As the price of Bitcoin (BTC) has dropped 24% from its all-time high of $109,000 set on January 20 this year, market sentiment has temporarily soured. However, several authoritative experts in the cryptocurrency field have stated that such a level of correction is not unusual but rather a normal phenomenon in Bitcoin's cyclical fluctuations. They unanimously believe that the Bitcoin bull market is not over, and its price peak may be delayed due to global macroeconomic conditions, making future trends still worth looking forward to.

Bitcoin Correction: A "Normal Cooling" in the Cycle

According to AICoin data, as of March 19, 2025, the price of Bitcoin has fallen 13.58% in the past month and is currently trading at lower levels. This volatility has drawn significant attention from market participants, especially considering the tariff policies proposed by U.S. President Donald Trump and the uncertainty surrounding U.S. interest rates. However, Ben Simpson, CEO of Collective Shift, has remained quite calm about this. In an interview with Cointelegraph, he stated, "I don't think the bull market is over; I think the peak of the cycle has been delayed due to macro conditions, and global liquidity is poor, which is unfavorable for cryptocurrencies."

Simpson further pointed out that the magnitude and frequency of adjustments in this cycle are significantly reduced compared to the previous cycle. He explained, "Compared to the 12 times in the last cycle, this is only the third or fourth time Bitcoin has corrected more than 25% in this cycle." In his view, this level of decline is a natural cooling after the market became "overheated," and is part of the cyclical adjustment rather than the end of the bull market. "The market needs to find a new foundation, and now we are waiting for the next new narrative," Simpson added. This viewpoint echoes the pattern of corrections that have occurred in Bitcoin's history after significant rises, such as the market peaks in 2017 and 2021, both of which were followed by significant adjustments.

Similarly, Nick Forster, founder of Derive, also holds an optimistic view of the current situation. He stated, "Bitcoin may be in a normal correction phase, and the peak of the cycle has not yet arrived. Historically, Bitcoin experiences this type of correction during a long-term upward trend, and there is no reason to believe this time will be different." Forster's analysis is based on Bitcoin's four-year cycle, which is often closely related to Bitcoin halving events. The halving in 2024 has further reduced the supply of new Bitcoins, while the growth in demand has not yet fully reflected in the price, providing potential momentum for future increases.

The Impact of Macroeconomic Conditions and Global Liquidity

Experts unanimously mention that the global macroeconomic environment plays a key role in the short-term fluctuations of Bitcoin prices. Simpson specifically pointed out that "poor global liquidity" is the main reason for the current market pressure. Global liquidity is typically driven by the monetary policies of major central banks, such as increasing the money supply through interest rate cuts or quantitative easing (QE). As a high-risk asset, Bitcoin tends to perform strongly in environments with ample liquidity, while facing downward pressure during liquidity tightening.

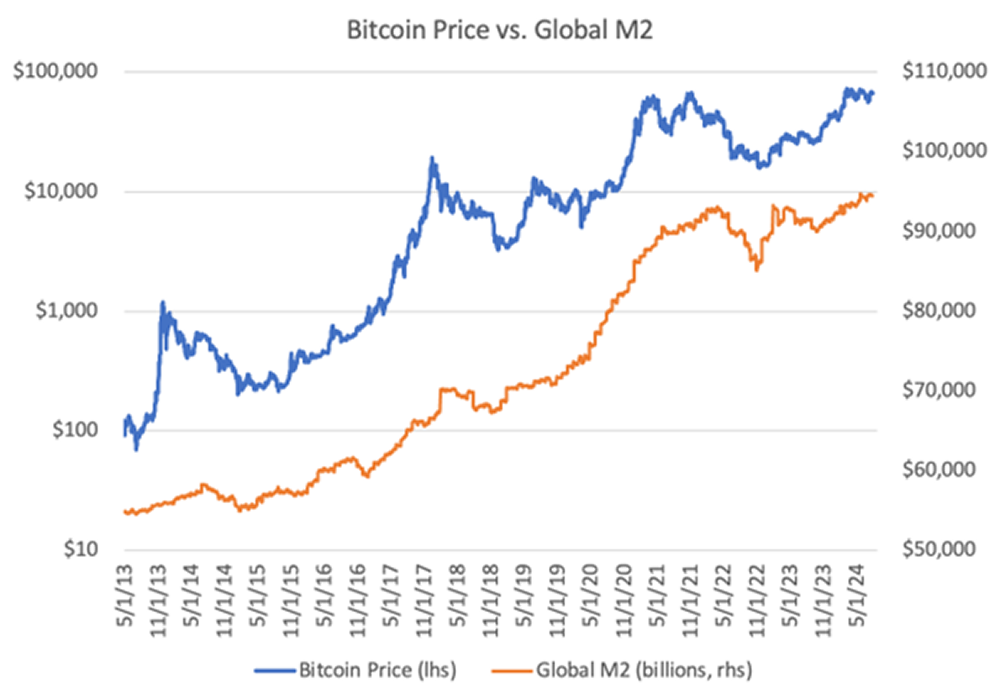

Research shows that since the global financial crisis, central banks have significantly influenced asset prices through unconventional monetary policies. Lyn Alden, in her research "Bitcoin: A Global Liquidity Barometer," pointed out that Bitcoin has a correlation with global liquidity as high as 83%, higher than other traditional asset classes. She believes that the volatility of Bitcoin prices can be seen as a "mirror reflection" of the speed of global money creation and the relative strength of the dollar. Currently, although some central banks have begun to ease monetary policy, the growth of global M2 money supply has not significantly rebounded, which may explain Bitcoin's recent weak performance.

Forster added that Bitcoin's fate over the next six months seems increasingly tied to traditional markets. He stated, "Although Bitcoin's current price trend appears turbulent, it is consistent with behaviors seen before past increases." This observation aligns with the trend of increasing correlation between Bitcoin and the Nasdaq and S&P 500 indices in recent years, especially in risk appetite-driven market environments. Forster's viewpoint suggests that Bitcoin may no longer be merely "digital gold," but is gradually evolving into an asset more closely related to macroeconomic cycles.

Next Stage Narrative: U.S. Rate Cuts and Global Liquidity Recovery?

Regarding the future of Bitcoin, both Simpson and Forster mentioned that the market may be waiting for a new "narrative" to drive the next round of increases. Simpson predicts that this narrative may revolve around "U.S. rate cuts, easing of quantitative tightening, and an increase in global liquidity." Since 2022, the Federal Reserve has tightened liquidity through quantitative tightening (QT) and interest rate hikes, but recent market expectations indicate that the Fed may shift to a rate-cutting cycle in 2025. According to federal funds futures data, the market has begun to price in potential rate cuts before the end of 2024, leading to a steepening of the U.S. yield curve, with short-term rates declining faster than long-term yields.

The movements of other central banks globally are also worth noting. According to research from Bank of America, as of 2024, 43% of 34 major central banks have entered a quantitative easing mode, up from just 10% in July 2023. Additionally, market consensus expects that by the end of 2025, 80% of central banks will ease monetary policy. The People's Bank of China recently injected $93 billion in liquidity through reverse repos, and although the effect is short-term and limited, it also indicates that global liquidity may gradually improve. If these factors continue to develop, they could provide support for risk assets like Bitcoin.

Simpson emphasized, "The market needs to cool down after overheating, and a new foundation is being formed." He believes that once global liquidity significantly rebounds, Bitcoin may usher in a new round of increases, potentially challenging previous highs. However, he also cautioned investors that uncertainties in macro conditions—such as weak U.S. economic data or the impact of Trump's policies—may continue to weigh on the market in the short term.

Jamie Coutts, Chief Crypto Analyst at Real Vision, predicts that Bitcoin could rise above $132,000 in 2025 based on the linear relationship with liquidity. He noted that if global liquidity increases by $20 trillion, Bitcoin could absorb 10% of the new capital inflow, totaling $2 trillion. Meanwhile, Raoul Pal, founder of Global Macro Investor, expects Bitcoin to reach a "local top" of $110,000 in January 2025, followed by a drop below $80,000. These predictions suggest that while there may still be volatility in the short term, the medium-term upside potential remains considerable.

Conclusion: Patiently Awaiting the "Liquidity Wave"

Overall, experts view the current correction in Bitcoin as a normal adjustment in the cycle rather than the end of the bull market. The analyses by Simpson and Forster indicate that global liquidity and macro conditions are key variables affecting short-term trends, while expectations of U.S. rate cuts and quantitative easing may serve as catalysts for the next round of increases. For investors, the current market may be the "calm before the storm." As Jeff Park from Bitwise stated, "Savvy institutional investors are preparing for the impending liquidity wave." In the context of the evolving global economic landscape, the future trajectory of Bitcoin is undoubtedly worth close attention.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AICoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。