🧐 Sonic × Pendle: The Best Combination for DeFi Players with High Returns, High Leverage, and Airdrops in One!

In the recent backdrop of a sluggish market, a Layer 1 has become the focus of capital pursuit—

Under the strong combination of @AndreCronjeTech, @pendle_fi, and Sonic @SonicLabs, Sonic's TVL has surpassed $800 million,

This figure has tripled in the past six weeks, making it one of the most favored public chains by capital at present.

Clearly, after experiencing a short-term PVP, the market has returned to tracks supported by fundamentals.

Meanwhile, Pendle, as a yield optimization tool in DeFi, has also brought additional arbitrage opportunities to the Sonic ecosystem: through reasonable strategy combinations, users can achieve a mix of high returns + high leverage + potential airdrops.

Below are the Sonic yield maximization strategies based on the Pendle platform, which interested players can refer to after DYOR.

1️⃣ What is Sonic? Why should you participate?—

Sonic, developed by @soniclabs, is the predecessor of the well-known public chain Fantom. The project raised $120 million,

Positioned as the fastest high-performance EVM Layer-1, it boasts a throughput of 10,000 TPS and instant finality.

Unlike other public chains chasing Meme coins and AI Agents, Sonic still adheres to the DeFi track, continuing the hardcore style of Fantom's founder Andre Cronje (AC).

On-chain activity has surpassed that of some mainstream public chains.

Additionally, Sonic plans to distribute 200 million $S tokens as ecosystem incentives in June 2025. This airdrop window is only three months away, with a short cycle that is friendly to DeFi players, avoiding long-term capital lock-up risks.

2️⃣ How to Obtain Sonic Airdrops—

Three methods to earn points for airdrops:

Passive Points—Hold whitelist assets;

Activity Points (Point Points)—Deploy whitelist assets on the application;

Application Points (Gems)—Participate in ecosystem projects to gain further allocations.

Best Strategy: By combining the Sonic ecosystem, earning yields, and acquiring points (Gems), you can maximize the benefits of $S tokens and future ecosystem airdrops.

3️⃣ Learn to Amplify Yields with Pendle—

In many previous tweets, I have mentioned that I really like @pendle_fi. Pendle is a yield optimization tool in the DeFi space, with two core advantages:

Flexible Yield Strategies:

Users can freely choose fixed income or high leverage strategies.

Super High Yield Stacking:

Investment combinations can enhance APY (Annual Percentage Yield).

In the Sonic ecosystem, Pendle also offers various yield optimization methods.

Users can flexibly choose based on their own situations—

Principal Tokens (PT): Fixed income, purchasing PT is equivalent to locking in the current high interest rate, and holding until maturity will yield risk-free returns.

Liquidity Provision (LP): High APY + zero impermanent loss (IL), with almost no IL risk when held until maturity, while enjoying multiple yield stacking.

Yield Tokens (YT): Super high leverage points and yields, allowing users to leverage hundreds of times at a very low cost.

For those who are not yet familiar with Pendle, you can first check out the official beginner's guide in Chinese, which is quite detailed:

https://pendle.notion.site/Pendle-1b2567a21d3780168a83dc0028731413

4️⃣ Sonic + Pendle High Yield Strategy | The Ultimate Combination of Yields and Airdrops)—

1) Basic Play: Suitable for DeFi newcomers, lazy people, and low-risk preference individuals.

Sonic has 5 pools on Pendle, with PT yields generally between 7%~10%, fixed interest, and capital preservation with no risk.

Some pools can also earn additional Rings and Veda points.

2) Advanced Play: Suitable for DeFi veterans familiar with market fluctuations.

a) Guaranteed Profit Strategy: High APY stablecoin LP with aUSDC

In the Pendle liquidity pool, providing liquidity with Aave's aUSDC can yield an LP APY of up to 23%, and you can earn 20 times the Sonic points.

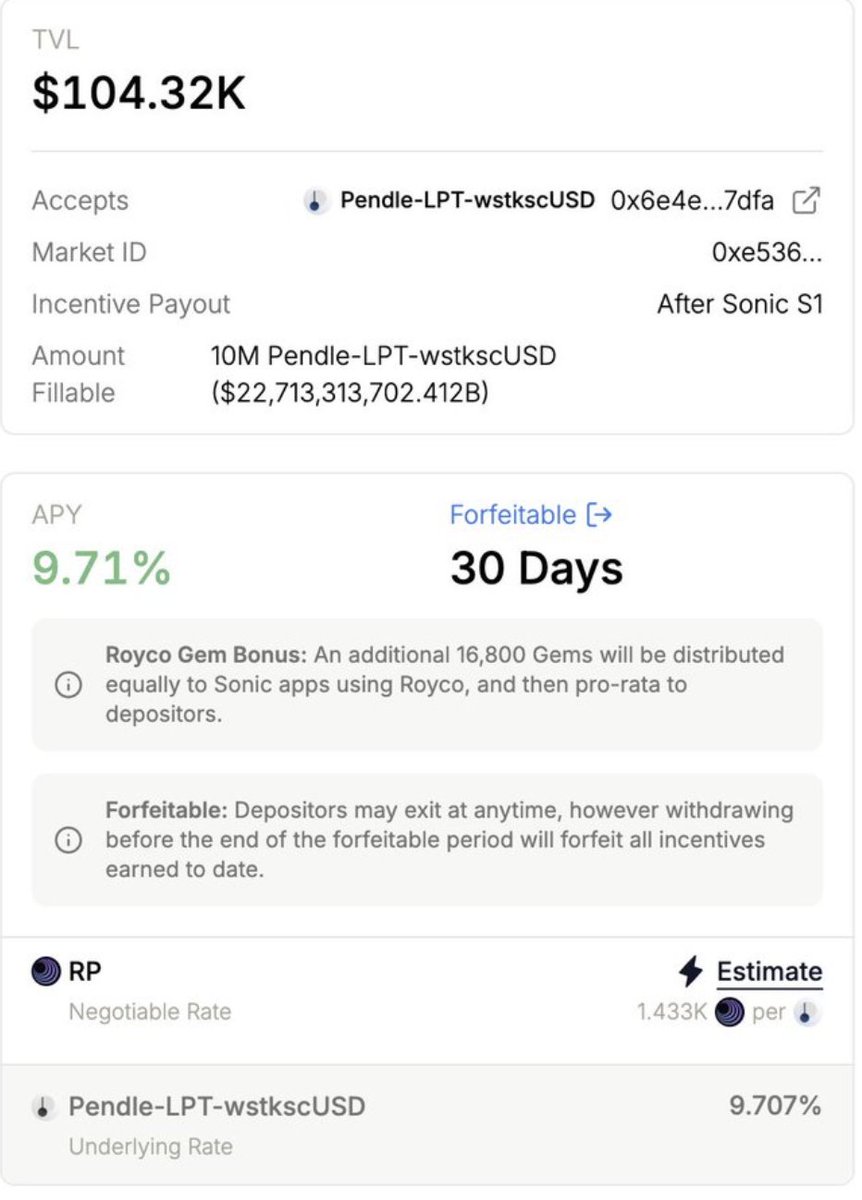

b) Combine LP-stkscUSD with Royco

Deposit LP-stkscUSD purchased in Pendle into Royco for an additional layer, earning an extra 1.43k Rings points and Royco's exclusive Sonic Gems, enhancing airdrop rewards, with a combined APY close to 10%.

Deposits can be withdrawn at any time, but early withdrawal may result in loss of incentives.

c) Use PT-stS + Silo Finance for Circular Arbitrage

In Silo Finance, collateralize PT-stS assets for 10x leverage, achieving an APY of 65%, and earn an additional 14 times Silo points.

d) Use YT-stkscUSD for Maximum Points Exposure

For example, you can invest 1,000u to purchase YT-stkscUSD, potentially earning 47 million Sonic points + 7.85 million Rings points + 12.2 million Veda points before maturity in 72 days, with expected profits around 1,300u and an APY of up to 150%.

Since YT carries the risk of value depreciation before maturity, this strategy is more suitable for users who are extremely bullish on Sonic points and Gems.

5️⃣ Strategy Summary and Action Recommendations—

As the Sonic ecosystem grows, Pendle will continue to be a core tool for yield maximization. The market currently underestimates the leverage potential of YT and the scarcity of Gems, which may lead to an influx of capital in the coming weeks.

Action Recommendations:

Short-term Players: Focus on YT strategies to quickly accumulate points and airdrops.

Long-term Holders: Choose PT or low-risk LP to steadily lock in fixed returns.

Risk Warning:

Pay attention to the APY fluctuations of the underlying protocols.

Understand the token unlocking cycles and holding costs.

Summary—

By leveraging the "yields + points + Gems" triple stacking of Pendle and Sonic,

You can maximize capital efficiency and seize the opportunity in this airdrop feast.

The above strategies are suitable for different groups, so please DYOR before participating!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。