO.

After the split from Block.one, the EOS community engaged in a years-long lawsuit over the ownership of the funds raised, but as of now, Block.one still retains ownership and usage rights to the funds.

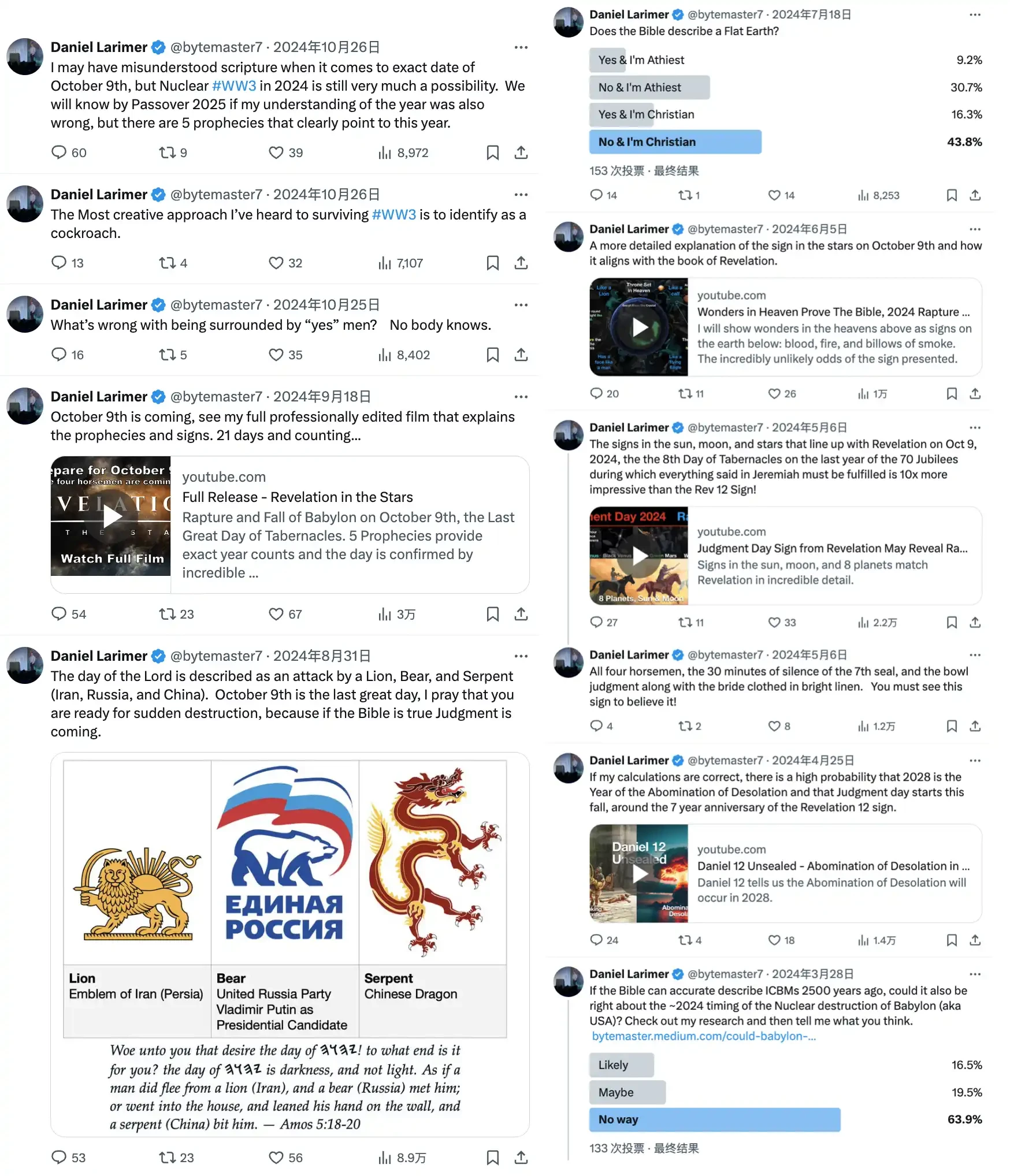

Even more absurdly, since 2024, BM's Twitter content has almost entirely ceased to involve blockchain, with the only technical discussion being a sporadic mention of database optimization. In contrast, his focus has completely shifted to theological preaching, with content heavily centered on biblical interpretation, apocalyptic prophecies regarding geopolitical conflicts, and critiques of mainstream Christianity…

BM's Twitter content

Looking back at this seven-year saga in crypto history, the collapse of EOS has long been a cautionary tale: no matter how high the TPS or how sophisticated the resource model, if the user experience is so complex that ordinary people are deterred, everything is meaningless. The once "Ethereum killer" ultimately perished in the quagmire of its own economic model, governance chaos, and technological stagnation.

Seven years ago, EOS raised $4.2 billion in crowdfunding, once considered the most glorious fundraising miracle in blockchain history; seven years later, its story has become the biggest "joke" in the crypto space.

In the end, EOS did not kill Ethereum; it first killed itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。