Source: Cointelegraph Original: "{title}"

ARK Invest CEO Cathie Wood believes that the White House has underestimated the economic recession risks posed by President Trump's tariff policies — a neglect that will ultimately force the president and the Federal Reserve to implement policies to promote economic growth.

On March 18, Wood spoke online at the Digital Assets Summit in New York, stating that U.S. Treasury Secretary Scott Bessent is not worried about a recession.

However, Wood said, "We are concerned about a recession." She also added, "We believe the velocity of money is slowing dramatically."

Cathie Wood speaking online at the Digital Assets Summit. Source: Cointelegraph

A slowing velocity of money means that the frequency of money changing hands is decreasing, which is typically associated with economic recessions as consumer and business spending and investment decline.

Wood stated, "However, I think if we do fall into a recession, with GDP declining, it will give the president and the Federal Reserve more leeway to do what they want to do in terms of tax cuts and monetary policy."

Investors believe that in the coming months, when the Federal Reserve ends its quantitative tightening program, the first domino may fall — those betting on the Polymarket platform believe there is a 100% chance this will happen before May.

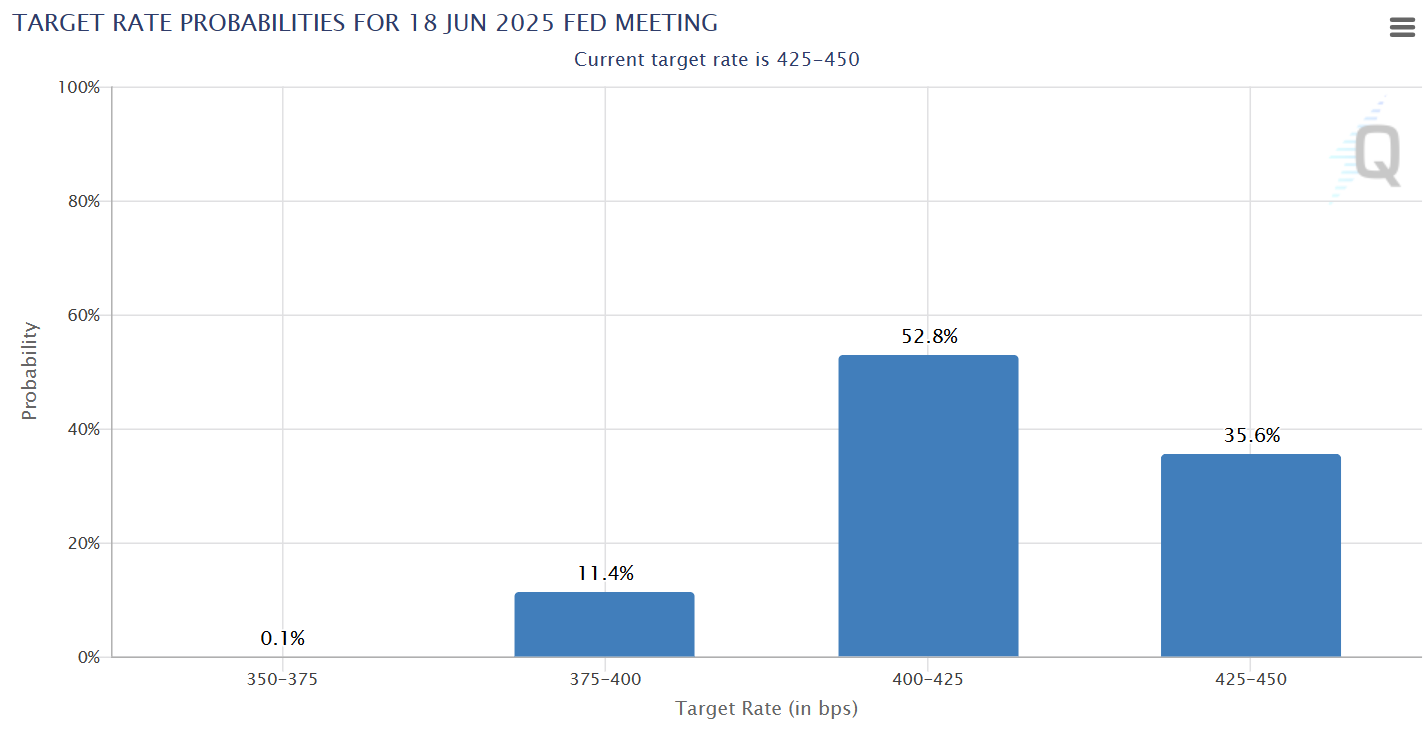

Meanwhile, according to the Chicago Mercantile Exchange Group (CME Group) federal funds futures prices, market expectations for multiple rate cuts by the Federal Reserve in the second half of this year are increasing.

By the time of the Federal Reserve's June 18 meeting, the probability of rates being below current levels is nearly 65%. Source: CME Group

Focus Remains on the Long Term

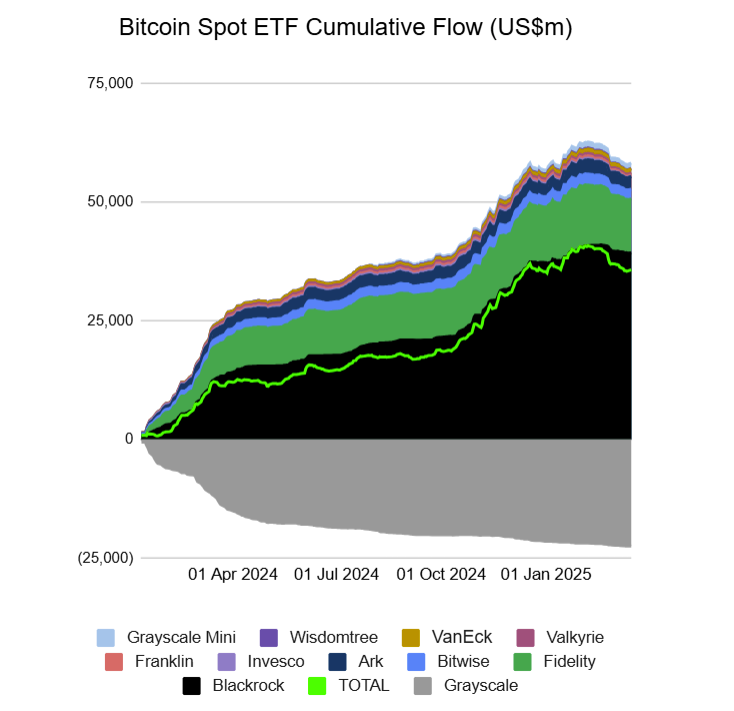

For years, ARK and Cathie Wood have been active cryptocurrency investors. According to Yahoo Finance, ARK and 21Shares' Bitcoin (BTC) spot exchange-traded fund (ETF) was approved on January 11, 2024, with net assets exceeding $3.9 billion.

In recent weeks, there has been a significant outflow of funds from Bitcoin spot ETFs, but the overall trend indicates that investors are still holding their positions. Source: Farside

ARK has also partnered with Eaglebrook Advisors to provide cryptocurrency portfolio solutions for wealth management institutions.

Wood stated at the New York Digital Assets Summit, "When we go through these tough times, innovation will win in the long run," referring to the recent market pullback.

When asked if cryptocurrencies are still a "worthwhile investment area" in the long term, Wood stated that this strategy is a cornerstone of ARK's investment approach.

She said, "The positions we build are not limited to just the three major cryptocurrencies." She referred to Bitcoin, Ethereum, and Solana.

Favorable regulatory policies support this long-term investment trend, greatly improving the investment environment.

Wood noted that supportive policy changes for cryptocurrencies "have given institutional investors the green light. If you look at the research we did back in 2016, we wrote a paper titled 'Bitcoin: The New Asset Class,' yet at that time, many institutions completely ignored it."

Today, institutional investors, after reviewing ARK's reports, express that they "have a fiduciary duty to expose their clients to a new asset class."

Related: Why is the dollar index falling while Bitcoin prices stagnate?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。