In the early hours of today Beijing time, the Federal Reserve released its latest interest rate decision, announcing that it would maintain the benchmark interest rate at 4.5%. This decision aligns with market expectations, indicating that the Federal Reserve has chosen to pause further tightening of monetary policy amid easing inflationary pressures, while economic growth remains fragile.

Against the backdrop of a more accommodative monetary policy environment, Bitcoin's price has shown a strong upward trend in the short term, peaking at $87,453.67 before experiencing a pullback, with the current price stabilizing around $86,316. Market analysts generally believe that the Federal Reserve's decision to pause tightening, combined with relatively ample market liquidity, provides some support for Bitcoin's price increase. However, whether Bitcoin's price can maintain upward momentum after a rapid rise in the short term still requires a comprehensive consideration of various factors.

Candlestick Patterns Indicate Strong Bullish Trend

Bullish Pattern Breakthrough

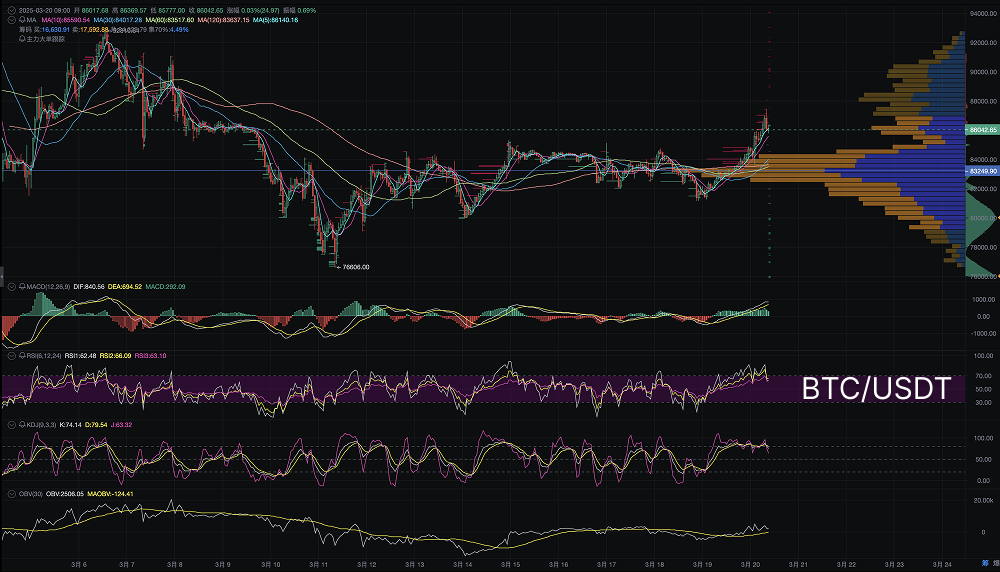

From the latest candlestick patterns, Bitcoin's price has shown a clear bullish breakout pattern, especially after breaking through the significant resistance level of $85,000, with trading volume significantly increasing, indicating strong buying power in the market. The appearance of long upper shadows at high levels suggests considerable selling pressure above, but the limited pullback in the short term indicates an intensifying divergence between bulls and bears in the market.

It is noteworthy that since effectively breaking through $85,000, market capital inflow has been rapid, with active buying. Although there was no immediate retest after the breakout, selling pressure remains at the upper level of $87,453.67. For the market to break through further, new capital inflow and continued strengthening of market sentiment are needed. Otherwise, high-level consolidation or short-term adjustments are inevitable.

Short-term Upward Momentum Weakens

Although the price briefly broke through high levels, technical indicators show that short-term upward momentum has weakened. Particularly, the failure of multiple candlesticks at high levels to close as solid bullish candles indicates insufficient willingness to chase prices higher. It is important to be cautious, as a reversal in market sentiment could lead to a rapid price pullback, making the importance of the $85,000 support level particularly prominent.

Large Capital Movements and Chip Distribution

OBV Indicator Shows Strong Capital Inflow

From the On-Balance Volume (OBV) indicator, the recent OBV curve has been rising continuously, indicating that large orders of capital are consistently flowing into the market, with major funds still in control. Especially at the time of breaking through $85,000, the OBV indicator surged rapidly, confirming the persistence of the bullish atmosphere in the market. In the short term, as long as the OBV does not show a significant decline, the market's upward momentum remains supported.

Chip Peaks Show Dense Support

Through chip distribution analysis, it can be seen that the current chip concentration area is around $84,222.75, which constitutes significant support. The pressure above is at $87,453.67; if this pressure level can be broken, it will open up further upward space.

Technical Indicator Analysis: Beware of Pullback Risks

- MACD Indicator: Bullish momentum is weakening, with the DIF line and DEA line still showing a bullish arrangement, but the height of the red bars is gradually shortening, indicating a decrease in upward momentum. If the red bars continue to shorten or even turn green, it will indicate that the market is entering an adjustment phase.

- RSI Indicator: Overbought signals are evident, with the RSI indicator at a high level of 68.08, close to the overbought line of 70, reflecting that there is pullback pressure in the market in the short term. If the RSI indicator continues to fall below 60, it may confirm an adjustment signal.

- KDJ Indicator: High-level death cross risk, with the K value and D value converging around 80, and the J value reaching as high as 88.80, indicating a severe overbought state. If the KDJ indicator shows a death cross signal, short-term downward pressure will further increase.

Market Sentiment and Risk Factor Considerations

Federal Reserve Policy Impact: Although interest rates remain unchanged, the market still faces policy uncertainty. If expectations for future rate hikes rise again, it will negatively impact the cryptocurrency market. Investors should closely monitor statements from Federal Reserve officials and changes in inflation data.

Market Liquidity Changes: As Bitcoin's price breaks through important levels, a large influx of speculative funds has entered the market. If the market suddenly reverses, insufficient liquidity will amplify the risk of a decline.

External Environment Risks: Changes in regulatory policies, unexpected macroeconomic data, and geopolitical risks may trigger sudden shifts in market sentiment, leading to irrational selling.

Future Market Assessment and Operational Strategies

Short-term Strategy: Cautious in Chasing Highs

Due to the significant pullback risk indicated by technical indicators, it is recommended that short-term traders gradually reduce positions around $86,000 to lock in some profits. If the price pulls back to the $85,000 area and stabilizes, consider re-entering.

Medium to Long-term Strategy: Accumulate on Dips

If Bitcoin's price pulls back without breaking the $85,000 support, gradually increase positions and patiently wait for the market to regain strength. After breaking through $87,453.67, actively follow up.

Risk Control: Keep the short-term position ratio within 30% to prevent significant fluctuations from causing account drawdowns. Additionally, hedging against downside risks through options or contracts can reduce uncertainty.

Conclusion

Bitcoin is currently at a critical juncture. The Federal Reserve's decision to maintain interest rates provides short-term support for the market, but the price faces certain adjustment pressures after a rapid rise. Short-term operations should closely monitor whether the $86,000 support holds firm to guard against a quick pullback. In the medium to long term, as long as the $85,000 support level is not effectively broken, the bullish trend still has the potential to continue.

In a policy environment and market sentiment that are subject to change, investors should comprehensively utilize technical analysis and capital flow monitoring, flexibly adjust positions, and avoid chasing highs and cutting losses. The uncertainty in the future market still exists, and prudent operations and reasonable position control are key to mitigating risks.

This article only represents the author's personal views and does not represent the stance and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。