Hello everyone! On February 27th at 16:00, the AICoin editor will discuss the judgment logic of the altcoin season with you!

Recently, Bitcoin and mainstream coins have dropped quite significantly, with many reasons behind it, including the U.S. macroeconomic situation, geopolitical issues, the Bybit hack, OK being fined, and other black swan events, as well as ETF fund outflows and major sell-offs. However, from a daily chart perspective, there is currently MA200 support, so it won't be easy to break below it in the short term.

The number of long and short positions in BTC on OKX once exceeded 3.7, and although it has since retreated, it remains at a high level, indicating that major funds are still leaning towards a bearish outlook. So, is it the altcoin season now? To determine this, we first need to understand the characteristics of an altcoin season.

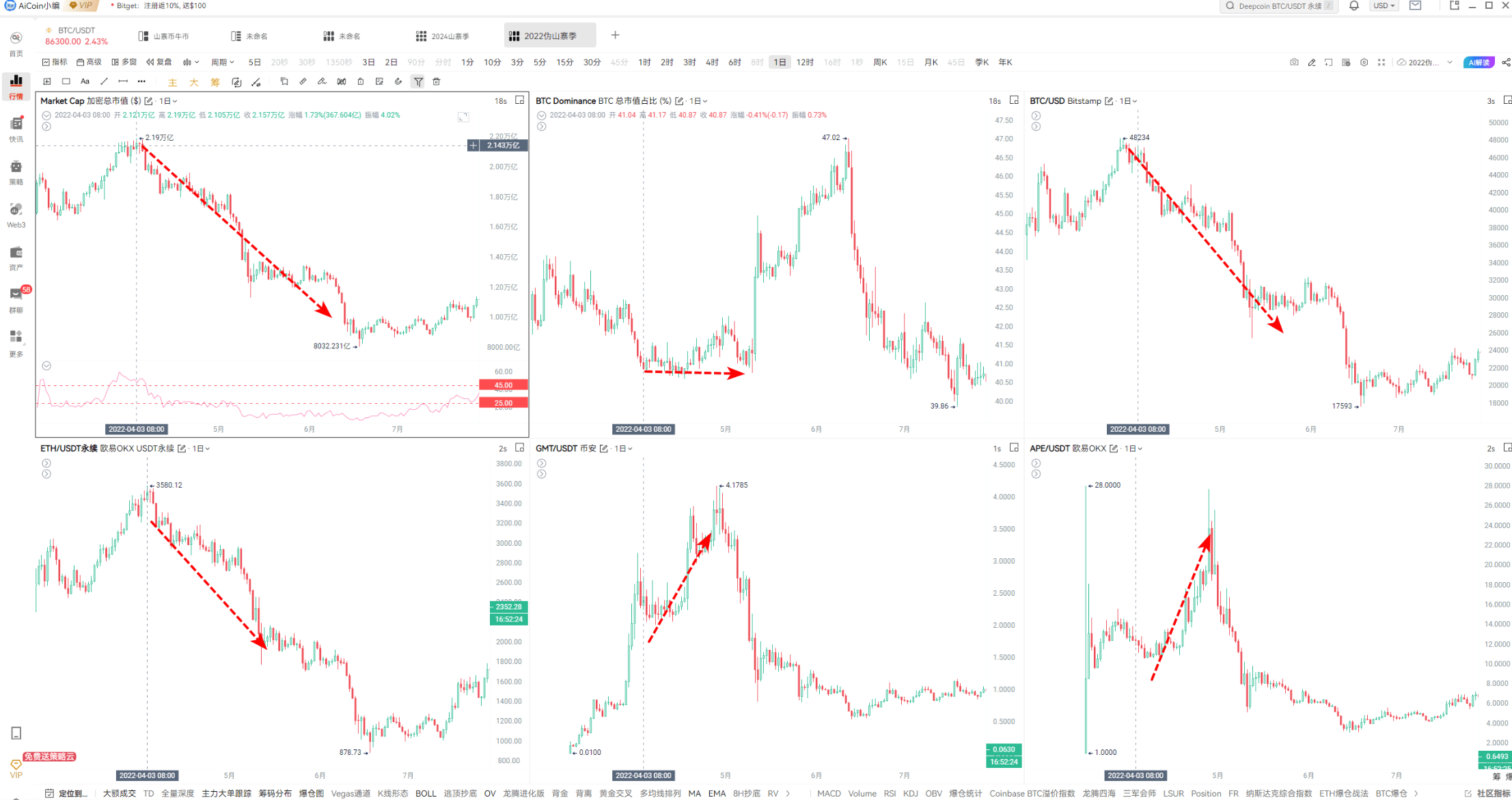

Characteristic 1: Total market capitalization increases, but Bitcoin's market cap percentage decreases

The logic behind this is that there is continuous inflow of funds into the market, but these funds are not flowing into Bitcoin; instead, they are going into altcoins. However, from the current data, while BTC's market cap percentage has indeed decreased, the total market cap is also declining. This indicates that there is no new capital entering the market; rather, funds are rotating internally, flowing out of mainstream coins like BTC and ETH into smaller market cap altcoins. Therefore, the overall amount of funds in the market has not increased.

Characteristic 2: Extreme FOMO (Fear of Missing Out) in the market

Currently, there is no extreme FOMO sentiment in the market. Other characteristics, such as frequent calls from KOLs, the emergence of new narratives or hot sectors, altcoins rising in succession, and active on-chain trading, do not align with the current situation. Therefore, I do not believe that now is the time for an altcoin season to erupt.

Characteristics of a pseudo altcoin season

A pseudo altcoin season is actually easy to distinguish; BTC's market cap percentage decreases, but the total market cap declines or remains flat. This situation is generally caused by a temporary surge due to fund rotation, rather than a true altcoin season. The current situation fits this characteristic well, as altcoins like KAITO, IP, PI, NEIRO, RUNE, and SUI are all rising, but the total market cap has not increased. Therefore, this resembles a brief rotation of funds in a risk-averse and speculative environment, rather than entering a true altcoin season.

For example, in Q2 2022, after the LUNA crash, the market also experienced a similar "dead cat bounce," but such rebounds usually do not last long. Once mainstream coins stabilize, funds will return to mainstream coins. Moreover, if BTC continues to drop significantly, it will be difficult for altcoins to strengthen independently.

For popular coins like PI, IP, and KAITO, although they are continuously reaching new highs, it is advisable not to short them easily. After all, market sentiment and fund flows are very difficult to predict, especially in this rotating market.

If you have activated the AiCoin PRO membership, you can also track major orders, large transactions, and other indicators to monitor the movements of major players in real-time, following the buying and selling of large holders. Additionally, PRO members can use the multi-window feature on the same screen, allowing you to view up to 18 trading pairs simultaneously (exclusive feature for annual members), which is very convenient!

In summary, the current market resembles a brief rotation of funds rather than a true altcoin season. Everyone should be cautious when trading, especially avoiding blindly chasing highs or shorting popular coins.

Finally, I recommend reading the following articles to help you better understand CME gaps and other trading strategies:

For more live content, please follow the AICoin “AiCoin - Leading Data Market and Intelligent Tool Platform” section, and feel free to download AiCoin - Leading Data Market and Intelligent Tool Platform

Risk Warning: The content of this article is for educational purposes only and does not constitute investment advice. Trading should be done with caution, and profits and losses are your own responsibility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。